XRP Price Prediction After Ripple's $50M SEC Settlement: A Comprehensive Analysis

Table of Contents

The Ripple SEC Settlement: A Recap and its Implications

The Ripple SEC settlement, concluding a long-running legal battle, significantly impacted the XRP price and the broader cryptocurrency market. Understanding the settlement's nuances is crucial for any accurate XRP price prediction.

Key Terms of the Settlement

The settlement involved Ripple paying a $50 million penalty to the SEC, without admitting guilt. This is a crucial point, as it doesn't set a legal precedent confirming XRP as a security. The key terms include:

- Financial Penalties: A $50 million payment to the SEC.

- Future Compliance Obligations: Ripple agreed to implement robust compliance measures to prevent future regulatory violations.

- Limitations on Operations: While the settlement doesn't explicitly restrict Ripple's operations, it establishes a framework for future compliance, impacting their future strategies.

Market Reaction to the Settlement

The immediate market reaction to the Ripple SEC settlement was mixed. Initially, the XRP price experienced a significant surge, reflecting relief among investors. However, this was followed by periods of volatility as the market digested the implications of the settlement.

- Short-term Price Fluctuations: The XRP price experienced sharp upward and downward movements in the days and weeks following the settlement announcement.

- Volatility: Market volatility remained high as investors assessed the long-term impact on XRP's value.

[Insert chart/graph illustrating XRP price movements around the settlement announcement]

Legal Precedents and Future Regulatory Uncertainty

The Ripple SEC settlement sets a precedent, but its impact on future regulatory actions remains uncertain. The outcome did not definitively label XRP as a security, leaving room for interpretation and potential future challenges.

- Ongoing Legal Battles: Other ongoing legal battles involving cryptocurrencies continue to fuel regulatory uncertainty, directly influencing XRP price prediction.

- Regulatory Landscape: The evolving regulatory landscape globally remains a major factor impacting the future price of XRP and other cryptocurrencies.

Factors Influencing Future XRP Price

Several factors will shape the future XRP price. Analyzing these is critical for a robust XRP price prediction.

Technological Advancements and RippleNet Adoption

Ripple's technology, particularly RippleNet, plays a vital role in determining future XRP price. Wider adoption by financial institutions can significantly boost its value.

- New Partnerships: New partnerships and collaborations with financial institutions will drive adoption and increase demand for XRP.

- Transaction Volume: Increased transaction volume on the RippleNet network positively correlates with XRP price.

- Network Growth: Expansion of RippleNet's global reach will solidify XRP's position in the cross-border payment market.

Market Sentiment and Investor Confidence

Investor sentiment toward XRP is crucial for its price. Positive sentiment can fuel price increases, while negative sentiment can lead to declines.

- Social Media Trends: Analyzing social media sentiment and news coverage provides insights into overall market confidence.

- Trading Volume: Increased trading volume generally signifies heightened interest and potential price movements.

- Market Capitalization: Changes in market capitalization reflect the overall valuation of XRP in the market.

Macroeconomic Factors and Global Market Conditions

Broader economic conditions influence XRP's price, as with any asset.

- Inflation and Interest Rates: Inflation and interest rate changes impact investor risk appetite, influencing cryptocurrency investment.

- Global Market Sentiment: Overall market sentiment, including stock market performance, affects investor behavior towards cryptocurrencies like XRP.

XRP Price Prediction Models and Scenarios

Predicting the future XRP price requires considering various models and scenarios.

Technical Analysis

Technical analysis uses charts and indicators to predict future price movements.

- Chart Patterns: Analyzing chart patterns, such as head and shoulders or triangles, can suggest potential price trends.

- Support and Resistance Levels: Identifying support and resistance levels can help estimate potential price ranges. [Insert relevant charts and graphs illustrating technical analysis]

Fundamental Analysis

Fundamental analysis focuses on XRP's underlying value and potential for growth.

- Adoption Rate: Increased adoption by financial institutions boosts its fundamental value.

- Utility: XRP's utility as a cross-border payment solution influences its long-term value.

- Market Competition: Competition from other cryptocurrencies impacts XRP's market share and price.

Price Prediction Scenarios

Based on different assumptions, various price scenarios are possible:

- Bullish Scenario: Widespread adoption of RippleNet, positive regulatory developments, and strong market sentiment could lead to significant price increases.

- Bearish Scenario: Negative regulatory actions, lack of widespread adoption, or a broader cryptocurrency market downturn could result in price declines.

- Neutral Scenario: Stable market conditions and moderate adoption could lead to gradual price appreciation.

[Include timelines for each prediction (short-term, mid-term, long-term)]

XRP Price Prediction After Ripple's Settlement – Key Takeaways and Next Steps

The Ripple SEC settlement's impact on XRP's future price is multifaceted. While the settlement removed a major uncertainty, several factors, including technological adoption, market sentiment, and macroeconomic conditions, will continue to shape XRP's price. Our analysis presents various price prediction scenarios, emphasizing the importance of considering different assumptions and market conditions.

Remember that any XRP price prediction is speculative. Conduct your own thorough research, considering the factors discussed above. Stay informed on the latest XRP price predictions, continue your XRP price research, and monitor the XRP market closely to make informed decisions. Explore reputable sources of financial news and analysis to deepen your understanding of the cryptocurrency market and XRP's place within it.

Featured Posts

-

Lotto Plus Results Winning Numbers For Lotto Lotto Plus 1 And 2

May 02, 2025

Lotto Plus Results Winning Numbers For Lotto Lotto Plus 1 And 2

May 02, 2025 -

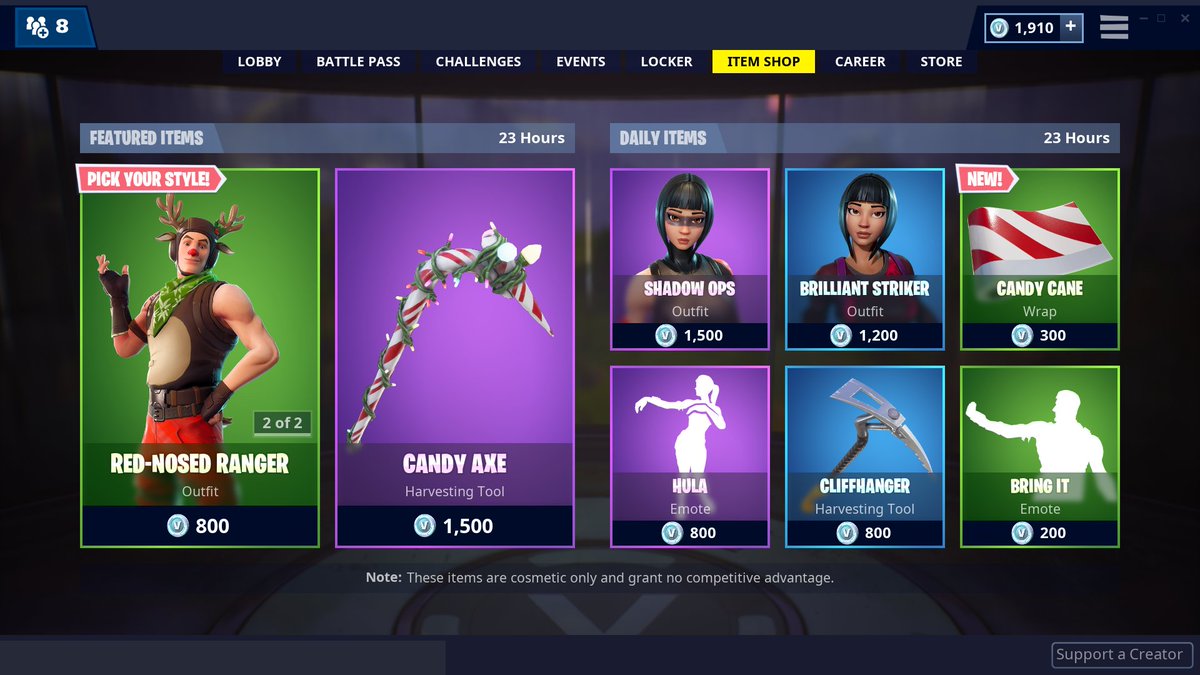

Fortnites Item Shop Offers Free Captain America Skins Limited Time

May 02, 2025

Fortnites Item Shop Offers Free Captain America Skins Limited Time

May 02, 2025 -

Englands Euro 2025 Hopes 3 Crucial Questions For Sarina Wiegman

May 02, 2025

Englands Euro 2025 Hopes 3 Crucial Questions For Sarina Wiegman

May 02, 2025 -

Harry Potter Actors Dramatic Transformation Crabbe Then And Now

May 02, 2025

Harry Potter Actors Dramatic Transformation Crabbe Then And Now

May 02, 2025 -

Latest Fortnite Shop Update Receives Backlash From Players

May 02, 2025

Latest Fortnite Shop Update Receives Backlash From Players

May 02, 2025

Latest Posts

-

Can A Smart Ring Really Prove You Re Not A Cheater

May 03, 2025

Can A Smart Ring Really Prove You Re Not A Cheater

May 03, 2025 -

From Scatological Data To Engaging Podcast The Power Of Ai

May 03, 2025

From Scatological Data To Engaging Podcast The Power Of Ai

May 03, 2025 -

Would A Smart Ring Enhance Or Destroy Trust In Relationships

May 03, 2025

Would A Smart Ring Enhance Or Destroy Trust In Relationships

May 03, 2025 -

A Smart Rings Promise Ending Infidelity Or Threatening Privacy

May 03, 2025

A Smart Rings Promise Ending Infidelity Or Threatening Privacy

May 03, 2025 -

The Ethics Of Smart Rings And Relationship Trust

May 03, 2025

The Ethics Of Smart Rings And Relationship Trust

May 03, 2025