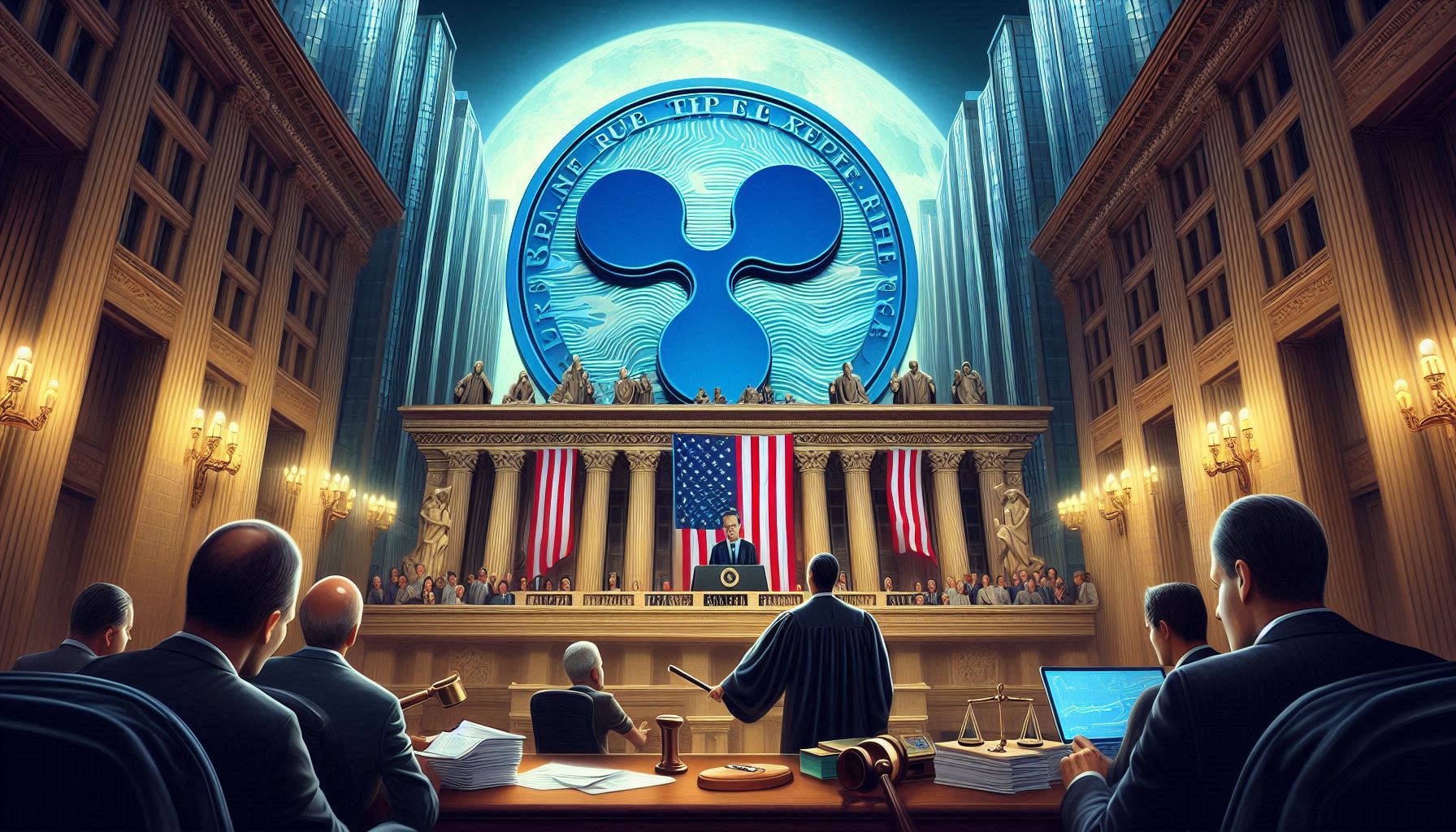

XRP On The Brink: Examining ETF Possibilities, SEC Actions, And Ripple's Transformation

Table of Contents

The Alluring Prospect of XRP ETFs

Understanding Exchange-Traded Funds (ETFs) and their impact on market accessibility

Exchange-Traded Funds (ETFs) are investment funds traded on stock exchanges, offering investors a diversified portfolio within a single security. Unlike directly purchasing cryptocurrency, which often involves navigating complex exchanges and wallets, ETFs provide a simpler, more regulated pathway to investment. An XRP ETF would dramatically increase accessibility for mainstream investors, potentially attracting a significantly larger investor base.

The benefits of an XRP ETF are numerous. Increased liquidity would make buying and selling XRP much easier and potentially reduce price volatility. Lower transaction costs compared to individual cryptocurrency trades are another significant advantage. Furthermore, regulatory oversight associated with ETFs would provide a degree of investor protection not always present in the volatile cryptocurrency market. Finally, an approved XRP ETF would represent a major step towards mainstream cryptocurrency adoption.

- Increased liquidity

- Lower transaction costs

- Regulatory oversight

- Increased mainstream adoption

Analyzing the Likelihood of XRP ETF Approval

The SEC's stance on cryptocurrencies, particularly their classification as securities, is a major hurdle to XRP ETF approval. The ongoing legal battle between the SEC and Ripple casts a long shadow, influencing the SEC's overall approach to crypto-related applications. The maturity of the XRP market, the level of investor demand, and the competitive landscape of other crypto ETFs also play critical roles. Approval would likely drive up XRP's price and market capitalization considerably; rejection, conversely, could severely hamper its growth.

- SEC regulatory scrutiny

- Market demand for XRP ETF

- Competition from other crypto ETFs

- Impact of Ripple's legal battles

Navigating the SEC Lawsuit and its Fallout

A Deep Dive into the SEC vs. Ripple Case

The SEC's lawsuit against Ripple alleges that XRP is an unregistered security. The key arguments revolve around whether XRP sales constituted investment contracts and whether Ripple engaged in the unregistered sale of securities. The outcome could significantly impact XRP's classification and its future trading. A ruling in Ripple's favor could potentially legitimize XRP in the eyes of regulators, whereas an SEC victory might severely restrict its trading and adoption. Regardless of the outcome, the lawsuit has already impacted XRP's price and trading volume, creating significant uncertainty for investors.

- SEC's arguments: Unregistered security offering.

- Ripple's defense: XRP is a decentralized digital asset, not a security.

- Potential legal outcomes: Favorable ruling for Ripple, SEC victory, or a settlement.

- Impact on XRP price and volume: Significant volatility and uncertainty.

Ripple's Transformation and its Impact on XRP

Ripple's Strategic Shifts and Product Development

Ripple has been actively diversifying its business beyond XRP, focusing on its On-Demand Liquidity (ODL) solution. ODL allows financial institutions to conduct faster and more cost-effective cross-border payments, creating demand for XRP as a bridge currency. This strategic shift could enhance XRP's utility beyond pure speculation, positively impacting its long-term value and adoption. The development of other blockchain technologies and strategic partnerships further contributes to Ripple's evolution and indirectly influences XRP's prospects.

- ODL adoption by financial institutions

- Development of new blockchain technologies

- Strategic partnerships and collaborations

The Future of XRP within Ripple's Ecosystem

Ripple envisions XRP as a crucial component of its global payment network. Whether XRP gains wider adoption as a digital asset will depend on various factors: its utility beyond speculative trading, continued community development, technological advancements, and the evolving global regulatory environment. Positive developments in these areas could fuel significant growth; conversely, continued regulatory uncertainty and lack of widespread adoption could hinder its progress.

- XRP’s utility beyond speculation

- Community development

- Technological advancements

- Global regulatory environment

Conclusion: The Uncertain Future of XRP

The future of XRP is undeniably intertwined with the approval or rejection of XRP ETFs, the outcome of the SEC lawsuit, and the continued success of Ripple's transformation. While the potential for significant growth exists, particularly with ETF approval, considerable uncertainty remains. The regulatory landscape, ongoing legal battles, and market dynamics will all play crucial roles in shaping XRP's trajectory. By closely following developments surrounding XRP ETFs, the SEC lawsuit, and Ripple's strategic moves, you can better navigate this complex landscape and make informed decisions about your XRP investments.

Featured Posts

-

Fox News Faces Defamation Lawsuit From Ray Epps Regarding January 6th Narratives

May 02, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Regarding January 6th Narratives

May 02, 2025 -

Agha Syd Rwh Allh Mhdy Ka Mqbwdh Kshmyr Pr Bharty Palysy Ky Shdyd Mdhmt

May 02, 2025

Agha Syd Rwh Allh Mhdy Ka Mqbwdh Kshmyr Pr Bharty Palysy Ky Shdyd Mdhmt

May 02, 2025 -

Six Nations Thriller England Beats France Thanks To Dalys Last Minute Score

May 02, 2025

Six Nations Thriller England Beats France Thanks To Dalys Last Minute Score

May 02, 2025 -

Epic Games Fortnite New Legal Battle Over In App Purchases

May 02, 2025

Epic Games Fortnite New Legal Battle Over In App Purchases

May 02, 2025 -

Fortnite Players Revolt Backwards Music Change Sparks Outrage

May 02, 2025

Fortnite Players Revolt Backwards Music Change Sparks Outrage

May 02, 2025

Latest Posts

-

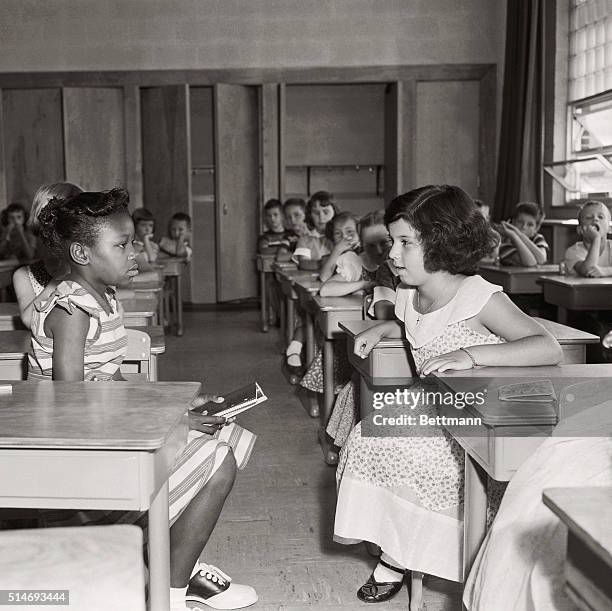

End Of School Desegregation Order Implications For Future Cases

May 02, 2025

End Of School Desegregation Order Implications For Future Cases

May 02, 2025 -

The Fallout From The Justice Departments School Desegregation Order Decision

May 02, 2025

The Fallout From The Justice Departments School Desegregation Order Decision

May 02, 2025 -

School Desegregation Order Terminated Potential For Further Changes

May 02, 2025

School Desegregation Order Terminated Potential For Further Changes

May 02, 2025 -

The Fallout From The Justice Departments School Desegregation Order Termination

May 02, 2025

The Fallout From The Justice Departments School Desegregation Order Termination

May 02, 2025 -

School Desegregation Orders End A Legal And Social Analysis

May 02, 2025

School Desegregation Orders End A Legal And Social Analysis

May 02, 2025