XRP Explained: Uses, Value, And Future Potential

Table of Contents

Understanding XRP's Functionality and Uses

XRP's primary function revolves around facilitating fast and cost-effective international transactions. Its design centers around solving the inefficiencies inherent in traditional cross-border payment systems.

XRP as a Bridge Currency for Cross-Border Payments

XRP acts as a bridge currency, enabling the swift conversion between different fiat currencies. This process significantly reduces transaction times and associated fees compared to traditional methods relying on correspondent banks and intermediaries.

- Faster Transactions: XRP transactions are typically processed within seconds, a stark contrast to the days or even weeks required by traditional banking systems.

- Lower Transaction Fees: The reduced reliance on intermediaries leads to significantly lower transaction fees, making it a more economical solution for businesses and individuals.

- RippleNet's Impact: RippleNet, Ripple's payment network, leverages XRP to connect banks and financial institutions globally, streamlining cross-border payments. This network facilitates real-time transactions, enhancing efficiency and transparency.

- Benefits for Banks: Banks utilizing XRP benefit from reduced operational costs, improved liquidity management, and enhanced customer satisfaction due to faster and cheaper remittance services.

XRP's Role in the Ripple Ecosystem

XRP isn't just a standalone cryptocurrency; it's integral to the Ripple ecosystem. It interacts with other cryptocurrencies and fiat currencies within this network, facilitating various financial operations.

- On-Demand Liquidity (ODL): ODL is a groundbreaking technology that allows for instant and cost-effective cross-border payments by utilizing XRP as a bridge currency. This minimizes the need for pre-funding accounts in different currencies, improving efficiency.

- Cryptocurrency Exchange: Within the Ripple ecosystem, XRP serves as a crucial component for exchanging different cryptocurrencies, streamlining the process and providing increased liquidity.

- Other Applications: Ripple is continuously exploring new use cases for XRP within its ecosystem, potentially extending its role in areas such as micropayments and decentralized finance (DeFi).

Beyond Ripple: Exploring Other Potential Uses of XRP

While closely associated with Ripple, XRP's potential extends beyond the RippleNet ecosystem. Its speed, efficiency, and low transaction costs make it attractive for various applications.

- Decentralized Finance (DeFi): XRP could potentially play a significant role in the DeFi space, offering a fast and efficient means of transferring value between different DeFi platforms.

- Payment Gateways: XRP's integration into existing payment gateways could provide users with a quicker and cheaper option for international transactions.

- Future Applications: The versatility of blockchain technology and XRP's inherent characteristics position it to potentially find applications in diverse sectors including supply chain management and digital identity verification.

Analyzing XRP's Current Value and Market Position

XRP's price, like all cryptocurrencies, is subject to significant volatility. Understanding the factors influencing its value is crucial for any investor.

Factors Influencing XRP's Price

Several factors contribute to XRP's price fluctuations:

- Market Sentiment: General market sentiment towards cryptocurrencies, positive or negative news, and overall market trends heavily influence XRP's price.

- Regulatory Developments: Regulatory actions and legal decisions, particularly concerning Ripple's ongoing legal battle with the SEC, significantly impact XRP's price.

- Adoption Rate: Increased adoption of XRP by financial institutions and businesses directly contributes to price appreciation.

- Ripple's Partnerships and Technological Advancements: Successful partnerships and technological breakthroughs by Ripple Labs often lead to increased demand and higher prices.

Comparing XRP to Other Cryptocurrencies

XRP differs significantly from Bitcoin and Ethereum. While Bitcoin is primarily a store of value and Ethereum a platform for smart contracts, XRP is primarily focused on facilitating payments.

- Strengths: XRP's speed, low transaction fees, and focus on cross-border payments provide a unique value proposition.

- Weaknesses: XRP's centralization, due to its association with Ripple, is often criticized by proponents of fully decentralized cryptocurrencies.

- Market Comparison: Compared to other major cryptocurrencies, XRP occupies a specific niche, primarily competing with other payment-focused digital assets.

Assessing XRP's Future Potential and Investment Outlook

Predicting future price movements for any cryptocurrency, including XRP, is inherently speculative. However, analyzing potential factors can provide a better understanding of its long-term viability.

Predicting Future Price Movements

(Disclaimer: Cryptocurrency investments are highly speculative and involve substantial risk. The information provided here is not financial advice.)

Several factors could influence XRP's future price:

- Resolution of the SEC Lawsuit: A favorable outcome could significantly boost XRP's price.

- Increased Adoption: Wider adoption by financial institutions and businesses could lead to substantial price growth.

- Technological Advancements: Innovation within the Ripple ecosystem could increase XRP's utility and demand.

Long-Term Viability and Sustainability

XRP's long-term viability depends on several factors:

- Regulatory Compliance: Navigating the evolving regulatory landscape will be crucial for XRP's continued success.

- Technological Advancements: Continuous improvement and innovation are essential to maintain its competitive edge.

- Community Support: A strong and engaged community is vital for the long-term sustainability of any cryptocurrency.

Conclusion: Investing in XRP's Future

XRP's unique position in the cryptocurrency landscape, its focus on cross-border payments, and its potential for wider adoption make it a compelling asset to consider. However, understanding its functionality, current market position, and associated risks is crucial before investing. Thorough due diligence and a comprehensive understanding of the XRP investment landscape are essential. Remember that all cryptocurrency investments, including XRP investment, carry inherent risks, and risk management strategies are paramount. Explore reputable sources and engage with the XRP community to learn more about its potential. The future of XRP remains to be written, and its evolution within the constantly shifting cryptocurrency investment world will be fascinating to watch.

Featured Posts

-

Kashmirs Long Awaited Rail Connection Inauguration Date Announced By Pm Modi

May 01, 2025

Kashmirs Long Awaited Rail Connection Inauguration Date Announced By Pm Modi

May 01, 2025 -

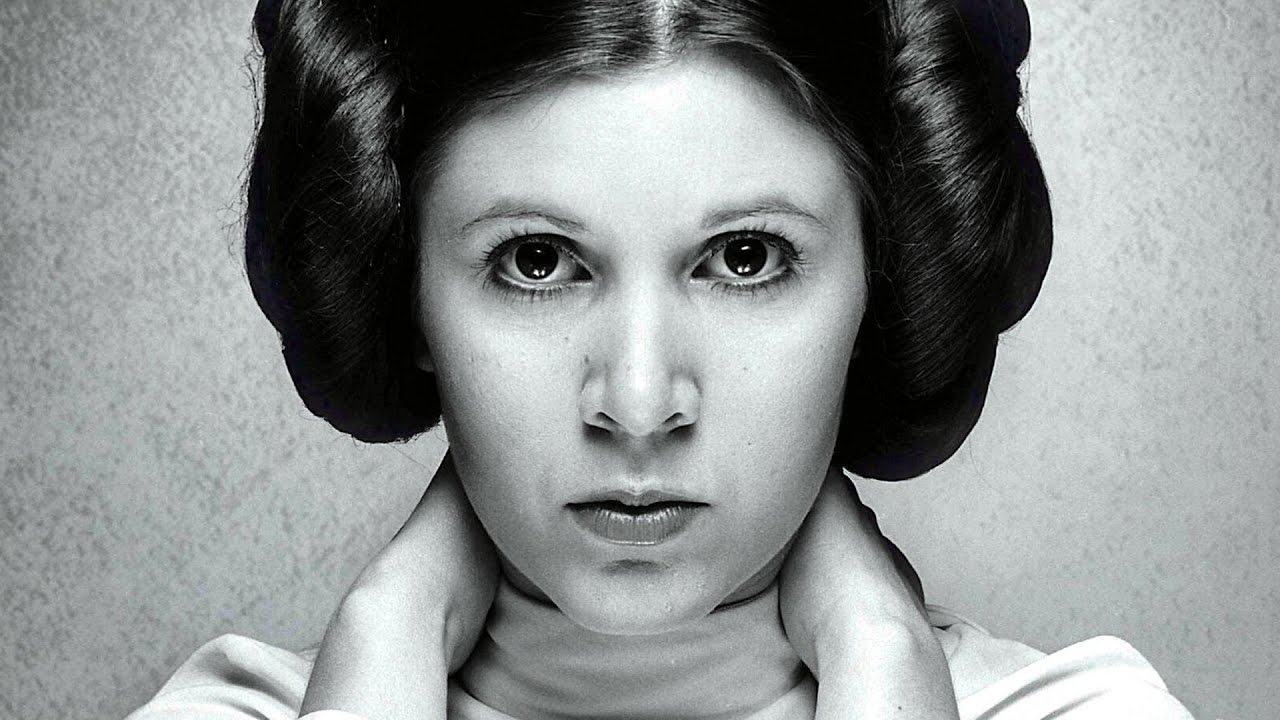

A Legacy Remembered The Passing Of A Dallas And Carrie Star

May 01, 2025

A Legacy Remembered The Passing Of A Dallas And Carrie Star

May 01, 2025 -

Understanding Rare Seabirds The Work Of Te Ipukarea Society

May 01, 2025

Understanding Rare Seabirds The Work Of Te Ipukarea Society

May 01, 2025 -

Death Of Priscilla Pointer Renowned Actress Passes Away At 100

May 01, 2025

Death Of Priscilla Pointer Renowned Actress Passes Away At 100

May 01, 2025 -

Big Islands Merrie Monarch Festival Celebrating Pacific Island Dance And Culture

May 01, 2025

Big Islands Merrie Monarch Festival Celebrating Pacific Island Dance And Culture

May 01, 2025

Latest Posts

-

Dallas Star Dies The End Of An Era For 80s Soap Operas

May 01, 2025

Dallas Star Dies The End Of An Era For 80s Soap Operas

May 01, 2025 -

The Death Of A Dallas And 80s Soap Star

May 01, 2025

The Death Of A Dallas And 80s Soap Star

May 01, 2025 -

A Dallas Legend And 80s Soap Star Is Dead

May 01, 2025

A Dallas Legend And 80s Soap Star Is Dead

May 01, 2025 -

Tv Icon From Dallas And 80s Soaps Passes Away

May 01, 2025

Tv Icon From Dallas And 80s Soaps Passes Away

May 01, 2025 -

Dallas And 80s Soap Opera The Passing Of A Beloved Star

May 01, 2025

Dallas And 80s Soap Opera The Passing Of A Beloved Star

May 01, 2025