XRP ETF Outlook: Assessing The Risks Of Abundant Supply And Limited Institutional Adoption

Table of Contents

Abundant XRP Supply and its Impact on Price Stability

H3: The Mechanics of XRP's Release: The ongoing release of XRP into the market is a significant factor influencing its price stability. Ripple, the company behind XRP, continues to sell XRP, impacting market capitalization and potentially suppressing price appreciation.

- Implications of Ripple's ongoing sales: These sales can increase the circulating supply, potentially leading to downward pressure on the price. The market needs to absorb this influx of XRP.

- Comparison to other cryptocurrencies and ETFs: Unlike Bitcoin, which has a fixed supply of 21 million coins, XRP's total supply is much larger (100 billion), creating a different dynamic. Traditional ETFs also have different supply mechanisms, usually tied to the underlying assets.

- Historical price movements: Analyzing XRP's price history reveals correlations between significant XRP releases and subsequent price drops. [Insert chart showing correlation between XRP releases and price movements]. This suggests that a consistent supply influx could hinder long-term price growth.

H3: The Dilution Effect on Investor Returns: A large and steadily increasing supply dilutes the value of each individual XRP token. This dilution effect directly impacts the potential returns of an XRP ETF.

- Effect of inflation on the value of XRP: The continuous release of XRP can be viewed as inflationary, diminishing the value of existing tokens over time. This contrasts with deflationary assets like Bitcoin, where scarcity drives value.

- Potential scenarios for future supply releases: Different scenarios regarding future XRP release rates need to be considered. A faster release rate would exacerbate the dilution effect, while a slower rate might provide more price stability.

- Comparison to established financial markets: The supply dynamics of XRP differ significantly from traditional financial markets, where supply often adjusts more organically to demand. This difference needs to be acknowledged when evaluating the risk profile of an XRP ETF.

Limited Institutional Adoption and Regulatory Uncertainty

H3: The Current State of Institutional XRP Holdings: Compared to Bitcoin or Ethereum, institutional investment in XRP remains relatively low. This lack of widespread institutional adoption raises questions about the long-term sustainability of the asset.

- Lack of major institutional endorsements: Many large institutional investors remain hesitant to embrace XRP due to concerns over its regulatory status and overall market maturity.

- Existing institutional investments and their significance: While some institutional investors have shown interest, their holdings remain relatively small compared to other crypto assets. This highlights a significant barrier to widespread ETF adoption.

- Reasons for low adoption: Regulatory concerns, particularly those stemming from the SEC lawsuit against Ripple, are a primary driver of low institutional adoption. The lack of clear, widely accepted use cases also contributes to this hesitation.

H3: Regulatory Hurdles and SEC Scrutiny: The ongoing legal battle between Ripple and the SEC casts a significant shadow over XRP's future. The outcome of this case will significantly influence the regulatory landscape and the potential for XRP ETF approvals.

- Potential implications of SEC rulings: A negative ruling could severely hamper the prospects of an XRP ETF, potentially even making it impossible. A positive ruling, conversely, could significantly boost investor confidence and increase the likelihood of ETF launches.

- Regulatory landscape in different jurisdictions: The regulatory landscape varies across different countries. Understanding these differences is crucial for assessing the global viability of an XRP ETF.

- Impact of regulatory uncertainty on investor confidence: The ongoing uncertainty discourages institutional investors and creates hesitancy amongst individual investors, negatively impacting market participation and hindering price stability.

Market Volatility and Risk Assessment for XRP ETFs

H3: Historical Price Volatility of XRP: XRP has historically demonstrated significant price volatility. This volatility presents a substantial risk for investors considering an XRP ETF.

- Charts illustrating price fluctuations: [Insert chart showing historical XRP price volatility]. This chart clearly shows the considerable price swings that XRP has experienced.

- Comparison to other cryptocurrencies and traditional assets: Compared to other cryptocurrencies and traditional assets, XRP demonstrates a higher degree of volatility, increasing the risk for investors.

- Correlation between XRP price and broader market trends: XRP’s price is also susceptible to broader market movements, meaning that overall market downturns can significantly impact its value.

H3: Assessing the Overall Risk Profile of an XRP ETF: Considering the abundant supply, limited institutional adoption, and regulatory uncertainty, investing in an XRP ETF carries a high-risk profile.

- Risks of price manipulation, market crashes, and regulatory changes: The relatively decentralized nature of the cryptocurrency market makes XRP susceptible to price manipulation and market crashes. Regulatory changes could also have a significant impact.

- Balanced perspective on potential rewards and inherent risks: While the potential rewards are tempting, investors must carefully consider the significant risks involved.

- Strategies for mitigating risk: Investors can mitigate risk through diversification, investing only a small portion of their portfolio in XRP, and employing appropriate risk management techniques.

Conclusion

The abundant supply of XRP and the relatively slow pace of institutional adoption, coupled with significant regulatory uncertainty, present significant risks for potential XRP ETF investors. Understanding these challenges is crucial before committing capital. While the potential rewards of an XRP ETF are tempting, investors must carefully weigh these risks before investing. Thorough due diligence and a comprehensive risk assessment are crucial before investing in any XRP-related ETF. Conduct further research on XRP ETF investments and understand the potential downsides before making any investment decisions.

Featured Posts

-

Assessing The Options Finding A Seasoned Veteran To Replace Taj Gibson

May 08, 2025

Assessing The Options Finding A Seasoned Veteran To Replace Taj Gibson

May 08, 2025 -

La Historia Se Escribe En Verde El Betis Historico

May 08, 2025

La Historia Se Escribe En Verde El Betis Historico

May 08, 2025 -

Westbrook Trade Buzz A Nuggets Players Reaction

May 08, 2025

Westbrook Trade Buzz A Nuggets Players Reaction

May 08, 2025 -

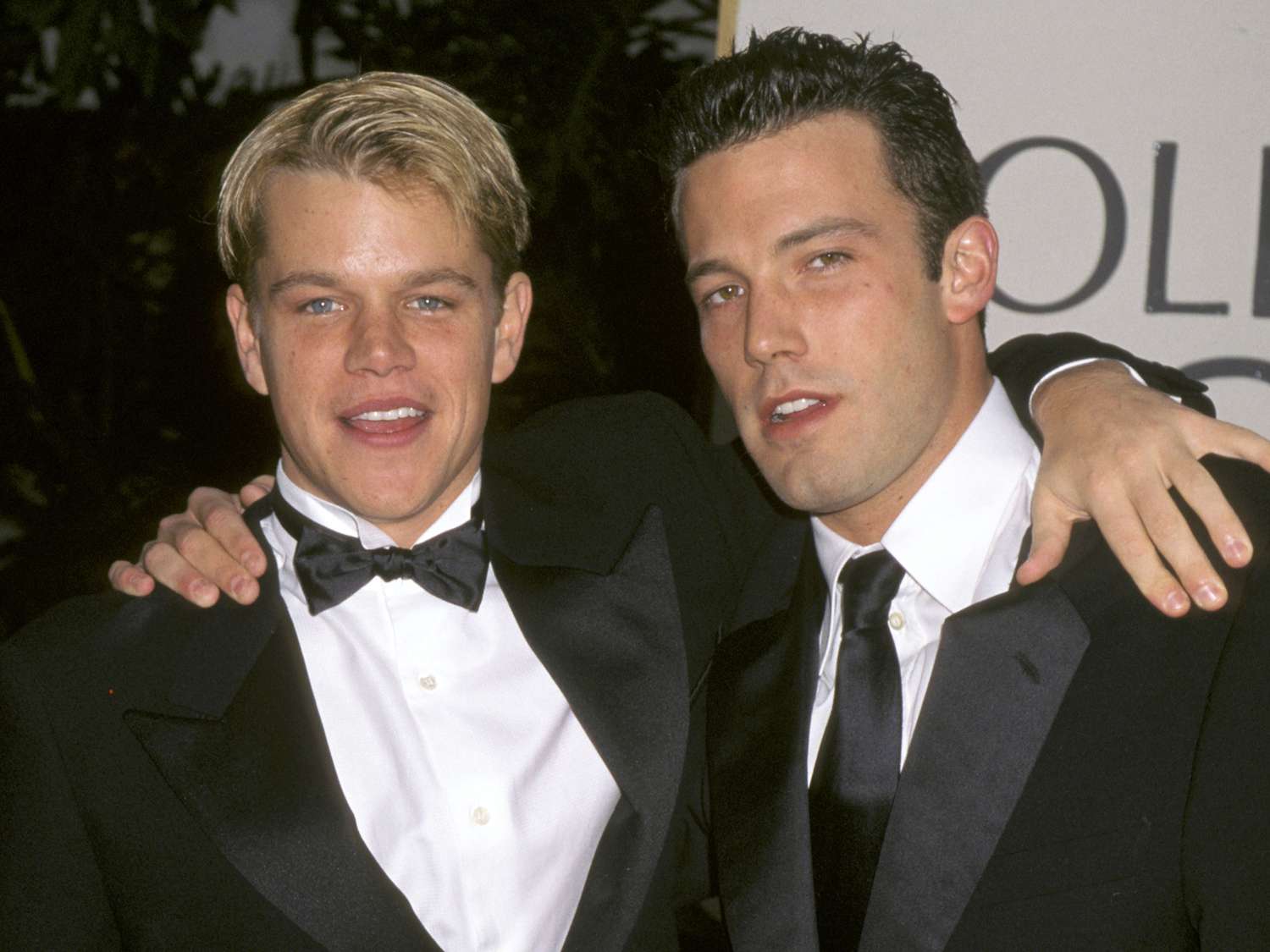

Ben Affleck Matt Damons Calculated Success In Hollywood

May 08, 2025

Ben Affleck Matt Damons Calculated Success In Hollywood

May 08, 2025 -

Colin Cowherds Continued Criticism Of Jayson Tatum

May 08, 2025

Colin Cowherds Continued Criticism Of Jayson Tatum

May 08, 2025