XAUUSD Gold Price Recovery: US Economic Data And Rate Cut Bets

Table of Contents

Main Points:

2.1 Weakening US Economic Data and its Impact on XAUUSD Gold

H3: Inflationary Pressures and Gold's Safe-Haven Appeal: The relationship between inflation, interest rates, and gold prices is complex but crucial. Generally, higher interest rates tend to negatively impact gold prices because they increase the opportunity cost of holding non-yielding assets like gold. Conversely, lower-than-expected inflation data could signal a potential rate cut by the Federal Reserve. This, in turn, could boost gold prices as investors seek alternative stores of value.

- Key Economic Indicators:

- Consumer Price Index (CPI): Measures the change in prices paid by urban consumers for a basket of consumer goods and services.

- Producer Price Index (PPI): Measures the average change over time in the selling prices received by domestic producers for their output.

- Unemployment Rate: Indicates the percentage of the labor force that is unemployed and actively seeking employment.

- Unexpected weakness in these indicators can signal economic slowdown, increasing investor anxiety and fueling demand for gold as a safe-haven asset. Investors often flock to gold during times of uncertainty, driving up its price.

H3: Recessionary Fears and the Flight to Safety: The possibility of a US recession significantly impacts XAUUSD. Gold traditionally acts as a hedge against economic uncertainty and often performs well during economic downturns. This "flight to safety" phenomenon sees investors move capital from riskier assets into more stable assets like gold.

- Potential Recessionary Indicators:

- Inversion of the yield curve (when short-term interest rates exceed long-term rates).

- Decreasing consumer spending and business investment.

- Significant decline in manufacturing activity.

- The perception of increased recession risk often strengthens gold's safe-haven appeal, leading to increased demand and potentially higher XAUUSD prices.

2.2 Federal Reserve Rate Cut Bets and their Influence on XAUUSD Gold Prices

H3: Market Expectations and Probability of a Rate Cut: Market participants closely monitor statements and actions from the Federal Reserve to gauge the likelihood of future rate cuts. Tools like the CME FedWatch Tool provide probabilities for various rate scenarios based on market pricing of federal funds futures contracts.

- Sources for Rate Cut Expectations:

- CME FedWatch Tool

- Statements from Federal Reserve officials

- Economic forecasts from major financial institutions

- The anticipation of rate cuts can significantly influence the US dollar and, consequently, XAUUSD. Lower interest rates generally weaken the dollar, making gold more attractive to international investors and pushing up the XAUUSD price.

H3: The Dollar Index (DXY) and its Correlation with XAUUSD: The US Dollar Index (DXY) measures the value of the US dollar against a basket of other major currencies. XAUUSD typically exhibits an inverse correlation with the DXY. A weakening dollar (lower DXY) generally leads to higher XAUUSD prices, as gold becomes cheaper for holders of other currencies.

- Impact of DXY Movements on Gold Prices:

- A strong dollar (higher DXY) can put downward pressure on gold prices.

- A weak dollar (lower DXY) can boost gold prices.

- Monitoring the DXY is crucial for understanding the potential impact on XAUUSD prices.

2.3 Technical Analysis of XAUUSD – Identifying Potential Support and Resistance Levels

H3: Chart Patterns and Trading Signals: Technical analysis involves studying past price movements and chart patterns to predict future price trends. Key technical indicators help identify potential support and resistance levels.

- Technical Indicators:

- Moving averages (e.g., 50-day, 200-day)

- Relative Strength Index (RSI)

- Moving Average Convergence Divergence (MACD)

- Identifying chart patterns like head and shoulders, double tops/bottoms, and triangles can provide insights into potential price reversals or continuations. (Include relevant charts/visuals here)

H3: Potential Price Targets based on Technical Indicators: Based on the technical analysis, different scenarios can be envisioned depending on the interplay of technical factors and market sentiment. However, precise price targets should be considered with caution.

- Scenario 1 (Bullish): Continued weakening of the dollar, combined with positive technical signals, could drive XAUUSD to higher levels.

- Scenario 2 (Bearish): Stronger-than-expected economic data leading to a stronger dollar and negative technical signals could put downward pressure on XAUUSD.

- Risk Management: Utilizing stop-loss orders and position sizing are crucial for managing risk in XAUUSD trading.

Conclusion: Navigating the XAUUSD Gold Price Recovery

The XAUUSD gold price recovery is intricately linked to US economic data and the Federal Reserve's decisions regarding interest rates. Weakening economic data, increasing recession fears, and expectations of rate cuts can all contribute to higher XAUUSD prices. Technical analysis provides additional tools for understanding potential price movements. However, predicting precise price targets remains challenging.

To capitalize on potential future gold price recovery, stay informed about the latest XAUUSD gold price movements and economic indicators. Regularly monitor key economic releases, follow Federal Reserve pronouncements, and use technical analysis tools effectively. By staying informed and employing sound risk management strategies, investors can better navigate the complexities of the XAUUSD market.

Featured Posts

-

Mariners Vs Reds Prediction Picks And Odds For Todays Mlb Game

May 17, 2025

Mariners Vs Reds Prediction Picks And Odds For Todays Mlb Game

May 17, 2025 -

Knicks Win Over Pistons Nba Referees Admit To Key Foul Call Error

May 17, 2025

Knicks Win Over Pistons Nba Referees Admit To Key Foul Call Error

May 17, 2025 -

Tam Krwz Ka Ayk Mdah Ke Ghyr Memwly Eml Pr Rdeml

May 17, 2025

Tam Krwz Ka Ayk Mdah Ke Ghyr Memwly Eml Pr Rdeml

May 17, 2025 -

How The Ultra Wealthy Are Weathering Economic Storms Through Luxury Property

May 17, 2025

How The Ultra Wealthy Are Weathering Economic Storms Through Luxury Property

May 17, 2025 -

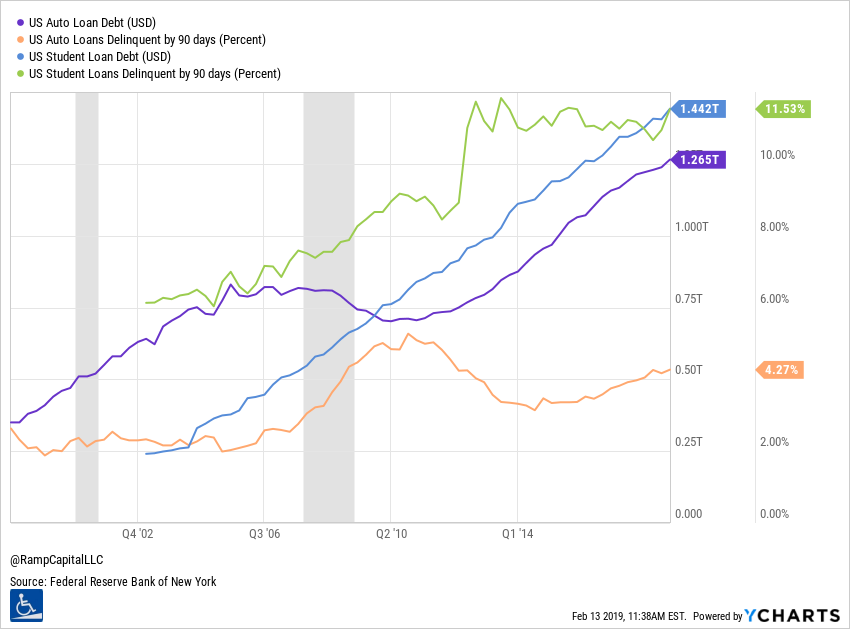

Student Loan Delinquency Repairing Your Credit

May 17, 2025

Student Loan Delinquency Repairing Your Credit

May 17, 2025

Latest Posts

-

75 Million Investment From Eccles Foundation To Build New U Of U Hospital

May 17, 2025

75 Million Investment From Eccles Foundation To Build New U Of U Hospital

May 17, 2025 -

Black Voices On Trumps Student Loan Executive Order

May 17, 2025

Black Voices On Trumps Student Loan Executive Order

May 17, 2025 -

Iowa Hawkeyes Hire Former D2 National Champion Ben Mc Collum

May 17, 2025

Iowa Hawkeyes Hire Former D2 National Champion Ben Mc Collum

May 17, 2025 -

North Dakotas Leading Businessperson Honored With Msum Honorary Degree

May 17, 2025

North Dakotas Leading Businessperson Honored With Msum Honorary Degree

May 17, 2025 -

Msum Awards Honorary Degree To North Dakotas Wealthiest Individual

May 17, 2025

Msum Awards Honorary Degree To North Dakotas Wealthiest Individual

May 17, 2025