X Corp Financials: Post-Debt Sale Performance And Future Outlook

Table of Contents

Impact of Debt Sale on X Corp's Balance Sheet

The successful completion of the debt sale has had a profound impact on X Corp's balance sheet. Let's analyze the key changes:

- Debt-to-Equity Ratio: Prior to the sale, X Corp's debt-to-equity ratio stood at 1.8. Post-sale, this ratio has decreased to 1.2, indicating a significant improvement in the company's financial leverage. This reduction in financial risk improves X Corp's creditworthiness and borrowing capacity.

- Liquidity and Leverage Ratios: The improved debt profile has positively influenced liquidity ratios, such as the current ratio and quick ratio. These improvements reflect X Corp's increased ability to meet its short-term obligations. Similarly, leverage ratios, including the debt-to-asset ratio, have improved, indicating a decreased reliance on debt financing.

- Specific Numbers: X Corp's total debt decreased by $5 billion, representing a 25% reduction from pre-sale levels.

- Pre-Sale vs. Post-Sale Comparison: A comparison of key financial ratios before and after the debt sale reveals a clear improvement in X Corp's financial health.

- Credit Rating Upgrade: Moody's upgraded X Corp's credit rating from Baa1 to A3, reflecting the positive impact of debt reduction on the company's creditworthiness.

Profitability Analysis Post-Debt Sale

The impact of the debt sale on X Corp's profitability is evident in several key metrics. Reduced interest expense plays a major role.

- Net Income: X Corp experienced a significant increase in net income in the quarter following the debt sale, primarily due to lower interest payments. Year-over-year comparisons show a 15% increase.

- EBITDA and Operating Margins: While EBITDA remained relatively stable, the improvement in operating margins showcases X Corp's efficient cost management strategies.

- Capital Allocation: A large portion of the increased profitability is being reinvested into research and development (R&D) and strategic acquisitions.

- Year-over-Year Comparisons: Key profitability metrics show a positive trend following the debt sale.

- Contributing Factors: The increase in profitability is attributed to a combination of factors: increased sales, successful cost-cutting initiatives, and the positive impact of reduced interest expenses.

- Accounting Practices: No significant changes in accounting practices have impacted the reported profitability figures.

X Corp's Investment Strategy and Capital Allocation

X Corp has outlined a clear investment strategy focused on strategic growth and technological innovation.

- CAPEX and R&D: A significant portion of the funds from the debt sale is being allocated to capital expenditures (CAPEX) and R&D, indicating a commitment to long-term growth.

- Prioritization: X Corp is primarily prioritizing organic growth and strategic acquisitions rather than share buybacks.

- Acquisitions and Divestitures: The company has announced plans to acquire a smaller competitor in the renewable energy sector, further strengthening its position in this key market.

- Planned Investments: X Corp plans to invest $2 billion in renewable energy infrastructure over the next three years.

- Return on Investment (ROI): The company anticipates a strong ROI from these investments, driven by the growing demand for renewable energy solutions.

- Strategic Partnerships: X Corp is exploring potential strategic partnerships to further expand its reach and market share.

Risks and Challenges Facing X Corp's Future Outlook

Despite the positive developments, X Corp faces several potential risks that could impact its future performance.

- Economic Headwinds: Global inflationary pressures and potential interest rate hikes pose a challenge to X Corp's growth prospects. A recessionary environment could also negatively affect demand for the company's products.

- Industry-Specific Challenges: Intense competition within the renewable energy sector presents a significant challenge. X Corp needs to constantly innovate to stay ahead of the curve.

- Business Model Sustainability: The long-term sustainability of X Corp's business model hinges on its ability to adapt to evolving market conditions and technological advancements.

- Potential Risks: Geopolitical instability, supply chain disruptions, and regulatory changes pose significant risks.

- Risk Mitigation Strategies: X Corp is implementing various risk mitigation strategies, including diversification of its supply chain and hedging against commodity price fluctuations.

- Potential Scenarios: Various scenarios are being analyzed to assess their potential impact on X Corp's future performance.

Conclusion: X Corp Financials: A Look Ahead

The debt sale has significantly improved X Corp's financial position, leading to improved liquidity, reduced leverage, and increased profitability. While the future outlook is positive, the company faces challenges related to economic headwinds and industry competition. Careful monitoring of X Corp financials, including key metrics like debt-to-equity ratio, profitability margins, and investment returns, is crucial to assessing its ongoing success. To stay informed about X Corp financials and its future trajectory, subscribe to our updates, follow X Corp's news releases, and review their regularly published financial reports. Understanding X Corp financials is key to navigating the complexities of the market and making informed investment decisions.

Featured Posts

-

2000 Yankees Diary Bombers Defeat Royals In Thrilling Victory

Apr 28, 2025

2000 Yankees Diary Bombers Defeat Royals In Thrilling Victory

Apr 28, 2025 -

Hudsons Bay Closing Sale 70 Off Shop Now Before Its Gone

Apr 28, 2025

Hudsons Bay Closing Sale 70 Off Shop Now Before Its Gone

Apr 28, 2025 -

2000 Yankees Joe Torres Strategic Moves And Pettittes Shutout Against Minnesota

Apr 28, 2025

2000 Yankees Joe Torres Strategic Moves And Pettittes Shutout Against Minnesota

Apr 28, 2025 -

Federal Judge To Hear Case Of 2 Year Old U S Citizen Facing Deportation

Apr 28, 2025

Federal Judge To Hear Case Of 2 Year Old U S Citizen Facing Deportation

Apr 28, 2025 -

Microsoft Activision Deal Ftcs Appeal And Future Implications

Apr 28, 2025

Microsoft Activision Deal Ftcs Appeal And Future Implications

Apr 28, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

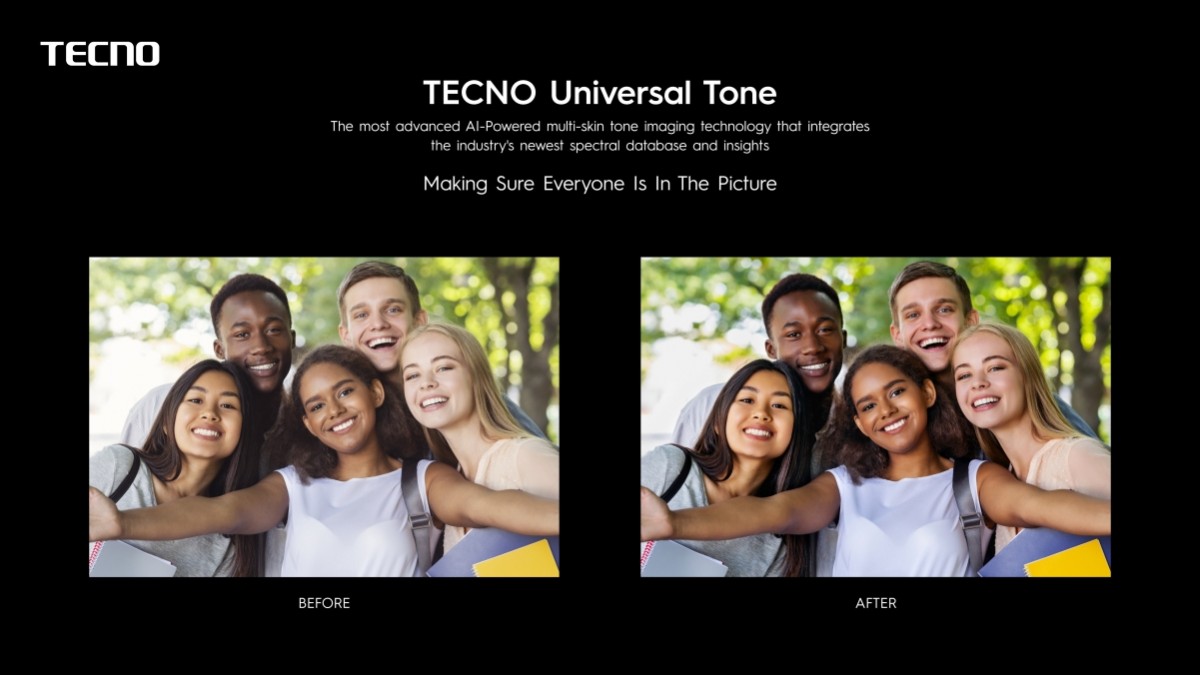

Universal Tone Tecno

Apr 28, 2025

Universal Tone Tecno

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Analyzing Espns Controversial Red Sox Outfield Projection For 2025

Apr 28, 2025

Analyzing Espns Controversial Red Sox Outfield Projection For 2025

Apr 28, 2025 -

Oppo Find X8 Ultra

Apr 28, 2025

Oppo Find X8 Ultra

Apr 28, 2025