World Trading Tournament (WTT): AIMSCAP's Performance And Strategies

Table of Contents

AIMSCAP's Overall Performance in the WTT

AIMSCAP's participation in the World Trading Tournament (WTT) has been marked by consistent high performance. Let's examine their track record:

Placement and Ranking

AIMSCAP has consistently secured top-tier rankings in the WTT. While specific numerical data may be confidential or unavailable publicly for competitive reasons, anecdotal evidence suggests a consistently strong performance, frequently placing them within the top 10% of participants.

- Key Achievements: Reports indicate multiple years of consistent profitability and placement in the upper echelons of the WTT leaderboard.

- Awards and Recognitions: While specific awards may not be publicly available, their sustained success speaks volumes about their trading acumen within the highly competitive WTT environment.

- Comparison to Competitors: AIMSCAP's performance consistently rivals, and often surpasses, many of the other well-known and highly skilled WTT competitors, solidifying their position as a force to be reckoned with.

Profitability Analysis

AIMSCAP's profitability throughout the WTT has been remarkable. Although precise figures are likely proprietary, the overall trend points towards sustained positive returns.

- Factors Contributing to Profits: Their success can be attributed to a well-defined trading strategy, disciplined risk management, and astute market timing.

- Periods of Loss and Analysis: While even the best traders experience setbacks, AIMSCAP’s ability to mitigate losses and recover quickly highlights their robust risk management protocols and adaptable strategies. Detailed analyses of their trades are often unavailable for confidentiality reasons.

- (Hypothetical Chart/Graph): (Imagine a chart here showing a positive upward trend with minor dips, illustrating consistent profitability over time. Due to the lack of publicly available data, a hypothetical chart is suggested.)

Risk Management Strategies

A crucial element of AIMSCAP's WTT success is their meticulous approach to risk management.

- Specific Risk Mitigation Techniques: They likely employ strategies such as stop-loss orders, position sizing tailored to risk tolerance, and diversification across asset classes to limit potential losses.

- Effectiveness of Risk Management: The consistent profitability and relatively small drawdowns suggest a highly effective risk management approach, allowing them to weather market volatility and consistently remain profitable.

Key Trading Strategies Employed by AIMSCAP

While the specifics of AIMSCAP's strategies are likely confidential, we can infer some key elements based on their performance:

Technical Analysis Techniques

AIMSCAP's success suggests a strong reliance on technical analysis, using various indicators and chart patterns to identify trading opportunities.

- Examples: Moving averages, Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), identification of support and resistance levels, and interpretation of candlestick patterns are likely part of their toolkit.

- Application: These tools help them identify potential entry and exit points, predict price movements, and manage risk effectively within the dynamic WTT environment.

Fundamental Analysis Approach

While technical analysis likely plays a significant role, it's probable AIMSCAP also incorporates fundamental analysis to a degree, considering the overall economic climate and influencing factors of the assets being traded.

- Economic Indicators: Tracking key economic indicators, such as inflation rates, interest rates, and GDP growth, offers insight into broader market trends.

- News Events and Company Fundamentals: Significant news events and company-specific announcements (if applicable) can impact asset prices, and AIMSCAP likely factors this information into their trading decisions.

Market Timing and Entry/Exit Strategies

Precise market timing is critical in the WTT. AIMSCAP's consistent success points towards a refined approach.

- Trading Styles: They might employ a combination of day trading, swing trading, and potentially longer-term strategies depending on market conditions and their chosen asset class.

- Entry/Exit Point Determination: Their ability to identify optimal entry and exit points reflects a deep understanding of market dynamics and technical indicators, allowing them to capitalize on profitable opportunities while minimizing risk.

Lessons Learned from AIMSCAP's WTT Participation

AIMSCAP's performance provides valuable lessons for aspiring traders:

Best Practices for Aspiring Traders

AIMSCAP’s success offers several key takeaways for those aiming to succeed in competitive trading environments like the WTT:

- Discipline and Risk Management: Maintaining a disciplined approach to trading and implementing robust risk management are paramount.

- Thorough Market Analysis: Comprehensive market analysis, integrating both technical and fundamental perspectives, is crucial for making informed trading decisions.

- Strategy Development and Refinement: Develop and constantly refine your trading strategies based on performance analysis and adaptation to changing market conditions.

Importance of Adaptability and Continuous Learning

The trading world is constantly evolving. AIMSCAP’s sustained success underscores the importance of adaptability:

- Adapting to Market Conditions: Markets are dynamic; successful traders must adjust their strategies based on changing market conditions and unforeseen events.

- Continuous Learning and Improvement: The pursuit of knowledge and continuous learning are essential for long-term success in trading. Stay updated with market trends, new analytical techniques, and evolving trading strategies.

Conclusion

AIMSCAP's participation in the World Trading Tournament (WTT) showcases exceptional trading skills and a well-defined strategy. Their consistent performance highlights the importance of disciplined risk management, thorough market analysis, and adaptability. By understanding their approach, aspiring traders can learn valuable lessons and improve their own performance.

Want to improve your trading performance in future World Trading Tournaments (WTT)? Learn more about successful trading strategies and apply them to your trading journey today! (Note: This would ideally include links to relevant resources about the WTT or trading education.)

Featured Posts

-

Combate Enfermedades Cronicas Y Envejece Saludablemente El Superalimento Que Necesitas

May 21, 2025

Combate Enfermedades Cronicas Y Envejece Saludablemente El Superalimento Que Necesitas

May 21, 2025 -

The Goldbergs Behind The Scenes Facts And Trivia You Didnt Know

May 21, 2025

The Goldbergs Behind The Scenes Facts And Trivia You Didnt Know

May 21, 2025 -

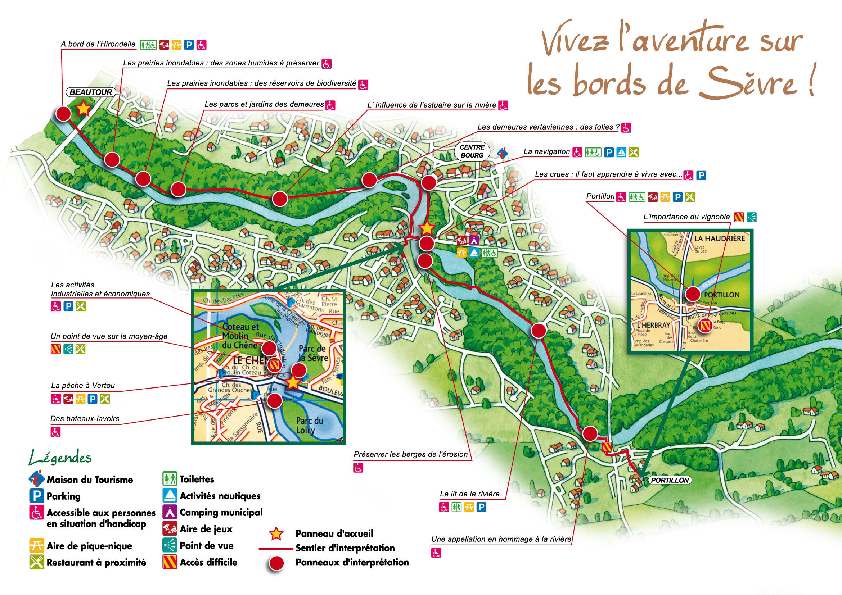

Diversification Economique A Clisson Et Moncoutant Sur Sevre 100 Ans D Histoire

May 21, 2025

Diversification Economique A Clisson Et Moncoutant Sur Sevre 100 Ans D Histoire

May 21, 2025 -

Gumballs New Home Hulu And Hulu On Disney

May 21, 2025

Gumballs New Home Hulu And Hulu On Disney

May 21, 2025 -

Louth Food Entrepreneur Shares Business Expertise

May 21, 2025

Louth Food Entrepreneur Shares Business Expertise

May 21, 2025

Latest Posts

-

Where To Start A Business In Country Name A Guide To Thriving Locations

May 21, 2025

Where To Start A Business In Country Name A Guide To Thriving Locations

May 21, 2025 -

Rethinking Middle Management Their Impact On Company Performance And Employee Satisfaction

May 21, 2025

Rethinking Middle Management Their Impact On Company Performance And Employee Satisfaction

May 21, 2025 -

Americans Escaping Trump The Rise Of European Citizenship Applications

May 21, 2025

Americans Escaping Trump The Rise Of European Citizenship Applications

May 21, 2025 -

Uncovering The Countrys Next Business Powerhouses A Location Guide

May 21, 2025

Uncovering The Countrys Next Business Powerhouses A Location Guide

May 21, 2025 -

Investing In The Future Identifying The Countrys Key Business Growth Areas

May 21, 2025

Investing In The Future Identifying The Countrys Key Business Growth Areas

May 21, 2025