Will XRP Reach $5 In 2025? Factors Influencing The Price

Table of Contents

Technological Advancements and XRP's Utility

XRP's potential largely hinges on the continued development and adoption of its underlying technology, the XRP Ledger (XRPL). The XRPL's capabilities and its integration into various financial systems are key drivers of the XRP price prediction.

XRP Ledger (XRPL) Upgrades and Scalability

The XRPL has undergone significant upgrades to enhance its transaction speed, efficiency, and overall scalability. These improvements are vital for competing with other blockchain networks and attracting wider adoption.

- Improved Transaction Speed: Recent updates have significantly reduced transaction processing times, making XRP more suitable for real-time payments.

- Enhanced Scalability: The XRPL's architecture allows for a high volume of transactions per second, making it capable of handling large-scale financial operations.

- Reduced Transaction Fees: Lower transaction fees compared to other networks make XRP a cost-effective solution for cross-border payments. This is a significant advantage in attracting businesses and institutions.

- Future Upgrades: Ongoing development promises further improvements in speed, scalability, and security, bolstering the XRP price prediction for the long term.

Adoption by Financial Institutions

The potential for increased use of XRP in cross-border payments and other financial applications is a major factor in any XRP price forecast. Several financial institutions are exploring the use of XRP for its efficiency and cost-effectiveness.

- Strategic Partnerships: Ripple, the company behind XRP, has forged several partnerships with financial institutions globally, integrating XRP into their payment systems. These partnerships showcase the growing acceptance of XRP in the financial industry.

- Faster and Cheaper Cross-Border Payments: XRP's speed and low transaction costs offer a compelling alternative to traditional cross-border payment systems, reducing processing times and fees for financial institutions.

- Obstacles to Wider Adoption: Regulatory uncertainty and the ongoing SEC lawsuit remain significant obstacles to widespread adoption, affecting the XRP price prediction.

The Role of Decentralized Finance (DeFi) on XRP

The growing integration of XRP into Decentralized Finance (DeFi) applications could significantly impact its price. While still nascent, the potential for growth in this sector is substantial.

- XRP-Based DeFi Projects: Several DeFi projects are incorporating XRP into their platforms, creating new use cases and increasing demand.

- Potential for Growth: The DeFi sector is experiencing rapid growth, and XRP's integration could benefit from this trend.

- Risks Associated with DeFi: DeFi investments carry inherent risks, including smart contract vulnerabilities and market volatility, which could negatively impact the XRP price prediction.

Regulatory Landscape and Legal Battles

The regulatory landscape and legal battles surrounding XRP significantly impact investor sentiment and, consequently, its price.

The SEC Lawsuit and Its Impact

The ongoing SEC lawsuit against Ripple Labs, the company behind XRP, is a major uncertainty influencing the XRP price prediction. The outcome of this lawsuit could dramatically affect XRP's price.

- Summary of the Lawsuit: The SEC alleges that XRP is an unregistered security. The case is complex and the outcome is uncertain.

- Potential Outcomes: A favorable ruling could lead to increased investor confidence and a rise in XRP's price; an unfavorable ruling could have the opposite effect.

- Impact on Investor Sentiment: The uncertainty surrounding the lawsuit significantly impacts investor sentiment and price volatility.

Global Regulatory Scrutiny on Cryptocurrencies

The broader regulatory environment for cryptocurrencies globally is another crucial factor affecting XRP's price prediction. Governments worldwide are developing regulations for cryptocurrencies, which could significantly impact their adoption.

- Varying Regulations Across Jurisdictions: Different countries have vastly different regulatory frameworks for cryptocurrencies, creating uncertainty for investors.

- Impact on XRP Adoption: Clear and favorable regulations could boost XRP adoption and its price, while restrictive regulations could hinder its growth.

- Implications for Exchanges Listing XRP: Regulatory changes could affect the listing of XRP on major cryptocurrency exchanges.

Market Sentiment and Investor Behavior

Market sentiment and investor behavior play a significant role in XRP's price volatility and any XRP price prediction.

Supply and Demand Dynamics

The interplay of supply and demand is a fundamental driver of XRP's price. The circulating supply of XRP, along with market demand, influences its valuation.

- XRP's Circulating Supply: The total supply of XRP is fixed, and its release into circulation is managed.

- Market Demand: Demand for XRP is driven by its adoption in payments, DeFi, and other applications.

- Market Capitalization: XRP's market capitalization is a key indicator of its overall value and market standing.

Influence of Bitcoin and Altcoin Market

The performance of Bitcoin and other altcoins significantly influences XRP's price. XRP often exhibits correlation with the broader cryptocurrency market.

- Correlation with Bitcoin: XRP's price often moves in tandem with Bitcoin's price, reflecting the overall market sentiment.

- Impact of General Market Trends: Bullish or bearish trends in the broader cryptocurrency market often impact XRP's price.

Social Media and News Influence

Social media sentiment and news coverage can significantly influence XRP's price volatility, particularly in the short term.

- Role of Influencers: Social media influencers can sway public opinion and affect trading activity.

- Impact of Positive/Negative News: Positive news about XRP's development or adoption can boost its price, while negative news can have the opposite effect.

- Importance of Verifying Information: Investors should critically assess information from various sources and avoid relying solely on social media or unverified news.

Conclusion

Predicting the exact XRP price is challenging, but analyzing technological advancements, the regulatory landscape, and market sentiment provides a framework for assessing its potential. The ongoing SEC lawsuit presents a significant hurdle, impacting investor confidence and price volatility. While XRP's technological strengths and potential for adoption are compelling, the uncertainties surrounding regulation and market behavior make a definitive XRP price prediction difficult. The possibility of XRP reaching $5 by 2025 depends on a confluence of favorable factors. While the potential is there, it's crucial to remember that the cryptocurrency market is inherently volatile. Do your own research and make informed decisions about investing in XRP.

Featured Posts

-

The Design Of Hawkgirls Organic Wings Isabela Merceds Interpretation

May 07, 2025

The Design Of Hawkgirls Organic Wings Isabela Merceds Interpretation

May 07, 2025 -

Macrons Plan For A European Streaming Giant Progress And Challenges

May 07, 2025

Macrons Plan For A European Streaming Giant Progress And Challenges

May 07, 2025 -

Xrp Price Prediction Whales 20 M Purchase And Market Outlook

May 07, 2025

Xrp Price Prediction Whales 20 M Purchase And Market Outlook

May 07, 2025 -

Play Station 5 Pro Teardown Examining The Next Gen Consoles Architecture

May 07, 2025

Play Station 5 Pro Teardown Examining The Next Gen Consoles Architecture

May 07, 2025 -

61 Shooting Cavs Key To Victory Against Knicks

May 07, 2025

61 Shooting Cavs Key To Victory Against Knicks

May 07, 2025

Latest Posts

-

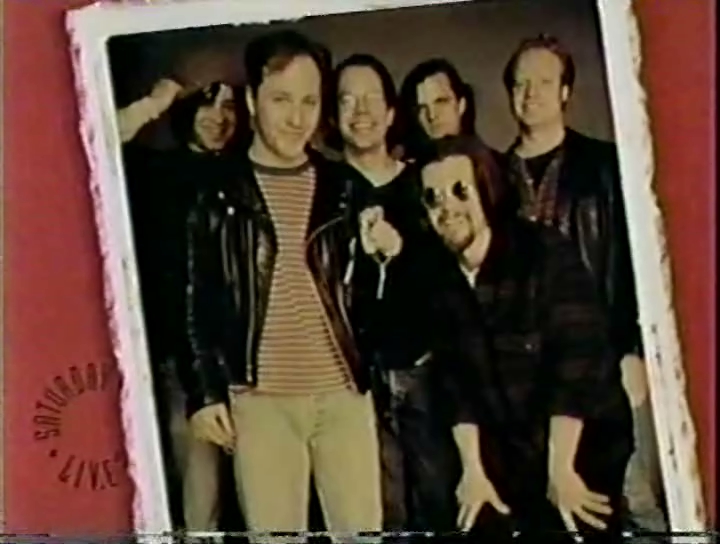

The Night Counting Crows Changed Their Destiny On Saturday Night Live

May 08, 2025

The Night Counting Crows Changed Their Destiny On Saturday Night Live

May 08, 2025 -

The Night Counting Crows Changed A Saturday Night Live Story

May 08, 2025

The Night Counting Crows Changed A Saturday Night Live Story

May 08, 2025 -

Saturday Night Live And Counting Crows A Career Defining Moment

May 08, 2025

Saturday Night Live And Counting Crows A Career Defining Moment

May 08, 2025 -

Saturday Night Lives Impact On Counting Crows Career A 98 Txt Retrospective

May 08, 2025

Saturday Night Lives Impact On Counting Crows Career A 98 Txt Retrospective

May 08, 2025 -

Saturday Night Lives Impact On Counting Crows Career

May 08, 2025

Saturday Night Lives Impact On Counting Crows Career

May 08, 2025