Will The Bank Of Canada Cut Rates Again? Tariffs And Job Losses Fuel Speculation

Table of Contents

The Impact of Tariffs on the Canadian Economy

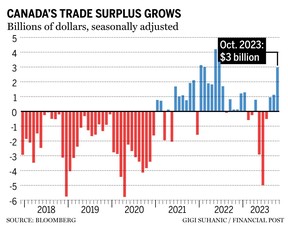

The ongoing trade war and the complexities of the USMCA agreement continue to cast a long shadow over the Canadian economy. Import tariffs, particularly those impacting key sectors like agriculture and manufacturing, have significantly hampered Canadian businesses. These tariffs, acting as a tax on imported goods, contribute directly to increased prices (inflation), squeezing consumer spending power and dampening economic growth. The resulting reduced competitiveness in global markets further exacerbates the situation.

- Decreased competitiveness in global markets: Canadian businesses face higher production costs, making their goods less attractive to international buyers.

- Increased costs for raw materials and finished goods: Tariffs inflate the price of essential inputs, increasing the overall cost of production and reducing profit margins.

- Reduced consumer purchasing power due to inflation: Higher prices for imported goods lead to decreased consumer spending, slowing overall economic activity.

- Potential for supply chain disruptions: Tariffs can disrupt established supply chains, forcing businesses to seek more expensive alternatives or face production delays.

- Negative impact on specific sectors: Industries heavily reliant on exports, like agriculture and manufacturing, are particularly vulnerable to the negative consequences of tariffs.

Rising Job Losses and Their Economic Implications

The Canadian job market is showing signs of weakening, with rising unemployment rates in several sectors. This increase in job losses fuels concerns about a potential economic slowdown and further impacts consumer confidence. When unemployment rises, consumer spending – a key driver of economic growth – typically falls. This creates a dangerous downward spiral, impacting aggregate demand and putting further pressure on businesses. The Bank of Canada's mandate includes price stability and full employment, making the rise in unemployment a significant factor in its deliberations.

- Analysis of recent unemployment data and trends: A close examination of recent statistics reveals concerning trends in specific sectors, pointing towards a weakening labour market.

- Discussion of specific sectors experiencing job losses: Industries like manufacturing and retail are particularly hard hit, indicating broader economic vulnerabilities.

- Impact on consumer spending and aggregate demand: Reduced employment leads to less disposable income, directly translating to lower consumer spending and weaker aggregate demand.

- Potential for a downward spiral in economic activity: A weakening job market and reduced consumer spending can create a self-reinforcing cycle, pushing the economy towards a recession.

The Bank of Canada's Current Monetary Policy Stance

The Bank of Canada's current monetary policy stance is crucial in understanding the potential for further interest rate cuts. Their recent announcements and press conferences offer clues, though the exact timing and magnitude of any future adjustments remain uncertain. The Bank carefully considers several key economic indicators when making interest rate decisions, including inflation, employment figures, and economic growth forecasts. Any hints or pronouncements from the Bank regarding future actions should be carefully analyzed.

- Summary of the Bank of Canada's current interest rate: The current interest rate serves as the benchmark for all other interest rates in the economy.

- Review of the Bank's recent statements and press conferences: Analyzing the Bank's communication reveals their assessment of the current economic climate and potential future scenarios.

- Analysis of the Bank's inflation and economic growth forecasts: These forecasts offer insights into the Bank's expectations for the economy and influence its monetary policy decisions.

- Potential scenarios for future interest rate decisions: Considering the interconnectedness of inflation, employment, and economic growth, various scenarios and their potential impact on interest rates can be considered.

Alternative Monetary Policy Tools

Besides interest rate cuts, the Bank of Canada possesses other tools in its monetary policy arsenal. Quantitative easing (QE), involving bond purchases to inject liquidity into the financial system, is one such unconventional monetary policy tool that could be employed if deemed necessary. These alternative measures aim to stimulate economic activity without solely relying on interest rate adjustments.

Conclusion

The interconnectedness of tariffs, rising job losses, and the Bank of Canada's potential response is undeniable. The current economic climate is characterized by significant uncertainty, making the question of further Bank of Canada interest rate cuts a key area of focus for businesses and consumers alike. While the exact timing and scale of any future action remain unclear, the current headwinds strongly suggest the possibility of further interest rate adjustments.

Call to Action: Stay informed about the evolving economic situation and the Bank of Canada's announcements regarding potential interest rate cuts. Monitor reliable financial news sources for updates on Bank of Canada interest rates and their implications for the Canadian economy. Regularly check the Bank of Canada's official website for the latest information. Understanding the Bank of Canada's interest rate decisions is crucial for navigating the current economic climate and making informed financial decisions.

Featured Posts

-

Airport Fashion Jessica Simpson In Cheetah Print And Blue Fur

May 12, 2025

Airport Fashion Jessica Simpson In Cheetah Print And Blue Fur

May 12, 2025 -

Magic Johnson Predicts The Winner Knicks Vs Pistons Playoffs

May 12, 2025

Magic Johnson Predicts The Winner Knicks Vs Pistons Playoffs

May 12, 2025 -

Exploring Rotorua The Vibrant Cultural Center Of New Zealand

May 12, 2025

Exploring Rotorua The Vibrant Cultural Center Of New Zealand

May 12, 2025 -

Post Francis Papacy Analyzing The Contenders For The Catholic Churchs Highest Office

May 12, 2025

Post Francis Papacy Analyzing The Contenders For The Catholic Churchs Highest Office

May 12, 2025 -

Are Trumps Tariffs Killing Small Businesses An Investigation

May 12, 2025

Are Trumps Tariffs Killing Small Businesses An Investigation

May 12, 2025

Latest Posts

-

The Gaza Hostage Crisis A Continuing Nightmare For Families

May 13, 2025

The Gaza Hostage Crisis A Continuing Nightmare For Families

May 13, 2025 -

Unending Agony The Plight Of Families Separated By The Gaza Hostage Crisis

May 13, 2025

Unending Agony The Plight Of Families Separated By The Gaza Hostage Crisis

May 13, 2025 -

Prolonged Hostage Crisis In Gaza The Families Painful Reality

May 13, 2025

Prolonged Hostage Crisis In Gaza The Families Painful Reality

May 13, 2025 -

Gaza Hostages The Nightmare Continues For Their Families

May 13, 2025

Gaza Hostages The Nightmare Continues For Their Families

May 13, 2025 -

The Lengthy Nightmare Hostages Families In Gaza Remain In Despair

May 13, 2025

The Lengthy Nightmare Hostages Families In Gaza Remain In Despair

May 13, 2025