Will Climate Change Affect My Mortgage Application? Understanding The Risks

Table of Contents

Increased Property Insurance Premiums and Unavailability

Climate change significantly increases the risk of damage from natural disasters. This heightened risk is directly impacting the property insurance market. Insurers are responding by increasing premiums or, in some cases, refusing coverage altogether in high-risk areas. This has significant implications for your mortgage application.

- Lenders require proof of adequate insurance: Most lenders mandate homeowners insurance as a condition for mortgage approval. If you can't secure insurance, or the premiums are prohibitively high, your mortgage application may be denied.

- Higher premiums affect your Debt-to-Income ratio (DTI): Higher insurance premiums increase your monthly housing costs, which directly impacts your DTI. A higher DTI can make it harder to qualify for a mortgage.

- Inability to secure insurance can lead to loan denial: This is a critical hurdle. Lenders see the lack of insurance as an unacceptable risk, leading to loan rejection.

This means understanding High-Risk Mortgage situations and the implications of Climate Change Insurance is paramount. Facing potential Mortgage Insurance Denial is a serious consequence of climate change's influence on the mortgage market.

Property Value Depreciation Due to Climate Change

Properties located in flood zones, wildfire-prone areas, or regions susceptible to extreme weather events are experiencing a decline in value. This depreciation is a direct result of the increased risk associated with climate change. Appraisers now consider climate risks when assessing property value, influencing your ability to secure a mortgage.

- Lenders assess Loan-to-Value ratio (LTV): The LTV ratio compares the loan amount to the appraised property value. A lower appraisal due to climate risk can result in a higher LTV, making it harder to qualify for a mortgage or requiring a larger down payment.

- Lower valuations may result in smaller loans or loan denial: If the appraised value is significantly lower than the purchase price, the lender may reduce the loan amount or deny the application altogether.

- You might need a larger down payment to compensate: To maintain an acceptable LTV, you may be required to make a larger down payment.

This highlights the crucial relationship between Property Valuation Climate Change, Flood Risk Mortgage, Wildfire Risk Mortgage, and your LTV Ratio. Understanding these factors is vital for navigating the mortgage application process successfully.

Stricter Lending Guidelines and Increased Scrutiny

Lenders are becoming increasingly proactive in assessing Climate Change Mortgage Risk. They are incorporating climate risk into their underwriting process, performing more thorough due diligence on properties situated in high-risk zones.

- More stringent documentation is required: Expect to provide more detailed information about your property's location and its vulnerability to climate-related events.

- Expect longer processing times for mortgage applications: The added scrutiny and detailed analysis will likely lead to longer processing times.

- A higher credit score and financial stability may be required to offset risk: To compensate for the added risk, lenders may demand a higher credit score and demonstrate stronger financial stability.

This increased scrutiny reflects the growing importance of Mortgage Underwriting Climate Change and the implementation of comprehensive Climate Risk Assessment Mortgage procedures leading to Stricter Lending Standards.

Disclosure Requirements and Climate-Related Risks

Many jurisdictions are implementing new disclosure laws regarding climate risks. You might be required to disclose potential climate-related hazards affecting your property. Failure to do so can have serious legal and financial implications. This emphasizes the need for transparency and thorough understanding of Climate Risk Disclosure Mortgage and Environmental Disclosure Mortgage regulations in your area.

Mitigation Strategies to Reduce Climate Change Mortgage Risk

While the impact of climate change on mortgages is significant, there are steps you can take to mitigate the risks:

- Research properties in low-risk areas: Choose properties in areas with a lower risk of flooding, wildfires, or other climate-related disasters.

- Invest in climate-resilient upgrades to your property: Consider upgrades like flood barriers, fire-resistant materials, or improved insulation to reduce your property's vulnerability.

- Maintain a strong credit score and healthy financial profile: A strong credit score and stable finances can help offset some of the perceived risk.

- Shop around for mortgage lenders who understand and address climate change risks: Some lenders are more proactive than others in assessing and managing climate-related risks.

These strategies help achieve a Climate Resilient Mortgage, securing a Low-Risk Mortgage and actively working to Reduce Climate Change Mortgage Risk.

Conclusion

Understanding Climate Change Mortgage Risk is no longer optional; it’s essential. As climate change intensifies, its impact on the mortgage market will only become more pronounced. By understanding the potential risks – increased insurance premiums, property devaluation, and stricter lending guidelines – and by taking proactive steps to mitigate these risks, you can significantly improve your chances of securing a mortgage and protecting your financial future. Don't wait until it's too late. Start researching your options today and take steps to minimize your climate change mortgage risk. Learn more about climate-resilient mortgages and secure your financial stability.

Featured Posts

-

Drug Rasskazal O Tyazhelom Polozhenii Mikhaelya Shumakhera Situatsiya Pechalnaya

May 20, 2025

Drug Rasskazal O Tyazhelom Polozhenii Mikhaelya Shumakhera Situatsiya Pechalnaya

May 20, 2025 -

Critics Honest Reviews Jennifer Lawrences New Film

May 20, 2025

Critics Honest Reviews Jennifer Lawrences New Film

May 20, 2025 -

Second Typhon Battery Us Army Expands Pacific Presence

May 20, 2025

Second Typhon Battery Us Army Expands Pacific Presence

May 20, 2025 -

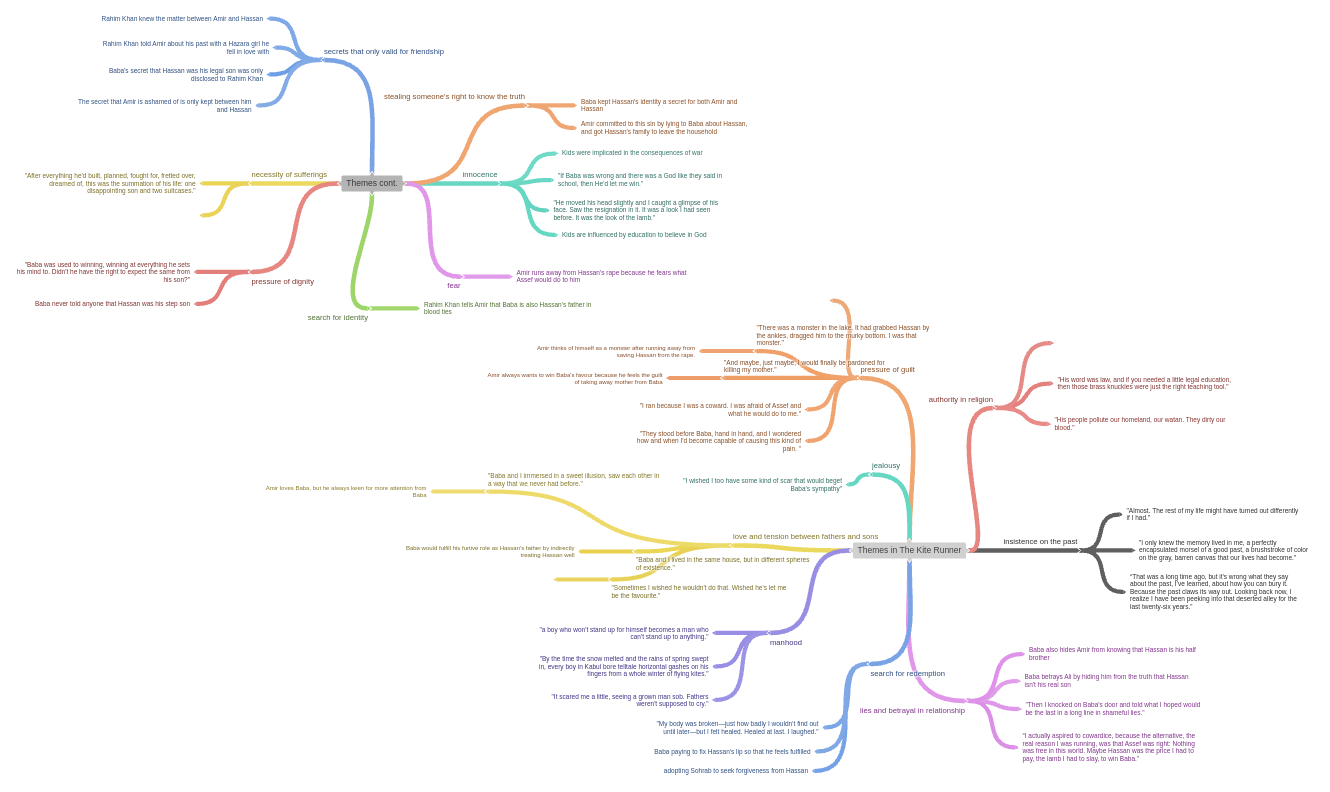

The Kite Runner And Nigeria Exploring Themes Of Pragmatism And Choice

May 20, 2025

The Kite Runner And Nigeria Exploring Themes Of Pragmatism And Choice

May 20, 2025 -

Canadian Beauty And Tariffs A Balancing Act For Consumers

May 20, 2025

Canadian Beauty And Tariffs A Balancing Act For Consumers

May 20, 2025

Latest Posts

-

Analyzing The Controversy Wayne Gretzkys Loyalty And His Relationship With Trump

May 20, 2025

Analyzing The Controversy Wayne Gretzkys Loyalty And His Relationship With Trump

May 20, 2025 -

The Wayne Gretzky Loyalty Debate Examining The Impact Of Trumps Policies On Canada Us Relations

May 20, 2025

The Wayne Gretzky Loyalty Debate Examining The Impact Of Trumps Policies On Canada Us Relations

May 20, 2025 -

Trumps Tariffs Gretzkys Loyalty A Canada Us Hockey Debate

May 20, 2025

Trumps Tariffs Gretzkys Loyalty A Canada Us Hockey Debate

May 20, 2025 -

Wayne Gretzky Fast Facts A Quick Look At The Great Ones Life And Career

May 20, 2025

Wayne Gretzky Fast Facts A Quick Look At The Great Ones Life And Career

May 20, 2025 -

Trumps Trade Policies And Gretzkys Allegiance A Look At The Stirred Debate

May 20, 2025

Trumps Trade Policies And Gretzkys Allegiance A Look At The Stirred Debate

May 20, 2025