Will A Resurgent Wall Street Undermine The German DAX's Momentum?

Table of Contents

The Current State of Wall Street

Wall Street's performance has been nothing short of remarkable recently. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite have all shown significant gains, driven by a confluence of factors. Strong corporate earnings reports, particularly in the technology and consumer discretionary sectors, have boosted investor confidence. Furthermore, the Federal Reserve's interest rate decisions, while aimed at curbing inflation, haven't significantly dampened market enthusiasm. Technological advancements continue to fuel innovation and growth in key sectors, further contributing to the upward trajectory.

The correlation between these strong US sectors and their German DAX counterparts is not always straightforward. While some technology companies listed on the DAX might benefit from positive sentiment towards the tech sector globally, others, such as those heavily reliant on energy or automotive manufacturing, might face different pressures.

- Examples of strong-performing US companies: Companies like Apple, Microsoft, and Tesla have seen significant growth, impacting investor sentiment globally.

- Investor confidence: High investor confidence in the US market suggests a continued inflow of capital, potentially drawing investment away from other markets.

- Quantitative easing's influence: Although tapering, the legacy of quantitative easing continues to influence market liquidity and overall risk appetite.

The German DAX's Recent Performance and Vulnerabilities

The German DAX, while exhibiting periods of growth, faces unique challenges. Its recent performance has been more subdued compared to the dynamism of Wall Street, influenced by factors specific to the European and German economies. The DAX is heavily weighted towards industrial and automotive sectors, making it vulnerable to global supply chain disruptions and energy price volatility. The ongoing war in Ukraine and the resulting energy crisis have significantly impacted the German economy, and by extension, the DAX.

- Prominent DAX companies and market standing: Companies like Volkswagen, Siemens, and BASF represent significant portions of the DAX and their performance directly impacts its overall trajectory.

- Correlation with other European indices: The DAX's performance is often intertwined with other major European indices like the CAC 40 (France) and FTSE 100 (UK), suggesting shared vulnerabilities and sensitivities.

- Dependence on exports: Germany's export-oriented economy makes it susceptible to global economic slowdowns and trade tensions.

Correlation and Interdependence: Wall Street vs. DAX

Historically, Wall Street and the DAX have shown a degree of correlation, though not always perfectly synchronized. Periods of strong growth on Wall Street often coincide with positive sentiment in European markets, including the DAX. However, this correlation can weaken or even become negative during times of geopolitical uncertainty or sector-specific shocks.

A strong Wall Street can impact the DAX through several mechanisms:

-

Investor sentiment: Positive news from Wall Street can boost global investor confidence, potentially leading to increased investment in the DAX. Conversely, a downturn on Wall Street could trigger capital flight from the DAX.

-

Capital flows: Investors might shift their portfolios based on relative performance, leading to capital flows between Wall Street and the DAX.

-

Currency fluctuations: The strength of the US dollar against the euro can also influence investment decisions and affect the DAX's performance.

-

Statistical analysis of historical correlations: Studying historical data reveals varying degrees of correlation, highlighting the complexities of the relationship.

-

Correlation scenarios: The correlation can be positive (both markets move in the same direction), negative (markets move inversely), or neutral (no clear relationship).

-

Role of international trade and investment flows: Global trade and investment flows act as crucial conduits, transmitting the impact of Wall Street's performance to the DAX.

Potential Scenarios and Outlook

Several scenarios are possible depending on Wall Street's continued performance:

- Optimistic scenario: Continued strong growth on Wall Street could lead to increased global investor confidence and spillover effects, positively impacting the DAX.

- Neutral scenario: Wall Street maintains moderate growth, with the DAX experiencing independent fluctuations based on its own economic factors.

- Pessimistic scenario: A sharp downturn on Wall Street could trigger global risk aversion, leading to capital flight from the DAX and a significant decline.

Forecasting the future is inherently uncertain, but considering current trends, experts suggest a range of potential outcomes for both markets. However, the interconnected nature of global markets implies that the DAX's fate is intertwined, to some degree, with Wall Street's trajectory.

- Potential outcomes and likelihoods: Experts offer probabilities for each scenario based on current economic indicators and geopolitical factors.

- Risk factors impacting the DAX: The energy crisis, supply chain issues, and geopolitical risks remain significant factors influencing the DAX's future.

- Recommendations for investors: Diversification and thorough due diligence are crucial for investors navigating this complex interplay between Wall Street and the DAX.

Conclusion: Navigating the Uncertainties – Wall Street's Impact on the German DAX

In conclusion, while a resurgent Wall Street might not directly "undermine" the German DAX's momentum in a simplistic cause-and-effect relationship, the two markets are undeniably interconnected. The impact will depend on a complex interplay of investor sentiment, capital flows, currency fluctuations, and global economic conditions. Investors must carefully assess the various potential scenarios, considering both the opportunities and risks associated with the German DAX, always mindful of the influence of a powerful Wall Street. Continue to monitor the situation closely, conducting thorough research before making investment decisions related to the German DAX, considering the dynamic interplay with Wall Street’s performance. Further reading on macroeconomic factors and global market analyses will enhance your understanding of "Wall Street's impact on the German DAX" and inform your investment strategy.

Featured Posts

-

Open Ai Facing Ftc Investigation Exploring The Future Of Ai Accountability

May 24, 2025

Open Ai Facing Ftc Investigation Exploring The Future Of Ai Accountability

May 24, 2025 -

Thames Waters Executive Pay Outrage Over Bonuses Amidst Crisis

May 24, 2025

Thames Waters Executive Pay Outrage Over Bonuses Amidst Crisis

May 24, 2025 -

Kueloenleges Porsche 911 80 Millio Forintos Extrak

May 24, 2025

Kueloenleges Porsche 911 80 Millio Forintos Extrak

May 24, 2025 -

Porsche Cayenne Gts Coupe Test I Recenzja Suv Marzen

May 24, 2025

Porsche Cayenne Gts Coupe Test I Recenzja Suv Marzen

May 24, 2025 -

Footballer Kyle Walker Spotted With Models In Milan Following Wifes Departure

May 24, 2025

Footballer Kyle Walker Spotted With Models In Milan Following Wifes Departure

May 24, 2025

Latest Posts

-

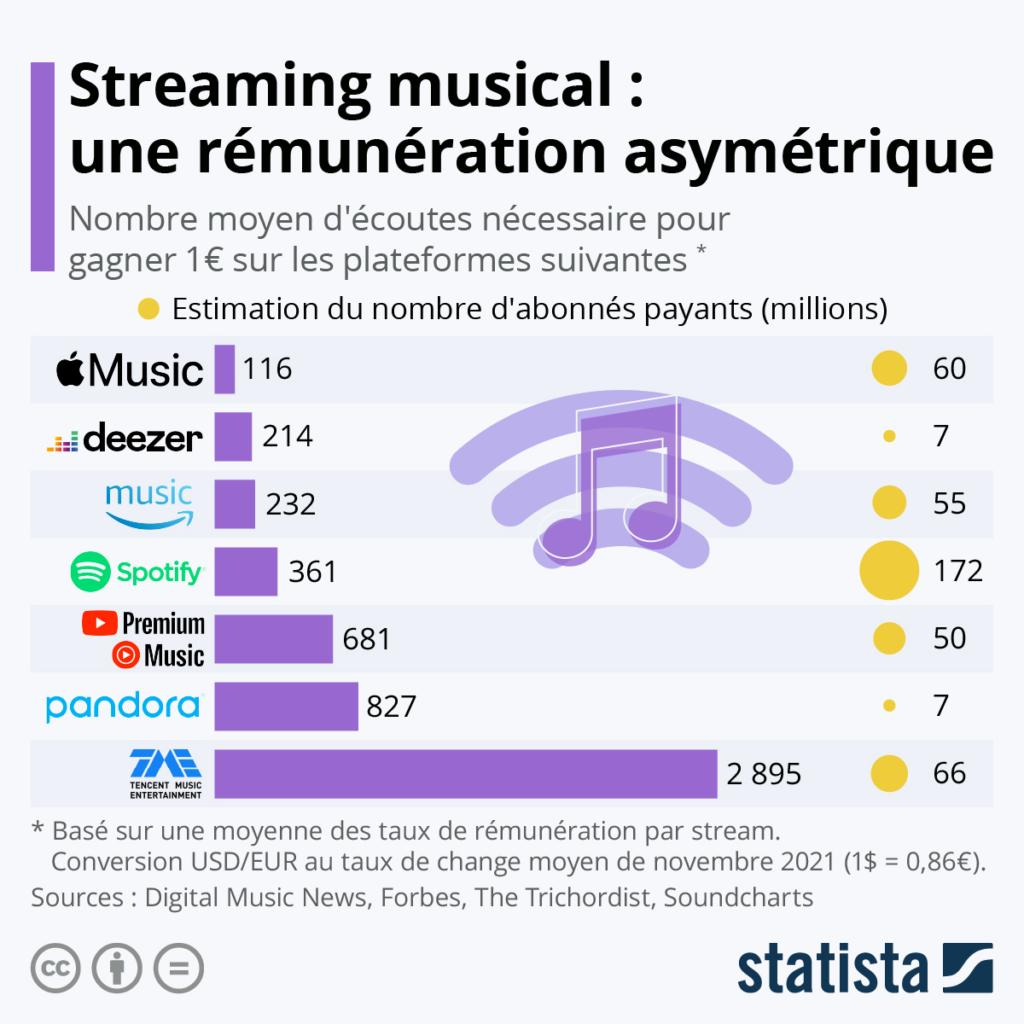

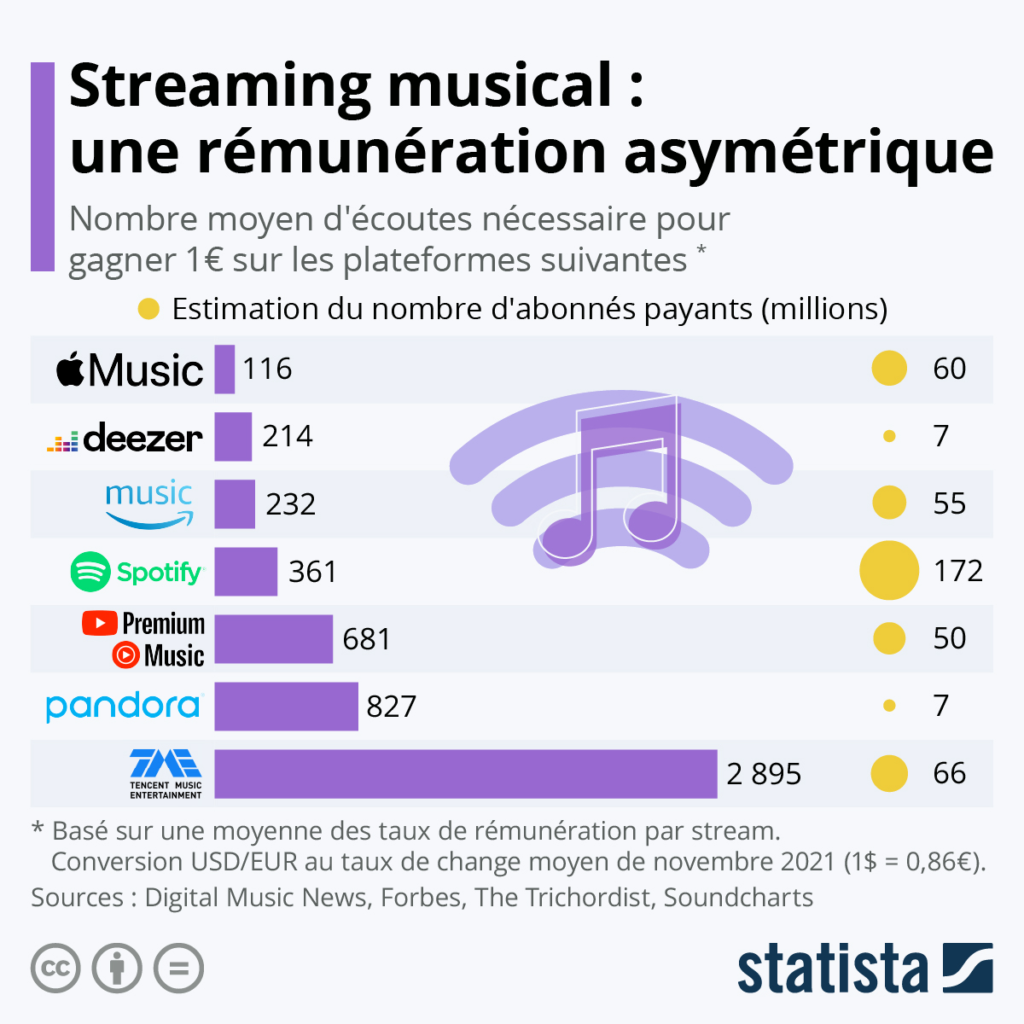

Nouvelles Reglementations Pour Le Contenu Francophone Sur Les Plateformes De Streaming Au Quebec

May 24, 2025

Nouvelles Reglementations Pour Le Contenu Francophone Sur Les Plateformes De Streaming Au Quebec

May 24, 2025 -

Quebec Quotas De Contenu Francais Obligatoires Sur Les Plateformes De Streaming

May 24, 2025

Quebec Quotas De Contenu Francais Obligatoires Sur Les Plateformes De Streaming

May 24, 2025 -

Canada Posts New Offers Averted Strike

May 24, 2025

Canada Posts New Offers Averted Strike

May 24, 2025 -

Quebec Impose Des Quotas Pour Le Contenu Francophone En Diffusion Continue

May 24, 2025

Quebec Impose Des Quotas Pour Le Contenu Francophone En Diffusion Continue

May 24, 2025 -

Canadian Automotive Sector Seeks Stronger Stance Amidst Trump Trade Threats

May 24, 2025

Canadian Automotive Sector Seeks Stronger Stance Amidst Trump Trade Threats

May 24, 2025