Wiggins' Financial Woes: Three Years From Retirement To Addiction And Bankruptcy

Table of Contents

The Pre-Retirement Picture: A Seemingly Secure Financial Future

Wiggins, a 65-year-old retiree, initially enjoyed a seemingly secure financial future. Years of diligent work and careful saving had culminated in a comfortable nest egg.

Wiggins' pre-retirement financial health:

Wiggins' financial stability was built upon several pillars:

- Retirement Savings: A substantial $500,000 in a 401(k) plan.

- Investment Portfolio: A diversified portfolio valued at approximately $200,000, consisting of stocks, bonds, and mutual funds.

- Pension Plan: A monthly pension of $2,500 from his former employer, providing a reliable income stream.

- Paid-off Home: A mortgage-free home, representing a significant asset.

Lifestyle and Spending Habits:

Before his financial decline, Wiggins enjoyed a comfortable lifestyle. He spent modestly, prioritized his health, and engaged in regular social activities. However, subtle warning signs were present:

- Impulse Purchases: Occasional expensive impulse purchases, suggesting a lack of strict budgeting.

- Lack of Financial Planning: While he had accumulated assets, he lacked a detailed retirement spending plan. This lack of proactive retirement planning laid the groundwork for future difficulties.

- Underestimating Expenses: He underestimated the potential increase in healthcare costs during retirement.

The Descent: Addiction's Grip and Financial Neglect

The seemingly secure financial future Wiggins had built began to crumble with the onset of a gambling addiction.

The onset of addiction:

Wiggins' gambling addiction started subtly, with small bets that gradually escalated. His initial wins fueled a false sense of security, leading to progressively larger stakes and more frequent gambling.

- Escalating Costs: The cost of his gambling habit steadily increased, consuming a larger portion of his disposable income.

- Impaired Decision-Making: His addiction severely impaired his judgment and decision-making abilities, affecting all aspects of his financial life.

- Secrecy and Isolation: He concealed his addiction from family and friends, further isolating himself and hindering his ability to seek help.

Eroding Financial Resources:

The addiction quickly eroded Wiggins' financial resources:

- Withdrawal of Retirement Savings: He began withdrawing significant sums from his 401(k) to finance his gambling habit.

- Liquidation of Investments: He liquidated a significant portion of his investment portfolio, incurring losses due to impulsive selling.

- Accumulation of Debt: He accumulated substantial credit card debt and high-interest loans.

- Loss of Home: Ultimately, the mounting debt and financial mismanagement resulted in the loss of his home through foreclosure.

The Aftermath: Bankruptcy and the Struggle for Recovery

The inevitable consequence of Wiggins' financial mismanagement and addiction was bankruptcy.

The bankruptcy process:

Wiggins filed for bankruptcy, a legally complex and emotionally draining process.

- Legal Consequences: Bankruptcy resulted in a significant impact on his credit rating, making it difficult to secure future loans or credit.

- Lifestyle Changes: He experienced a dramatic decline in his lifestyle, moving into a smaller, rented apartment.

- Strained Relationships: The financial strain caused significant stress on his relationships with family and friends.

The road to recovery:

Wiggins' journey to recovery is ongoing and challenging:

- Addiction Treatment: He is actively pursuing addiction treatment, attending support groups and seeking professional help.

- Financial Counseling: He is working with a financial counselor to create a budget and develop a plan for financial rehabilitation.

- Debt Consolidation: He is exploring options for debt consolidation to manage his outstanding debts.

- Social Support: He has started rebuilding relationships with supportive friends and family.

Conclusion: Learning from Wiggins' Financial Woes

Wiggins' story is a cautionary tale of how addiction and poor financial management can lead to devastating consequences, even for those who initially enjoy financial security. His descent highlights the critical importance of proactive retirement planning, responsible spending habits, and seeking help when facing addiction. Don't let your retirement dreams turn into Wiggins' financial woes. Take control of your finances and plan for a secure future. Develop a comprehensive retirement plan, budget diligently, and seek professional financial advice. For addiction resources and support, visit [link to addiction resource website] and for financial planning assistance, visit [link to financial planning website]. Remember, proactive planning and seeking help are key to avoiding a similar fate.

Featured Posts

-

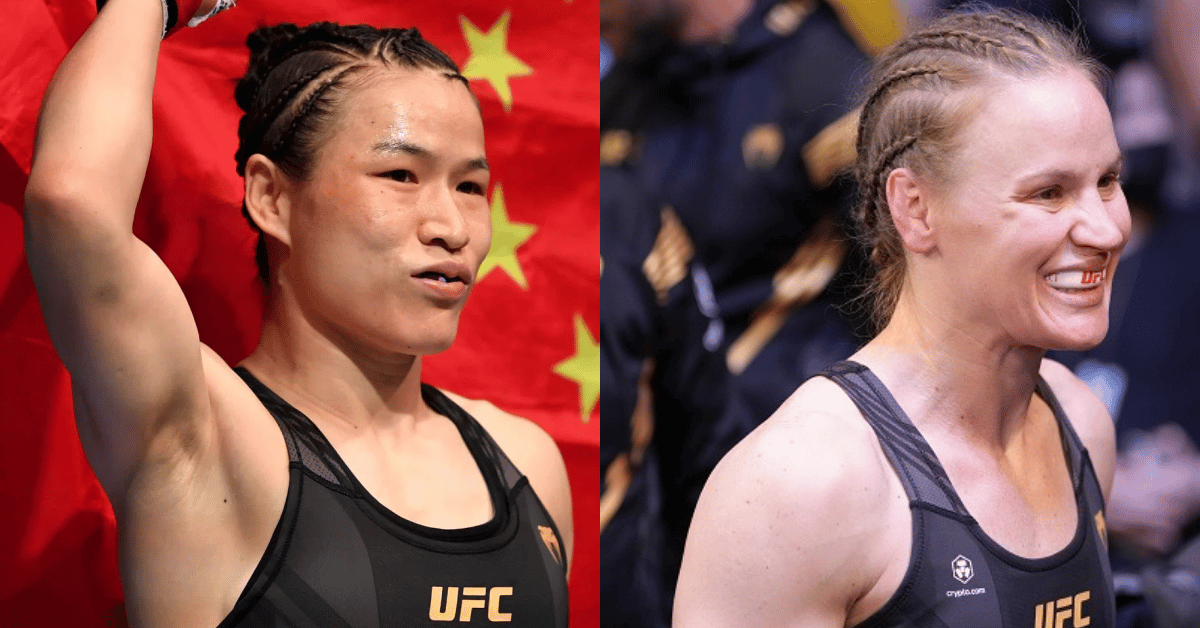

Ufc 315 Shevchenko Open To Zhang Weili Superfight

May 12, 2025

Ufc 315 Shevchenko Open To Zhang Weili Superfight

May 12, 2025 -

Valentina Shevchenko Vs Manon Fiorot Ufc 315 Fight Analysis And Predictions

May 12, 2025

Valentina Shevchenko Vs Manon Fiorot Ufc 315 Fight Analysis And Predictions

May 12, 2025 -

Mc Ilroy And Lowry Trail In Zurich Classic Defense

May 12, 2025

Mc Ilroy And Lowry Trail In Zurich Classic Defense

May 12, 2025 -

Ufc 315 Muhammad Vs Della Maddalena Full Main Card Results And Analysis

May 12, 2025

Ufc 315 Muhammad Vs Della Maddalena Full Main Card Results And Analysis

May 12, 2025 -

Bilateral Anophthalmia Understanding This Rare Condition Affecting Babies Born Without Eyes

May 12, 2025

Bilateral Anophthalmia Understanding This Rare Condition Affecting Babies Born Without Eyes

May 12, 2025

Latest Posts

-

Develop Voice Assistants With Ease Open Ais 2024 Developer Event

May 12, 2025

Develop Voice Assistants With Ease Open Ais 2024 Developer Event

May 12, 2025 -

Executive Office365 Accounts Compromised Millions In Losses

May 12, 2025

Executive Office365 Accounts Compromised Millions In Losses

May 12, 2025 -

Millions Lost Inside The Executive Office365 Data Breach

May 12, 2025

Millions Lost Inside The Executive Office365 Data Breach

May 12, 2025 -

Creating Voice Assistants Made Easy Open Ais Latest Announcement

May 12, 2025

Creating Voice Assistants Made Easy Open Ais Latest Announcement

May 12, 2025 -

Office365 Security Flaw Hacker Makes Millions From Executive Accounts

May 12, 2025

Office365 Security Flaw Hacker Makes Millions From Executive Accounts

May 12, 2025