Why The Fed Remains Cautious On Interest Rate Cuts

Table of Contents

Persistent Inflation as a Major Obstacle to Interest Rate Cuts

The primary roadblock to immediate interest rate cuts is the persistent nature of inflation. While headline inflation – the overall increase in prices – may be showing some deceleration, core inflation – which excludes volatile food and energy prices – remains stubbornly high.

Core Inflation Remains Stubbornly High

Headline inflation can fluctuate wildly due to temporary shocks in energy or food prices. Core inflation, however, provides a more accurate picture of underlying inflationary pressures within the economy. Recent data reveals core inflation remaining significantly above the Fed's 2% target, indicating that inflationary pressures are deeply embedded within the economy.

- Rising wages, driven by a tight labor market, are contributing significantly to core inflation.

- Lingering supply chain disruptions continue to push up prices for certain goods.

- Increased demand for services, as the economy recovers from the pandemic, adds further inflationary pressure.

The Risk of Unanchored Inflation Expectations

Perhaps the most significant concern for the Fed is the risk of unanchored inflation expectations. If consumers and businesses begin to expect persistently high inflation, they will adjust their behavior accordingly – demanding higher wages and raising prices proactively. This can lead to a dangerous wage-price spiral, where rising wages fuel further price increases, creating a self-perpetuating cycle of inflation.

- Unanchored inflation erodes purchasing power, reducing consumer spending and potentially triggering a recession.

- Economic instability increases, making long-term planning and investment more challenging.

- The Fed's credibility is at stake; if inflation remains high for an extended period, it undermines public confidence in the central bank's ability to manage the economy.

Strong Labor Market and Potential for Wage-Price Spirals

The remarkably strong labor market further complicates the decision-making process regarding interest rate cuts. Low unemployment rates and a high number of job openings contribute to upward pressure on wages.

Low Unemployment and Tight Labor Market Conditions

The unemployment rate remains historically low, indicating a tight labor market where employers are competing fiercely for workers. This competition drives up wages, adding fuel to the inflationary fire.

- Many sectors, including technology, healthcare, and hospitality, are experiencing significant labor shortages.

- Job openings outnumber available workers, giving employees greater leverage in wage negotiations.

- This wage growth, while positive for workers, exacerbates inflationary pressures.

The Fed's Mandate to Maintain Full Employment Without Fueling Inflation

The Fed operates under a dual mandate: to maintain maximum employment and price stability. Achieving both simultaneously is a delicate balancing act. While a strong labor market is generally positive, the current situation presents a significant challenge. Interest rate cuts, while potentially boosting employment, risk further accelerating inflation if not carefully implemented.

- Premature interest rate cuts could lead to a resurgence of inflation, forcing the Fed to reverse course and raise rates again.

- The Fed needs to carefully assess the trade-offs between employment gains and the risk of reigniting inflation.

- Finding the optimal balance requires a cautious and data-driven approach.

Uncertainty Regarding the Economic Outlook and the Risk of Premature Cuts

Adding to the complexity is the considerable uncertainty surrounding the global economic outlook. Geopolitical risks and a potential global slowdown make it difficult to predict the effectiveness of interest rate cuts.

Global Economic Slowdown and Geopolitical Risks

Global events, from the war in Ukraine to supply chain disruptions, cast a shadow over the US economy. These uncertainties complicate economic forecasting and make it challenging to assess the impact of interest rate cuts.

- The ongoing war in Ukraine continues to disrupt energy markets and global supply chains.

- Geopolitical tensions in other parts of the world further add to economic uncertainty.

- A potential global recession could significantly impact the US economy, regardless of domestic monetary policy.

Potential for Further Rate Hikes if Inflation Remains High

The risk of premature interest rate cuts reigniting inflation is substantial. If the Fed cuts rates too soon, it could undo any progress made in combating inflation, forcing it to reverse course and raise rates again. This would be a costly mistake, potentially triggering a deeper economic downturn.

- Historical examples demonstrate the challenges of reversing monetary policy decisions.

- The Fed needs to ensure that inflation is decisively under control before considering significant interest rate cuts.

- A premature easing of monetary policy could prolong the fight against inflation and cause unnecessary economic hardship.

The Cautious Path Forward on Interest Rate Cuts

In conclusion, the Federal Reserve's cautious approach to interest rate cuts is driven by several interconnected factors: persistent inflation, a robust labor market with the potential for wage-price spirals, and significant uncertainty surrounding the global economic outlook. The Fed is prioritizing a data-driven approach, carefully weighing the risks of premature cuts against the potential benefits. Understanding these complex factors is crucial for navigating the current economic landscape. Therefore, staying informed about the Fed's decisions and future announcements regarding interest rate cuts is paramount. Follow reputable financial news sources and the Federal Reserve website to stay abreast of developments and understand the implications of interest rate cuts for your personal finances and investment strategies.

Featured Posts

-

Palantir Stock Analyzing Q1 2024 Government And Commercial Growth

May 10, 2025

Palantir Stock Analyzing Q1 2024 Government And Commercial Growth

May 10, 2025 -

Nicolas Cage Lawsuit Dismissed Son Weston Still Facing Claims

May 10, 2025

Nicolas Cage Lawsuit Dismissed Son Weston Still Facing Claims

May 10, 2025 -

Brutal Killing Family Torn Apart By Racist Violence

May 10, 2025

Brutal Killing Family Torn Apart By Racist Violence

May 10, 2025 -

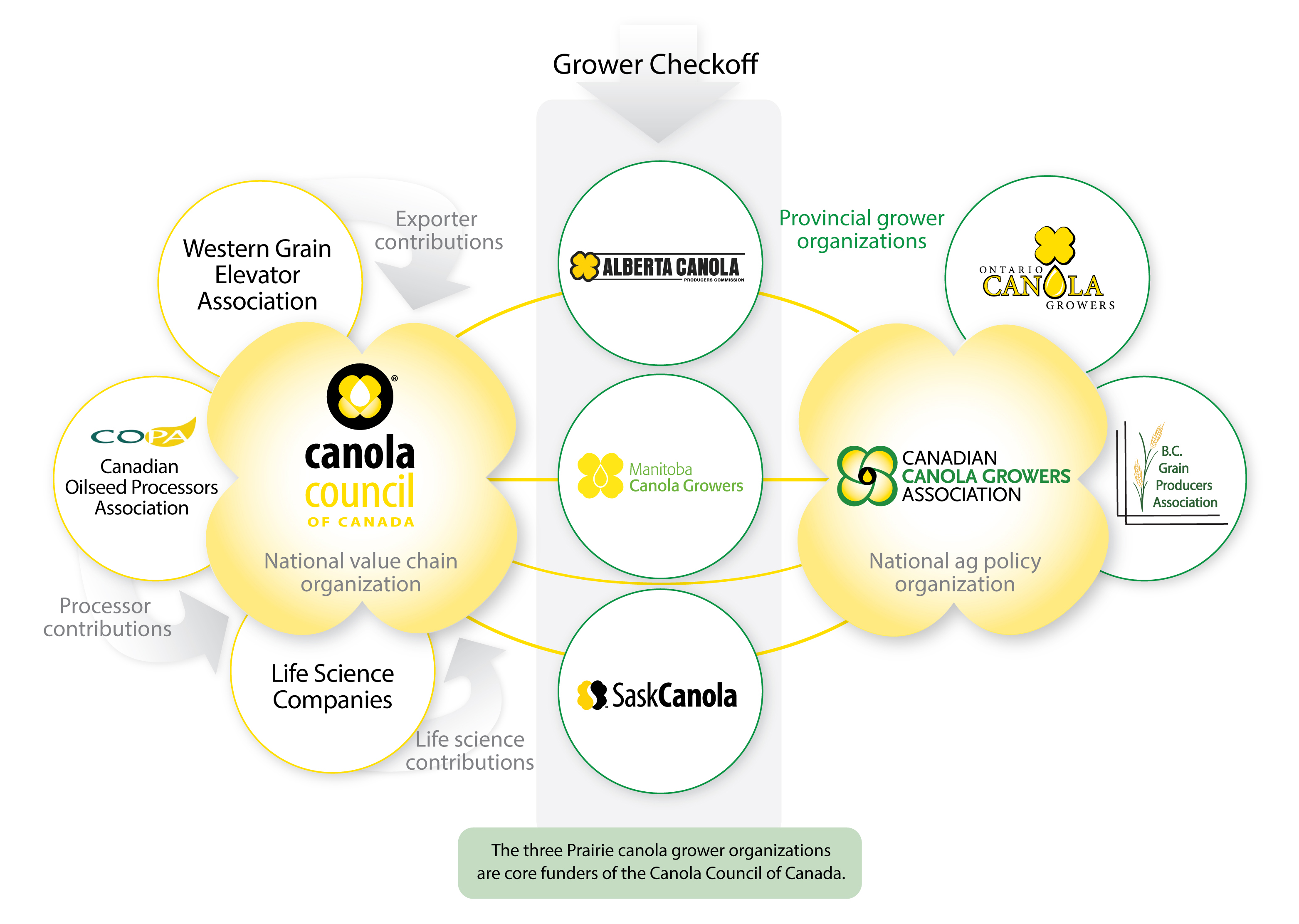

Chinas Canola Supply Chain Adapting To The Canada Break

May 10, 2025

Chinas Canola Supply Chain Adapting To The Canada Break

May 10, 2025 -

Trumps Trade Policies A 174 Billion Impact On Global Billionaires

May 10, 2025

Trumps Trade Policies A 174 Billion Impact On Global Billionaires

May 10, 2025