Why Stretched Stock Market Valuations Shouldn't Deter Investors: BofA's Analysis

Table of Contents

BofA's Key Arguments Against Immediate Market Correction

BofA's analysis suggests that while valuations are indeed high, several factors argue against a swift and significant market downturn. Their core arguments highlight the resilience of the current market environment and its potential for continued growth. Here's a summary of their key points:

-

Strong Corporate Earnings Growth: BofA's report emphasizes that corporate earnings growth has outpaced the increase in valuations. This suggests that the current high valuations are at least partially justified by strong underlying company performance. This positive trend is a key factor in their optimistic outlook.

-

Low Interest Rates as a Supporting Factor: The persistently low interest rate environment continues to support high stock valuations. Low borrowing costs make equities more attractive compared to bonds, encouraging investment and driving up prices. This dynamic is a cornerstone of their analysis.

-

Positive Long-Term Economic Outlook: BofA's analysis incorporates a positive outlook on the long-term economic landscape. This expectation of continued economic growth mitigates concerns about short-term valuation risks. The long-term potential outweighs the immediate valuation concerns, in their view.

-

Supporting Data: The BofA report includes specific data points, such as projected GDP growth, corporate profit margins, and inflation forecasts, to support these claims. While the exact figures are subject to the report itself, the consistent message is one of cautiously optimistic growth.

The Role of Low Interest Rates in Sustaining High Valuations

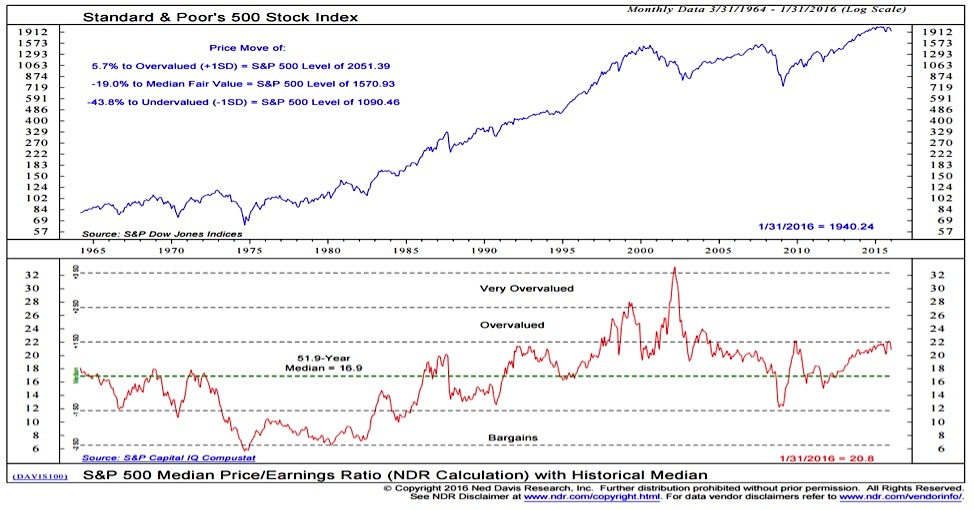

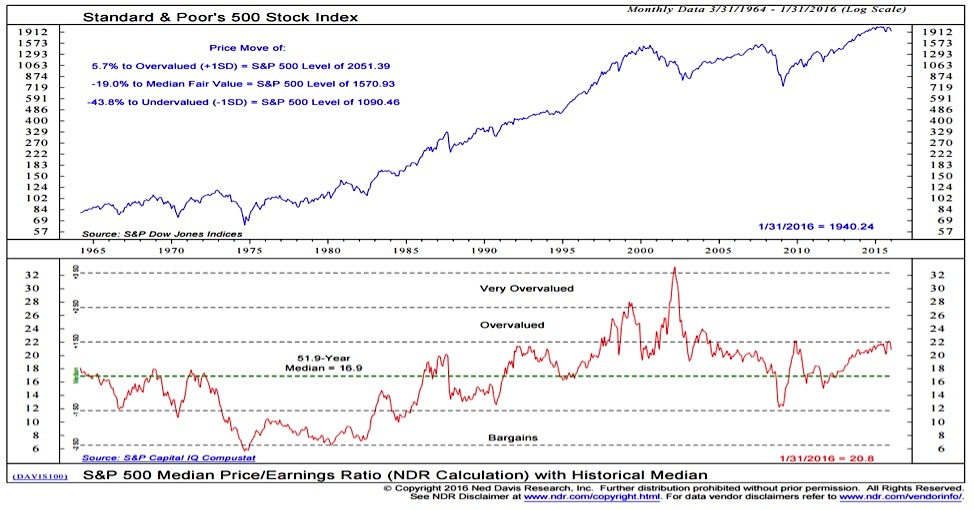

Low interest rates play a crucial role in maintaining high stock valuations. Historically low bond yields directly impact the discount rate used in stock valuation models. When bond yields are low, the opportunity cost of investing in stocks decreases, making equities more attractive even at higher price-to-earnings ratios (P/E ratios). This creates a positive feedback loop, with low interest rates (low bond yields) fueling higher stock prices and higher P/E ratios. Keywords: low interest rate environment, bond yields, discount rate, stock valuation models. Investors are less inclined to hold low-yielding bonds when stocks offer potentially higher returns, even with elevated valuations.

Long-Term Growth Potential and Sector-Specific Opportunities

BofA's analysis doesn't simply dismiss the high valuations; it also highlights promising long-term growth prospects across specific sectors. Despite the overall stretched market, BofA identifies areas with significant potential. This suggests a strategy of sector rotation and selective investment, rather than complete market avoidance.

-

Technology: The continued innovation and digital transformation across various industries continue to support the growth of technology stocks, according to BofA's assessment.

-

Healthcare: Aging populations and advancements in medical technology offer consistent growth opportunities within the healthcare sector.

-

Renewable Energy: The global push towards sustainable energy creates a significant and expanding market for renewable energy companies.

These are just examples, and specific sector recommendations will vary based on the latest BofA reports. Keywords: sector rotation, growth stocks, value stocks, long-term investment, portfolio diversification.

Managing Risk in a High-Valuation Environment

While BofA's analysis offers a relatively optimistic outlook, it's crucial to acknowledge the legitimate risks associated with high valuations. A prudent investment strategy should always incorporate risk management.

-

Diversification: Diversifying across various asset classes (stocks, bonds, real estate) and sectors is paramount. This reduces the impact of any single sector underperforming.

-

Focus on Quality: Prioritize high-quality companies with strong fundamentals – consistent earnings growth, low debt, and strong management teams. Thorough due diligence is essential.

-

Gradual Investment: Instead of making large, lump-sum investments, consider a gradual approach, allowing you to average into the market and reduce the risk of investing at a peak.

Keywords: risk management, portfolio optimization, investment diversification, due diligence, fundamental analysis.

Conclusion: Navigating Stretched Stock Market Valuations with Confidence

BofA's analysis suggests that while stretched stock market valuations are a factor to consider, they shouldn't necessarily deter long-term investors. Strong corporate earnings, low interest rates, and a positive long-term economic outlook contribute to their optimistic view. However, responsible risk management remains crucial. A well-diversified portfolio, focused on high-quality companies and employing a gradual investment strategy, can help navigate this environment effectively. By considering BofA's perspective and implementing a sound investment strategy, investors can approach the current market with confidence. For further insights into BofA's market analysis and investment strategies, explore their official publications and research materials. Remember, a long-term perspective is key when dealing with stretched stock market valuations.

Featured Posts

-

Dollar Gains Momentum Against Major Peers Amidst Trumps Less Aggressive Fed Rhetoric

Apr 24, 2025

Dollar Gains Momentum Against Major Peers Amidst Trumps Less Aggressive Fed Rhetoric

Apr 24, 2025 -

Los Angeles Palisades Fire A List Of Celebrities Who Lost Properties

Apr 24, 2025

Los Angeles Palisades Fire A List Of Celebrities Who Lost Properties

Apr 24, 2025 -

Blue Origins Rocket Launch Delayed Subsystem Issue Identified

Apr 24, 2025

Blue Origins Rocket Launch Delayed Subsystem Issue Identified

Apr 24, 2025 -

Investigation Reveals Lingering Toxic Chemicals In Buildings After Ohio Train Derailment

Apr 24, 2025

Investigation Reveals Lingering Toxic Chemicals In Buildings After Ohio Train Derailment

Apr 24, 2025 -

Hope Liam And Luna What To Expect In The Next Two Weeks Of The Bold And The Beautiful

Apr 24, 2025

Hope Liam And Luna What To Expect In The Next Two Weeks Of The Bold And The Beautiful

Apr 24, 2025