Why Is The Canadian Dollar Falling Against Other Currencies?

Table of Contents

2.1. Impact of Commodity Prices on the CAD

Canada's economy is heavily reliant on commodity exports, particularly oil, natural gas, and lumber. The price of these commodities is intrinsically linked to the strength of the Canadian dollar. When commodity prices fall, as they have recently done in certain sectors, Canadian exports become less valuable, reducing demand for the CAD. This, in turn, weakens the currency.

- Lower Oil Prices: A significant portion of Canada's exports comes from its energy sector. Any decline in global oil prices directly impacts the revenue generated by these exports, negatively affecting the CAD exchange rate. For example, recent predictions of lower oil prices for the remainder of 2024 are already impacting investor confidence and putting downward pressure on the loonie.

- Fluctuations in Natural Gas and Lumber: Similar to oil, fluctuations in natural gas and lumber prices, key Canadian exports, directly influence the CAD's value. A decrease in global demand for these commodities results in a weaker Canadian dollar.

- Trade Balance Impact: The relationship between commodity prices and the CAD is reflected in Canada's trade balance. A decline in export values due to lower commodity prices leads to a trade deficit, further weakening the Canadian dollar.

2.2. Interest Rate Differentials and Monetary Policy

Interest rate differentials between Canada and other major economies play a crucial role in determining currency exchange rates. The Bank of Canada's monetary policy directly influences Canadian interest rates. Higher interest rates generally attract foreign investment, increasing demand for the CAD and strengthening the currency. Conversely, lower interest rates make the CAD less attractive, leading to a weaker exchange rate.

- Bank of Canada's Actions: The Bank of Canada's recent decisions on interest rate adjustments reflect its response to inflation and economic growth. These decisions, compared to those of the Federal Reserve (US), the European Central Bank (ECB), and the Bank of England, significantly influence the CAD's performance against the USD, EUR, and GBP.

- Comparative Interest Rates: By comparing Canadian interest rates to those of major economies, we can understand the relative attractiveness of investing in Canadian assets. A lower interest rate environment in Canada compared to other countries makes the CAD less appealing to foreign investors.

- Inflation's Role: High inflation erodes purchasing power and can prompt central banks to raise interest rates, impacting currency values. The Bank of Canada's efforts to manage inflation are a key factor driving its monetary policy decisions and impacting the CAD exchange rate.

2.3. Geopolitical Factors and Global Uncertainty

Global events and geopolitical instability significantly impact currency markets. Uncertainty in international affairs often leads investors to seek safe havens, such as the US dollar, reducing demand for riskier currencies like the CAD.

- Trade Wars and Protectionism: Trade disputes and protectionist policies can disrupt global trade flows, negatively impacting commodity-dependent economies like Canada and weakening the CAD.

- Political Instability: Political uncertainty in major trading partners can create volatility in currency markets, impacting the CAD exchange rate.

- Global Economic Slowdowns: Global economic slowdowns reduce demand for commodities and negatively affect the Canadian economy, weakening the CAD.

2.4. US Dollar Strength

The US dollar's role as the world's primary reserve currency significantly influences other currencies, including the CAD. A strong USD often translates to a weaker CAD due to increased demand for the USD and reduced demand for the CAD.

- USD as a Safe Haven: During times of global uncertainty, investors tend to flock to the USD, further strengthening it and weakening currencies like the CAD.

- US Economic Growth: Strong US economic growth increases demand for the USD, putting downward pressure on the CAD.

- Federal Reserve Policy: The Federal Reserve's monetary policy decisions also heavily influence the USD's value, indirectly affecting the CAD exchange rate.

3. Conclusion: Understanding and Navigating the Falling Canadian Dollar

The decline of the Canadian dollar is a complex issue influenced by a combination of factors: fluctuating commodity prices, interest rate differentials, geopolitical risks, and the strength of the US dollar. Monitoring these factors is crucial for individuals and businesses alike. To mitigate the risks associated with a falling CAD, consider strategies such as hedging, diversifying investments, and staying informed about CAD exchange rate forecasts.

To make informed financial decisions, stay updated on the Canadian dollar exchange rate and its influencing factors. Utilize resources like financial news websites and currency trading platforms to track the CAD's performance and potential future movements. Understanding these dynamics allows for better financial planning and risk management in the face of a volatile CAD. Learn more about currency trading and hedging strategies to protect yourself from future fluctuations in the Canadian dollar exchange rate.

Featured Posts

-

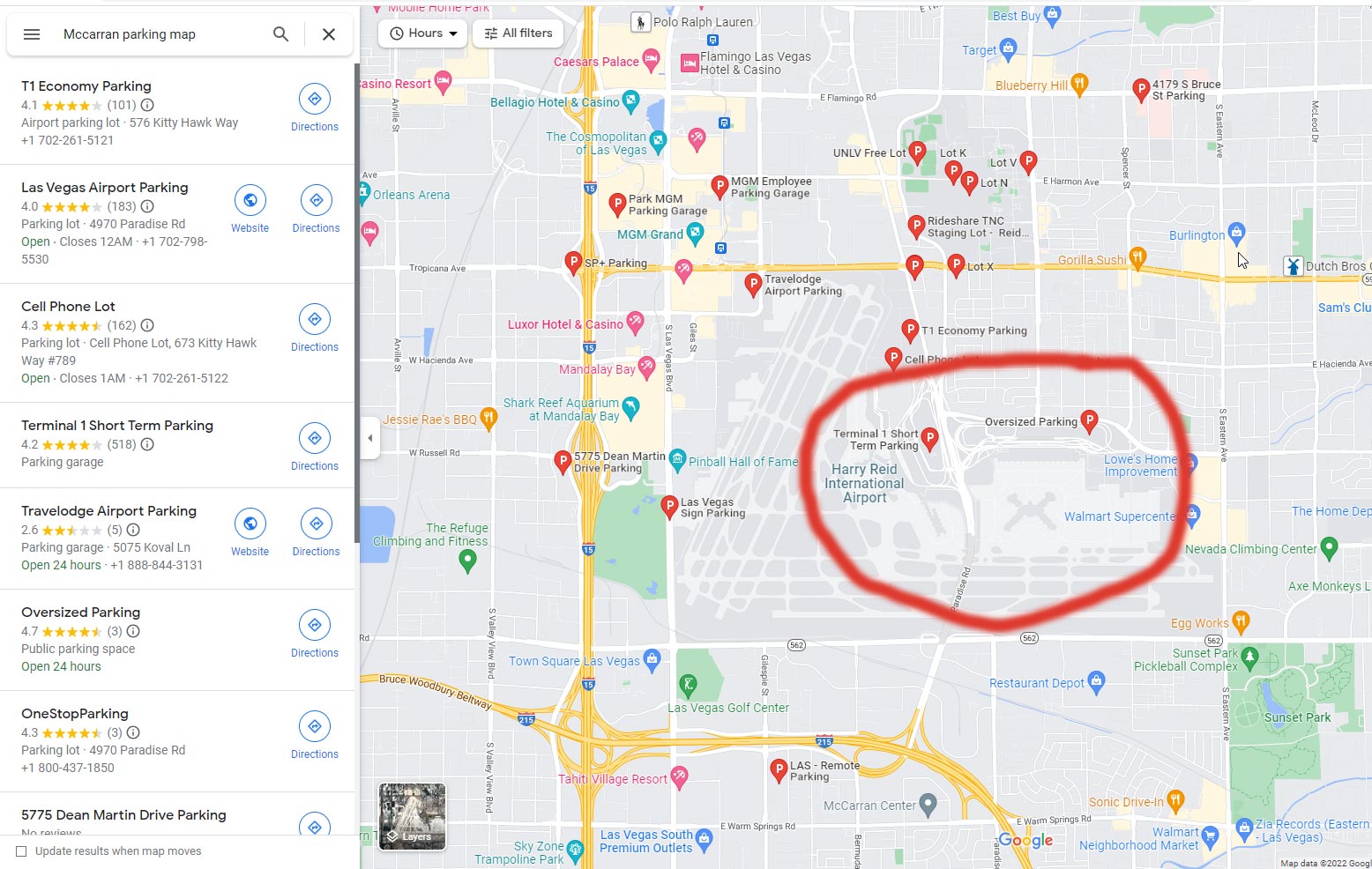

Las Vegas Airport Faas Focus On Collision Avoidance

Apr 24, 2025

Las Vegas Airport Faas Focus On Collision Avoidance

Apr 24, 2025 -

Usd Strengthens Against Major Currencies As Trump Softens Stance On Fed

Apr 24, 2025

Usd Strengthens Against Major Currencies As Trump Softens Stance On Fed

Apr 24, 2025 -

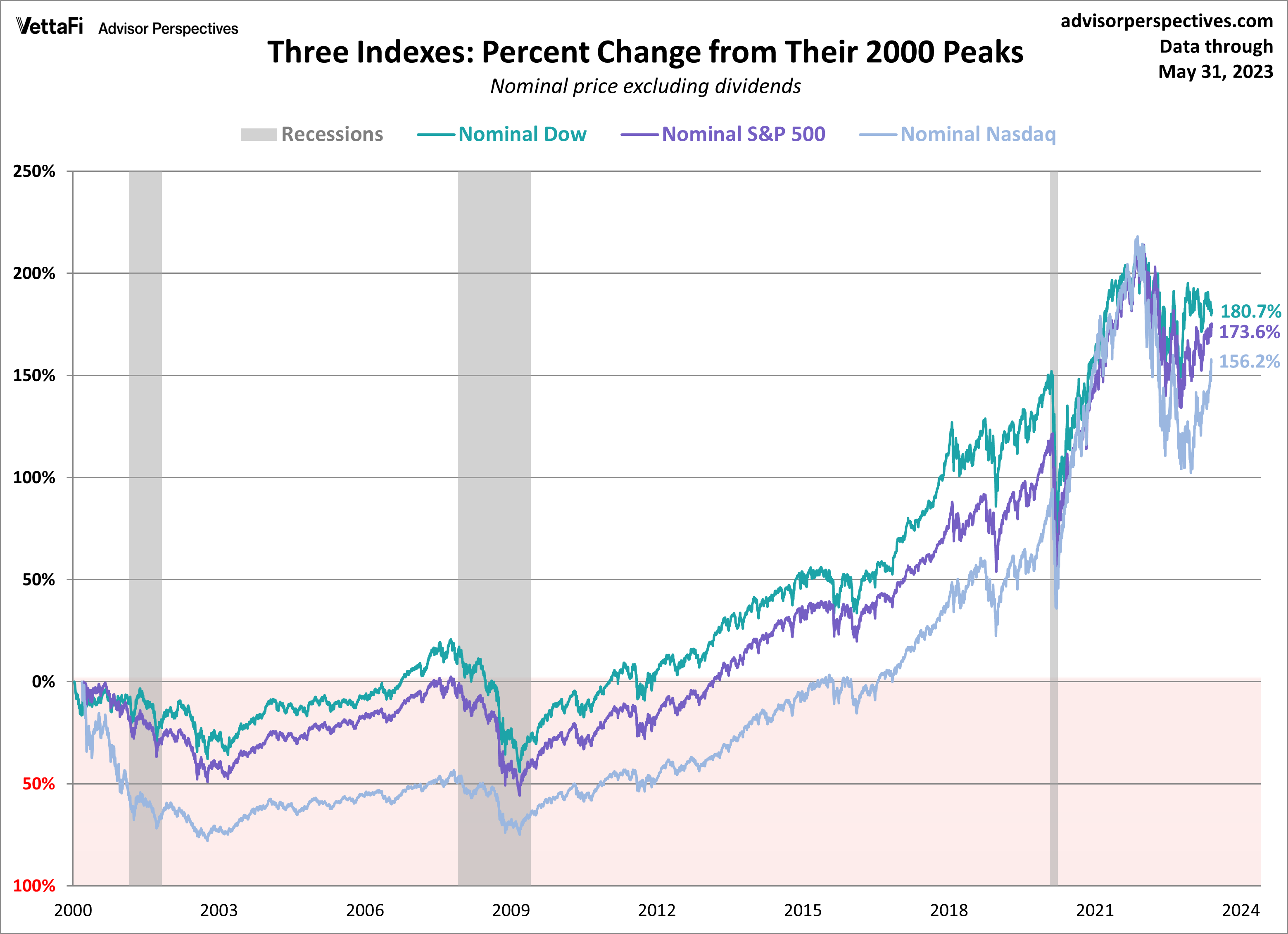

Live Stock Market Updates Dows 1000 Point Rally And Market Analysis

Apr 24, 2025

Live Stock Market Updates Dows 1000 Point Rally And Market Analysis

Apr 24, 2025 -

Access To Easier Voice Assistant Creation Open Ais 2024 Developer Event

Apr 24, 2025

Access To Easier Voice Assistant Creation Open Ais 2024 Developer Event

Apr 24, 2025 -

Stock Market Today Dow S And P 500 Live Updates For April 23rd

Apr 24, 2025

Stock Market Today Dow S And P 500 Live Updates For April 23rd

Apr 24, 2025