Why Did Uber Stock Rally Double Digits In April?

Table of Contents

April saw Uber stock (UBER) experience a remarkable double-digit rally, leaving many investors surprised. This unexpected surge sparked considerable interest, prompting questions about the underlying reasons for this significant price increase. This article delves into the key factors contributing to Uber's impressive April performance, examining the interplay of strong earnings, increased investor confidence, and favorable macroeconomic conditions.

Strong First-Quarter Earnings Report Exceeded Expectations

Uber's impressive April performance was largely fueled by a surprisingly strong first-quarter earnings report that significantly exceeded analyst expectations. This positive news injected a much-needed dose of confidence into the market.

Revenue Growth and Profitability Improvements

- Revenue Growth: Uber reported a substantial year-over-year increase in revenue, exceeding forecasts by a considerable margin. Specific figures, once released, should be inserted here, highlighting growth in both ride-sharing and delivery segments. For example, "Revenue growth in the ride-sharing segment reached X%, while delivery services saw a Y% increase."

- Improved Profitability: Key profitability metrics like EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and net income showed significant improvement compared to the same period last year and analyst predictions. The reduction in losses or increase in profits indicated a positive trajectory for the company's financial health.

- Increased Rider and Driver Activity: A notable increase in both rider and driver activity contributed significantly to the improved revenue and profitability. This suggests a recovery in demand post-pandemic and effective operational strategies to maintain driver engagement. Further details on growth in specific geographic regions would add value here.

Positive Guidance for Future Quarters

The positive first-quarter results were further bolstered by the company's optimistic guidance for the coming quarters. This forward-looking projection instilled further confidence among investors.

- Projected Growth: Uber's management projected continued revenue growth and margin expansion in subsequent quarters, outlining a clear path towards sustained profitability. The specific figures projected should be included here for context and to demonstrate the basis for investor optimism.

- Driving Factors: The positive outlook was based on factors such as continued growth in existing markets, expansion into new geographic regions, and the successful implementation of new initiatives like enhanced delivery services or loyalty programs.

- Strategic Changes: Any significant strategic changes, such as new partnerships or technological upgrades, which contributed to the positive outlook should be detailed. These factors underscore the company's proactive approach to growth and innovation.

Increased Investor Confidence in Uber's Long-Term Growth Potential

Beyond the immediate impact of the first-quarter earnings, the April rally also reflected a growing belief in Uber's long-term growth potential. This confidence stemmed from several strategic moves and technological advancements.

Strategic Initiatives and Market Expansion

Uber's strategic expansion efforts and successful initiatives played a vital role in bolstering investor confidence.

- Market Penetration: Successful penetration of new markets or service segments demonstrates the company's ability to adapt and capitalize on emerging opportunities. Examples of successful expansion strategies should be provided here, with specific data on market share gains.

- Strategic Partnerships: Any strategic partnerships or acquisitions that strengthened Uber's competitive position or expanded its service offerings should be discussed, highlighting their impact on investor perception.

- Sustainable Growth: The successful implementation of these initiatives demonstrated a clear path towards achieving sustainable long-term growth, addressing previous investor concerns about profitability and market share.

Technological Advancements and Innovation

Uber's commitment to technological innovation further fueled investor confidence.

- Autonomous Vehicle Initiatives: Progress in autonomous vehicle technology, even if still in early stages, signals long-term potential cost savings and operational efficiency. Any updates or milestones achieved in this area should be mentioned here.

- New Delivery Options: Expansion into new delivery services or improvements in existing offerings showcase Uber's adaptability and ability to tap into growing market trends, leading to increased revenue streams.

- Technological Leadership: Uber's position as a leader in ride-sharing and delivery technology was reinforced, demonstrating the company’s ability to adapt to the evolving landscape and attract and retain customers.

Favorable Macroeconomic Conditions and Market Sentiment

The positive performance of Uber stock in April also benefited from broader macroeconomic conditions and a generally upbeat market sentiment.

Overall Market Recovery and Tech Stock Rally

The overall market experienced a period of recovery in April, with a particular rally in the tech sector. This positive market sentiment positively influenced the price of technology stocks, including Uber.

- Broader Market Trends: Details on the broader market trends in April, including any positive economic indicators or shifts in investor sentiment, would be beneficial in providing context.

- Correlation to Uber's Performance: This section should analyze the correlation between the overall market performance and Uber's specific stock price increase, highlighting the impact of general market sentiment on UBER's share price.

Reduced Inflationary Pressures

Easing inflationary pressures also played a role in boosting investor confidence in the company and the tech sector in general.

- Impact on Consumer Spending: Reduced inflation potentially led to increased consumer spending, benefiting companies like Uber that rely on consumer demand for their services. This section should explain how lower inflation could translate to increased ride-sharing and delivery orders.

Conclusion

Uber's double-digit stock rally in April was a result of a confluence of positive factors, including exceeding first-quarter earnings expectations, showcasing impressive revenue growth and improved profitability, significantly increased investor confidence in its long-term growth trajectory, supported by successful strategic initiatives and technological advancements, and a generally favorable macroeconomic environment. The combination of strong financial performance, promising future guidance, and positive market sentiment created a perfect storm for a significant stock price increase.

Call to Action: Understanding the factors behind Uber's stock price movement is crucial for investors. Stay informed about future Uber (UBER) developments to make well-informed investment decisions. Continue to monitor Uber stock performance and related news to capitalize on future opportunities in the dynamic ride-sharing and delivery market.

Featured Posts

-

Ftc Adjusts Approach In High Stakes Meta Monopoly Lawsuit

May 18, 2025

Ftc Adjusts Approach In High Stakes Meta Monopoly Lawsuit

May 18, 2025 -

Reakcja Polakow Na Dzialania Trumpa W Ukrainie Sondaz Ujawnia Prawde

May 18, 2025

Reakcja Polakow Na Dzialania Trumpa W Ukrainie Sondaz Ujawnia Prawde

May 18, 2025 -

Navigating The Five Boro Bike Tour A Comprehensive Guide For Nyc Cyclists

May 18, 2025

Navigating The Five Boro Bike Tour A Comprehensive Guide For Nyc Cyclists

May 18, 2025 -

Daily Lotto Results Monday 28 April 2025

May 18, 2025

Daily Lotto Results Monday 28 April 2025

May 18, 2025 -

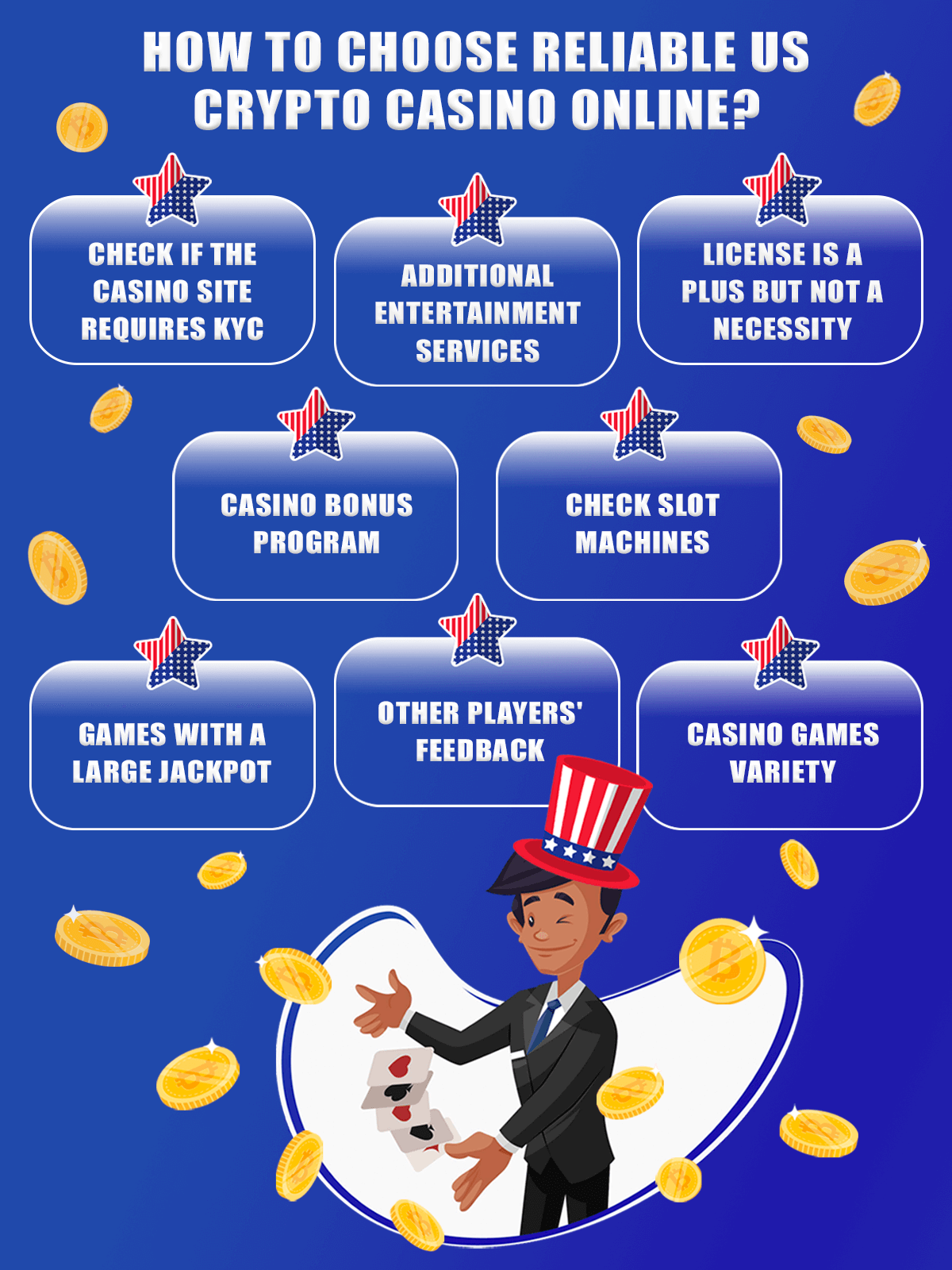

Finding The Right Bitcoin And Crypto Casino In 2025 Expert Advice

May 18, 2025

Finding The Right Bitcoin And Crypto Casino In 2025 Expert Advice

May 18, 2025

Latest Posts

-

Abd Li Dergi Tuerkiye Israil Catismasi Ve Erdogan Netanyahu Karsilasmasi

May 18, 2025

Abd Li Dergi Tuerkiye Israil Catismasi Ve Erdogan Netanyahu Karsilasmasi

May 18, 2025 -

No Other Land Analisis Film Pemenang Oscar Tentang Konflik Palestina Israel

May 18, 2025

No Other Land Analisis Film Pemenang Oscar Tentang Konflik Palestina Israel

May 18, 2025 -

Infografis Analisis Terbaru Kans Perdamaian Israel Palestina Menipis Bagaimana Peran Indonesia

May 18, 2025

Infografis Analisis Terbaru Kans Perdamaian Israel Palestina Menipis Bagaimana Peran Indonesia

May 18, 2025 -

Realita Konflik Palestina Israel Terungkap Dalam Film Pemenang Oscar No Other Land

May 18, 2025

Realita Konflik Palestina Israel Terungkap Dalam Film Pemenang Oscar No Other Land

May 18, 2025 -

Infografis Pesimisme Yang Meningkat Jalan Buntu Solusi Dua Negara Israel Palestina And Peran Indonesia

May 18, 2025

Infografis Pesimisme Yang Meningkat Jalan Buntu Solusi Dua Negara Israel Palestina And Peran Indonesia

May 18, 2025