Why Did CoreWeave (CRWV) Stock Prices Jump Last Week?

Table of Contents

Positive Earnings Report and Revenue Growth

CoreWeave's recent Q2 earnings report played a pivotal role in the surge of its stock price. The report revealed key figures that significantly exceeded analysts' expectations, boosting investor confidence and driving up the CRWV stock price.

-

Exceptional Revenue Growth: CoreWeave reported a revenue growth percentage of [insert percentage]% compared to the previous quarter and a [insert percentage]% year-over-year growth. This substantial increase showcases the company's rapid expansion and strong market position. This impressive CRWV revenue growth highlights the increasing demand for its services.

-

Successful Customer Acquisition: The earnings report highlighted a significant increase in customer acquisition, indicating strong market penetration and the effectiveness of CoreWeave's sales and marketing strategies. Specific details about new major contracts secured would provide additional weight to this point.

-

Upward Revision of Future Guidance: CoreWeave also provided an upward revision to its future guidance, projecting even stronger revenue growth in the coming quarters. This positive outlook further solidified investor confidence in the company's long-term prospects. This optimistic forecast significantly influenced the CRWV stock performance.

-

Robust Financial Health: The overall financial health of CoreWeave, as depicted in the Q2 earnings report, revealed a strong balance sheet and healthy cash flow, indicating financial stability and the ability to continue investing in growth initiatives. This financial strength is a significant factor contributing to the positive CoreWeave financial results. Analyzing key metrics such as profitability and debt levels will paint a clearer picture for investors.

Increased Investor Confidence and Market Sentiment

The positive Q2 earnings report wasn't the only factor contributing to the CRWV stock price jump. A broader shift in investor sentiment towards the cloud computing sector, coupled with positive market trends, also played a crucial role.

-

Positive Cloud Computing Sector Sentiment: The overall market sentiment toward cloud computing stocks has been generally positive recently, reflecting the ongoing digital transformation across various industries. This positive sentiment created a favorable environment for CoreWeave's stock performance.

-

Positive Analyst Reports and Upgrades: Several influential analysts upgraded their ratings and price targets for CRWV following the earnings report, further boosting investor confidence and contributing to the upward price movement. These upgrades reflect the growing optimism around CoreWeave's future.

-

Booming AI Infrastructure Demand: The increasing demand for AI infrastructure is a major tailwind for CoreWeave, as its services are crucial for supporting the computational needs of AI applications. This surging demand directly translates into increased revenue opportunities for CoreWeave.

-

Decreased Short Interest: A reduction in CRWV's short interest suggests that more investors are becoming bullish on the company, contributing to the upward pressure on the stock price. This reduced short interest indicates growing confidence in CoreWeave’s future.

Strategic Partnerships and Technological Advancements

CoreWeave's strategic partnerships and continuous technological advancements are key drivers of its long-term growth potential and contributed significantly to the recent stock price surge.

-

High-Profile Partnerships: The formation of new partnerships with major technology companies and cloud providers expands CoreWeave's market reach and enhances its service offerings. Detailing these partnerships, specifically mentioning the names of collaborating companies, will increase the impact of this point.

-

Innovative Technology and Service Offerings: The introduction of new technologies and service offerings strengthens CoreWeave's competitive advantage and attracts new customers. Highlighting specific innovations and their impact on the market is crucial here.

-

Enhanced Long-Term Growth: These partnerships and advancements contribute to CoreWeave's long-term growth potential by opening up new market segments and strengthening its position as a leading provider of cloud computing services. Explaining how these developments translate into tangible long-term growth benefits will strengthen the argument.

-

Competitive Differentiation: These strategic initiatives clearly differentiate CoreWeave from competitors, establishing a stronger competitive advantage in the increasingly crowded cloud computing market. This competitive edge is a key factor in attracting investors.

Addressing Potential Short-Term Volatility

While the recent surge in CRWV stock price is encouraging, it's important to acknowledge the inherent volatility of the stock market.

-

Market Risks: Factors like overall market conditions, economic downturns, and industry-specific risks can influence CRWV's stock price in the short term.

-

Short-Term Fluctuations: Investors should be prepared for potential short-term fluctuations in the CRWV stock price, as these are typical in the technology sector.

-

Balanced Perspective: While the long-term outlook for CoreWeave appears promising, investors need to maintain a balanced perspective, acknowledging both the positive and negative factors that can impact the stock price.

Conclusion

The recent surge in CoreWeave (CRWV) stock prices can be attributed to a combination of a stellar Q2 earnings report, increased investor confidence fueled by positive market sentiment and the cloud computing sector's growth, and strategic advancements in partnerships and technology. While short-term market fluctuations are possible, the company's strong performance and promising future outlook, particularly within the booming AI infrastructure market, suggest a positive trajectory. Understanding these factors is crucial for informed investment decisions regarding CRWV. Continue to monitor CoreWeave's progress and financial reports to make well-informed decisions about this exciting company in the dynamic cloud computing market. Stay updated on all the latest news regarding CoreWeave (CRWV) stock prices and make strategic moves based on thorough research and analysis.

Featured Posts

-

Could This Be The Year The Trans Australia Run Record Falls

May 22, 2025

Could This Be The Year The Trans Australia Run Record Falls

May 22, 2025 -

Ai Mode In Google Search Benefits Challenges And Predictions

May 22, 2025

Ai Mode In Google Search Benefits Challenges And Predictions

May 22, 2025 -

A Western Neo Noir Gem Remembering Dennis Quaid Meg Ryan And James Caan

May 22, 2025

A Western Neo Noir Gem Remembering Dennis Quaid Meg Ryan And James Caan

May 22, 2025 -

Don Song Phat Trien Phan Tich Nhung Du An Ha Tang Giao Thong Tp Hcm Binh Duong

May 22, 2025

Don Song Phat Trien Phan Tich Nhung Du An Ha Tang Giao Thong Tp Hcm Binh Duong

May 22, 2025 -

Wtt Star Contender Chennai Indias 19 Paddler Strong Showing

May 22, 2025

Wtt Star Contender Chennai Indias 19 Paddler Strong Showing

May 22, 2025

Latest Posts

-

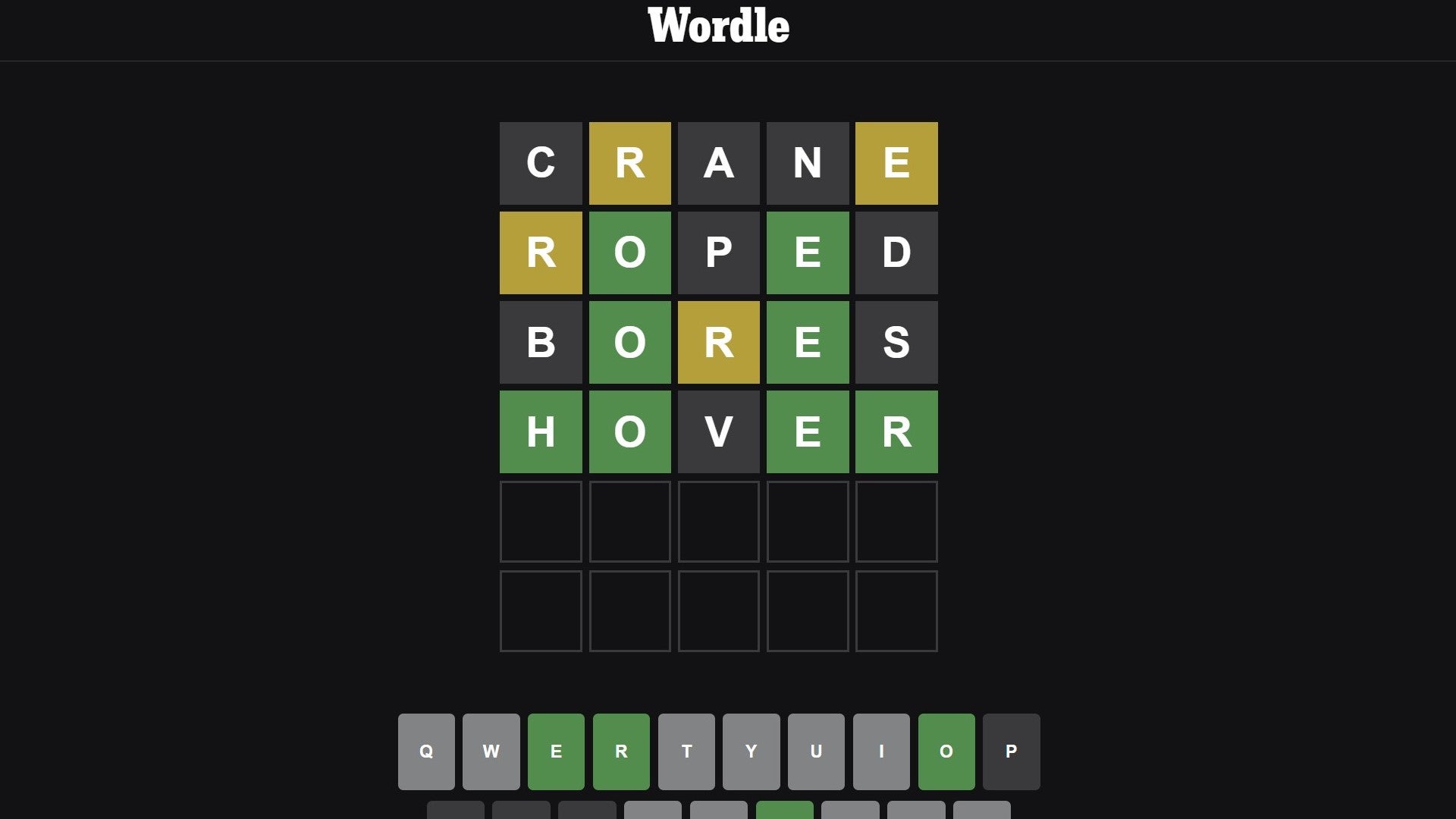

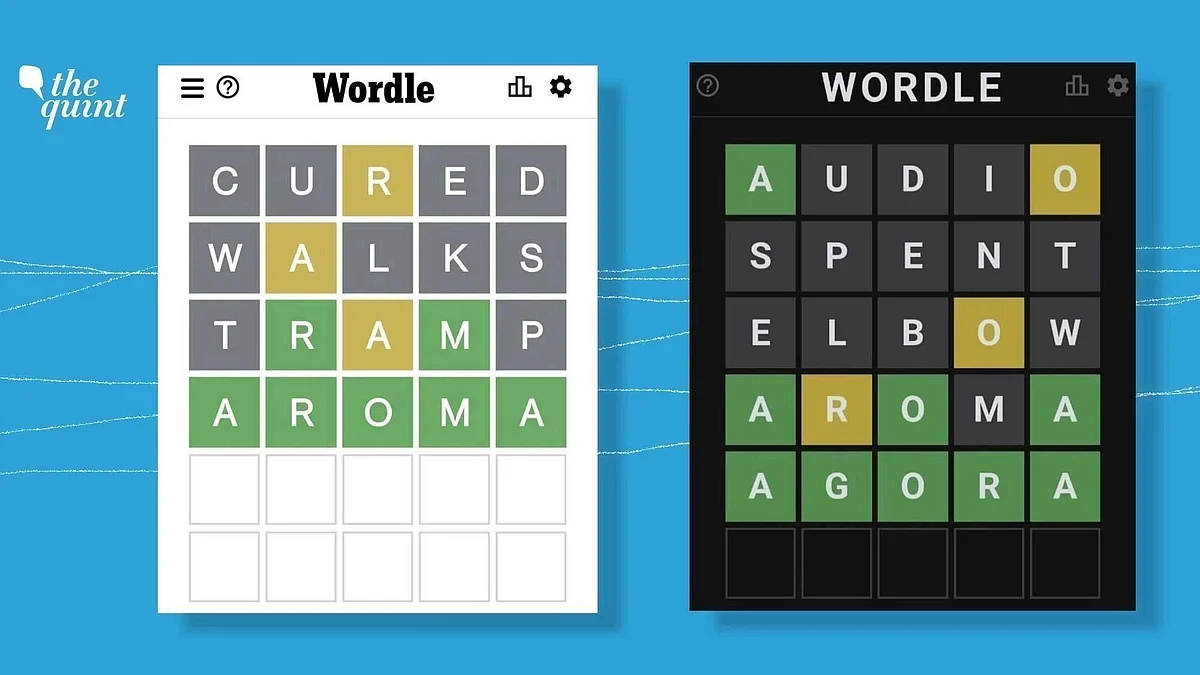

Wordle 1358 Hints And Solution For March 8th

May 22, 2025

Wordle 1358 Hints And Solution For March 8th

May 22, 2025 -

Nyt Wordle March 26 Solution And Analysis

May 22, 2025

Nyt Wordle March 26 Solution And Analysis

May 22, 2025 -

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025

Wordle Help Solving Todays March 26 Nyt Wordle Puzzle

May 22, 2025 -

Tough Wordle Today March 26 Nyt Wordle Answer Revealed

May 22, 2025

Tough Wordle Today March 26 Nyt Wordle Answer Revealed

May 22, 2025 -

Nyt Wordle Solution For March 26 Tips And Hints

May 22, 2025

Nyt Wordle Solution For March 26 Tips And Hints

May 22, 2025