Why Current Stock Market Valuations Shouldn't Deter Investors: BofA's View

Table of Contents

BofA's Bullish Outlook: Understanding the Rationale

BofA maintains a generally bullish outlook on the stock market, and their reasoning is rooted in several key factors. Their positive stock market prediction is based on a confluence of economic indicators and corporate performance projections. This bullish sentiment isn't simply blind optimism; it's supported by a robust analysis of underlying economic strengths and future growth drivers.

-

Strong Corporate Earnings Growth Potential: BofA's analysts forecast continued robust corporate earnings growth, fueled by factors such as increasing consumer spending, business investment, and global economic expansion. This expectation of strong profit generation underpins their positive market outlook. Specific sectors showing strong potential, according to BofA research, include technology and consumer discretionary goods.

-

Continued Economic Expansion: Several key economic indicators support BofA's optimism. For example, low unemployment rates in many developed economies suggest strong consumer demand and a healthy labor market. Positive GDP growth projections further reinforce the expectation of continued economic expansion. These indicators point towards a sustained environment favorable for corporate profitability.

-

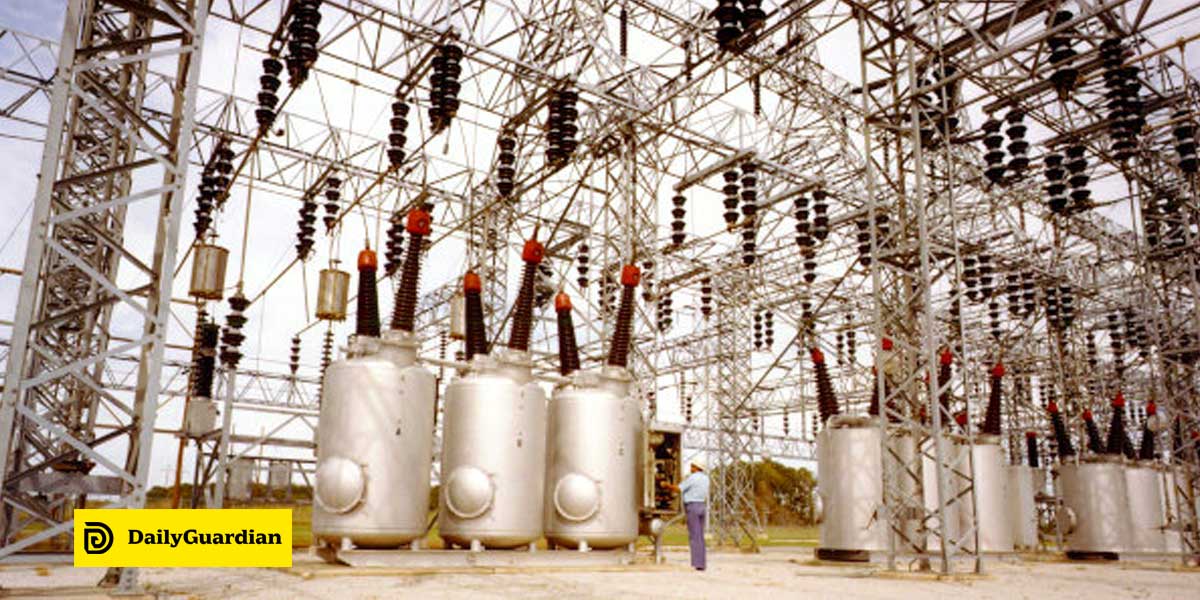

Innovation and Technological Advancements: Technological advancements continue to drive productivity gains and create entirely new markets, which translates into significant growth opportunities for businesses and investors. BofA highlights the transformative power of sectors like artificial intelligence, renewable energy, and biotechnology as key drivers of future economic growth.

-

Supportive Monetary Policy (Historically): While interest rates are not historically low at the time of this writing, supportive monetary policies in the past have played a significant role in boosting economic activity and corporate investment. (Note: This point should be adjusted based on current monetary policy conditions.)

Specific data points and caveats: While BofA's outlook is optimistic, it's crucial to acknowledge that their predictions are not guarantees. They typically include caveats and acknowledge potential risks, such as geopolitical uncertainty or unforeseen economic shocks. Referring to their specific research reports will provide a more comprehensive understanding of their predictions and their associated uncertainties.

Addressing Valuation Concerns: Why High P/E Ratios Might Not Be a Deterrent

High P/E ratios are often a red flag for investors, signaling potentially overvalued stocks. However, BofA argues that in the current context, high P/E ratios may not be as alarming as they seem. This assessment is based on several key factors:

-

Impact of Low Interest Rates (Historically): Historically low interest rates have compressed yields on bonds and other fixed-income investments, making equities relatively more attractive. This dynamic can lead to higher valuation multiples across the board. (Note: This point should be adjusted based on current interest rates.)

-

Strong Future Earnings Growth: The expectation of strong future earnings growth can justify current, seemingly high, P/E ratios. If a company is projected to experience significant earnings growth in the coming years, a higher current P/E ratio might reflect the market's anticipation of that future growth.

-

Alternative Valuation Metrics: P/E ratios are not the only metric used to assess valuation. Other metrics, such as the Price-to-Earnings-to-Growth (PEG) ratio, offer a more nuanced view by taking into account projected earnings growth rates. Investors should consider a broader range of valuation metrics before drawing conclusions.

-

Intrinsic Value vs. Market Price: Market price reflects current investor sentiment, which can be volatile. Intrinsic value, on the other hand, represents the underlying worth of a company based on its assets, earnings power, and future prospects. BofA's analysts likely consider intrinsic value alongside market price when evaluating stock valuations.

-

Potential for M&A Activity: The potential for mergers and acquisitions (M&A) can also influence valuations. Companies that are seen as attractive acquisition targets may command higher prices, leading to elevated P/E ratios.

The Importance of Long-Term Investing

Successfully navigating stock market valuations requires a long-term perspective. The short-term fluctuations of the stock market are often irrelevant to long-term investors who understand the historical data.

-

Historical Performance: Historically, the stock market has delivered positive returns over the long term, despite short-term volatility. This long-term trend underscores the importance of patience and a commitment to a long-term investment strategy.

-

Dollar-Cost Averaging: Dollar-cost averaging, a strategy that involves investing a fixed amount of money at regular intervals, helps mitigate the risk of market timing. This approach reduces the impact of buying high and selling low.

-

Diversification: Diversification across different asset classes (stocks, bonds, real estate, etc.) is crucial for reducing overall portfolio risk. A diversified portfolio reduces the impact of any single asset's underperformance.

-

Reducing the Impact of Volatility: A long-term perspective reduces the emotional impact of short-term market volatility. Investors who are not focused on immediate returns are better equipped to withstand temporary market downturns.

Managing Risk: A Balanced Approach

While BofA's outlook is positive, it's essential to acknowledge the inherent risks involved in stock market investing. A well-structured approach to risk management is key.

-

Diversification: Diversify your portfolio across various sectors and asset classes to reduce your exposure to any single risk factor.

-

Defensive Stocks: Incorporate defensive stocks (companies less sensitive to economic downturns) into your portfolio to provide stability during periods of market uncertainty.

-

Risk Tolerance: Understand your own risk tolerance before making any investment decisions. A financial advisor can help you determine an appropriate level of risk based on your individual circumstances and financial goals.

-

Market Corrections: Market corrections are a normal part of the market cycle. Prepare for potential corrections by maintaining a diversified portfolio and having a long-term investment plan.

Conclusion:

Current stock market valuations, while seemingly high, shouldn't deter long-term investors, particularly given BofA's perspective. Factors such as strong corporate earnings growth potential, a generally supportive economic environment (considering historical trends), and the power of long-term investing create a compelling case for continued investment. By adopting a well-diversified investment strategy aligned with your risk tolerance and long-term financial objectives, you can navigate the complexities of the market and potentially reap the rewards of long-term growth. Don't let concerns about current stock market valuations prevent you from pursuing your financial goals. Consult a financial advisor to tailor your approach and make informed decisions regarding your stock market investments. Learn more about BofA's market outlook and investment strategies to gain a deeper understanding of the current market environment and develop a robust long-term investment plan.

Featured Posts

-

Noa Argamani From Hamas Hostage To Time 100 Influential Person

Apr 30, 2025

Noa Argamani From Hamas Hostage To Time 100 Influential Person

Apr 30, 2025 -

Knda Twajh Thdyat Wjwdyt Thlyl Tsryhat Tramb

Apr 30, 2025

Knda Twajh Thdyat Wjwdyt Thlyl Tsryhat Tramb

Apr 30, 2025 -

Tramp Zelenskiy Peregovory Na Fone Pokhoron Papy

Apr 30, 2025

Tramp Zelenskiy Peregovory Na Fone Pokhoron Papy

Apr 30, 2025 -

Preserving History The Significance Of Hudsons Bay Artifacts In Manitoba

Apr 30, 2025

Preserving History The Significance Of Hudsons Bay Artifacts In Manitoba

Apr 30, 2025 -

Canada Election The Impact Of Trumps Statements On Us Canada Relations

Apr 30, 2025

Canada Election The Impact Of Trumps Statements On Us Canada Relations

Apr 30, 2025