Why Climate Risk Impacts Your Home Loan Application

Table of Contents

Increased Flood Risk and Your Mortgage Approval

Increased flood risk, a direct consequence of climate change manifesting in more frequent and intense rainfall and rising sea levels, significantly impacts a lender's assessment of property value and risk. This heightened risk translates directly into challenges for prospective homeowners.

- Higher flood insurance premiums: These premiums, often significantly increased in high-risk zones, directly impact affordability and the all-important loan-to-value ratio (LTV). A higher LTV makes it harder to secure a loan as it increases the lender's risk.

- Increased likelihood of property damage: The increased frequency and severity of flooding lead to a higher probability of property damage, making the property a less attractive investment for lenders. This increases the perceived risk and may lead to loan denial or stricter terms.

- Potential for stricter lending criteria in flood-prone areas: Lenders are increasingly implementing stricter lending criteria for properties located in areas identified as being at high risk of flooding. This might involve higher down payments, stricter credit score requirements, or even loan denials.

- Government regulations and building codes in high-risk zones: Government regulations and building codes are becoming stricter in flood-prone areas, impacting both the cost of building and the insurability of properties. These regulations can affect the lender's assessment of the property's long-term value.

Flood maps, produced by government agencies and insurance companies, play a pivotal role in lender decisions. These maps delineate areas at varying levels of flood risk, influencing insurance premiums and loan eligibility. Different types of flood insurance, such as those offered by the National Flood Insurance Program (NFIP) in the US, come with varying levels of coverage and cost, further impacting affordability and loan approval.

Wildfire Risk and its Impact on Home Loan Applications

The growing concern surrounding wildfires and their devastating impact on property values is another significant climate risk impacting home loan applications. Proximity to wildfire-prone areas significantly affects the lender's assessment of risk.

- Increased insurance premiums for homes in high-risk wildfire zones: Homes located in areas identified as high wildfire risk face substantially higher insurance premiums, making them less affordable and increasing the overall cost of homeownership.

- Difficulty in obtaining insurance coverage altogether: In some high-risk areas, obtaining insurance coverage can be extremely difficult or even impossible, making it virtually impossible to secure a mortgage.

- Higher appraisal risk due to potential property damage from wildfire: The potential for significant property damage from wildfires increases the appraisal risk, potentially leading to lower appraisals and impacting the loan-to-value ratio.

- Impact on property values following a wildfire incident: Even if a property survives a wildfire, its value can be significantly impacted by the event, making it a less attractive investment for lenders.

Homeowners can take steps to mitigate wildfire risk and impress lenders. Creating defensible space around the property by removing flammable vegetation, and using fire-resistant building materials are crucial preventative measures that demonstrate responsible risk management and can influence lender decisions positively.

Extreme Weather Events and Their Financial Implications

Beyond flooding and wildfires, a broader range of extreme weather events—heat waves, droughts, severe storms, and hurricanes—significantly impact property values and lender assessments. The increased frequency and severity of these events are forcing lenders to exercise greater caution.

- Damage to property from extreme weather can affect loan applications: Damage from extreme weather events, even minor damage, can negatively impact a loan application, as it indicates increased risk and potential future costs for the lender.

- Increased frequency and severity of extreme weather increasing lender caution: Lenders are increasingly factoring the predicted frequency and severity of extreme weather events into their risk assessments, leading to stricter lending practices in vulnerable areas.

- Impact on infrastructure and services in affected areas: Damage to infrastructure and essential services in affected areas can also negatively impact property values and lender decisions. This reflects the broader economic risks associated with extreme weather.

- Potential for reduced property values in areas frequently impacted by extreme weather: Properties in areas frequently impacted by extreme weather events are likely to see reduced property values over time, further increasing the risk for lenders.

Climate change models provide valuable insights into the projected frequency and intensity of future extreme weather events, helping lenders to better assess long-term risks and make informed decisions.

How to Mitigate Climate Risk When Applying for a Home Loan

Borrowers can take proactive steps to improve their chances of securing a loan despite climate risks:

- Thoroughly research the property's vulnerability to climate risks: Conduct thorough research using flood maps, wildfire risk assessments, and other relevant data to understand the property's susceptibility to climate-related hazards.

- Invest in home improvements to reduce risk: Investing in mitigation measures, such as flood barriers, fire-resistant roofing, or drought-resistant landscaping, can significantly reduce risk and impress lenders.

- Obtain comprehensive insurance coverage: Securing adequate and comprehensive insurance coverage demonstrates responsible risk management and can increase your chances of loan approval.

- Work with a lender experienced in assessing climate-related risks: Choose a lender familiar with assessing climate-related risks and who can provide guidance and support throughout the application process.

- Discuss climate risk mitigation strategies with your lender upfront: Proactively discussing your plans to mitigate climate risks with your lender can demonstrate your commitment to responsible homeownership and increase your chances of approval.

Conclusion

Climate risk is a significant factor impacting home loan applications. Lenders are increasingly considering flood risk, wildfire risk, and the impact of other extreme weather events when assessing applications. Understanding these risks and taking proactive steps can significantly improve your chances of securing a mortgage. Don't let climate risk derail your dream of homeownership. Be proactive, research thoroughly, and discuss your concerns with your lender. Understanding how climate risk impacts your home loan application is the first step towards securing your future home.

Featured Posts

-

Why Did D Wave Quantum Qbts Stock Price Rise Today

May 21, 2025

Why Did D Wave Quantum Qbts Stock Price Rise Today

May 21, 2025 -

Vybz Kartel Speaks Out Prison Life Freedom Family And New Music

May 21, 2025

Vybz Kartel Speaks Out Prison Life Freedom Family And New Music

May 21, 2025 -

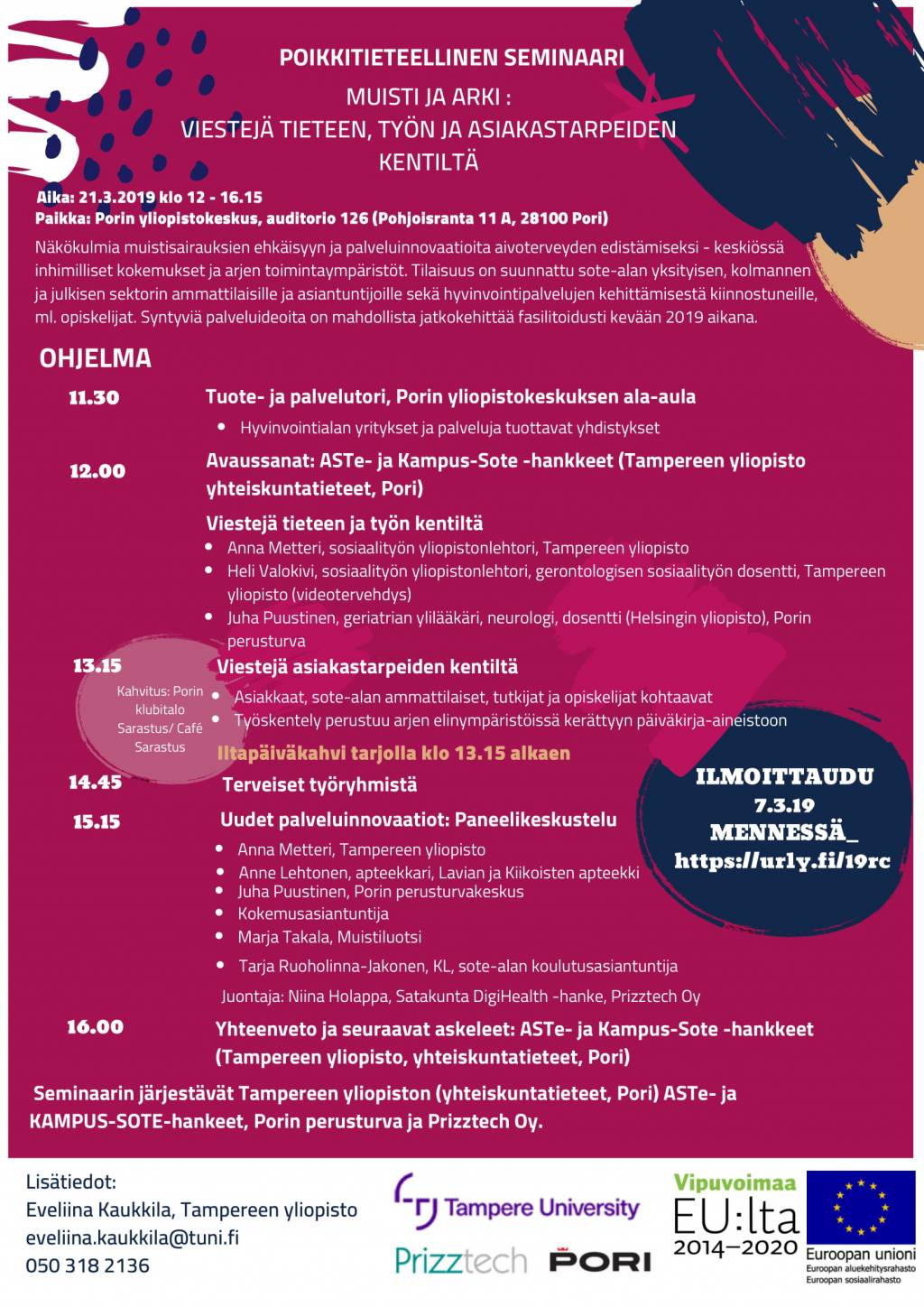

Kaellman Ja Hoskonen Puolalaisseuraura Paeaettynyt

May 21, 2025

Kaellman Ja Hoskonen Puolalaisseuraura Paeaettynyt

May 21, 2025 -

Alito And Roberts Two Decades On The Supreme Court Bench

May 21, 2025

Alito And Roberts Two Decades On The Supreme Court Bench

May 21, 2025 -

Get To Know Paulina Gretzky Dustin Johnsons Wife Career And Family

May 21, 2025

Get To Know Paulina Gretzky Dustin Johnsons Wife Career And Family

May 21, 2025

Latest Posts

-

Benjamin Kaellman Maalintekovire Huuhkajien Avuksi

May 21, 2025

Benjamin Kaellman Maalintekovire Huuhkajien Avuksi

May 21, 2025 -

Kaellmanin Nousu Kentaeltae Ja Sen Ulkopuolelta

May 21, 2025

Kaellmanin Nousu Kentaeltae Ja Sen Ulkopuolelta

May 21, 2025 -

Benjamin Kaellman Huuhkajien Uusi Taehti

May 21, 2025

Benjamin Kaellman Huuhkajien Uusi Taehti

May 21, 2025 -

Jalkapallo Jacob Friis Paljastaa Avauskokoonpanon Kamara Ja Pukki Vaihtopelaajina

May 21, 2025

Jalkapallo Jacob Friis Paljastaa Avauskokoonpanon Kamara Ja Pukki Vaihtopelaajina

May 21, 2025 -

Avauskokoonpano Julkistettu Glen Kamara Ja Teemu Pukki Vaihdossa

May 21, 2025

Avauskokoonpano Julkistettu Glen Kamara Ja Teemu Pukki Vaihdossa

May 21, 2025