Why Choose A Shorter Mortgage Term In Canada? The 10-Year Mortgage Debate

Table of Contents

Significant Long-Term Savings with Shorter Terms

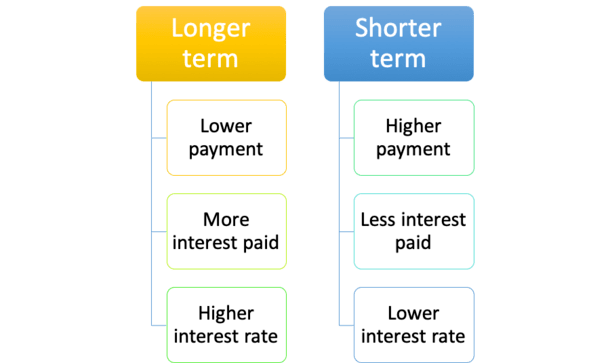

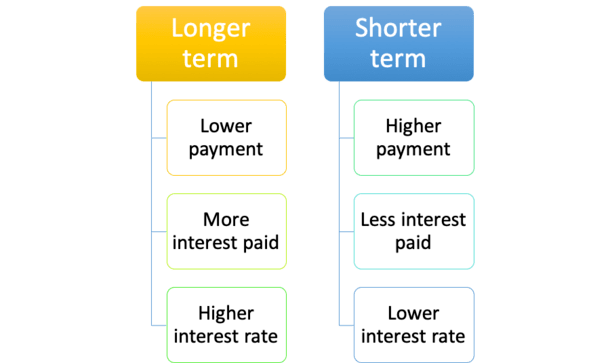

Choosing a shorter mortgage term, like a 5-year or 10-year term, compared to a traditional 25-year term, leads to substantial savings over the life of your mortgage.

Reduced Interest Payments Over the Life of the Mortgage

The magic lies in the power of compounding interest. A shorter mortgage term significantly reduces the total interest you pay because you're paying down the principal faster. Let's illustrate: imagine a $500,000 mortgage at a 5% interest rate. Over 25 years, you'll pay approximately $430,000 in interest. However, with a 10-year mortgage, that number drops drastically, to approximately $120,000, saving you over $300,000!

- Faster principal repayment: More of your monthly payment goes towards the principal, shrinking the loan balance rapidly.

- Less interest accrued: The smaller loan balance means less interest is calculated each month.

- Substantial long-term savings: These savings can be reinvested, used for other financial goals, or simply enjoyed as extra disposable income.

Faster Equity Building

Paying down your principal faster translates to building equity in your home much quicker. This means you own a larger percentage of your home sooner.

- Increased borrowing power: Faster equity growth can improve your borrowing power, allowing you to access funds more easily for renovations, investments, or other opportunities.

- Investment opportunities: The accumulated equity can be leveraged for investments, potentially generating additional income.

- Financial security: Owning a larger share of your home provides a stronger financial safety net.

Financial Discipline and Improved Budgeting

A shorter mortgage term demands a higher monthly payment, which, while initially challenging, can cultivate strong financial habits.

Forcing Savings and Responsible Spending

The pressure of larger monthly payments naturally encourages better budgeting and responsible spending. It forces you to prioritize your finances and make conscious decisions about your expenses.

- Improved financial awareness: You become more attuned to your spending habits and identify areas where you can cut back.

- Enhanced savings potential: To manage higher payments, you'll likely find ways to increase savings and reduce unnecessary expenses.

- Reduced financial stress: While initially demanding, paying off your mortgage faster can significantly reduce long-term financial stress.

Faster Path to Mortgage Freedom

The psychological benefits of being mortgage-free cannot be overstated. Imagine the peace of mind knowing you own your home outright and are free from the burden of monthly mortgage payments.

- Financial independence: You'll experience increased financial freedom and flexibility.

- Reduced financial stress: The absence of a mortgage payment significantly reduces financial anxiety.

- Increased disposable income: You'll have more disposable income to allocate towards other financial goals, travel, or leisure activities.

Navigating the 10-Year Mortgage Debate: Weighing the Pros and Cons

The 10-year mortgage is a popular choice, but it's crucial to understand the trade-offs before committing.

Understanding the Trade-offs

Shorter-term mortgages undeniably come with higher monthly payments. This can pose challenges, especially during economic uncertainty or unexpected financial setbacks.

- Advantages of 10-year mortgages: Significant long-term savings, faster equity building, improved financial discipline, and quicker path to mortgage freedom.

- Disadvantages of 10-year mortgages: Higher monthly payments, potential for financial strain during economic downturns, and less flexibility.

Considering Your Personal Financial Situation

Before selecting a mortgage term, it's vital to assess your personal financial circumstances, including your income, expenses, financial goals, and risk tolerance.

- Consult a financial advisor: A financial professional can provide personalized advice based on your unique circumstances.

- Use online mortgage calculators: Explore various scenarios using online mortgage calculators to compare the long-term costs and benefits of different mortgage terms.

Strategies for Managing Higher Mortgage Payments

Managing higher payments associated with a shorter-term mortgage requires careful planning and potentially some adjustments to your lifestyle.

Increasing Your Income

Explore avenues to boost your income to ease the burden of higher mortgage payments.

- Seeking a higher-paying job: Consider upgrading your skills or exploring opportunities in a higher-paying field.

- Taking on a side hustle: Supplement your income with a part-time job or freelance work.

Reducing Expenses

Identify areas where you can cut unnecessary expenses to free up more money for your mortgage payments.

- Review recurring subscriptions: Cancel unused subscriptions to streaming services, gym memberships, or other recurring costs.

- Reduce eating out: Cook more meals at home instead of dining out frequently.

- Lower transportation costs: Explore options like carpooling, biking, or public transit.

Conclusion: Making the Right Choice for Your Canadian Mortgage

Choosing a shorter mortgage term in Canada offers significant advantages: substantial long-term savings, accelerated equity growth, and improved financial discipline. While higher monthly payments are a consideration, the long-term benefits often outweigh this initial challenge. Remember to carefully assess your personal financial situation and consult with a financial advisor or mortgage broker before making a decision. Start your journey towards a shorter mortgage term today! Contact a trusted mortgage broker to explore your options and unlock the benefits of shorter-term financing in Canada. Understanding the nuances of different mortgage terms – whether a 5-year, 10-year, or even a 25-year mortgage – is crucial for making an informed decision that aligns with your financial goals. Don't hesitate to leverage available resources and professional advice to secure the best mortgage term for your future financial well-being.

Featured Posts

-

Nhl Standings Crucial Friday Matchups And Playoff Scenarios

May 04, 2025

Nhl Standings Crucial Friday Matchups And Playoff Scenarios

May 04, 2025 -

Harassment And Lizzos Fitness A Trainers Response

May 04, 2025

Harassment And Lizzos Fitness A Trainers Response

May 04, 2025 -

The Los Angeles Wildfires And The Growing Market For Disaster Related Wagers

May 04, 2025

The Los Angeles Wildfires And The Growing Market For Disaster Related Wagers

May 04, 2025 -

Western Conference Wild Card Battle Nhl Playoff Standings Analysis

May 04, 2025

Western Conference Wild Card Battle Nhl Playoff Standings Analysis

May 04, 2025 -

La Fires Price Gouging Allegations Surface Amid Housing Crisis

May 04, 2025

La Fires Price Gouging Allegations Surface Amid Housing Crisis

May 04, 2025

Latest Posts

-

Hospital Hammer Incident The Case Of James Burns Belfast Ex Soldier

May 04, 2025

Hospital Hammer Incident The Case Of James Burns Belfast Ex Soldier

May 04, 2025 -

Belfast Hospital Hammer Incident Ex Soldier James Burns Actions

May 04, 2025

Belfast Hospital Hammer Incident Ex Soldier James Burns Actions

May 04, 2025 -

Oscars 2025 Red Carpet Emma Stones Bold Sequin Dress And Pixie Haircut

May 04, 2025

Oscars 2025 Red Carpet Emma Stones Bold Sequin Dress And Pixie Haircut

May 04, 2025 -

Emma Stones Show Stopping Oscars 2025 Appearance Custom Louis Vuitton And Retro Glam

May 04, 2025

Emma Stones Show Stopping Oscars 2025 Appearance Custom Louis Vuitton And Retro Glam

May 04, 2025 -

The Truth Behind The Emma Stone Margaret Qualley Oscars Feud Rumors

May 04, 2025

The Truth Behind The Emma Stone Margaret Qualley Oscars Feud Rumors

May 04, 2025