Who Received The €18 Million? Deutsche Bank London Fixed Income Bonus Under Scrutiny

Table of Contents

The €18 Million Bonus: A Closer Look

The €18 million bonus payout at Deutsche Bank's London fixed income division remains shrouded in some mystery, fueling speculation and intense scrutiny. While the exact details surrounding the bonus remain largely undisclosed, several crucial aspects are under investigation. Was this an exceptional performance-based bonus, or was it part of a broader, potentially problematic compensation scheme? Understanding the context is crucial to assessing the ethical and legal implications.

-

Timing of the bonus payment: The precise timing is critical. Did the payment coincide with specific trading activities or financial events that might raise concerns? Pinpointing the date could illuminate potential connections to market fluctuations or questionable dealings.

-

Performance metrics (if known): Were there clear, measurable performance metrics justifying such a substantial bonus? The lack of transparency surrounding these metrics fuels speculation about whether the bonus was deserved, or if other factors influenced the decision.

-

Unusual circumstances surrounding the payout: Were there any unusual circumstances surrounding the approval and disbursement of the bonus? Were standard procedures bypassed? Did any internal policies or regulations seem to be violated?

-

Potential links to specific trading activities or financial events: Investigators are likely scrutinizing the bank's trading activities during the relevant period to determine if the bonus is linked to any specific transactions, potentially including those that were risky or violated internal regulations.

Identifying the Recipients: Challenges and Investigations

Publicly identifying the recipients of the €18 million bonus presents significant challenges. Strict confidentiality agreements and data protection laws hinder the release of this information. However, ongoing investigations by regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK, aim to shed light on the identities of those who benefited.

-

Names of individuals suspected: While names haven't been officially released, speculation abounds, particularly within financial circles. Any leaks or whistleblowers could provide valuable information to investigators.

-

Legal battles underway: It is possible that legal challenges could arise, either to protect the identities of the recipients or to challenge the legitimacy of the bonus payout itself.

-

Potential legal repercussions for Deutsche Bank and recipients: Depending on the findings of the investigations, Deutsche Bank and the individuals who received the bonus could face severe penalties, including fines, sanctions, and even criminal charges.

-

The role of whistleblowers and leaked information: Whistleblowers and leaked documents can play a crucial role in uncovering the truth behind this scandal. Their testimony and evidence could be essential in any subsequent legal proceedings.

The Ethical and Legal Implications of the Bonus Payout

The €18 million bonus payout raises significant ethical concerns, particularly if it was awarded without clear justification or in the context of potential misconduct. The sheer size of the bonus, especially given the current economic climate and potential concerns about Deutsche Bank's financial performance, raises eyebrows.

-

Potential conflicts of interest: Did any conflicts of interest influence the decision to award such a large bonus? Did individuals involved in the decision-making process benefit personally from the payout?

-

Compliance issues and violations of internal policies: Did the bonus payout violate any internal policies or regulations within Deutsche Bank? The investigation will likely focus on whether appropriate checks and balances were in place and followed.

-

The impact on shareholder confidence: News of such a substantial bonus payout could severely damage shareholder confidence in Deutsche Bank. Investors might question the bank's management and financial prudence.

-

The wider implications for the banking sector: This scandal could have a ripple effect across the entire banking sector, potentially leading to increased scrutiny of bonus structures and compensation policies.

Deutsche Bank's Response and Future Actions

Deutsche Bank has issued public statements acknowledging the controversy surrounding the €18 million bonus. The bank is likely conducting its own internal review and cooperating with regulatory investigations. The bank's response will significantly impact its reputation and future business prospects.

-

Public statements released by Deutsche Bank: The bank's official statements will be closely analyzed for transparency and accountability. Any attempt to downplay or deflect responsibility could further damage its image.

-

Changes in bonus structures or compensation policies: The scandal could prompt Deutsche Bank to overhaul its bonus structure and introduce stricter controls to prevent similar incidents in the future.

-

Measures taken to improve transparency and accountability: The bank might implement measures to enhance transparency and accountability in its compensation practices, such as greater public disclosure of bonus metrics and stricter oversight.

-

The potential impact on Deutsche Bank's reputation and future business: The scandal could have long-term consequences for Deutsche Bank's reputation, potentially affecting its ability to attract and retain talent and secure future business opportunities.

Conclusion

The €18 million Deutsche Bank London bonus scandal remains a developing story, leaving many unanswered questions. The mystery surrounding the recipients and the reasons behind the payout underscores the critical need for greater transparency and accountability in the financial sector. The ethical and legal implications are profound, potentially leading to significant consequences for Deutsche Bank and those involved. This high-profile case serves as a stark reminder of the importance of robust regulatory oversight and ethical conduct within the banking industry.

The €18 million Deutsche Bank bonus scandal underscores the need for greater transparency and accountability in the financial sector. Stay informed about further developments in this ongoing investigation, and continue following our coverage for updates on who received the €18 million and the ultimate consequences of this high-profile case. Search for "Deutsche Bank bonus scandal," "London fixed income bonus," or "€18 million Deutsche Bank investigation" to find further information.

Featured Posts

-

Amanda Anisimova Stops Mirra Andreevas Momentum In Miami

May 30, 2025

Amanda Anisimova Stops Mirra Andreevas Momentum In Miami

May 30, 2025 -

Baylor Football Player Dies After Gunfire Incident City Imposes Curfew

May 30, 2025

Baylor Football Player Dies After Gunfire Incident City Imposes Curfew

May 30, 2025 -

Affaire Marine Le Pen Un Appel En 2026 L Analyse De Laurent Jacobelli

May 30, 2025

Affaire Marine Le Pen Un Appel En 2026 L Analyse De Laurent Jacobelli

May 30, 2025 -

Middle School Track Meet In Des Moines Canceled Following Nearby Shooting

May 30, 2025

Middle School Track Meet In Des Moines Canceled Following Nearby Shooting

May 30, 2025 -

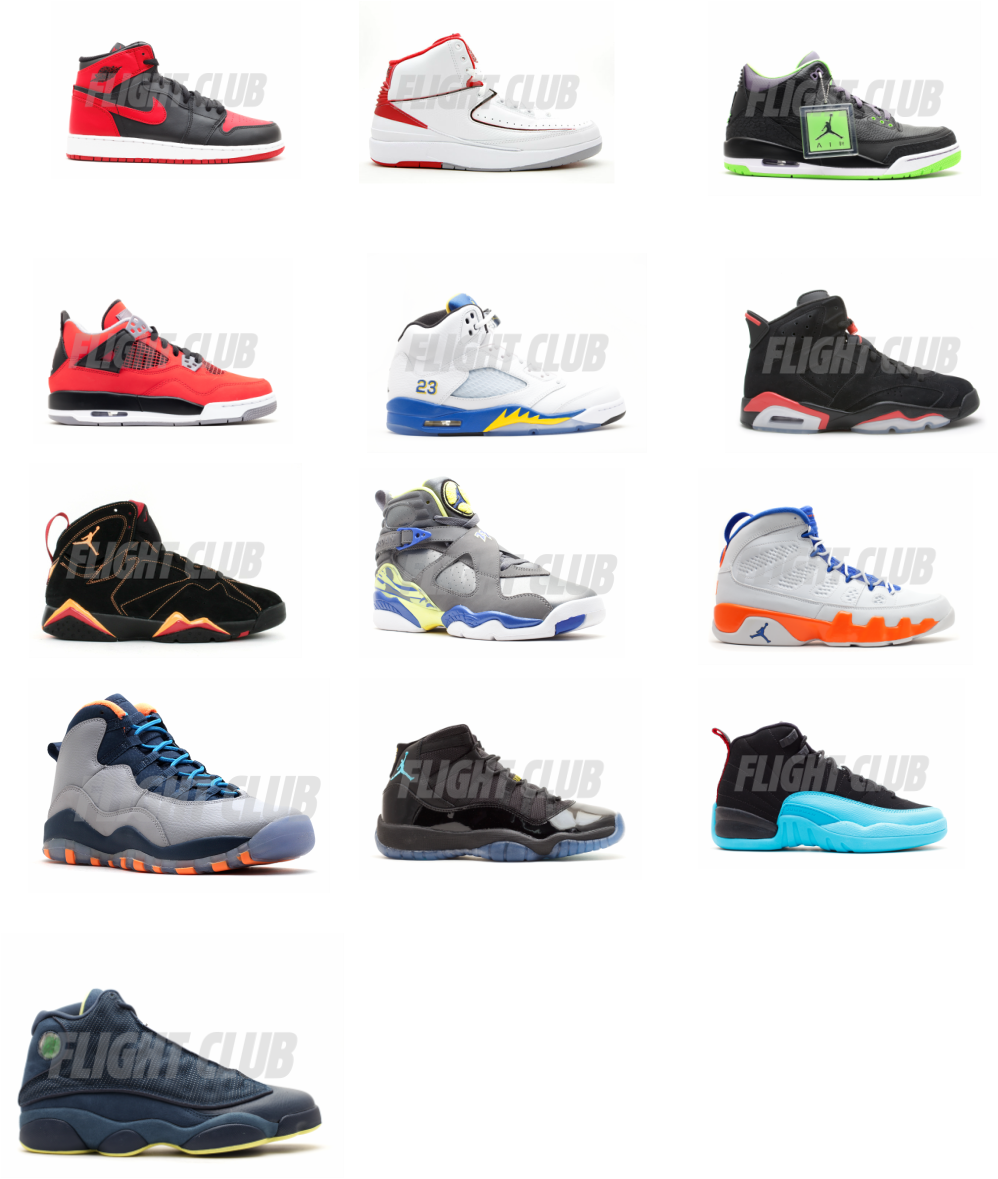

Air Jordan June 2025 Release Dates Must Know Information

May 30, 2025

Air Jordan June 2025 Release Dates Must Know Information

May 30, 2025