Who Is Weihong Liu And Why Is He Buying 28 Hudson's Bay Leases?

Table of Contents

Unveiling Weihong Liu: The Man Behind the Investment

While details about Weihong Liu's personal life remain relatively private, understanding his business background is crucial to comprehending the scale and significance of his Hudson's Bay lease purchase. He is understood to be a seasoned investor with a focus on strategic real estate acquisitions. While precise details about his past ventures aren't widely publicized, his current investment signals a significant player in the global real estate market, particularly with an interest in North American retail spaces.

- Liu's primary business interests: While his portfolio isn't publicly available, his Hudson's Bay investment showcases an interest in large-scale retail property acquisitions.

- His history of real estate investments: Further research is needed to uncover the full extent of his previous real estate investments.

- His investment philosophy: Liu's strategy appears to be focused on acquiring strategically located properties with high growth potential.

- Any affiliations with larger investment groups: At this time, there's no public information confirming affiliations with larger investment groups. Further investigation may reveal such connections.

Deciphering the Hudson's Bay Lease Acquisition

The acquisition of 28 Hudson's Bay leases marks a significant transaction in the Canadian retail real estate market. The precise locations of all 28 leases haven't been publicly disclosed, but the sheer number suggests a wide geographical spread across Canada, targeting prime retail locations. This strategic move holds implications not only for Hudson's Bay but also for the broader Canadian retail landscape. The current economic climate and the shift towards e-commerce are key factors to consider.

- The number and location of the acquired leases: 28 leases, with locations yet to be fully disclosed. However, we can expect a distribution across major Canadian cities.

- The financial terms of the deal: The exact financial details of the transaction remain confidential.

- Potential future use of the acquired properties: Various possibilities exist, including continued retail operation under new management, redevelopment into mixed-use spaces, or even conversion into residential or commercial properties.

- Analysis of the strategic implications for Hudson's Bay: This acquisition could signify a strategic repositioning for Hudson's Bay, potentially freeing up capital for other ventures or streamlining their operations.

Potential Impacts and Implications

Weihong Liu's investment has far-reaching implications for the Canadian retail and real estate sectors.

- Potential impact on Hudson's Bay's future: The sale of these leases could significantly affect Hudson's Bay's future, potentially allowing them to focus on core business strategies.

- Effects on jobs and local communities: The long-term effects on employment and local communities remain uncertain and depend heavily on Liu's future plans for the properties.

- Predictions for future investment trends in Canadian retail real estate: This acquisition could spark further interest in Canadian retail real estate, particularly properties with redevelopment potential.

- Overall economic implications: The investment could stimulate economic activity through redevelopment projects and job creation.

Analyzing the Motivation Behind the Investment

While the precise reasons behind Weihong Liu's investment remain speculative, several factors likely contributed to his decision.

- Possible reasons for the investment: Long-term appreciation, redevelopment opportunities (converting retail space into residential or mixed-use), and strategic location in high-traffic areas are all potential motivators.

- Analysis of potential return on investment: The profitability of the investment hinges on several factors, including future market trends and Liu's redevelopment plans (if any).

- Comparison to other similar investments in the Canadian market: The scale of this acquisition is significant and sets a precedent for future large-scale transactions in the Canadian retail real estate market.

Conclusion

Weihong Liu's acquisition of 28 Hudson's Bay leases represents a significant investment in the Canadian real estate market. While many details surrounding Liu and his investment strategy remain undisclosed, the impact of this deal on the Canadian retail landscape is undeniable. The future use of these properties will be key to understanding the full implications of this transaction. This deal highlights the ongoing evolution of the Canadian retail market and its potential for significant change.

Stay tuned for further updates on Weihong Liu's impact on the Canadian real estate market, particularly concerning his Hudson's Bay lease acquisitions. Subscribe to our newsletter or follow us on social media for more insights on this developing story and future developments involving Weihong Liu and Hudson's Bay.

Featured Posts

-

Guillermo Del Toros Frankenstein Tease Leaves Horror Fans Baffled

May 30, 2025

Guillermo Del Toros Frankenstein Tease Leaves Horror Fans Baffled

May 30, 2025 -

Jon Jones Tom Aspinall Fight Experts Warn Of Jones Knockout Risk

May 30, 2025

Jon Jones Tom Aspinall Fight Experts Warn Of Jones Knockout Risk

May 30, 2025 -

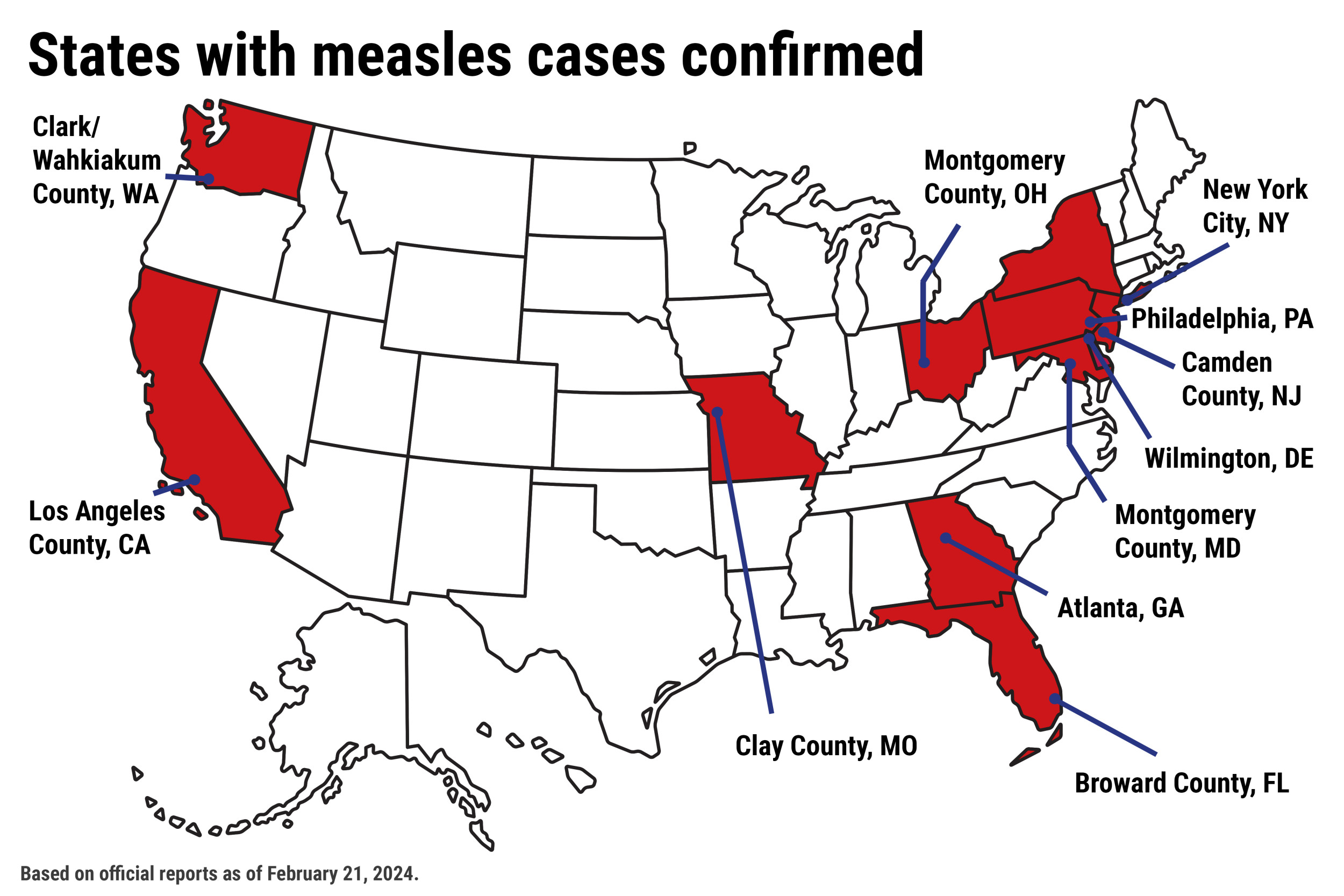

Slight Increase In Us Measles Cases Total Reaches 1 046

May 30, 2025

Slight Increase In Us Measles Cases Total Reaches 1 046

May 30, 2025 -

Victoria Day Weekend Kee To Bala Summer Concert Series Begins

May 30, 2025

Victoria Day Weekend Kee To Bala Summer Concert Series Begins

May 30, 2025 -

Manchester United E Arsenal Grande Jogo Termina Em Emocionante Empate

May 30, 2025

Manchester United E Arsenal Grande Jogo Termina Em Emocionante Empate

May 30, 2025

Latest Posts

-

Rebuilding After The Inferno The Texas Panhandles Post Wildfire Recovery

May 31, 2025

Rebuilding After The Inferno The Texas Panhandles Post Wildfire Recovery

May 31, 2025 -

Out Of Control Wildfires In Eastern Manitoba A Look At The Ongoing Emergency Response

May 31, 2025

Out Of Control Wildfires In Eastern Manitoba A Look At The Ongoing Emergency Response

May 31, 2025 -

Deadly Wildfires Continue To Threaten Eastern Manitoba Update On Firefighting Efforts

May 31, 2025

Deadly Wildfires Continue To Threaten Eastern Manitoba Update On Firefighting Efforts

May 31, 2025 -

One Year After The Texas Panhandle Wildfire Assessing The Damage And Progress

May 31, 2025

One Year After The Texas Panhandle Wildfire Assessing The Damage And Progress

May 31, 2025 -

Respiratory Health Concerns Rise As Canadian Wildfires Affect Minnesota Air

May 31, 2025

Respiratory Health Concerns Rise As Canadian Wildfires Affect Minnesota Air

May 31, 2025