Where To Invest: A Comprehensive Map Of The Country's Top Business Locations

Table of Contents

Economic Powerhouses: Thriving Metros and Their Investment Opportunities

Major metropolitan areas often represent some of the best business locations, offering robust economic growth and a wealth of investment opportunities. These hubs typically boast well-established infrastructure, a diverse talent pool, and access to significant capital. Let's examine some prime examples, focusing on sectors driving their economic success:

Keywords: Metropolitan areas, economic growth, investment opportunities, high-growth markets, business hubs.

-

City A (e.g., New York City): A global financial center, City A attracts significant foreign investment and boasts a highly developed financial sector. While salaries are high, so is the cost of living. However, the sheer volume of business and access to capital make it a compelling location for many businesses. Job growth consistently outpaces the national average, fueled by finance, technology, and media industries. GDP growth is typically strong, and startup activity is vibrant.

-

City B (e.g., Austin, TX): City B exemplifies a booming tech scene, attracting tech giants and innovative startups alike. Its large pool of skilled workers, coupled with a relatively lower cost of living compared to City A, makes it an attractive alternative. Competition is fierce, but the potential for rapid growth is substantial. The city's focus on technology fosters a dynamic and innovative ecosystem.

-

City C (e.g., Detroit, MI): A traditional manufacturing hub, City C offers established infrastructure and access to key supply chains. While economic growth might be slower than in tech-focused cities, the lower cost of labor can be a significant advantage for certain businesses. The city is also undergoing a revitalization, attracting new investments in advanced manufacturing and technology.

Emerging Markets: Untapped Potential and High-Growth Sectors

Beyond the established economic powerhouses lie emerging markets, presenting unique opportunities for early investors. These regions often benefit from government incentives, rapid population growth, and the development of new industries. While riskier than established markets, the potential rewards can be substantial.

Keywords: Emerging markets, high-growth sectors, regional development, investment incentives, untapped potential, up-and-coming areas.

-

Region X (e.g., Specific area focused on renewable energy): This region is actively attracting new businesses with government incentives, particularly in renewable energy and sustainable agriculture. This focus on green technologies presents a strong growth potential, though it also requires careful consideration of the evolving regulatory landscape.

-

Region Y (e.g., Region with rapid population growth): Rapid population growth in Region Y is driving increased consumer spending, creating opportunities in retail, hospitality, and related service sectors. This growth presents considerable upside, but requires careful market research to understand local consumer preferences and competition.

-

Region Z (e.g., Region with developing digital infrastructure): Region Z is prioritizing technological innovation and the development of digital infrastructure, opening up significant opportunities in tech startups, e-commerce, and related fields. While the infrastructure might still be developing, the potential for rapid growth in the digital economy is high.

Factors to Consider When Choosing Your Investment Location

Selecting where to invest requires a comprehensive assessment of factors extending beyond purely economic indicators. Thorough due diligence is crucial for minimizing risk and maximizing returns.

Keywords: Investment factors, location analysis, due diligence, market research, risk assessment, cost of living, infrastructure.

-

Infrastructure: Evaluate the quality of transportation networks (roads, rail, airports), utilities (electricity, water), and communication infrastructure (internet access). Reliable infrastructure is essential for efficient operations.

-

Talent Pool: Assess the availability of skilled labor and the presence of educational institutions. Access to a skilled workforce is crucial for many businesses.

-

Regulatory Environment: Research local laws, taxes, and business regulations. A favorable regulatory environment can significantly impact your operational costs and ease of doing business.

-

Cost of Living: Consider not only the cost of doing business but also the overall cost of living for employees. This impacts your ability to attract and retain talent.

-

Market Research: Conduct comprehensive market research to understand local demand, competition, and potential market size for your business. This is critical for identifying profitable opportunities.

Conclusion

Choosing where to invest your capital requires careful consideration of various factors. This guide has highlighted some of the country's top business locations, categorizing them by economic strength and growth potential. Remember to conduct thorough due diligence, focusing on economic indicators, infrastructure, and the overall business environment. Consider the specific needs of your business when weighing the advantages and disadvantages of each location.

Call to Action: Start your search for the perfect investment location today! Use the insights provided in this guide to pinpoint the best opportunities and maximize your return on investment. Find the best place where to invest and unlock your business's full potential. Begin your location analysis now and discover the ideal spot for your next venture.

Featured Posts

-

The Economic Fallout Of Trumps Tariffs Californias 16 Billion Loss

May 16, 2025

The Economic Fallout Of Trumps Tariffs Californias 16 Billion Loss

May 16, 2025 -

Is Dustin Poirier Retiring Too Soon Paddy Pimblett Weighs In

May 16, 2025

Is Dustin Poirier Retiring Too Soon Paddy Pimblett Weighs In

May 16, 2025 -

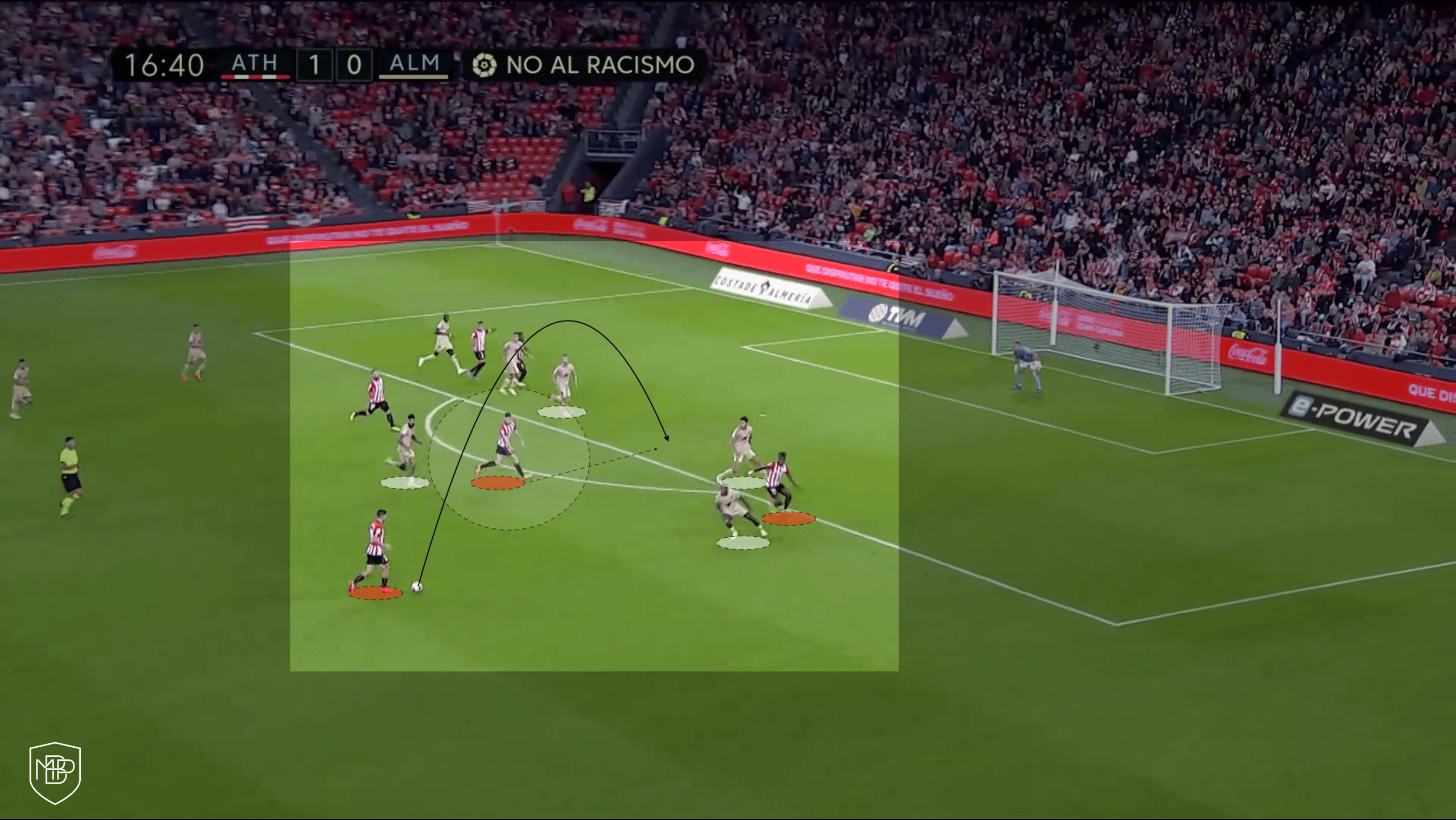

Vavels Comprehensive Coverage Of Athletic Club De Bilbao

May 16, 2025

Vavels Comprehensive Coverage Of Athletic Club De Bilbao

May 16, 2025 -

Ufc 314 Chandler Predicts Pimblett Will Struggle With His Aggressive Style

May 16, 2025

Ufc 314 Chandler Predicts Pimblett Will Struggle With His Aggressive Style

May 16, 2025 -

Napoles Vs Venezia Transmision En Directo Online

May 16, 2025

Napoles Vs Venezia Transmision En Directo Online

May 16, 2025

Latest Posts

-

Dodgers Muncys Brief Torpedo Bat Experiment Ends In Game Tying Double

May 16, 2025

Dodgers Muncys Brief Torpedo Bat Experiment Ends In Game Tying Double

May 16, 2025 -

Muncy Ditches Torpedo Bat After 3 At Bats Connects For Game Tying Hit

May 16, 2025

Muncy Ditches Torpedo Bat After 3 At Bats Connects For Game Tying Hit

May 16, 2025 -

Shohei Ohtani Delivers Walk Off Blow Dodgers Suffer 8 0 Rout

May 16, 2025

Shohei Ohtani Delivers Walk Off Blow Dodgers Suffer 8 0 Rout

May 16, 2025 -

Cubs Poteet Triumphs In Spring Training Abs Challenge Debut

May 16, 2025

Cubs Poteet Triumphs In Spring Training Abs Challenge Debut

May 16, 2025 -

Dodgers Historic 8 0 Loss Ohtanis Walk Off Home Run Seals Defeat

May 16, 2025

Dodgers Historic 8 0 Loss Ohtanis Walk Off Home Run Seals Defeat

May 16, 2025