When To Buy S&P 500 Downside Insurance: A Volatility-Based Approach

Table of Contents

Understanding Market Volatility and its Impact on the S&P 500

Defining Volatility:

Volatility, in simple terms, measures the degree of price fluctuation in an asset like the S&P 500. High volatility means prices are swinging wildly, increasing the risk of significant losses. Conversely, low volatility suggests more stable price movements. This connection between volatility and market risk is fundamental to understanding investment protection strategies.

- Defining Volatility and its Measurement: Volatility is often measured using standard deviation, which quantifies the dispersion of returns around the average. A higher standard deviation implies greater volatility.

- High Volatility and S&P 500 Losses: Periods of high volatility significantly increase the probability of substantial S&P 500 losses. Sharp price drops can quickly erode investment value.

- The VIX Index: The VIX (Volatility Index), often called the "fear gauge," is a key indicator of market volatility. It measures the implied volatility of S&P 500 index options, reflecting investor expectations of future price swings.

- VIX and Implied Volatility: The VIX's relationship with implied volatility is crucial. A high VIX suggests investors anticipate significant price fluctuations in the near term, increasing the cost of options but also highlighting potential need for downside protection.

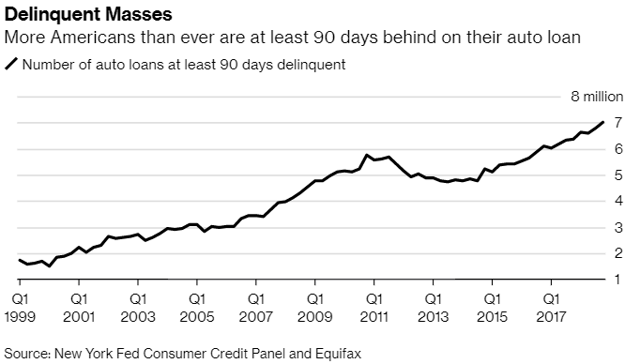

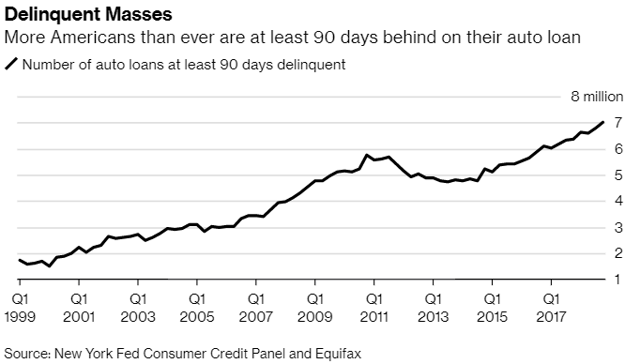

Historically, the S&P 500 has experienced periods of both low and high volatility. Analyzing historical data reveals a clear correlation: higher volatility periods often precede or accompany market downturns, impacting investor returns negatively. (Include a chart or graph here illustrating historical S&P 500 volatility and its correlation with market performance.)

Strategies for Utilizing S&P 500 Downside Insurance

Protective Puts:

Protective puts are a common way to insure against S&P 500 losses. They involve buying put options on an S&P 500 index fund or ETF. A put option gives the holder the right, but not the obligation, to sell the underlying asset at a specific price (the strike price) before the option expires.

- How Protective Puts Work: If the market drops below the strike price, the put option can be exercised, limiting potential losses. The profit from the put option offsets some or all of the losses in the underlying asset.

- The Cost of Protective Puts: Buying protective puts requires paying a premium, which is the cost of the option. This premium represents the cost of the insurance.

- Factors Influencing Put Option Prices: Several factors influence put option prices, including time to expiration (longer-term options are generally more expensive), and the strike price (lower strike prices are more expensive as they represent greater potential payoff).

Other Hedging Strategies:

Besides protective puts, other hedging strategies can provide S&P 500 downside insurance:

-

Collars: A collar involves simultaneously buying put options and selling call options. This strategy limits both potential gains and losses.

-

Index Funds with Built-in Downside Protection: Some index funds employ strategies designed to limit downside risk, although often at the cost of some upside potential.

-

Pros and Cons: Each strategy has its advantages and disadvantages. Protective puts offer strong downside protection but are costly. Collars offer a balance between protection and participation in upside gains, but the protection is less robust. Index funds with built-in protection may offer lower costs but may still be susceptible to losses.

-

Suitability: The best strategy depends on your individual risk tolerance and investment goals. Conservative investors may prefer protective puts, while more aggressive investors might consider collars or other strategies.

(Include real-world examples of how these strategies have protected investors during market crashes or corrections here.)

A Volatility-Based Approach to Timing S&P 500 Downside Insurance

Identifying High-Volatility Periods:

A volatility-based approach relies on monitoring market volatility indicators, like the VIX, to identify opportune times to buy S&P 500 downside insurance.

- Interpreting VIX Levels: Elevated VIX levels, typically above a certain threshold (e.g., 20 or higher), signal increased market uncertainty and higher risk.

- Other Volatility Indicators: Consider other factors alongside the VIX, such as economic news (e.g., unexpected recession signals), geopolitical events (e.g., wars or trade disputes), and investor sentiment.

- Historical VIX Spikes: Examine historical data to see how VIX spikes have correlated with subsequent S&P 500 downturns. (Include a chart or graph illustrating historical VIX spikes and corresponding S&P 500 movements.)

Determining Optimal Entry Points:

A volatility-based approach suggests buying S&P 500 downside insurance when volatility is high.

- VIX Thresholds as Buying Signals: While there's no magic number, consider using specific VIX thresholds (e.g., 25, 30, or higher) as potential buying signals for protective puts or other hedging strategies.

- Time Horizon and Risk Tolerance: The optimal entry point also depends on your investment time horizon and risk tolerance. Longer-term investors might tolerate higher volatility and wait for more pronounced VIX spikes.

- Imperfect System: Remember, no system is perfect. Even with a volatility-based approach, losses are still possible.

(Discuss risk management techniques like diversification, position sizing, and stop-loss orders within this approach.)

Conclusion

Using a volatility-based approach, primarily focusing on VIX levels, can help investors time their purchase of S&P 500 downside insurance more effectively. This allows for better risk management and potentially limits losses during market downturns. However, remember that no strategy guarantees profits and losses are always possible. Diversification and a well-defined investment strategy are crucial complements to downside protection.

Call to Action: Learn more about managing your S&P 500 investment risk and explore the benefits of implementing a volatility-based approach to buying S&P 500 downside insurance. Start protecting your portfolio today!

Featured Posts

-

The Merrie Monarch Festival Hoike A Deep Dive Into Pacific Island Arts

May 01, 2025

The Merrie Monarch Festival Hoike A Deep Dive Into Pacific Island Arts

May 01, 2025 -

Priscilla Pointer Dies Remembering The Dallas And Carrie Star

May 01, 2025

Priscilla Pointer Dies Remembering The Dallas And Carrie Star

May 01, 2025 -

Verdeelstation Oostwold Bewoners Voelen Zich Niet Gehoord

May 01, 2025

Verdeelstation Oostwold Bewoners Voelen Zich Niet Gehoord

May 01, 2025 -

Ywm Ykjhty Kshmyr Pakstan Myn Mkml Ykjhty Ka Azhar

May 01, 2025

Ywm Ykjhty Kshmyr Pakstan Myn Mkml Ykjhty Ka Azhar

May 01, 2025 -

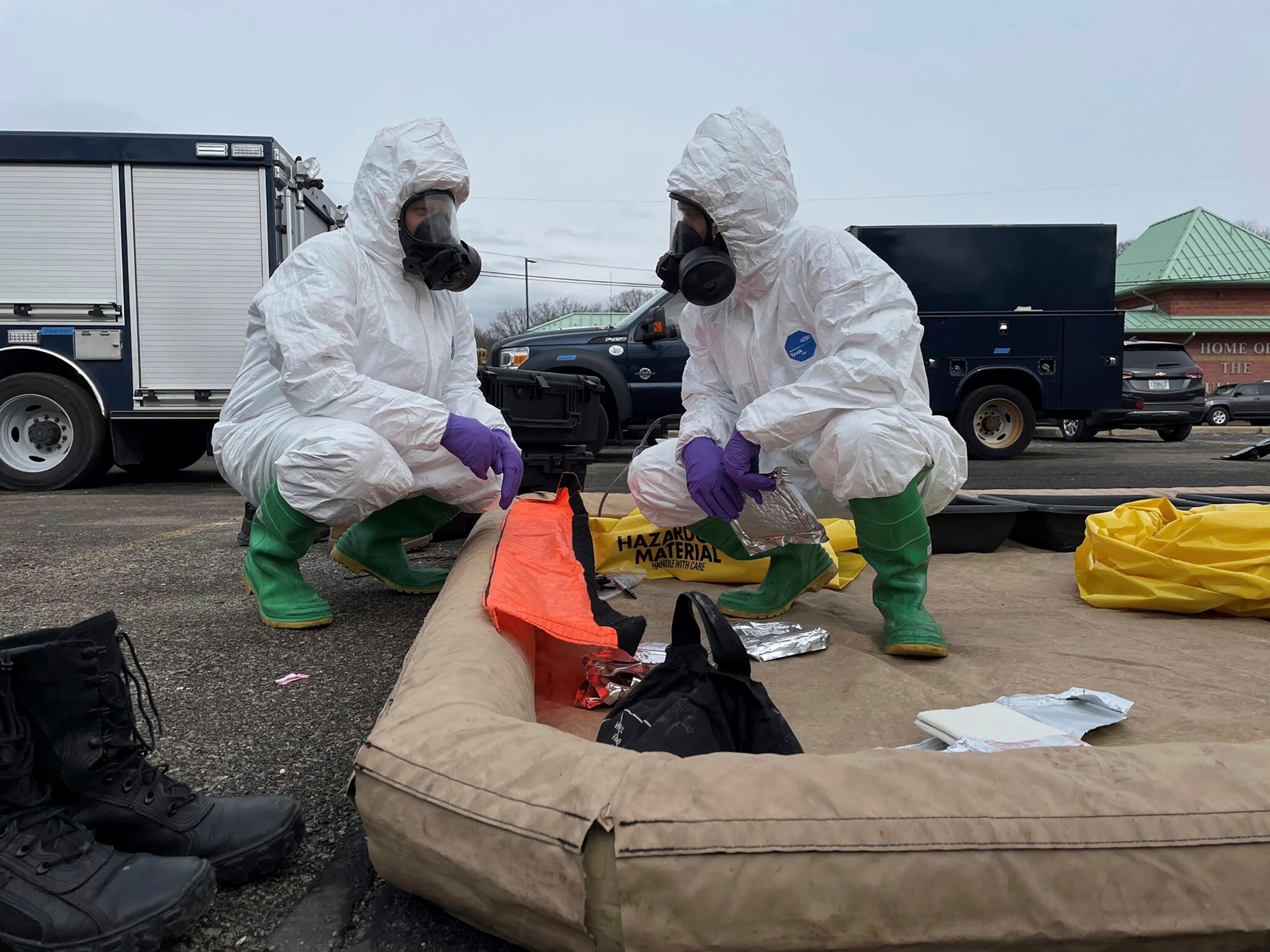

Investigation Reveals Lingering Toxic Chemicals In Buildings Months After Ohio Train Derailment

May 01, 2025

Investigation Reveals Lingering Toxic Chemicals In Buildings Months After Ohio Train Derailment

May 01, 2025

Latest Posts

-

Americas Favorite Cruise Lines Reviews And Recommendations

May 01, 2025

Americas Favorite Cruise Lines Reviews And Recommendations

May 01, 2025 -

Than Trong Khi Rot Von Nhan Dien Va Tranh Rui Ro Dau Tu Vao Cong Ty Ma

May 01, 2025

Than Trong Khi Rot Von Nhan Dien Va Tranh Rui Ro Dau Tu Vao Cong Ty Ma

May 01, 2025 -

Choosing The Right Cruise Line A Comparison Of Top Us Operators

May 01, 2025

Choosing The Right Cruise Line A Comparison Of Top Us Operators

May 01, 2025 -

Phap Ly Va Rui Ro Khi Dau Tu Vao Doanh Nghiep Bi Nghi Van Lua Dao

May 01, 2025

Phap Ly Va Rui Ro Khi Dau Tu Vao Doanh Nghiep Bi Nghi Van Lua Dao

May 01, 2025 -

Nguy Co Mat Trang Khi Gop Von Vao Cong Ty Co Tien Su Lua Dao

May 01, 2025

Nguy Co Mat Trang Khi Gop Von Vao Cong Ty Co Tien Su Lua Dao

May 01, 2025