What's In The GOP's Massive New Bill? A Comprehensive Review

Table of Contents

Tax Cuts and Economic Impacts

The GOP's Massive New Bill includes significant tax provisions designed to stimulate economic growth, though their effectiveness remains a subject of ongoing debate.

Individual Income Tax Changes

The bill proposes several changes to the individual income tax system:

- Reduced Tax Brackets: The number of tax brackets may be reduced, potentially impacting how different income levels are taxed.

- Increased Standard Deduction: An increased standard deduction could benefit lower- and middle-income taxpayers.

- Elimination of Certain Deductions: The elimination of certain itemized deductions could disproportionately affect higher-income taxpayers.

The impact on different income groups is complex. While some argue that the reduced tax rates will boost economic activity by leaving more money in the hands of taxpayers, others express concern that the benefits will primarily accrue to the wealthy, exacerbating income inequality. Economic modeling suggests potential scenarios ranging from modest economic stimulus to a more significant expansion, but these projections depend heavily on various economic factors and assumptions.

Corporate Tax Rate Adjustments

The GOP's Massive New Bill also includes substantial changes to corporate tax rates. The proposed reduction in the corporate tax rate aims to make the U.S. more competitive globally and attract more business investment.

- Lower Corporate Tax Rate: A lower corporate tax rate is intended to incentivize businesses to expand, invest, and create jobs.

- Impact on Investment and Job Creation: Proponents argue this will lead to increased investment, job creation, and higher wages.

- Potential Downsides: Critics warn that it could lead to increased income inequality and may not result in the promised job growth. The impact on small businesses versus large corporations is also a key area of contention. Small businesses may not benefit as much from the lower rates as large corporations, potentially widening the gap between them.

Healthcare and Social Welfare Provisions

The healthcare and social welfare aspects of the GOP's Massive New Bill are particularly controversial.

Changes to the Affordable Care Act (ACA)

The bill proposes significant changes to the Affordable Care Act (ACA), commonly known as Obamacare. These changes could have a profound impact on healthcare access and costs for millions of Americans.

- Reduced Subsidies: The bill may reduce or eliminate subsidies that help individuals and families afford health insurance.

- Impact on Healthcare Coverage: This could lead to a significant decrease in the number of Americans with health insurance coverage.

- Increased Healthcare Costs: The changes could also result in increased healthcare costs for those who remain insured. Vulnerable populations are especially at risk.

Social Security and Medicare Reforms

The GOP's Massive New Bill may also include reforms to Social Security and Medicare. These programs provide crucial financial security for millions of seniors and individuals with disabilities.

- Benefit Reductions: Proposed changes could involve reducing benefits or raising the retirement age.

- Funding Mechanisms: Reforms may also focus on altering the funding mechanisms for these programs, potentially impacting their long-term sustainability.

- Impact on Beneficiaries: Any changes to these programs would have substantial implications for millions of senior citizens and individuals relying on these vital social safety nets.

Environmental Regulations and Energy Policy

The environmental and energy provisions of the GOP's Massive New Bill have generated considerable concern among environmental advocates.

Proposed Changes to Environmental Regulations

The bill may propose weakening or rolling back existing environmental regulations, potentially impacting pollution control and climate change mitigation efforts.

- Relaxed Emission Standards: Relaxing emission standards could lead to increased air and water pollution.

- Reduced Environmental Protection Funding: Cuts in funding for environmental protection agencies could hamper their ability to enforce regulations.

- Impact on Climate Change: These changes could significantly worsen the effects of climate change.

Energy Sector Reforms

The bill's energy policy reforms could significantly shift the balance between renewable and fossil fuel energy sources.

- Increased Fossil Fuel Production: The bill may prioritize the expansion of fossil fuel production, potentially hindering the transition to renewable energy.

- Reduced Investment in Renewable Energy: Reduced investment in renewable energy technologies could slow the progress towards a cleaner energy future.

- Impact on the Energy Sector Workforce: The shifts in energy policy may impact the workforce employed in different sectors of the energy industry.

Political Ramifications and Public Opinion

The GOP's Massive New Bill has generated strong reactions across the political spectrum. The bill's passage or failure will have significant implications for the upcoming elections and the future of American policy. Public opinion polls show a divided nation, with strong support from some segments of the population and staunch opposition from others. Analysis of these polls reveals that opinions are often strongly correlated with existing political affiliations. Influential figures and organizations have weighed in, further fueling the debate and influencing public discourse.

Conclusion

This review has provided a comprehensive overview of the key components of the GOP's Massive New Bill. Understanding the proposed changes to tax laws, healthcare, environmental regulations, and other key areas is critical for engaging in informed civic discourse. The potential economic, social, and environmental ramifications of this legislation are far-reaching and demand careful consideration. We encourage you to continue researching the details of the GOP's Massive New Bill and its various components, and to participate in the ongoing debate about its impact on your community and the nation. Stay informed and make your voice heard. Understanding the nuances of this legislation is crucial to influencing its trajectory and ensuring a more informed future.

Featured Posts

-

The Gorklon Rust Name Change What It Means For X And Elon Musk

May 15, 2025

The Gorklon Rust Name Change What It Means For X And Elon Musk

May 15, 2025 -

Oakland As News Muncy Makes Roster Starts At Second

May 15, 2025

Oakland As News Muncy Makes Roster Starts At Second

May 15, 2025 -

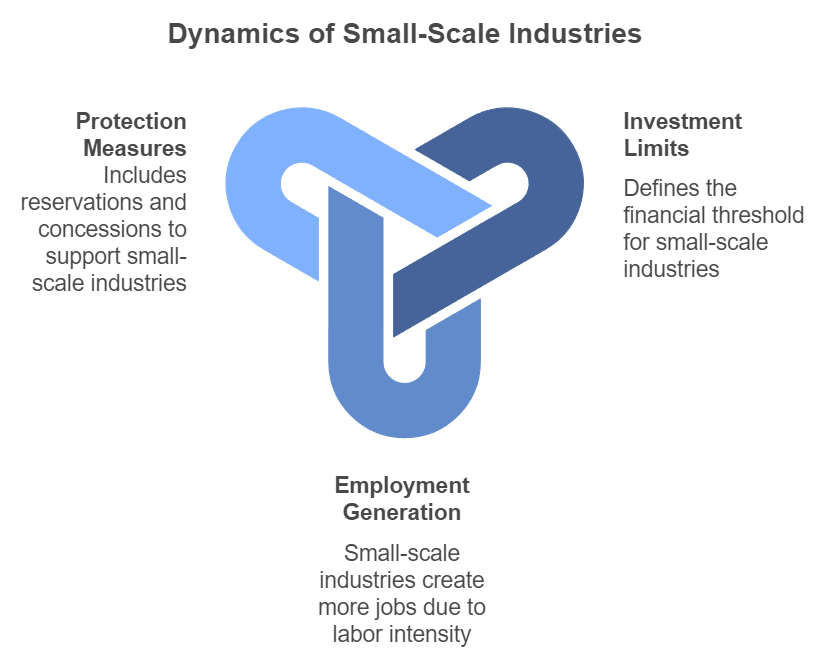

Second Order Effects Of Reciprocal Tariffs On The Indian Economy

May 15, 2025

Second Order Effects Of Reciprocal Tariffs On The Indian Economy

May 15, 2025 -

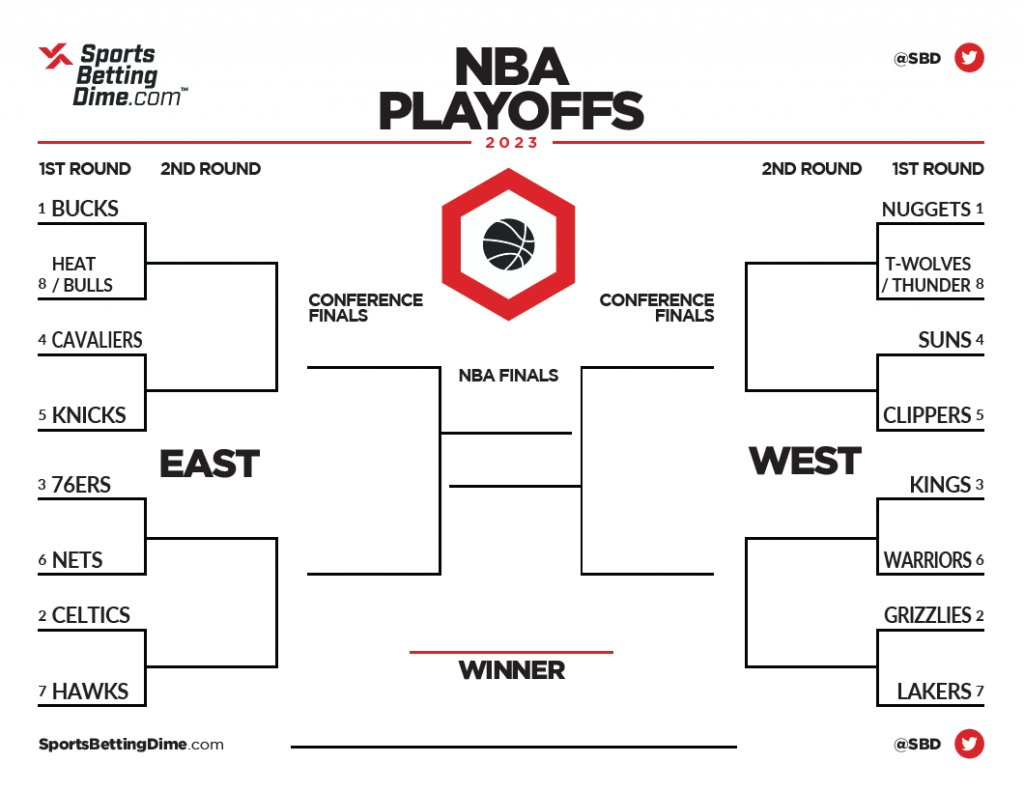

Nba And Nhl Playoffs Best Bets For Round 2

May 15, 2025

Nba And Nhl Playoffs Best Bets For Round 2

May 15, 2025 -

Hyeseong Kims Return To The Dodgers Roster Implications And Impact

May 15, 2025

Hyeseong Kims Return To The Dodgers Roster Implications And Impact

May 15, 2025