What's Driving The Price Of Riot Platforms Stock (RIOT)?

Table of Contents

Bitcoin's Price and Mining Revenue

The most significant factor influencing Riot Platforms' stock price is the price of Bitcoin (BTC). Riot Platforms, like other publicly traded Bitcoin miners, generates revenue directly from mining Bitcoin. A higher Bitcoin price translates to higher revenue for Riot, directly impacting its profitability and, consequently, its stock valuation.

-

Impact of Bitcoin's price volatility on RIOT's stock: The inherent volatility of Bitcoin creates significant uncertainty for RIOT. Sharp price drops in Bitcoin can severely impact Riot's revenue and profitability, leading to a decline in its stock price. Conversely, Bitcoin price rallies usually translate to increased revenue and a boost in RIOT's stock value.

-

Analysis of historical correlation between Bitcoin price and RIOT stock price: Historical data clearly shows a strong positive correlation between Bitcoin's price and RIOT's stock performance. This correlation isn't always perfectly linear, as other factors also influence the stock price, but it remains a dominant factor.

-

Discussion of potential future Bitcoin price scenarios and their effect on RIOT: Predicting Bitcoin's future price is inherently challenging. However, considering various scenarios – a sustained bull market, a bear market correction, or sideways trading – allows investors to assess the potential impact on RIOT's financial performance and stock price accordingly. A prolonged bear market, for example, could significantly pressure RIOT's stock price.

Mining Efficiency and Operational Costs

Beyond Bitcoin's price, Riot Platforms' operational efficiency plays a crucial role in its profitability and stock performance. This involves optimizing several key areas:

-

Explanation of how improved hashing power per watt impacts profitability: Riot Platforms aims to maximize its Bitcoin mining output per unit of energy consumed. Improvements in hashing power (the computational power used to mine Bitcoin) per watt directly reduce operational costs and increase profitability. This, in turn, enhances investor confidence and positively impacts the RIOT stock price.

-

Analysis of Riot's operational costs and their trends: Analyzing Riot's operational costs, including energy expenses, hardware maintenance, and personnel costs, is vital. Trends in these costs reveal the company's efficiency in managing its operations and its ability to maintain profitability even during periods of Bitcoin price volatility.

-

Impact of new mining equipment on efficiency and ROI: Investing in state-of-the-art mining equipment significantly impacts efficiency and return on investment (ROI). Riot Platforms' strategic decisions regarding equipment upgrades directly influence its long-term profitability and its stock price. Efficient, new ASICs (Application-Specific Integrated Circuits) are key to staying competitive.

Regulatory Landscape and Government Policies

The regulatory environment significantly impacts the cryptocurrency mining industry. Government policies related to energy consumption, taxation, and overall cryptocurrency regulation influence Riot's operations and stock price.

-

Impact of supportive or restrictive mining regulations on RIOT's operations: Supportive regulations, such as tax breaks for renewable energy usage in mining, can reduce operational costs and boost profitability. Conversely, restrictive regulations, such as increased energy costs or bans on cryptocurrency mining, can negatively impact RIOT's operations and stock price.

-

Analysis of current regulatory trends and their potential influence on RIOT's future: Staying informed about evolving regulatory landscapes is critical. Changes in tax policies, environmental regulations, and cryptocurrency legislation can significantly affect Riot's future prospects.

-

Discussion of geopolitical factors affecting cryptocurrency mining: Geopolitical factors, such as energy policies in different regions, can influence where Riot chooses to operate its mining facilities, impacting its operational costs and overall profitability.

Market Sentiment and Investor Confidence

Investor sentiment towards cryptocurrencies and the broader mining industry significantly affects Riot Platforms' stock price. Positive sentiment leads to higher demand for RIOT stock, driving the price upward, while negative sentiment can cause a price decline.

-

Influence of broader market trends on RIOT's stock valuation: The overall performance of the cryptocurrency market and the broader stock market impacts investor confidence in RIOT. A general downturn in these markets can negatively affect RIOT's stock price, even if the company's fundamentals remain strong.

-

Analysis of news and events impacting investor sentiment: News and events, such as SEC actions related to cryptocurrencies, industry partnerships, or technological breakthroughs, can significantly influence investor sentiment and subsequently impact RIOT's stock price.

-

Impact of analyst ratings and price targets on RIOT's stock performance: Analyst ratings and price targets from financial institutions play a role in shaping investor expectations and influencing the stock price. Positive analyst reports can boost the price, while negative reports can lead to a decline.

Competition and Market Share

Riot Platforms operates in a competitive landscape. Understanding its position relative to competitors is crucial for assessing its future prospects.

-

Comparison with major competitors (e.g., Marathon Digital Holdings): Analyzing Riot's performance against key competitors, such as Marathon Digital Holdings, provides valuable insights into its market position and competitive advantages.

-

Analysis of Riot's competitive advantages (e.g., mining efficiency, geographical location): Riot's competitive advantages, such as its mining efficiency, strategic geographic location, or its commitment to sustainable energy sources, influence its ability to maintain and grow its market share.

-

Discussion of the long-term implications of competition on RIOT's growth: The intensity of competition and Riot's ability to adapt to changing market dynamics will significantly impact its long-term growth prospects and stock price performance.

Conclusion

The price of Riot Platforms stock (RIOT) is driven by a complex interplay of factors, including Bitcoin's price, operational efficiency, the regulatory environment, market sentiment, and competition. Understanding the interconnectedness of these drivers is crucial for investors. Bitcoin's price remains the dominant factor, but operational efficiency, regulatory changes, and market sentiment all play significant roles. Before making any investment decisions regarding Riot Platforms stock (RIOT), conduct thorough research, follow relevant news sources, and analyze financial reports to develop a comprehensive understanding of the company's performance and the evolving dynamics of the cryptocurrency mining industry.

Featured Posts

-

1 Mayis Ta Yasanan Arbedelerin Analizi Emek Hareketinin Gecmisi Ve Gelecegi

May 03, 2025

1 Mayis Ta Yasanan Arbedelerin Analizi Emek Hareketinin Gecmisi Ve Gelecegi

May 03, 2025 -

Astratyjyt Astthmaryt Jdydt Lljbht Alwtnyt Tfasyl Wrqt Alsyasat

May 03, 2025

Astratyjyt Astthmaryt Jdydt Lljbht Alwtnyt Tfasyl Wrqt Alsyasat

May 03, 2025 -

Farmings Future Can The Reform Uk Party Be Trusted

May 03, 2025

Farmings Future Can The Reform Uk Party Be Trusted

May 03, 2025 -

Farage Denies Far Right Claims In Row With Teaching Union

May 03, 2025

Farage Denies Far Right Claims In Row With Teaching Union

May 03, 2025 -

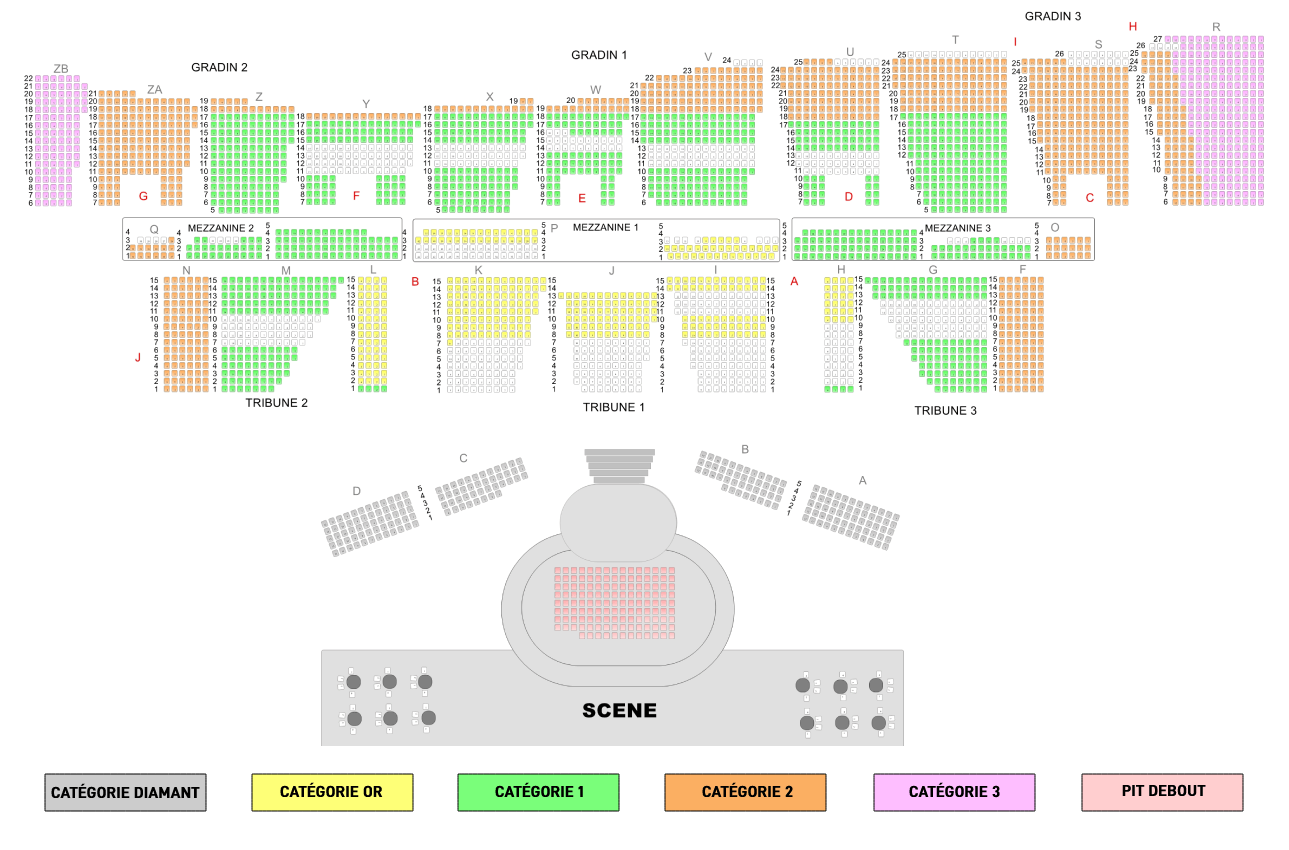

La Seine Musicale Concerts Danse Cinema Et Spectacles Pour Enfants 2025 2026

May 03, 2025

La Seine Musicale Concerts Danse Cinema Et Spectacles Pour Enfants 2025 2026

May 03, 2025