WhatsApp And Instagram: The FTC's Antitrust Lawsuit Against Meta Platforms

Table of Contents

The FTC's Allegations Against Meta's Acquisition of WhatsApp and Instagram

The FTC's complaint centers on Meta's acquisitions of WhatsApp in 2014 and Instagram in 2012. The commission alleges that these acquisitions were not merely strategic business moves but rather deliberate attempts to eliminate potential competitors and solidify Meta's monopolistic grip on the social media market. The core of the FTC's argument rests on the idea that Meta used its already substantial market power to preemptively neutralize emerging threats.

-

Allegations of Monopolization: The FTC argues that Meta leveraged its existing dominance in social networking to stifle competition, creating a near-monopoly. This claim is supported by evidence presented showing Meta's significant market share across various social media platforms.

-

Claims of Suppressing Competition through Acquisitions: The FTC contends that instead of allowing fair competition, Meta opted to acquire promising competitors, preventing them from reaching their full potential and challenging Meta's market leadership. This acquisition strategy is presented as a form of anti-competitive behavior.

-

Examples of Specific Anti-Competitive Practices: The lawsuit details specific instances where Meta allegedly engaged in anti-competitive conduct, including potentially leveraging data from acquired companies to enhance its existing platforms while limiting the growth of those acquired entities.

-

Relevant Case Law and Legal Precedents: The FTC's case draws on established antitrust law precedents, citing similar cases where large companies have been found guilty of using acquisitions to suppress competition. This includes references to landmark cases involving other tech giants facing antitrust challenges.

The Impact on Competition in the Social Media Market

The FTC's concerns extend beyond Meta's actions; they address the broader implications for competition within the social media market. The potential consequences of Meta's alleged anti-competitive behavior are far-reaching.

-

Reduced Innovation due to Lack of Competition: A lack of robust competition can stifle innovation. When a dominant player controls a significant market share, the incentive to develop new features or improve existing services diminishes.

-

Higher Prices or Reduced Quality of Services for Consumers: A monopolistic market can lead to higher prices or a decline in the quality of services offered to consumers. Without competitive pressure, companies may prioritize profits over customer satisfaction.

-

Limited Choices for Users: Meta's dominance restricts the choices available to users. Without viable alternatives, users have less power to negotiate better terms or switch to platforms that better suit their needs.

-

Potential for Future Monopolistic Practices: The FTC aims to prevent Meta from engaging in similar anti-competitive practices in the future, setting a precedent for other tech giants.

Arguments Presented by Meta Platforms in its Defense

Meta has vigorously defended itself against the FTC's accusations, presenting counterarguments to the claims of anti-competitive behavior.

-

Claims of Pro-competitive Benefits from Acquisitions: Meta argues that the acquisitions of WhatsApp and Instagram brought significant benefits to consumers, integrating innovative features and expanding user reach. They claim these acquisitions fostered competition, not hindered it.

-

Arguments Against the FTC's Definition of the Relevant Market: Meta disputes the FTC's definition of the relevant market, arguing that the social media landscape is far more diverse than the FTC suggests, with numerous competing platforms offering similar services.

-

Discussion of Consumer Benefits Derived from Meta's Services: Meta highlights the benefits its services provide to consumers, emphasizing free access to communication tools and the positive social impact of its platforms.

-

Mention any settlements or counter-suits: (Note: This section needs to be updated with the latest information regarding any settlements or countersuits filed by Meta.)

Potential Outcomes and Implications of the Lawsuit

The FTC antitrust lawsuit against Meta could have several potential outcomes, each carrying significant implications.

-

Potential for Significant Financial Penalties for Meta: The lawsuit could result in substantial fines for Meta, potentially impacting its financial performance and future investments.

-

Impact on Future M&A Activity in the Tech Sector: The outcome of this case will set a precedent for future mergers and acquisitions in the tech sector, potentially leading to stricter regulatory scrutiny of such deals.

-

Changes to Antitrust Regulations: The case could lead to broader changes in antitrust regulations, affecting how tech companies are regulated and monitored in the future.

-

The Precedent the Case Will Set: This case will serve as a significant precedent, impacting how future antitrust cases involving large tech companies are handled.

Conclusion: Understanding the FTC Antitrust Lawsuit's Long-Term Effects on Meta, WhatsApp, and Instagram

The FTC antitrust lawsuit against Meta Platforms concerning its acquisition of WhatsApp and Instagram is a landmark case with far-reaching implications. The FTC’s allegations of anti-competitive behavior, Meta's defense, and the potential outcomes all contribute to a complex legal battle that will shape the future of the social media landscape. Understanding the nuances of this case is crucial for anyone interested in the future of online communication and the evolving regulatory environment for tech giants. Stay updated on the ongoing FTC antitrust lawsuit against Meta Platforms and its implications for WhatsApp and Instagram. Understanding this case is crucial for navigating the future of social media.

Featured Posts

-

Air Traffic Controller Shortage High Profile Trials And Thc Drinks Todays Top News

May 13, 2025

Air Traffic Controller Shortage High Profile Trials And Thc Drinks Todays Top News

May 13, 2025 -

Kelly Graves Lands Australian Star Recruit

May 13, 2025

Kelly Graves Lands Australian Star Recruit

May 13, 2025 -

Access Exclusive Off Market Homes Via Luxury Presences New Platform

May 13, 2025

Access Exclusive Off Market Homes Via Luxury Presences New Platform

May 13, 2025 -

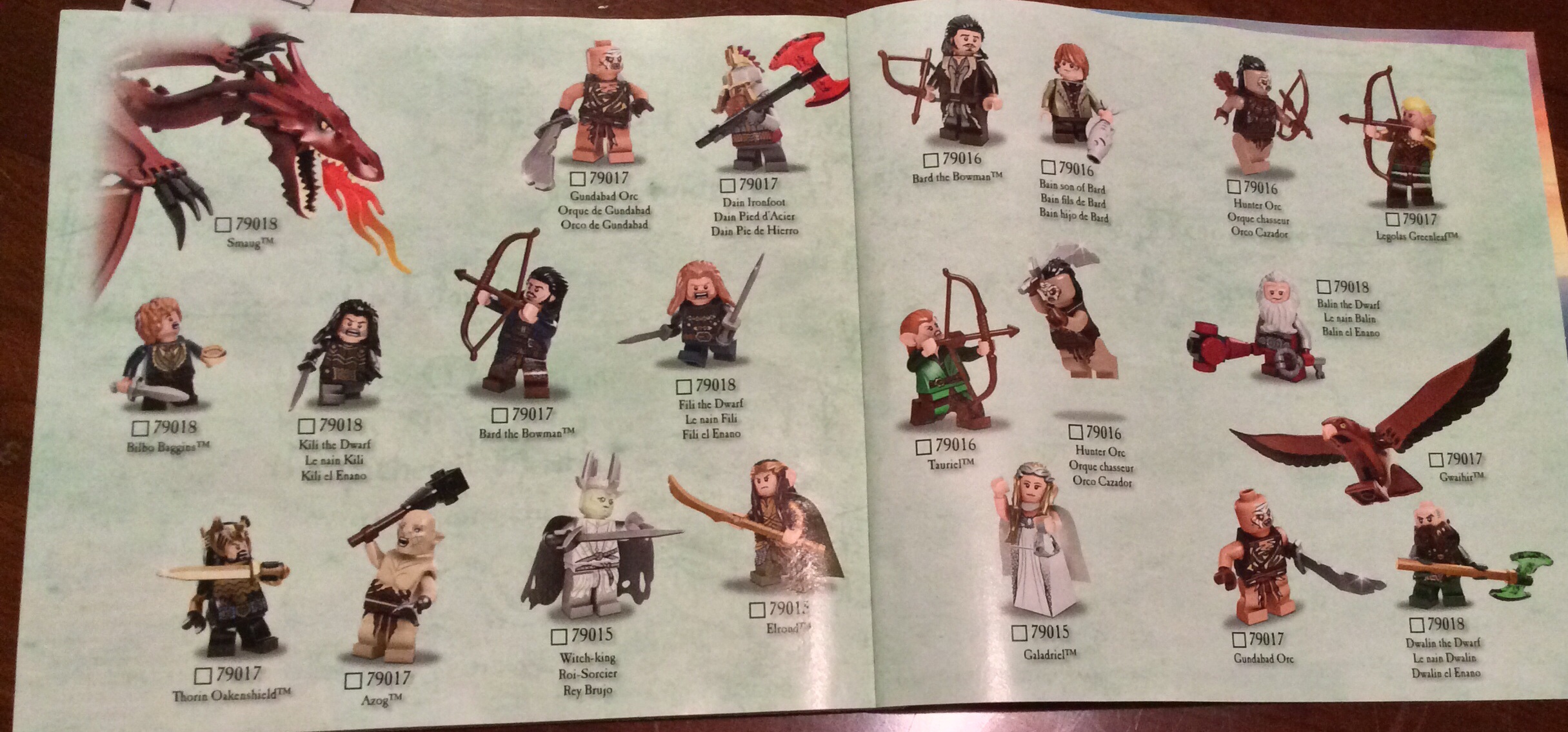

The Hobbit The Battle Of The Five Armies Characters Plot And Legacy

May 13, 2025

The Hobbit The Battle Of The Five Armies Characters Plot And Legacy

May 13, 2025 -

Update Hamas May Free Edan Alexander And Other Captives At End Of Ramadan

May 13, 2025

Update Hamas May Free Edan Alexander And Other Captives At End Of Ramadan

May 13, 2025