What To Expect From QBTS Stock Following Its Earnings Release

Table of Contents

Analyzing QBTS's Earnings Report: Key Financial Metrics

Understanding the key financial metrics within the QBTS earnings report is crucial for assessing the company's performance and its likely impact on QBTS stock. Analyzing these metrics allows investors to gauge the health of the business and predict future growth potential.

- Revenue Growth: Examine the percentage change in revenue compared to the same period last year. A significant increase indicates strong growth, potentially boosting QBTS share price. Conversely, a decline may signal underlying problems. Was this growth in line with analyst predictions and market expectations for QBTS earnings?

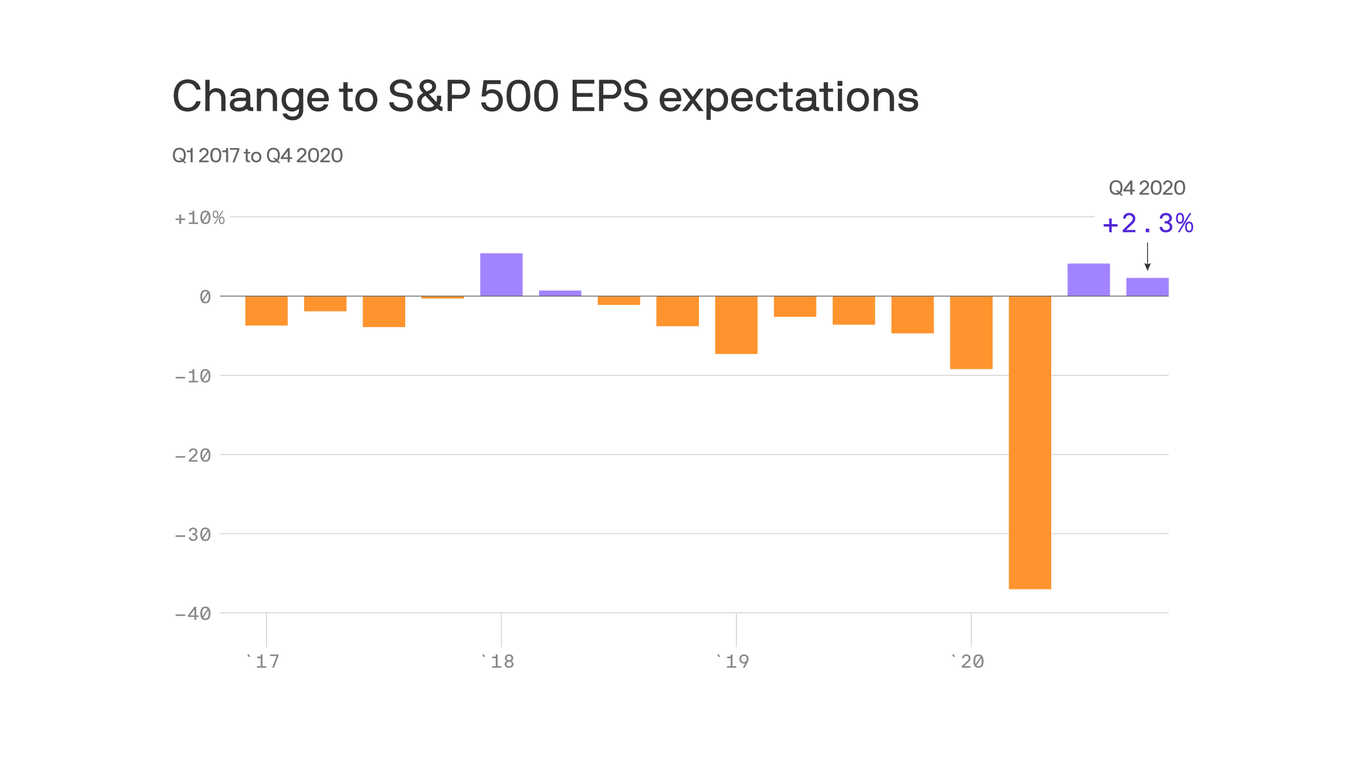

- Earnings Per Share (EPS): EPS shows the portion of a company's profit allocated to each outstanding share. Did QBTS beat or miss EPS estimates? Consistent positive EPS growth is a positive sign for long-term QBTS investment. Analyzing the trend of EPS over several quarters provides a more comprehensive picture.

- Profit Margins: Profit margins reveal the company's profitability relative to its revenue. Expanding margins suggest efficient operations and increased profitability, while contracting margins may indicate rising costs or declining sales. This is a critical metric for assessing the overall health of the QBTS business model.

- Debt Levels: High debt levels can pose significant risks, potentially impacting the company's ability to invest in growth and withstand economic downturns. Analyzing QBTS's debt-to-equity ratio and interest coverage ratio provides valuable insights into its financial stability.

Any significant deviations from expectations in these key metrics should be carefully considered. For instance, a surprise increase in revenue or a significant improvement in profit margins could trigger a positive market reaction, increasing demand for QBTS stock. Conversely, unexpected decreases can lead to a sell-off.

Impact of the Earnings Release on QBTS Stock Price

The immediate market reaction to the QBTS earnings announcement often provides a glimpse into investor sentiment. However, the short-term volatility following such releases can be misleading. Analyzing the historical relationship between QBTS earnings releases and subsequent stock price movements can provide a better understanding of potential future trends.

- Short-Term Volatility: Expect increased volatility in the days and weeks following the earnings release. Investors often react quickly to the news, causing fluctuations in QBTS share price.

- Long-Term Trends: Consider the company's long-term growth prospects, strategic direction, and competitive landscape. Fundamental factors, rather than short-term market noise, will ultimately drive the long-term performance of QBTS stock.

- Analyst Ratings: Post-earnings, analyst ratings can shift significantly, impacting investor confidence. An upgrade could lead to a price surge, while a downgrade may trigger selling pressure. It's essential to consider multiple analyst opinions before making decisions regarding QBTS stock.

- Market Sentiment & Economic Conditions: The overall market sentiment and prevailing economic conditions also play a significant role. A strong market might overshadow negative QBTS earnings, while a weak market may amplify any negative news.

Future Outlook and Investment Strategies for QBTS Stock

The company's guidance for upcoming quarters offers vital clues about future performance. This, combined with an assessment of potential risks and opportunities, informs investment decisions.

-

Company Guidance: Pay close attention to QBTS's projections for revenue, EPS, and other key metrics. Realistic guidance suggests management's confidence in future performance, while overly optimistic projections might raise concerns.

-

Risks and Opportunities: Identify potential risks, such as increased competition, regulatory changes, or economic slowdowns. Also, look for opportunities, such as expansion into new markets or the launch of innovative products. These factors will all impact the value of QBTS stock.

-

Investment Strategies: Based on your analysis, decide whether a buy, hold, or sell strategy is appropriate for your investment goals and risk tolerance. Consider diversifying your portfolio to mitigate risk.

-

Investment Considerations:

- Risk Tolerance: Before investing in QBTS stock, assess your risk tolerance carefully. Are you comfortable with the potential for short-term price fluctuations?

- Diversification: Diversification is crucial for mitigating risk. Don't put all your eggs in one basket. Spread your investments across different assets and sectors.

- Long-Term Perspective: Consider a long-term investment horizon. Don't let short-term market fluctuations dictate your investment decisions. Focus on the long-term growth potential of QBTS stock.

Conclusion: Making Informed Decisions about QBTS Stock

The QBTS earnings report provides valuable insights into the company's financial health and future prospects. However, the impact on QBTS share price will depend on several factors, including market sentiment, analyst ratings, and the company's future guidance. Remember, thorough research is crucial before making any investment decisions. Consider all the factors discussed above and compare your analysis against other viewpoints. Learn more about QBTS stock and how to analyze its future performance to make smart investment choices. Stay updated on QBTS earnings and make informed decisions regarding your QBTS investment.

Featured Posts

-

Oh Jun Sung Triumphs In Wtt Star Contender Chennai

May 21, 2025

Oh Jun Sung Triumphs In Wtt Star Contender Chennai

May 21, 2025 -

Bp Chiefs Plan Double Valuation No Us Listing Switch Says Ft

May 21, 2025

Bp Chiefs Plan Double Valuation No Us Listing Switch Says Ft

May 21, 2025 -

Barry Ward Interview The Irish Actor On Roles And Stereotypes

May 21, 2025

Barry Ward Interview The Irish Actor On Roles And Stereotypes

May 21, 2025 -

Wtt Star Contender Chennai Oh Jun Sung Secures The Win

May 21, 2025

Wtt Star Contender Chennai Oh Jun Sung Secures The Win

May 21, 2025 -

William Goodge Australian Foot Crossing Record Breaker

May 21, 2025

William Goodge Australian Foot Crossing Record Breaker

May 21, 2025

Latest Posts

-

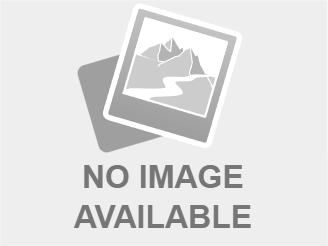

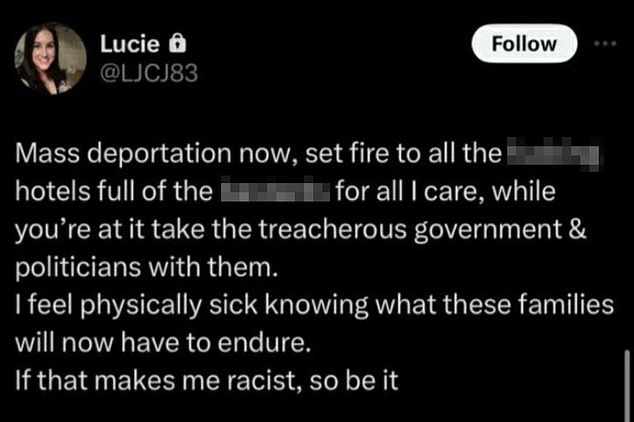

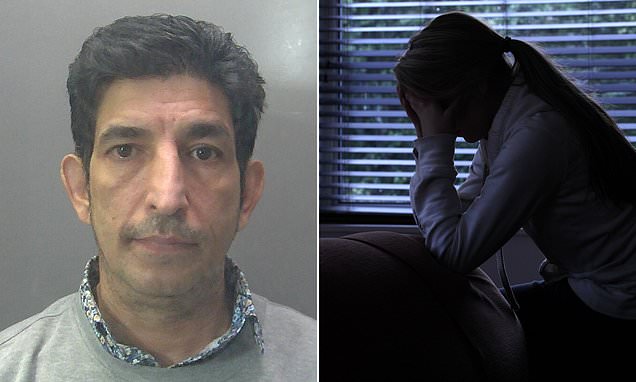

Ex Tory Councillors Wife Awaits Racial Hatred Tweet Appeal Ruling

May 22, 2025

Ex Tory Councillors Wife Awaits Racial Hatred Tweet Appeal Ruling

May 22, 2025 -

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal The Wait Continues

May 22, 2025

Ex Tory Councillors Wifes Racial Hatred Tweet Appeal The Wait Continues

May 22, 2025 -

Appeal Pending Ex Tory Councillors Wifes Racial Hatred Tweet Case

May 22, 2025

Appeal Pending Ex Tory Councillors Wifes Racial Hatred Tweet Case

May 22, 2025 -

Appeal Pending Ex Tory Councillors Wife Faces Decision On Racial Hatred Tweet

May 22, 2025

Appeal Pending Ex Tory Councillors Wife Faces Decision On Racial Hatred Tweet

May 22, 2025 -

Jailed Tory Councillors Wife Denies Incitement In Migrant Hotel Rant

May 22, 2025

Jailed Tory Councillors Wife Denies Incitement In Migrant Hotel Rant

May 22, 2025