Weihong Liu And The Acquisition Of 28 Hudson's Bay Leases

Table of Contents

Understanding the Hudson's Bay Company and its Real Estate Portfolio

The Hudson's Bay Company, a cornerstone of Canadian history, boasts a vast real estate portfolio built over centuries of operation. Its retail footprint once spanned the nation, but recent economic shifts and changing consumer behavior have led to strategic restructuring. Divesting certain leases is a common tactic for companies seeking to streamline operations and focus on core profitable ventures. The 28 leases acquired by Weihong Liu represent a significant portion of HBC's former holdings, likely chosen for their strategic locations and potential for redevelopment.

- HBC's History: Founded in 1670, HBC holds a unique place in Canadian history, evolving from a fur trading company to a major department store operator.

- Reasons for Divestment: HBC's decision to divest these leases is likely driven by a combination of factors: a focus on its core retail brands, debt reduction strategies, and an overall shift towards online retail.

- Value and Location of Leases: The 28 leases are situated in key locations across Canada, many in high-traffic areas with significant footfall, making them attractive investments for redevelopment or continued retail use. Precise locations and financial details of the deal remain largely undisclosed.

- Key Characteristics of Acquired Leases:

- Varied sizes and configurations, catering to diverse retail needs.

- Strategic locations in high-density urban and suburban areas.

- Potential for mixed-use development (residential, commercial, or both).

Weihong Liu's Business Background and Investment Strategy

Weihong Liu is a prominent figure in the world of real estate investment, though details about his specific investment strategies and past projects are not widely publicized. His acquisition of the 28 Hudson's Bay leases suggests a long-term investment strategy focused on high-value properties with significant redevelopment potential. The choice of these particular leases implies a keen understanding of market trends and an ability to identify undervalued assets.

- Investment Style: While specifics remain largely private, Liu's purchase of these leases points towards a portfolio strategy focused on large-scale, high-impact acquisitions in prime locations.

- Reasons for Acquisition: Liu's interest in these leases might stem from several factors:

- Redevelopment Potential: Converting underutilized retail spaces into residential or mixed-use properties offers substantial return potential.

- Prime Locations: The strategic locations of the acquired leases provide significant value for long-term growth.

- Market Diversification: Adding these properties to his portfolio may diversify his holdings across various sectors and regions.

- Past Successful Investments (If Publicly Available): Further research into Weihong Liu's past investments would reveal more about his investment approach and success rate.

Financial Aspects and Market Implications of the Acquisition

The financial details surrounding Weihong Liu's acquisition of the 28 Hudson's Bay leases remain confidential. However, the sheer scale of the deal speaks to a substantial financial commitment. For HBC, the divestment likely contributes to its financial restructuring efforts. For the retail landscape, this acquisition signifies a shift in ownership and potentially a transformation of existing retail spaces.

- Financial Terms (If Available): Publicly available financial information regarding the purchase price and related financing terms would provide crucial context for analysis.

- Impact on HBC: This sale allows HBC to reduce its real estate holdings, streamlining operations and potentially improving its overall financial position.

- Market Implications: The acquisition could impact the retail market in the specific locations where the leases are situated, influencing rents, competition, and potentially driving new development.

- Potential Financial Gains for Weihong Liu: The potential returns for Liu depend heavily on his plans for redevelopment and the overall market performance in the coming years.

- Implications for Retail Spaces: This acquisition highlights the ongoing evolution of the retail sector, with a growing trend towards repurposing traditional retail spaces.

Future Plans and Potential Developments of the Acquired Leases

Weihong Liu's plans for the 28 acquired Hudson's Bay leases remain largely unknown. However, given the prime locations and potential for redevelopment, several scenarios are possible. These could range from maintaining the retail spaces with new tenants to transforming them into mixed-use properties incorporating residential units or other commercial ventures.

- Redevelopment Scenarios:

- Conversion to residential apartments or condominiums.

- Integration of retail spaces with office or commercial areas.

- Renovation and lease to new retail tenants.

- Impact on Local Communities: The redevelopment plans will significantly impact the local communities, potentially creating jobs and improving the surrounding infrastructure.

- Possible Future Scenarios: The future of these properties will depend on market conditions, local zoning regulations, and Weihong Liu's investment strategy.

Conclusion: The Significance of Weihong Liu's Hudson's Bay Lease Acquisition

Weihong Liu's acquisition of 28 Hudson's Bay leases is a significant event in the Canadian real estate market. This deal signals a strategic shift for HBC, allowing for financial restructuring and a focus on core business operations. For Weihong Liu, it represents a substantial investment with high redevelopment potential, altering the landscape of several key retail locations across the country. The future of these properties will undoubtedly shape the retail and residential spaces in their respective communities. Stay informed about the future developments related to Weihong Liu and the acquisition of 28 Hudson's Bay leases, and learn more about Weihong Liu's real estate portfolio and investment strategies for a deeper understanding of this significant transaction.

Featured Posts

-

Game Stop Limits Pokemon Tcg Sales One Per Customer

May 29, 2025

Game Stop Limits Pokemon Tcg Sales One Per Customer

May 29, 2025 -

Ajax Nieuwe Trainer Arne Slot In De Spotlights

May 29, 2025

Ajax Nieuwe Trainer Arne Slot In De Spotlights

May 29, 2025 -

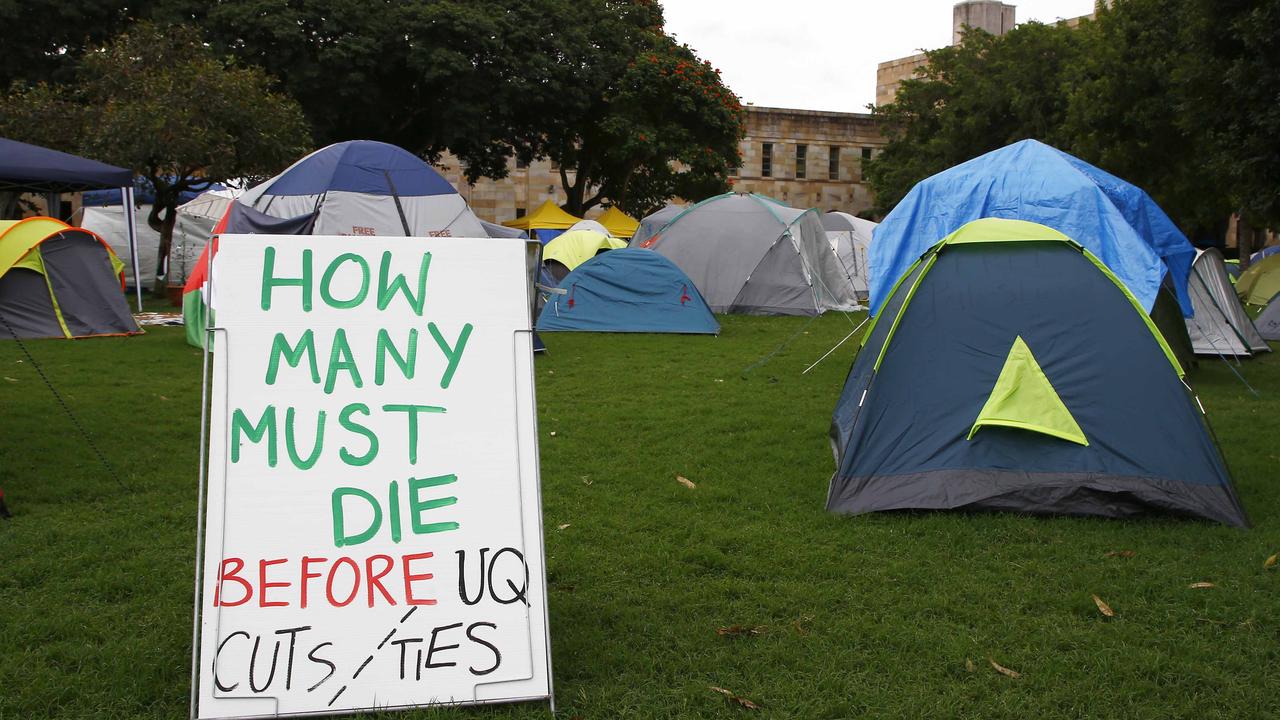

Music Industry Figures Support Queensland Award Winner Amidst Palestine Controversy

May 29, 2025

Music Industry Figures Support Queensland Award Winner Amidst Palestine Controversy

May 29, 2025 -

Rivalries Renewed Marini Comments On Espargaros Moto Gp Return

May 29, 2025

Rivalries Renewed Marini Comments On Espargaros Moto Gp Return

May 29, 2025 -

Influencia De Kroos En El Estilo De Juego De Valverde

May 29, 2025

Influencia De Kroos En El Estilo De Juego De Valverde

May 29, 2025