Warren Buffett's Biggest Hits And Misses: What We Can Learn

Table of Contents

Warren Buffett's Greatest Investing Hits: A Case Study in Long-Term Value Investing

Warren Buffett's phenomenal success is largely attributed to his unwavering commitment to a long-term value investing strategy. He doesn't chase quick profits; instead, he identifies fundamentally strong companies and holds them for years, even decades, benefiting from their growth and consistent dividend payouts.

Coca-Cola Investment: A Textbook Example of Long-Term Holding

Buffett's investment in Coca-Cola serves as a prime example of his long-term investment strategy and the power of dividend investing.

- Initial Investment: Berkshire Hathaway began acquiring Coca-Cola stock in 1988.

- Long-Term Growth: Over the years, Coca-Cola's stock price has significantly appreciated, delivering substantial capital gains.

- Dividends Received: The company's consistent dividend payments have generated a significant stream of passive income for Berkshire Hathaway.

- Overall Return: The Coca-Cola investment has yielded astronomical returns for Berkshire Hathaway, showcasing the power of identifying strong brands and holding them for the long term. This exemplifies Buffett's focus on brand strength and consistent cash flow as cornerstones of his value investing approach.

This success story underscores the importance of value investing, long-term investment strategy, and the significant role dividend investing can play in building wealth.

American Express: Navigating a Crisis and Reaping the Rewards

Buffett's investment in American Express during the 1960s Salad Oil scandal exemplifies his contrarian investing style and his ability to identify undervalued assets during times of crisis.

- The Scandal: A major fraud involving a massive amount of fake salad oil exposed weaknesses in American Express's finances.

- Buffett's Approach: While many investors panicked and sold their shares, Buffett saw an opportunity. He recognized that American Express's underlying business remained strong, and the scandal was a temporary setback.

- The Recovery: American Express bounced back strongly, and Buffett's contrarian bet paid off handsomely.

- Key takeaway: This showcases the importance of contrarian investing, crisis investing, identifying undervalued assets, and effective risk management.

This investment highlights Buffett’s ability to navigate market volatility and profit from others' fear.

Berkshire Hathaway: The Power of Conglomerate Ownership

Buffett's transformation of Berkshire Hathaway from a struggling textile company into a diversified conglomerate is a testament to his masterful acquisition strategies.

- Strategic Acquisitions: Buffett strategically acquired numerous undervalued companies across various sectors, creating a diversified portfolio with synergistic opportunities.

- Synergies and Efficiency: By combining these companies under the Berkshire Hathaway umbrella, he fostered operational efficiencies and cross-selling opportunities.

- Portfolio Diversification: This approach significantly reduced overall portfolio risk and enhanced long-term growth potential.

- Value Creation: This strategy demonstrates the power of conglomerate ownership, acquisitions, and synergy in building a highly profitable and resilient business empire.

This demonstrates the significant benefits of focusing on acquisitions, synergy, and portfolio diversification within a conglomerate structure.

Warren Buffett's Notable Investing Misses: Learning from Mistakes

Even the Oracle of Omaha has made investment mistakes. Examining these failures provides invaluable lessons for aspiring investors.

The Dexter Shoe Company Acquisition: A Case Study in Overpayment

The acquisition of Dexter Shoe Company in the late 1980s stands as a notable misstep in Buffett's career.

- Overpayment: Berkshire Hathaway paid a premium price for Dexter Shoe, a decision later attributed to inadequate due diligence and perhaps emotional decision-making.

- Lack of Synergy: Dexter Shoe failed to integrate effectively with Berkshire Hathaway's existing portfolio, diminishing the potential for synergy.

- Subsequent Sale: The investment ultimately resulted in a loss, underscoring the importance of thorough due diligence and avoiding overpayment in any investment.

- Key Takeaway: This highlights the critical importance of rigorous due diligence, accurate business valuation, and avoiding emotional decision-making in the investment process.

Early Investments in Airlines: A Lesson in Industry Volatility

Buffett's investments in airline companies illustrate the importance of understanding industry dynamics and market volatility.

- Industry Volatility: The airline industry is notoriously volatile, susceptible to economic downturns, fuel price fluctuations, and intense competition.

- Later Divestment: After significant losses, Buffett eventually divested from his airline holdings, recognizing the inherent risks of the sector.

- Key Takeaway: This highlights the importance of industry analysis, sector diversification, and a thorough risk assessment before investing in any sector. Understanding market volatility is crucial for long-term success.

Energy Sector Investments: A Missed Opportunity?

Buffett's approach to the energy sector has been a mixed bag, raising questions about market timing and long-term trend prediction.

- Cautious Approach: While Berkshire Hathaway has some energy investments, it hasn’t embraced the sector as aggressively as some other investors.

- Missed Opportunities?: Some argue that Buffett may have missed opportunities in renewable energy, particularly in the early stages of its growth.

- Key Takeaway: This underscores the challenges in predicting long-term trends within the energy sector, the importance of commodity investing knowledge, and the need for a well-defined investment strategy.

Key Takeaways from Warren Buffett's Investing Strategy

Warren Buffett's success isn't magic; it's a result of a disciplined and consistent approach. The core principles of his Warren Buffett investing strategy include:

- Long-Term Value Investing: Focus on companies with strong fundamentals and hold them for the long term.

- Fundamental Analysis: Thoroughly research a company's financial statements and business model before investing.

- Understanding Management: Invest in companies with competent and ethical management teams.

- Patience: Avoid short-term trading and focus on long-term growth.

- Risk Management: Diversify your portfolio and understand the risks associated with each investment. Risk mitigation is key.

Conclusion

Warren Buffett's investing journey demonstrates that a successful Warren Buffett investing strategy is built on a foundation of thorough research, long-term vision, and effective risk management. His successes and failures offer invaluable lessons for investors of all levels. By understanding his core principles—fundamental analysis, value investing principles, and adopting a long-term perspective—and learning from both his triumphs and setbacks, you can significantly improve your chances of achieving long-term investment success. Start applying these lessons to your own portfolio today, and further your research into Warren Buffett's investment philosophy and the principles of value investing. Remember, mastering a Warren Buffett investing strategy requires dedication, patience, and continuous learning.

Featured Posts

-

V Mware Costs To Skyrocket At And T Reports 1 050 Price Hike From Broadcom

May 06, 2025

V Mware Costs To Skyrocket At And T Reports 1 050 Price Hike From Broadcom

May 06, 2025 -

Understanding Trumps Meeting Style How To Win And Avoid Losing

May 06, 2025

Understanding Trumps Meeting Style How To Win And Avoid Losing

May 06, 2025 -

Is The Gigabyte Aorus Master 16 Worth It A Thorough Review

May 06, 2025

Is The Gigabyte Aorus Master 16 Worth It A Thorough Review

May 06, 2025 -

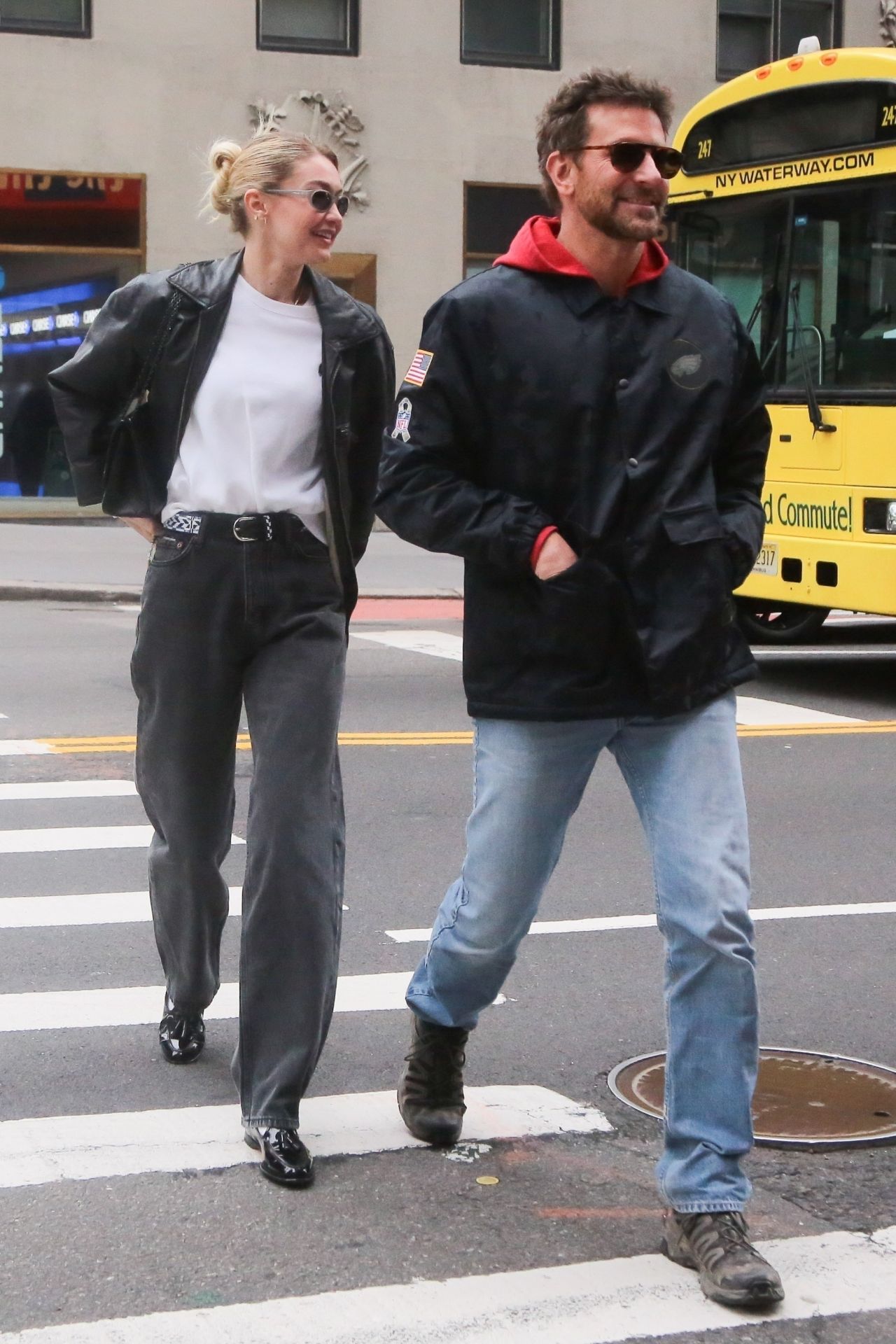

Gigi Hadids 30th Birthday Instagram Post Confirms Relationship With Bradley Cooper

May 06, 2025

Gigi Hadids 30th Birthday Instagram Post Confirms Relationship With Bradley Cooper

May 06, 2025 -

Aorus Master 16 Gigabyte Review High End Specs High End Noise

May 06, 2025

Aorus Master 16 Gigabyte Review High End Specs High End Noise

May 06, 2025

Latest Posts

-

Arnold Schwarzenegger Es A Bueszke Apa Fianak Sikerei

May 06, 2025

Arnold Schwarzenegger Es A Bueszke Apa Fianak Sikerei

May 06, 2025 -

Razdelis Li Patrik Shvartsenegger I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025

Razdelis Li Patrik Shvartsenegger I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025 -

Patrick Schwarzeneggers Unseen Superman Audition

May 06, 2025

Patrick Schwarzeneggers Unseen Superman Audition

May 06, 2025 -

The Superman Race Patrick Schwarzeneggers Near Miss

May 06, 2025

The Superman Race Patrick Schwarzeneggers Near Miss

May 06, 2025 -

Patrick Schwarzenegger Reflects On Failed Superman Audition

May 06, 2025

Patrick Schwarzenegger Reflects On Failed Superman Audition

May 06, 2025