Warren Buffett's Apple Sale: Timing, Strategy, And Future Implications

Table of Contents

The recent reduction of Berkshire Hathaway's Apple holdings has sent shockwaves through the investment world. Warren Buffett, renowned for his long-term investment strategy and unwavering faith in Apple, trimming his position raises crucial questions about the timing, underlying strategy, and potential future implications for both Berkshire Hathaway and Apple. This article delves into the details, analyzing the potential reasons behind this significant move and its broader market significance.

The Timing of the Apple Sale

Market Conditions

Recent market trends have significantly impacted tech stocks and the overall economy, potentially influencing Buffett's decision. Rising interest rates, aimed at curbing inflation, have negatively affected the valuations of growth stocks like Apple. The potential for a slowdown in consumer spending, coupled with geopolitical uncertainties creating market volatility, adds another layer of complexity.

- Rising interest rates impacting valuations of growth stocks: Higher interest rates increase borrowing costs for companies, reducing their attractiveness to investors.

- Potential slowdown in consumer spending affecting Apple's sales: Economic uncertainty can lead consumers to delay purchases of non-essential items like iPhones and other Apple products.

- Geopolitical uncertainties creating market volatility: Global events, such as the war in Ukraine and rising tensions between major world powers, create unpredictable market conditions. These factors contribute to increased risk aversion among investors.

Berkshire Hathaway's Portfolio Rebalancing

The sale might also reflect Berkshire Hathaway's broader portfolio rebalancing strategy. Buffett, known for his pragmatic approach, might be shifting investments towards sectors deemed less susceptible to current economic headwinds.

- Increased investment in energy sector: Berkshire Hathaway has significantly increased its investments in the energy sector recently, suggesting a shift towards more stable, less volatile sectors.

- Strategic allocation of funds to less volatile sectors: This strategy aims to mitigate risk and protect against potential market downturns.

- Rebalancing portfolio to mitigate risk: Diversification is a cornerstone of Buffett's investment philosophy, and this sale may reflect a conscious effort to rebalance his portfolio and reduce exposure to a single, albeit historically strong, stock.

Buffett's Investment Strategy and the Apple Sale

Value Investing Principles

The Apple sale needs to be analyzed within the context of Buffett's core value investing philosophy. While seemingly counterintuitive given his long-held position, the sale doesn't necessarily contradict his approach.

- Assessment of Apple's current intrinsic value: Buffett may have reassessed Apple's intrinsic value, determining that the current market price doesn't adequately reflect its long-term potential.

- Potential overvaluation of Apple stock in the current market: The sale could indicate a belief that Apple's stock is currently overvalued, offering an opportunity to take profits.

- Taking profits on a significantly appreciated investment: This is a sound strategy, even for a long-term investor, to secure substantial gains.

Potential for Future Apple Investment

While Berkshire Hathaway has reduced its holdings, the possibility of future investment remains. Market corrections or a renewed assessment of Apple's growth trajectory could prompt a repurchase.

- Market corrections creating buying opportunities: A significant market downturn might present an opportunity for Buffett to reinvest in Apple at a lower price.

- Apple's future innovation and growth potential: Apple's continued innovation and the potential for growth in new markets remain attractive for long-term investors.

- Changes in macroeconomic conditions: Favorable changes in macroeconomic factors could lead to a reassessment of Apple's value and potential for future investment.

Future Implications of the Apple Sale

Impact on Apple's Stock Price

The Apple sale has had, and will continue to have, a significant impact on Apple's stock price. The initial reaction was likely negative, but the long-term impact depends on various factors, including Apple's future performance.

- Initial negative market reaction: The news of a reduction in Berkshire Hathaway's holdings likely caused a temporary dip in Apple's stock price.

- Long-term impact on investor confidence in Apple: While the sale may raise concerns among some investors, Apple's fundamentals remain strong.

- Potential recovery based on company performance: Apple's future performance and the overall market environment will ultimately determine the long-term impact on its stock price.

Implications for Berkshire Hathaway's Overall Performance

The sale's influence on Berkshire Hathaway's overall performance is complex. While it might slightly impact short-term earnings, the long-term implications relate more to diversification and risk management.

- Short-term effect on Berkshire Hathaway's earnings: The sale resulted in a decrease in Berkshire Hathaway's assets, affecting short-term financial statements.

- Long-term implications for diversification and risk management: The shift in portfolio allocation towards less volatile sectors aims to reduce overall risk.

- Overall impact on shareholder value: The ultimate impact on shareholder value will depend on the success of Berkshire Hathaway's overall investment strategy.

Conclusion

This analysis of Warren Buffett's Apple sale highlights the complexities of investment decisions in a dynamic market. The timing, influenced by macroeconomic factors and portfolio rebalancing, signifies a strategic shift rather than a rejection of Apple's long-term prospects. While the sale had immediate market implications, the long-term impact remains to be seen.

Call to Action: Understanding the nuances of Warren Buffett's investment decisions is crucial for investors seeking to navigate the complexities of the stock market. Continue learning about successful investment strategies by following the latest updates on Warren Buffett's portfolio moves and market analyses. Stay informed about future developments in the Apple stock and Berkshire Hathaway's investment strategies. Learn from the master of value investing and refine your own approach to the Apple stock and other investments.

Featured Posts

-

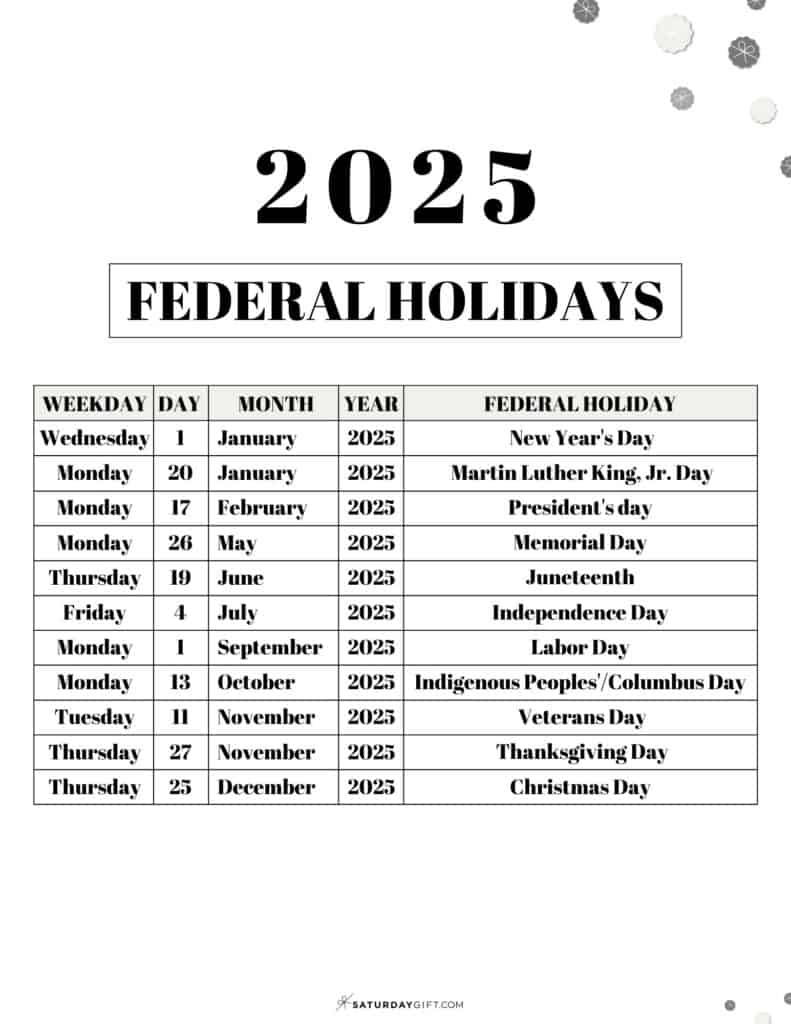

Us Holiday Calendar 2025 Federal And Non Federal Holidays

Apr 23, 2025

Us Holiday Calendar 2025 Federal And Non Federal Holidays

Apr 23, 2025 -

Ontarios Plan To Ease Internal Trade Removing Barriers To Alcohol And Labour Mobility

Apr 23, 2025

Ontarios Plan To Ease Internal Trade Removing Barriers To Alcohol And Labour Mobility

Apr 23, 2025 -

Mlb Player Props Today Steeltown Vs Jazz Best Bets And Analysis

Apr 23, 2025

Mlb Player Props Today Steeltown Vs Jazz Best Bets And Analysis

Apr 23, 2025 -

Pazartesi Dizileri 7 Nisan Tv Programi

Apr 23, 2025

Pazartesi Dizileri 7 Nisan Tv Programi

Apr 23, 2025 -

Nintendos Action Ryujinx Switch Emulator Development Ceases

Apr 23, 2025

Nintendos Action Ryujinx Switch Emulator Development Ceases

Apr 23, 2025