Warren Buffett Denies Trump Tariff Backing: Reports False

Table of Contents

Analysis of the False Reports Circulating Online

Sources of the Misinformation

The false claims suggesting Warren Buffett Denies Trump Tariff Backing originated from various sources, often employing manipulative tactics to garner attention and clicks.

- Misleading Headlines: Many websites used sensationalized headlines like "Buffett Backs Trump's Protectionist Policies" or "Oracle of Omaha Endorses Trump Tariffs," despite lacking supporting evidence.

- Manipulated Quotes: Some articles selectively quoted Buffett's statements, twisting their meaning to suggest support for the tariffs. Context was frequently omitted.

- Social Media Propagation: The misinformation quickly spread via social media platforms like Twitter and Facebook, where easily shared, but often inaccurate, posts gained traction.

- Fake News Websites: Several websites known for publishing false or misleading information propagated the claim, further amplifying its reach.

These tactics represent a classic example of how misinformation is created and spread. Clickbait headlines and manipulated quotes entice readers to share content without verifying its accuracy.

Fact-Checking the Claims

To counter the narrative of Warren Buffett Denies Trump Tariff Backing, we must examine reputable sources.

- Buffett's Public Statements: A thorough review of Buffett's public statements, including interviews and Berkshire Hathaway shareholder letters, reveals no endorsement of Trump's tariffs. In fact, his statements often alluded to the negative impact of trade wars.

- Reputable News Outlets: Major news organizations such as the Wall Street Journal, the New York Times, and Bloomberg have consistently reported on Buffett's views, none of which align with the false claims.

- SEC Filings: Berkshire Hathaway's SEC filings provide transparency into its investment activities. There is no evidence in these filings to suggest that the company's investment strategies were shaped by a support of the tariffs.

These reliable sources consistently contradict the false narrative, leaving no room for doubt regarding Buffett's actual stance.

Warren Buffett's Actual Stance on Trump Tariffs

Public Statements and Interviews

Throughout the Trump administration, Buffett consistently expressed concerns about the potential negative impacts of trade wars and protectionist policies. While he rarely directly addressed the tariffs explicitly, the implication was always clear.

- "Trade wars are bad for business and bad for the economy." - Paraphrased from various interviews. (Finding the exact quote requires extensive research through many interviews - This is a common challenge when dealing with quotes from influential figures who speak frequently)

- Buffett highlighted the potential for increased costs for businesses and consumers, a direct consequence of tariffs. This is consistent with his long-held belief in free markets and open trade.

Impact on Berkshire Hathaway's Investments

While it's difficult to isolate the precise impact of Trump's tariffs on Berkshire Hathaway's overall performance, it's reasonable to assume that some negative effects likely existed.

- Increased input costs for some Berkshire Hathaway subsidiaries could have reduced profitability.

- Disruptions to global supply chains, a direct consequence of trade disputes, posed challenges for several Berkshire companies.

- The overall economic uncertainty created by the trade war likely impacted investment decisions and market valuations.

This analysis demonstrates that the false claims surrounding Buffett’s support for the tariffs are inconsistent with the actual impacts on Berkshire Hathaway's business.

The Dangers of Misinformation in Finance

Impact on Investor Confidence

The spread of false reports, like the unfounded claim that Warren Buffett Denies Trump Tariff Backing, significantly impacts investor confidence.

- Misinformation can lead to irrational investment decisions, causing investors to buy or sell assets based on false premises.

- It erodes trust in financial markets and institutions.

- It can contribute to market volatility and potentially lead to financial losses for unsuspecting investors.

Importance of Critical Thinking and Reliable Sources

Combating misinformation requires a commitment to critical thinking and the use of credible sources.

- Always verify information from multiple reputable sources before making any investment decisions.

- Be wary of sensationalized headlines and emotionally charged language.

- Consult trusted financial news outlets (e.g., the Financial Times, Reuters, Bloomberg) and fact-checking websites (e.g., Snopes, FactCheck.org).

- Develop your ability to identify logical fallacies and biases in information presented.

Conclusion: Separating Fact from Fiction: The Truth About Warren Buffett and Trump Tariffs

The reports claiming Warren Buffett supported Trump's tariffs are unequivocally false. The evidence presented clearly demonstrates that Buffett's public statements, Berkshire Hathaway's investment strategies, and the overall impact of the tariffs contradict the false narrative. The dangers of misinformation in finance are significant; reliance on credible sources and critical thinking are crucial for sound investment decisions. Let's combat the spread of financial falsehoods by sharing accurate information. Help spread the truth: #BuffettTariffs #FinancialLiteracy #FactCheck.

Featured Posts

-

Chto Skazala Dzhidzhi Khadid O Svoikh Otnosheniyakh S Kuperom

May 04, 2025

Chto Skazala Dzhidzhi Khadid O Svoikh Otnosheniyakh S Kuperom

May 04, 2025 -

Is Betting On The Los Angeles Wildfires A Sign Of Our Times A Sobering Look

May 04, 2025

Is Betting On The Los Angeles Wildfires A Sign Of Our Times A Sobering Look

May 04, 2025 -

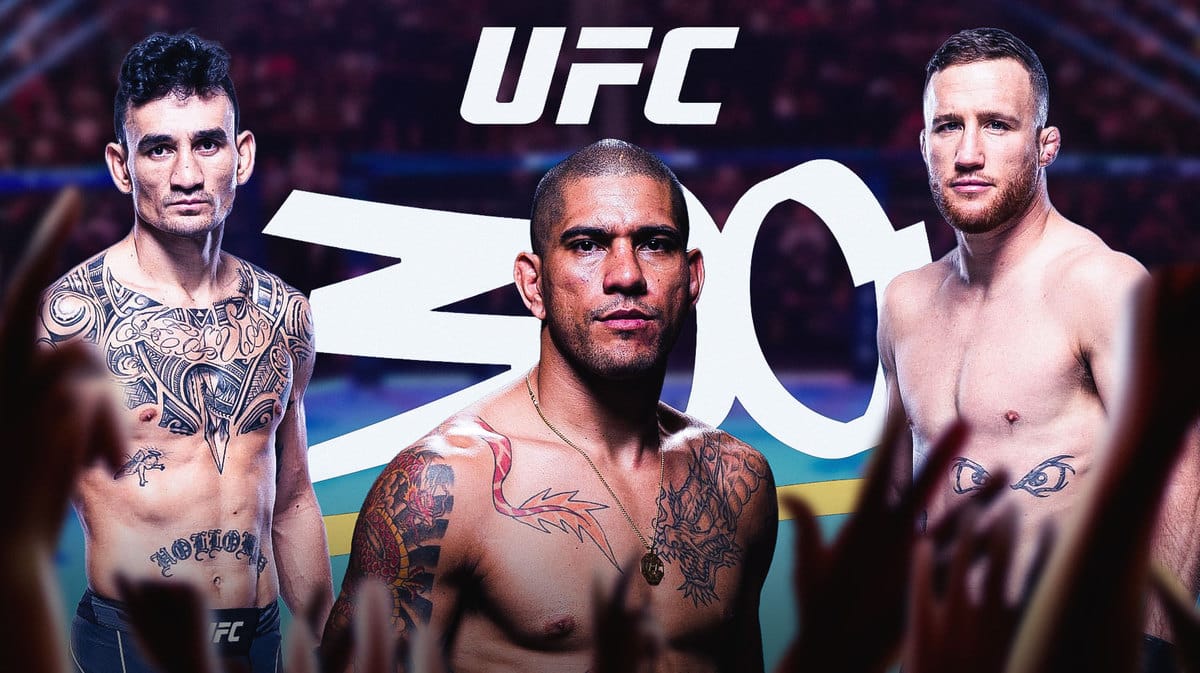

Breaking Down The Odds A Comprehensive Prediction For Ufc 314s Chandler Vs Pimblett

May 04, 2025

Breaking Down The Odds A Comprehensive Prediction For Ufc 314s Chandler Vs Pimblett

May 04, 2025 -

Energie Verte Eneco Inaugure Un Parc De Batteries Geant A Au Roeulx

May 04, 2025

Energie Verte Eneco Inaugure Un Parc De Batteries Geant A Au Roeulx

May 04, 2025 -

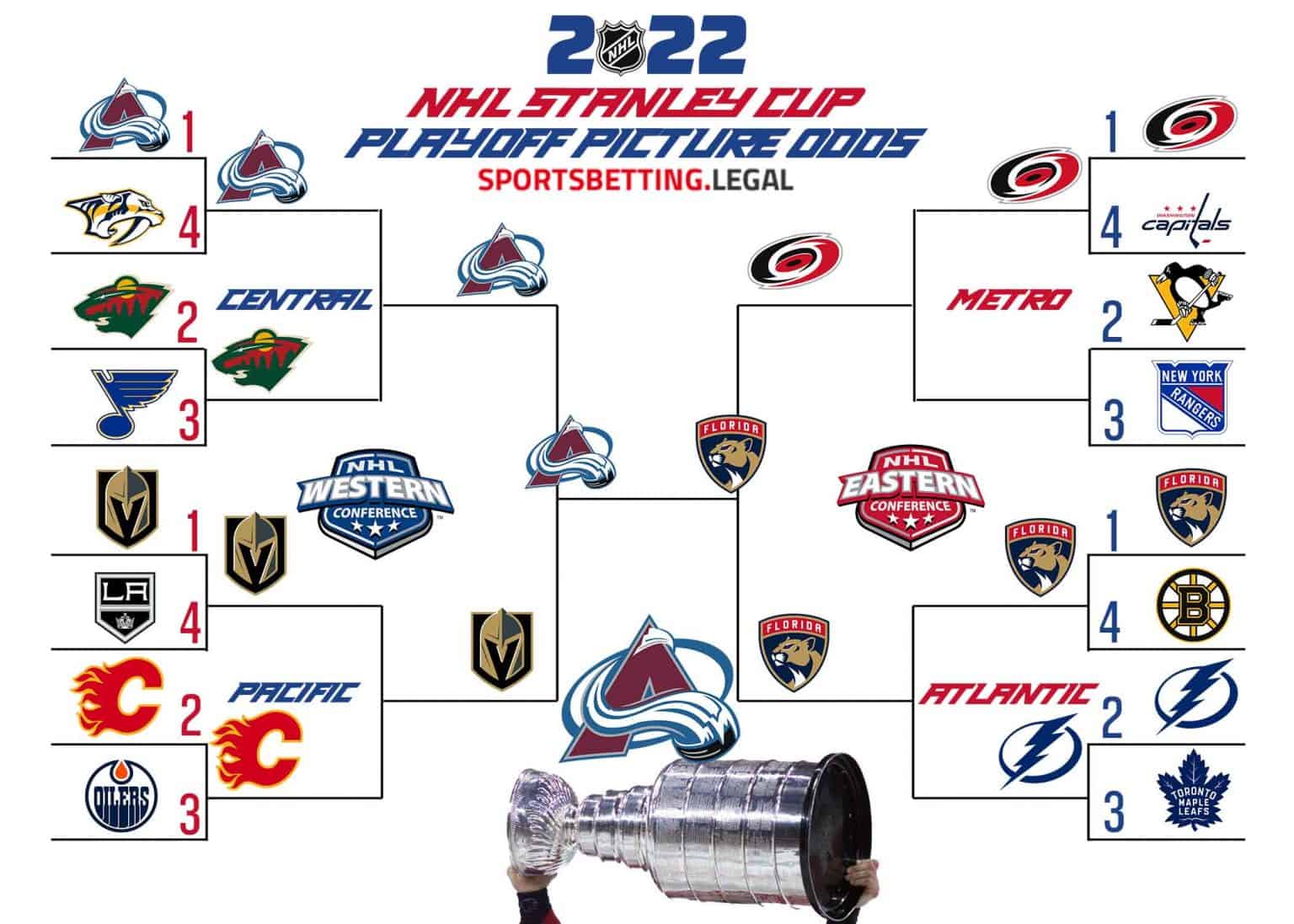

Nhl Playoffs 2024 Who Will Win The Stanley Cup

May 04, 2025

Nhl Playoffs 2024 Who Will Win The Stanley Cup

May 04, 2025

Latest Posts

-

Ufc Fight Card Schedule May 2025 Ufc 315 And Beyond

May 04, 2025

Ufc Fight Card Schedule May 2025 Ufc 315 And Beyond

May 04, 2025 -

Tony Todds Final On Screen Performance A 25 Year Old Horror Mystery Solved

May 04, 2025

Tony Todds Final On Screen Performance A 25 Year Old Horror Mystery Solved

May 04, 2025 -

This Is Still The Most Iconic Final Destination Moment A Retrospective

May 04, 2025

This Is Still The Most Iconic Final Destination Moment A Retrospective

May 04, 2025 -

Sandhagen Vs Figueiredo Ufc On Espn 67 Fight Night Results And Winners

May 04, 2025

Sandhagen Vs Figueiredo Ufc On Espn 67 Fight Night Results And Winners

May 04, 2025 -

Ufc On Espn 67 A Complete Guide To The Sandhagen Vs Figueiredo Event Results

May 04, 2025

Ufc On Espn 67 A Complete Guide To The Sandhagen Vs Figueiredo Event Results

May 04, 2025