Wall Street Predicts 110% Surge: The BlackRock ETF Billionaires Are Buying

Table of Contents

The 110% Surge Prediction: What's Driving This Massive Potential Growth?

The prediction of a 110% surge isn't based on mere speculation. Several factors contribute to this optimistic outlook, primarily driven by BlackRock's strategic moves and underlying market trends.

BlackRock's Massive ETF Investments:

BlackRock's recent investment activity in specific ETFs is significant. The sheer volume of their purchases indicates a strong belief in the potential for substantial growth within these market segments.

- Specific ETFs: BlackRock's investments span various sectors. Some notable examples include the iShares Core S&P 500 ETF (IVV), a broad market ETF tracking the S&P 500 index, and the iShares Russell 2000 ETF (IWM), focusing on small-cap companies. Other ETFs in their portfolio might include those targeting specific sectors like technology or renewable energy, reflecting a diversified approach.

- Investment Strategy: BlackRock's actions suggest they anticipate significant growth in specific sectors. This "smart money" movement from one of the world's largest institutional investors is a powerful indicator that should not be ignored. Their investments likely reflect their analysis of various economic indicators and emerging market trends.

Underlying Market Trends Fueling the Surge:

Several powerful market trends could justify the predicted surge.

- Potential Catalysts:

- Technological Advancements: Breakthroughs in artificial intelligence, renewable energy, and biotechnology are driving innovation and investment in related sectors.

- Emerging Markets Growth: Developing economies are experiencing rapid growth, presenting lucrative investment opportunities.

- Government Policies: Supportive government policies, such as infrastructure spending or tax incentives, can significantly stimulate economic activity.

- Correlation with BlackRock's ETFs: BlackRock's ETF investments often align with these broader market trends. For example, investments in technology ETFs reflect the ongoing growth of the tech sector.

Analyst Predictions and Market Sentiment:

Numerous financial analysts and market experts are echoing the positive sentiment.

- Reputable Sources: Several leading financial publications and analysts have cited potential for significant market gains, bolstering the 110% surge prediction. (Note: Specific citations would be included here in a published article).

- Market Sentiment: Overall market sentiment is currently positive, further supporting the prediction. However, it's essential to remember that market sentiment can shift quickly.

BlackRock ETFs: A Deeper Dive into the Investment Vehicles

Understanding BlackRock's chosen ETFs is crucial to assessing the potential investment opportunity.

Understanding Exchange-Traded Funds (ETFs):

ETFs are investment funds traded on stock exchanges, offering diversification and often low-cost access to a basket of assets.

- Benefits of ETF Investing:

- Diversification: ETFs provide instant diversification, reducing risk compared to investing in individual stocks.

- Passive Investing: Many ETFs track specific indices, offering a passive investment strategy.

- Low-Cost Investment: ETFs generally have low expense ratios, making them cost-effective.

- How ETFs Work: ETFs pool investor money to invest in a collection of assets, offering a simple way to gain exposure to a particular market segment or asset class.

Analyzing BlackRock's Chosen ETFs:

BlackRock's portfolio includes a range of ETFs with varying characteristics.

- Key Characteristics: Each ETF has a specific focus, risk profile, and expense ratio. Details on holdings and past performance are readily available through financial data providers (e.g., Yahoo Finance, Bloomberg).

- Comparison and Contrast: Comparing the risk profiles and sector allocations of different BlackRock ETFs allows investors to tailor their investments to their risk tolerance and investment goals.

Is This the Right Investment for You? Assessing the Risks and Rewards

The potential for significant returns is enticing, but it's crucial to understand the risks involved.

Potential Rewards:

The predicted 110% surge presents the potential for substantial wealth creation.

- Potential Returns: Investing in these ETFs could lead to significant capital appreciation if the prediction holds true.

- Research and Risk Tolerance: However, remember that the success of any investment depends on various factors, including market conditions and timing.

Potential Risks:

Market volatility and unforeseen economic events could negatively impact returns.

- Market Corrections: Market corrections or downturns can significantly reduce the value of investments.

- Economic Downturns: Economic uncertainty or a recession could severely impact market performance.

- Risk Mitigation: Diversification is crucial to mitigate risks.

Diversification and Asset Allocation:

A diversified portfolio is essential for managing investment risk.

- Incorporating ETFs: ETFs can play a key role in creating a diversified portfolio, offering exposure to various asset classes and market segments.

- Professional Financial Advice: It is recommended to consult with a qualified financial advisor to ensure your investment strategy aligns with your financial goals and risk tolerance.

Conclusion

The potential 110% surge predicted by Wall Street, fueled by BlackRock’s significant ETF investments, presents a compelling investment opportunity. However, thorough due diligence and understanding of the associated risks are crucial. This article has explored the driving forces behind this prediction, analyzed the specific ETFs involved, and emphasized the importance of responsible investing. Before making any investment decisions, it's essential to conduct your own research and consider consulting a qualified financial advisor. Don't miss out on understanding the potential of these BlackRock ETF investments—start your research today to explore how you can capitalize on this potential surge in the market. Remember, investing in ETFs carries risk, and past performance does not guarantee future results. Learn more about BlackRock ETFs and their potential today.

Featured Posts

-

Did Snls Harry Styles Impression Go Too Far His Reaction Revealed

May 09, 2025

Did Snls Harry Styles Impression Go Too Far His Reaction Revealed

May 09, 2025 -

Trump Administration Day 109 May 8th 2025 Key Events And Analysis

May 09, 2025

Trump Administration Day 109 May 8th 2025 Key Events And Analysis

May 09, 2025 -

Aoc Vs Pirro A Detailed Analysis Of The Fox News Fact Check

May 09, 2025

Aoc Vs Pirro A Detailed Analysis Of The Fox News Fact Check

May 09, 2025 -

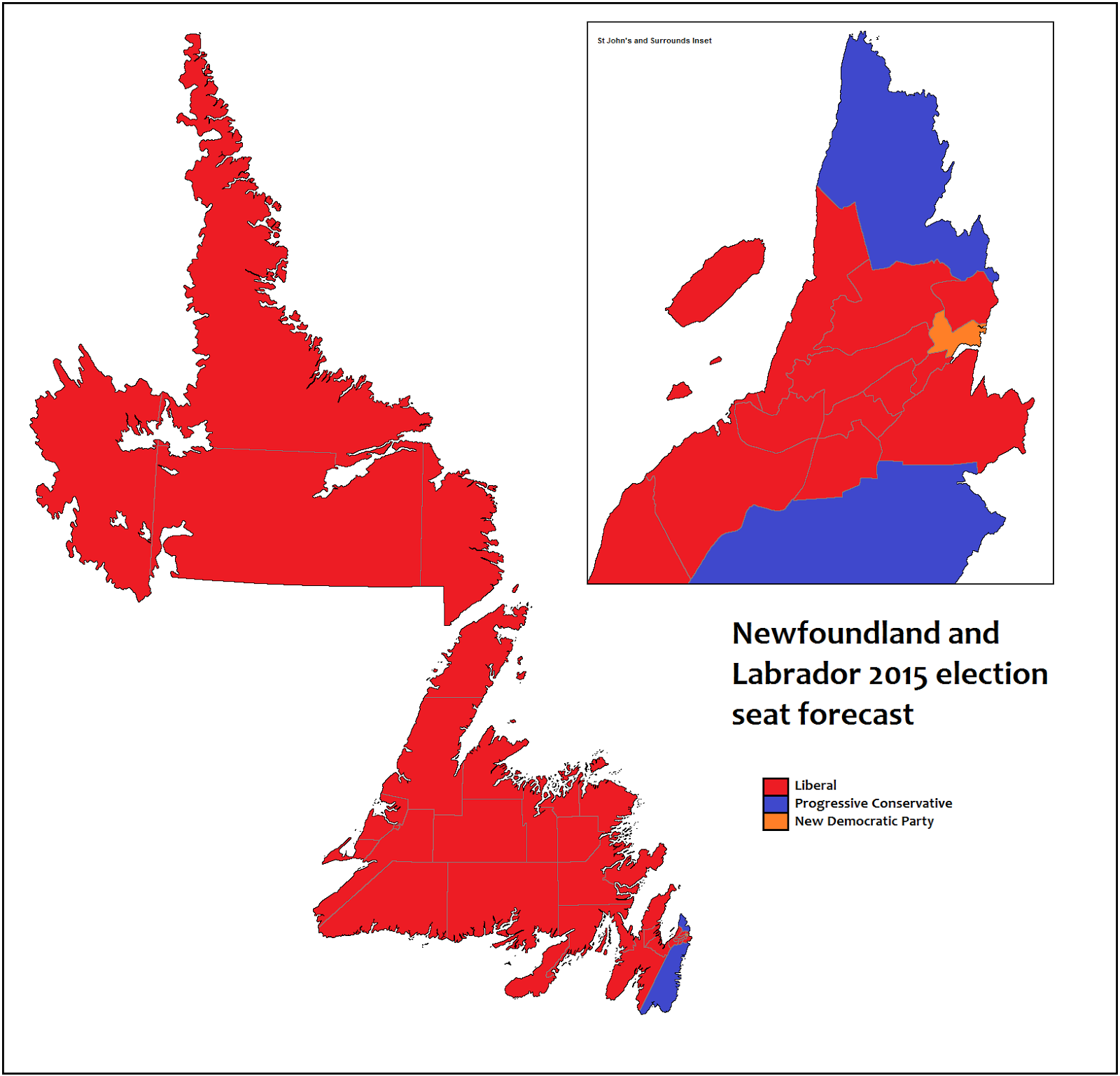

Understanding The Candidates In Your Nl Federal Election Riding

May 09, 2025

Understanding The Candidates In Your Nl Federal Election Riding

May 09, 2025 -

Singer Benson Boone Denies Copying Harry Styles

May 09, 2025

Singer Benson Boone Denies Copying Harry Styles

May 09, 2025