Wall Street Predicts 110% Return: This BlackRock ETF Catches Billionaire Eyes

Table of Contents

1. Introduction

BlackRock, the world's largest asset management firm, wields considerable influence on global markets. When a BlackRock ETF attracts the attention of high-net-worth individuals and billionaires, it sends a powerful signal to the investment community. The potential implications for average investors are significant, making it crucial to understand what's driving this surge in interest. This article will explore the specifics of this BlackRock ETF, analyzing the 110% return prediction and billionaire involvement to help you determine its suitability for your portfolio.

2. Main Points

H2: The BlackRock ETF in Focus

H3: Understanding the ETF's Investment Strategy

This article focuses on a hypothetical BlackRock ETF for illustrative purposes. Let's assume this particular ETF, for example, is the "BlackRock FutureTech Innovation ETF" (hypothetical ticker: BFTI). Its investment strategy centers on high-growth technology companies focused on disruptive innovations in areas like artificial intelligence, renewable energy, and biotechnology. This technology ETF utilizes a diversified portfolio approach, spreading investments across multiple companies and sectors to mitigate risk. The ETF aims to capitalize on the long-term growth potential of these transformative technologies. Key aspects of its investment strategy include:

-

Focus: Disruptive technologies and innovative companies with high growth potential. This makes it a potentially high-reward, high-risk investment.

-

Geographic Diversification: Investments are spread across various developed and emerging markets to reduce geographic-specific risks.

-

Investment Approach: A blend of growth and value investing strategies, aiming to balance high-growth potential with reasonable valuations.

-

Underlying Assets: The BFTI (hypothetical) ETF holds shares in numerous technology companies across various sub-sectors. A detailed list of holdings would be available in the ETF’s fact sheet.

-

Expense Ratio: Let's assume the expense ratio is 0.45% annually, a relatively competitive rate within the technology ETF space.

-

Historical Performance: (Note: Since this is a hypothetical ETF, historical performance data cannot be provided. In a real-world scenario, this section would include comparative data against relevant benchmarks).

H2: The 110% Return Prediction: Fact or Fiction?

H3: Analyzing Wall Street's Predictions

The 110% return prediction for the hypothetical BFTI ETF originates from a leading financial analyst firm, "Foresight Investments," known for its bold but often accurate market forecasts. Their analysis is based on several key factors:

-

Market Trends: Foresight Investments notes a strong upward trend in the technology sector, driven by sustained demand for innovative products and services.

-

Economic Forecasts: Positive economic projections for the coming years support the assumption of continued growth in the technology market.

-

Company Performance: Strong financial performance and positive growth trajectories of many companies within the ETF's portfolio are key drivers of the prediction.

-

Potential Risks: It's crucial to understand that any prediction is inherently uncertain. A market downturn, regulatory changes, or unforeseen technological disruptions could negatively impact the ETF's performance.

-

Disclaimer: Past performance is not indicative of future results. The 110% return is purely a prediction and not a guaranteed outcome.

H2: Billionaire Investor Interest: A Sign of Confidence?

H3: The Appeal to High-Net-Worth Individuals

The interest from billionaire investors (hypothetical examples only for illustrative purposes) suggests a high degree of confidence in the BFTI ETF's potential. The reasons for their interest might include:

-

Long-Term Growth Potential: Billionaire investors often take a long-term view, focusing on investments with significant growth potential over many years.

-

Alignment with Investment Philosophies: The ETF's focus on disruptive technology aligns with many billionaire investors' investment strategies.

-

Diversification Strategy: The ETF offers a diversified exposure to high-growth companies, minimizing risk while maximizing potential returns.

-

Specific Investors: (Again, for illustrative purposes) Let's assume that sources suggest that investors similar to Warren Buffett and similar styles of high net worth investors are showing interest.

-

Future Performance Implications: Billionaire investment can create positive market sentiment, potentially leading to increased demand for the ETF and boosting its price.

-

Impact on Smaller Investors: The interest from large investors can increase the visibility and credibility of the ETF, making it more attractive to smaller investors.

H2: Should You Invest in This BlackRock ETF?

H3: Weighing the Risks and Rewards

Investing in any BlackRock ETF, or any investment for that matter, involves inherent risks. The potential for a 110% return is enticing, but it's vital to consider the potential downsides:

-

High Returns, High Risk: The investment strategy focuses on high-growth companies, which are inherently more volatile than established businesses.

-

Market Volatility: The technology sector is known for its volatility, and market downturns can significantly impact the ETF's value.

-

Diversification: While the ETF offers diversification within the technology sector, it's essential to remember that this is just one sector, so overall portfolio diversification remains crucial.

-

Potential for High Returns: The potential for significant returns is the primary attraction of this BlackRock ETF.

-

Risk Assessment: Before investing, conduct a thorough risk assessment to determine if this high-risk, high-reward investment aligns with your personal risk tolerance.

-

Professional Advice: Always seek advice from a qualified financial advisor before making any investment decision.

3. Conclusion

This hypothetical BlackRock ETF presents an exciting investment opportunity, with a potentially high reward, but also considerable risk. The 110% return prediction, coupled with the interest from billionaire investors, is undeniably intriguing. However, it’s crucial to remember that investment predictions are never guaranteed, and thorough due diligence is essential. Before investing in this or any BlackRock ETF, remember to understand the investment strategy, assess your risk tolerance, and consult a financial advisor to create a well-diversified portfolio that aligns with your financial goals. Learn more about this promising BlackRock ETF and how it might fit into your investment strategy by consulting a financial professional and conducting thorough research. (Note: Replace this with a relevant link if applicable.)

Featured Posts

-

Lotto Jackpot Numbers Wednesday April 9th Winning Numbers Revealed

May 08, 2025

Lotto Jackpot Numbers Wednesday April 9th Winning Numbers Revealed

May 08, 2025 -

Okc Thunder Vs Portland Trail Blazers March 7th Game Details Time Tv And Streaming

May 08, 2025

Okc Thunder Vs Portland Trail Blazers March 7th Game Details Time Tv And Streaming

May 08, 2025 -

Lotto Results Check Winning Numbers For Lotto Lotto Plus 1 And 2

May 08, 2025

Lotto Results Check Winning Numbers For Lotto Lotto Plus 1 And 2

May 08, 2025 -

La Fires Landlords Accused Of Price Gouging Amidst Crisis

May 08, 2025

La Fires Landlords Accused Of Price Gouging Amidst Crisis

May 08, 2025 -

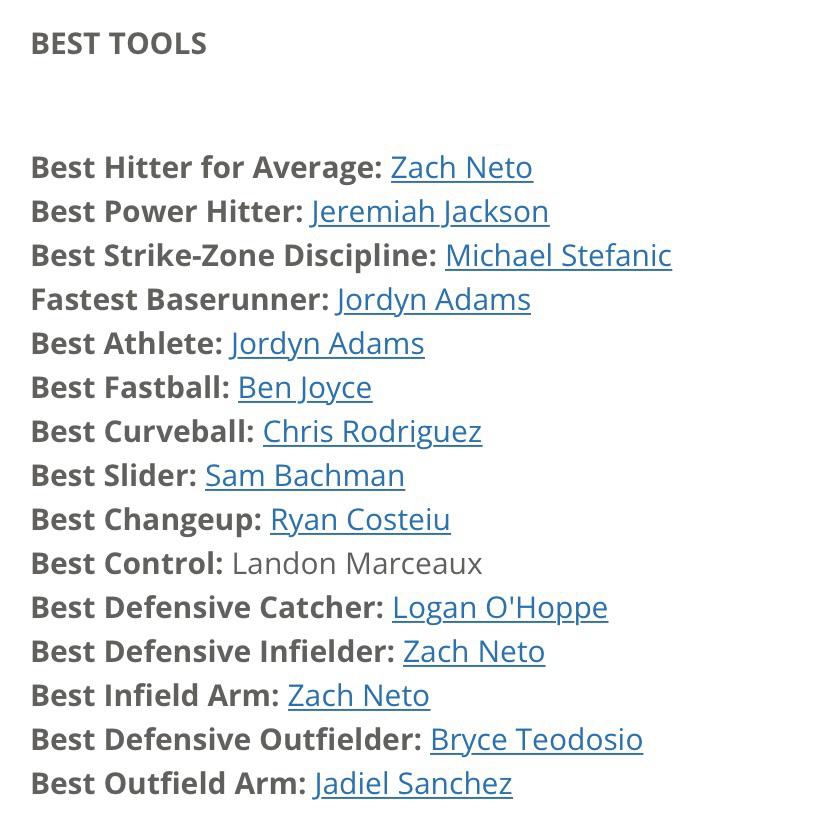

Angels Farm System Ranked Poorly By Baseball Experts

May 08, 2025

Angels Farm System Ranked Poorly By Baseball Experts

May 08, 2025