USD Rally: Trump's Retracted Fed Criticism Boosts Dollar

Table of Contents

Trump's Previous Fed Criticism and its Market Impact

President Trump's past pronouncements regarding the Federal Reserve's monetary policies have frequently created uncertainty and volatility in the US dollar and broader global markets. His criticisms, often voiced via Twitter and public statements, targeted the Fed's interest rate hikes and what he perceived as overly aggressive monetary tightening. This consistent criticism sowed seeds of doubt among investors concerning the independence and effectiveness of the central bank.

- Examples of Trump's past statements: Statements included accusations of the Fed raising rates too quickly, hindering economic growth, and claims that the Fed was working against his administration's economic agenda.

- Impact on currency markets: This created an environment of considerable uncertainty. Investors worried about the potential for political interference in monetary policy, leading to unpredictable shifts in the dollar's value.

- Evidence of dollar weakening: During periods of heightened Trump-Fed tension, the US dollar often experienced periods of relative weakness against other major currencies. This volatility made it challenging for businesses involved in international trade and investment to accurately plan for the future.

The Retraction and its Immediate Effect on the USD

The recent shift in Trump's stance, characterized by a noticeable softening or retraction of his criticism towards the Federal Reserve, triggered an almost immediate and dramatic response in the currency markets. While the exact phrasing and context may be debated, the market interpreted it as a significant reduction in the perceived threat of political interference in monetary policy.

- Timing and market reaction: The retraction, occurring during a period of relative market stability, amplified its impact. The immediate response was a sharp appreciation of the USD against other major currencies like the Euro and the Yen.

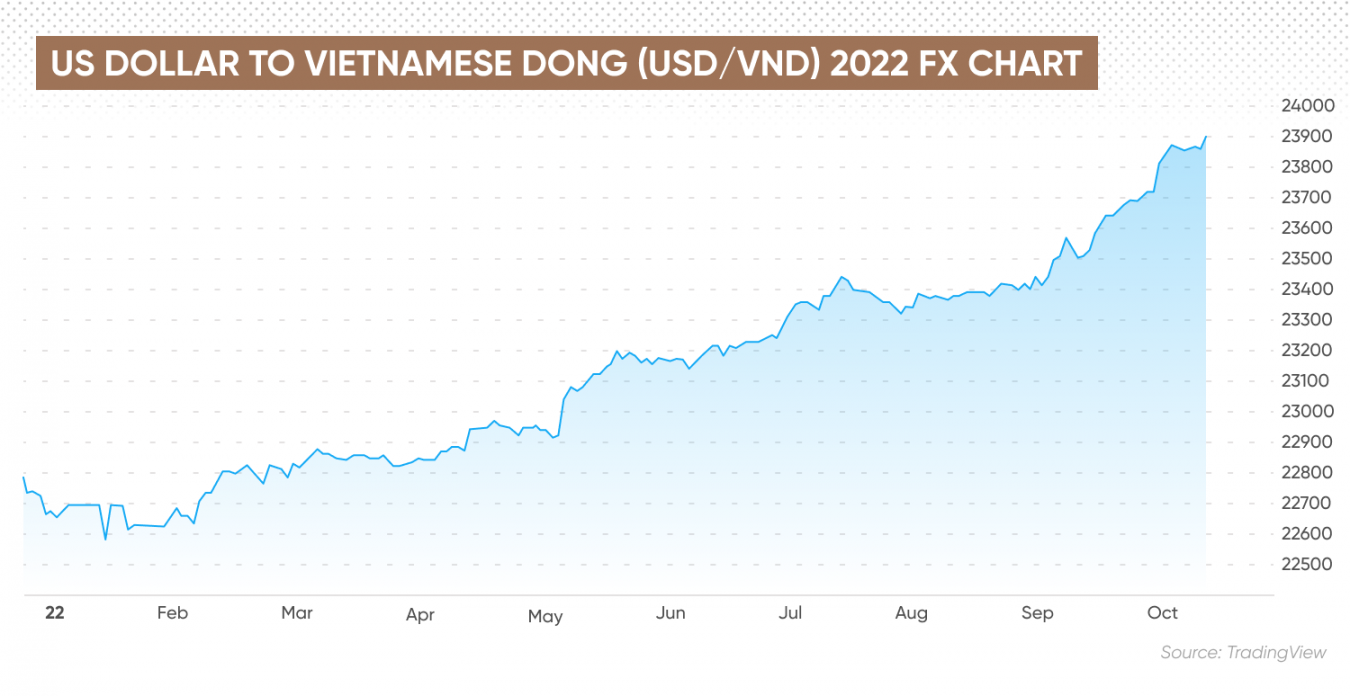

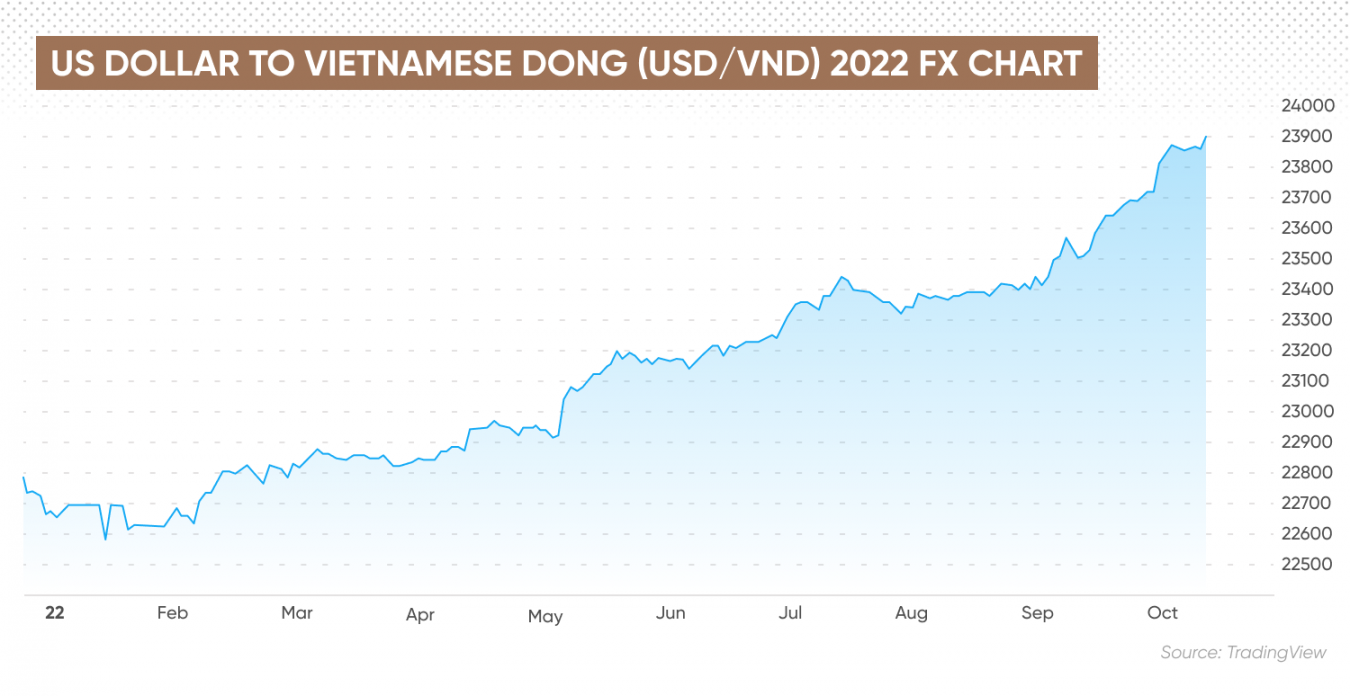

- Illustrative charts and graphs: (Note: To fully optimize this section, charts and graphs illustrating the USD surge immediately following the retraction would be included here. These visuals would clearly demonstrate the correlation between Trump's statement and the subsequent dollar strength).

- Analysis of market indicators: Trading volumes increased significantly, signaling heightened investor activity and a renewed confidence in the dollar's stability. Other market indicators, such as the VIX (volatility index), showed a decline, reflecting reduced market uncertainty.

Analyzing the Long-Term Implications for the USD Rally

While the immediate impact of Trump's altered stance on the Fed is undeniable, the sustainability of this USD rally remains a point of considerable discussion amongst financial experts. Whether this is a temporary reprieve or a sign of a sustained strengthening of the dollar is a matter of ongoing analysis.

- Factors contributing to continued strength: The strength of the US economy relative to other global economies, coupled with continued positive expectations for US interest rates, could help maintain the upward trend of the dollar. Global geopolitical uncertainty might also increase safe-haven demand for the US dollar.

- Potential risks and headwinds: Unexpected economic downturns, changes in global risk appetite, or a renewed escalation of tensions between the Trump administration and the Federal Reserve could easily reverse this current trend. Furthermore, other global economic factors remain in play and could negatively impact the dollar.

- Expert opinions and market forecasts: (Note: This section would benefit from inclusion of relevant quotes and forecasts from leading economists and financial analysts regarding the long-term prospects of the dollar.)

Alternative Factors Contributing to the USD Rally (Beyond Trump's Statement)

It's crucial to acknowledge that the recent USD rally is likely not solely attributable to Trump's softened stance on the Fed. Other contributing factors should be considered for a comprehensive understanding.

- Safe-haven demand: Increasing global geopolitical uncertainty often leads to a flight to safety, boosting demand for the US dollar as a relatively stable and liquid asset.

- US economic strength: The relative strength of the US economy compared to its global peers can also enhance the appeal of the USD.

- Investor sentiment and risk appetite: Shifting investor sentiment and risk appetite, factors independent of the Trump administration's pronouncements, also play a significant role in currency valuation.

Conclusion: Understanding the USD Rally and its Future

The recent USD rally has been undeniably influenced by President Trump's retraction of his criticism towards the Federal Reserve. This lessening of perceived political interference in monetary policy created a wave of renewed confidence, leading to a sharp increase in the dollar's value. However, it's vital to remember that this is not the sole factor contributing to the current USD strength. Global economic conditions, geopolitical uncertainties, and broader investor sentiment also play crucial roles. Understanding the interplay of these diverse factors is critical to accurately predicting the future direction of the US dollar. Stay tuned for further updates on the USD rally and its implications for global finance. Continue to monitor the USD's performance and stay informed about developments affecting the US dollar and global currency markets. Understanding the USD outlook requires a holistic approach to currency market analysis.

Featured Posts

-

How Middle Management Drives Company Performance And Employee Satisfaction

Apr 24, 2025

How Middle Management Drives Company Performance And Employee Satisfaction

Apr 24, 2025 -

White House Announces Drop In Illegal Border Crossings Between U S And Canada

Apr 24, 2025

White House Announces Drop In Illegal Border Crossings Between U S And Canada

Apr 24, 2025 -

Faa Investigates Las Vegas Airport Collision Risks

Apr 24, 2025

Faa Investigates Las Vegas Airport Collision Risks

Apr 24, 2025 -

Los Angeles Wildfires The Rise Of Disaster Betting And Its Implications

Apr 24, 2025

Los Angeles Wildfires The Rise Of Disaster Betting And Its Implications

Apr 24, 2025 -

New Legal Obstacles Slow Trump Administrations Immigration Crackdown

Apr 24, 2025

New Legal Obstacles Slow Trump Administrations Immigration Crackdown

Apr 24, 2025