US Treasury Sales Off The Table In Kato's Trade Negotiations

Table of Contents

Reasons Behind the Exclusion of US Treasury Sales

The omission of US Treasury sales from Kato's trade negotiations is a complex issue with several contributing factors. Understanding these reasons is crucial for assessing the broader implications of this decision.

-

Political Sensitivities Surrounding US Debt: The sheer size and scale of US national debt are a significant political concern both domestically and internationally. Including US Treasury sales in trade negotiations could be perceived as leveraging this debt, potentially harming diplomatic relations and creating unnecessary friction. The current political climate necessitates careful handling of such sensitive matters.

-

Focus on Other Trade Priorities: Kato's trade negotiations likely prioritize other pressing issues, such as tariff reductions, market access for specific goods, and intellectual property rights. The complexities of incorporating US Treasury sales into these discussions might divert attention and resources from these more immediate concerns. The negotiators may have strategically chosen to address these higher-priority issues first.

-

Concerns About Market Instability: The inclusion of US Treasury sales in trade negotiations could potentially destabilize financial markets. Any perceived linkage between trade negotiations and US debt could trigger volatility and uncertainty in the market, impacting investor confidence and global economic stability. This risk is significant and needs careful consideration.

-

Strategic Considerations by Negotiating Parties: The decision to exclude US Treasury sales may be a strategic move by one or both negotiating parties. This could involve leveraging other aspects of the trade deal to achieve a more favorable outcome overall. It's a calculated move that warrants deeper analysis of the specific negotiating dynamics.

Impact on US-Related Trade Deals

The exclusion of US Treasury sales significantly impacts broader US trade relations and the overall structure of future agreements.

-

Potential for Reduced US Influence in the Negotiations: By omitting a key financial instrument, the US potentially reduces its leverage in the negotiations. This could lead to less favorable terms in the final trade agreement.

-

Impact on Overall Trade Deal Terms: The absence of US Treasury sales as a bargaining chip could affect the negotiation of other aspects of the trade deal. This may result in compromises on other trade priorities.

-

Influence on Future US-Led Trade Agreements: This decision sets a precedent for future US-led trade agreements. The approach taken in these negotiations could influence how other countries perceive the US’s willingness to integrate financial instruments into future trade discussions. This could have long-term implications for bilateral trade agreements and multilateral trade agreements alike. The US trade policy needs to be reassessed in light of this development.

Alternative Investment Avenues for Investors

Investors seeking exposure to US assets now need to consider alternative avenues in light of the exclusion of US Treasury sales from the negotiations. Several options exist, each with its own set of risks and rewards.

-

Corporate Bonds: Investing in high-quality corporate bonds can offer a similar level of stability to US Treasuries, albeit with slightly higher risk. Thorough risk assessment is crucial before making any investment decision.

-

US Equities: Investing in US stocks provides exposure to the performance of US companies, offering the potential for higher returns but also greater risk. Portfolio diversification is highly recommended.

-

Real Estate Investment Trusts (REITs): REITs offer exposure to the US real estate market, providing diversification and potential for income generation. However, their performance can be highly sensitive to changes in interest rates.

-

Other Sovereign Debt: Investors might explore sovereign debt issued by other developed economies, offering potentially similar characteristics to US Treasuries, but with varying risk profiles.

The Role of Global Economic Conditions

The global economic outlook significantly influences both the trade negotiations and investor decisions. Factors such as inflation, interest rates, and economic uncertainty play a substantial role. High inflation rates and rising interest rates could impact the attractiveness of alternative investment options, while significant economic uncertainty makes it more challenging to predict the outcome of the trade negotiations and their influence on investment strategies.

Conclusion: The Future of US Treasury Sales in International Trade

The exclusion of US Treasury sales from Kato's trade negotiations marks a significant shift in how trade deals are structured and negotiated. This decision has implications for US trade relations, influencing the terms of existing and future agreements. Investors need to reassess their strategies, considering alternative investment avenues and carefully analyzing the risk-reward profile of each option. The future role of US Treasury sales in international trade remains uncertain, demanding close observation of global economic conditions and future trade negotiations. Stay informed on the latest developments in Kato's trade negotiations and the evolving role of US Treasury sales in global finance. Continue to monitor our site for updates on the impact of these decisions on your investment strategy.

Featured Posts

-

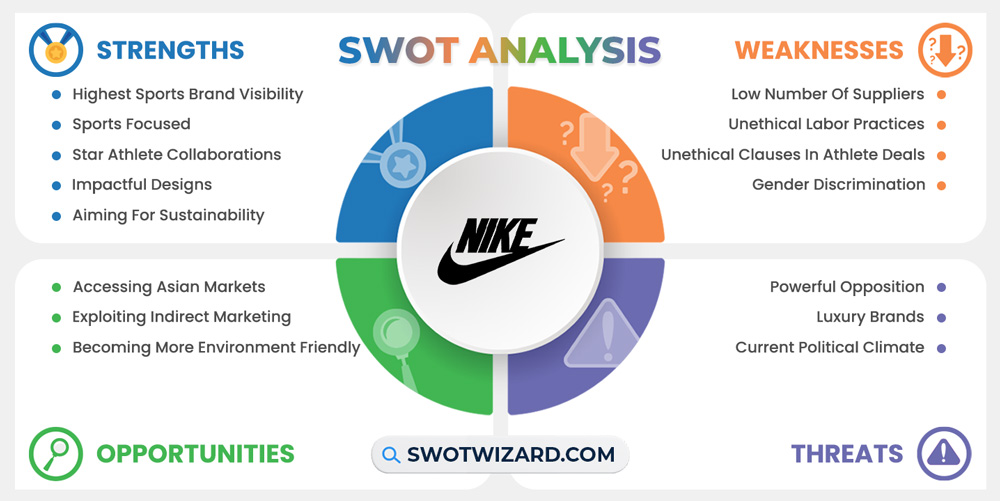

Nike Facing Five Year Revenue Low Analysis And Predictions

May 06, 2025

Nike Facing Five Year Revenue Low Analysis And Predictions

May 06, 2025 -

Celtics Vs Trail Blazers Game Time Tv Schedule And Streaming Options March 23rd

May 06, 2025

Celtics Vs Trail Blazers Game Time Tv Schedule And Streaming Options March 23rd

May 06, 2025 -

Ddg Unleashes Dont Take My Son Diss Track Full Lyrics And Analysis

May 06, 2025

Ddg Unleashes Dont Take My Son Diss Track Full Lyrics And Analysis

May 06, 2025 -

Where To Watch Celtics Vs Magic Game 5 On April 29th

May 06, 2025

Where To Watch Celtics Vs Magic Game 5 On April 29th

May 06, 2025 -

Schwarzenegger On Superman The Audition That Didnt Fly

May 06, 2025

Schwarzenegger On Superman The Audition That Didnt Fly

May 06, 2025

Latest Posts

-

Priyanka Chopras Early Career Her Mother Shares Insights On Industry Hardships

May 06, 2025

Priyanka Chopras Early Career Her Mother Shares Insights On Industry Hardships

May 06, 2025 -

When Is The Nike Hyperice Hyperboot Releasing A Look At Potential Launch Dates

May 06, 2025

When Is The Nike Hyperice Hyperboot Releasing A Look At Potential Launch Dates

May 06, 2025 -

Nikes New Fitness Line With Kim Kardashians Skims What To Expect

May 06, 2025

Nikes New Fitness Line With Kim Kardashians Skims What To Expect

May 06, 2025 -

Priyanka Chopras Mother Reveals Industry Challenges Faced By The Actress

May 06, 2025

Priyanka Chopras Mother Reveals Industry Challenges Faced By The Actress

May 06, 2025 -

The Future Of Fitness Nike And Skims Partner On New Brand

May 06, 2025

The Future Of Fitness Nike And Skims Partner On New Brand

May 06, 2025