US Stock Futures Jump After Trump Reassures On Powell

Table of Contents

Trump's Statements and Their Market Impact

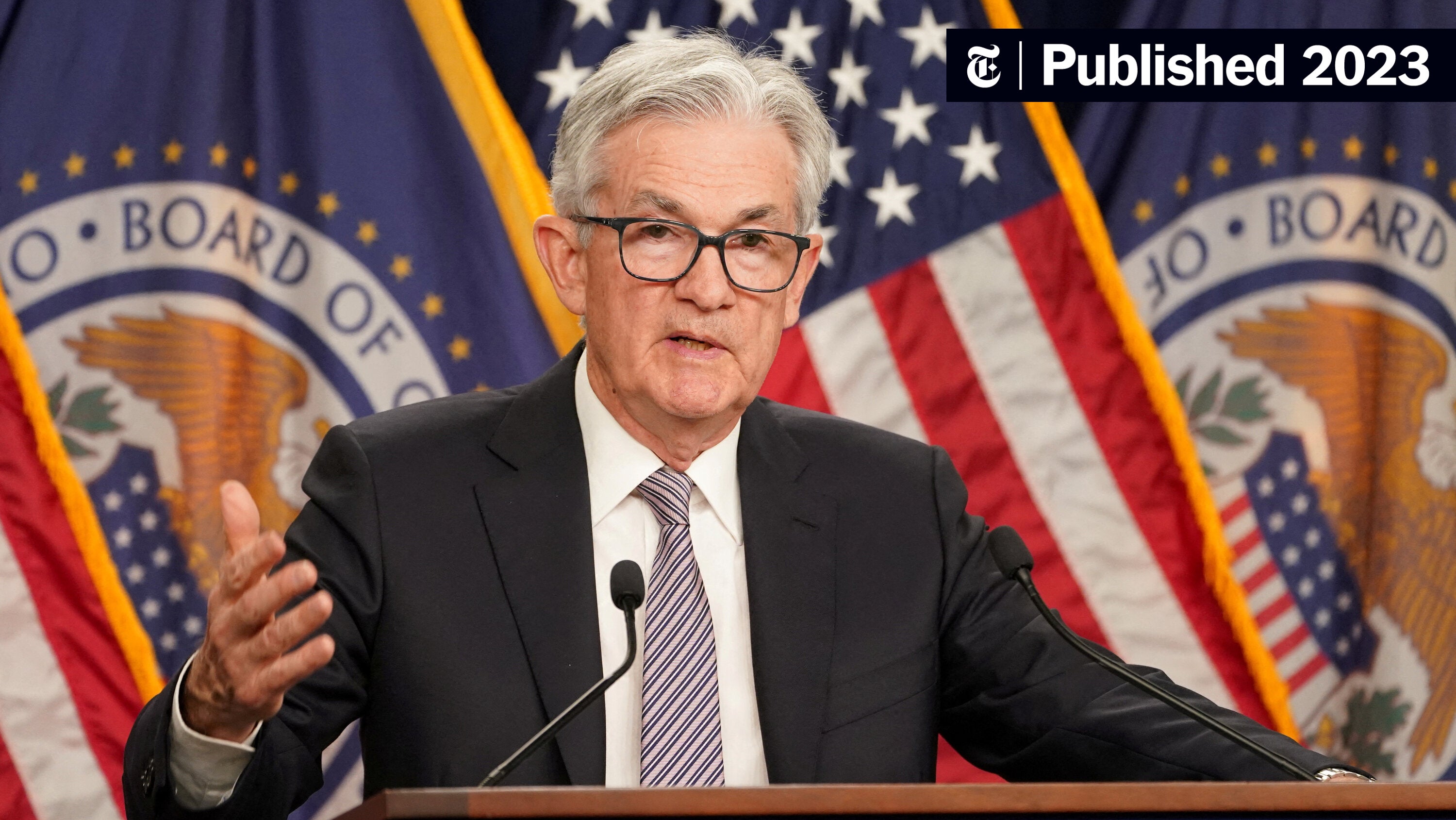

President Trump's recent statements regarding Federal Reserve Chairman Jerome Powell and the ongoing monetary policy significantly impacted US Stock Futures. His comments, while not explicitly endorsing any specific action, conveyed a sense of confidence in Powell's leadership and suggested a degree of alignment on economic goals. This subtle shift in tone was enough to trigger a strong positive reaction in the market.

-

Specific Statements: While the exact wording varied across different media appearances, Trump's statements consistently avoided direct criticism of Powell's policies, instead focusing on positive economic indicators and the strength of the US economy. This marked a departure from previous pronouncements which had been interpreted as openly critical of the Fed’s approach.

-

Market Reaction: The immediate market reaction was dramatic. Dow Jones futures jumped by [Insert Percentage]% shortly after the comments were released, with similar gains seen in S&P 500 and Nasdaq futures. This sharp increase in futures contracts clearly demonstrates the market's sensitivity to presidential pronouncements on monetary policy.

-

Investor Sentiment Shift: Investor sentiment experienced a palpable shift from uncertainty and anxiety to a more optimistic outlook. The perception of reduced political pressure on the Federal Reserve, even if temporary, seemed to ease concerns about potential interference in monetary policy decisions.

-

Increased Trading Volume: The surge in futures trading wasn't simply a price movement; it also involved a notable increase in trading volume, suggesting a significant influx of investor activity. This heightened activity further underlines the magnitude of the market's response to Trump's remarks.

The Role of the Federal Reserve (Fed) and Interest Rates

The Federal Reserve's role in influencing US Stock Futures and the overall economy is paramount. The current stance of the Fed on interest rates is a key factor affecting market confidence. Currently, [Insert Current Fed Stance on Interest Rates – e.g., holding rates steady, considering a rate cut, etc.].

-

Interest Rate Expectations: The market's expectation regarding future interest rate adjustments is crucial. Prior to Trump's comments, [Insert Market Expectations before Trump's comments - e.g., there was speculation of an imminent rate cut, or the market was uncertain about the future direction of rates].

-

Influence on Fed Decision-Making: Trump’s comments, although not directly impacting the Fed's decision-making process, likely influence the perception of political pressure on the central bank. Any perceived alignment between the President and the Fed can lead to increased market stability, while disagreement can fuel volatility.

-

Interest Rates and Stock Market Performance: Historically, lower interest rates tend to stimulate economic activity and boost stock market performance, encouraging investment and making borrowing more attractive. Conversely, higher rates can slow economic growth, impacting stock prices negatively. The market's positive reaction to Trump's comments could be interpreted as a bet on a more accommodative monetary policy stance from the Fed, even if not explicitly stated.

Potential Long-Term Implications and Risks

While the immediate market reaction to Trump's statements was positive, the long-term implications remain uncertain and carry significant risks. The influence of political pronouncements on monetary policy creates an environment of increased volatility.

-

Increased Market Volatility: The possibility of heightened market volatility in the coming weeks and months is significant. The relationship between political rhetoric and the Federal Reserve's actions remains a source of uncertainty that can easily disrupt market equilibrium.

-

Economic Uncertainty: The unpredictability introduced by political interference in the traditionally independent operation of the Federal Reserve can lead to broader economic uncertainty. Economic forecasting becomes more challenging when political factors outweigh purely economic considerations.

-

Risks of Relying on Presidential Assurances: Investors should exercise caution in relying solely on presidential assurances for making long-term investment strategies. Such pronouncements are inherently subject to change and can easily be overturned by shifting political dynamics.

-

Due Diligence: A cautious approach to investment decisions is always advisable. Investors need to conduct thorough due diligence, analyzing fundamental economic indicators and diverse market perspectives before making any investment choices.

Alternative Perspectives and Expert Opinions

Market analysts offer varying perspectives on the long-term effects of Trump's statement.

-

Differing Viewpoints: Some analysts view the market surge as a temporary reprieve, emphasizing the inherent uncertainties related to both the political and economic landscape. Others believe the comments signal a potential shift towards a more cooperative relationship between the administration and the Fed, leading to a period of sustained growth.

-

Expert Predictions: Leading economists and market analysts have offered a range of predictions, highlighting the difficulty in forecasting with certainty in this volatile environment. [Insert quotes or summaries from leading experts].

Conclusion

Trump's reassuring remarks on Powell led to a significant jump in US stock futures, demonstrating the President's considerable influence on market sentiment. However, the long-term implications remain uncertain, and investors should proceed with caution. The interplay between political statements and the Federal Reserve’s actions continues to be a critical factor impacting market stability. Understanding this complex relationship is crucial for navigating the sometimes turbulent world of US Stock Futures. Stay informed about the latest developments in US stock futures and the Federal Reserve's policy decisions. Monitoring news related to US Stock Futures and the Federal Reserve closely is crucial for making sound investment decisions in this dynamic environment.

Featured Posts

-

Analysis Trumps Remarks On Not Dismissing Fed Chair Jerome Powell

Apr 24, 2025

Analysis Trumps Remarks On Not Dismissing Fed Chair Jerome Powell

Apr 24, 2025 -

60 Minutes Faces Shakeup Executive Producers Resignation Over Trump Lawsuit

Apr 24, 2025

60 Minutes Faces Shakeup Executive Producers Resignation Over Trump Lawsuit

Apr 24, 2025 -

Is Instagrams New Video Editor A Tik Tok Killer

Apr 24, 2025

Is Instagrams New Video Editor A Tik Tok Killer

Apr 24, 2025 -

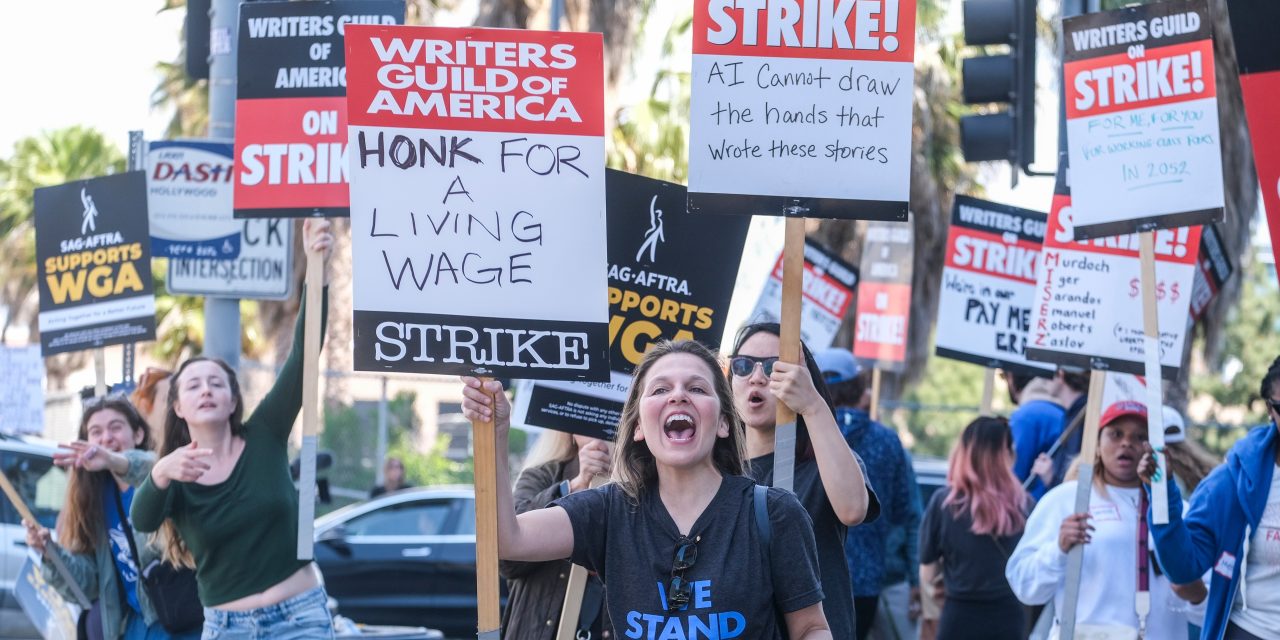

Wga And Sag Aftra Strike A Complete Shutdown Of Hollywood

Apr 24, 2025

Wga And Sag Aftra Strike A Complete Shutdown Of Hollywood

Apr 24, 2025 -

Trump Administration And Harvard A Potential Settlement After Legal Battle

Apr 24, 2025

Trump Administration And Harvard A Potential Settlement After Legal Battle

Apr 24, 2025