US Sanctions On Iran: Implications For The Chinese Plastics Supply Chain

Table of Contents

Iran's Role in the Global Petrochemical Market

Iran as a Key Supplier of Petrochemical Feedstock

Iran is a significant producer of petrochemicals, including ethylene, propylene, and benzene – crucial feedstocks for the plastics industry. Before the intensification of US sanctions, Iran held a considerable share of the global petrochemical market, particularly in supplying regions like Asia.

- Specific Iranian petrochemical exports relevant to plastics manufacturing: Iran exported significant quantities of polyethylene (PE), polypropylene (PP), and Polyvinyl chloride (PVC) – all essential polymers in plastics production.

- Iran's past contribution to the global petrochemical market: While precise figures vary depending on the year and reporting agency, Iran consistently ranked among the top petrochemical exporters globally, contributing a substantial percentage to the overall supply.

- Key Iranian petrochemical companies: Companies like the National Petrochemical Company of Iran (NPC) played a major role in shaping Iran's petrochemical exports and global market presence.

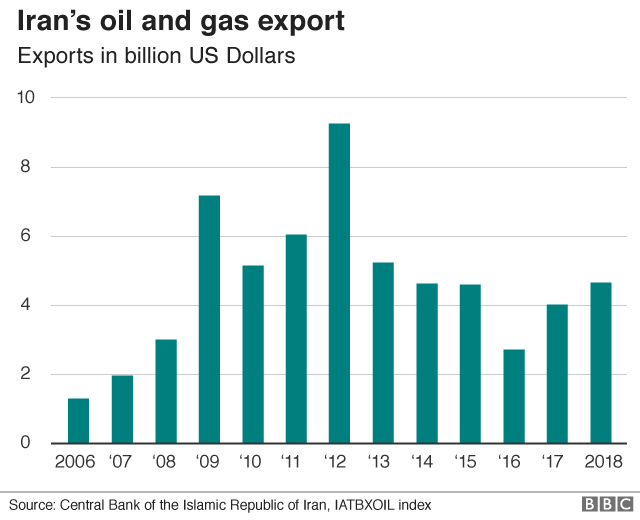

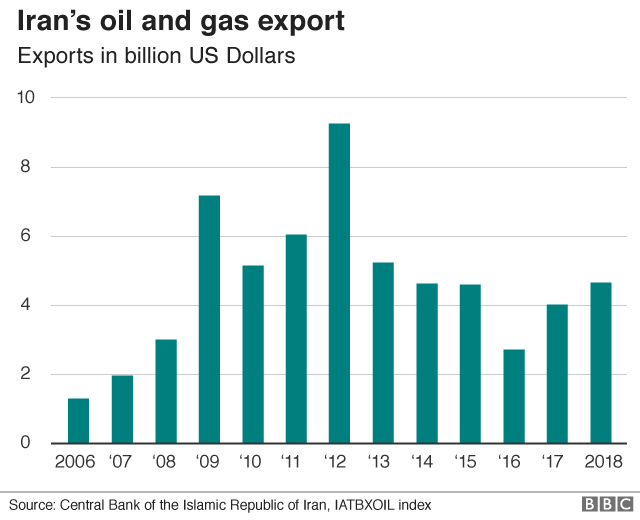

Impact of Sanctions on Iranian Petrochemical Exports

US sanctions, including those targeting the Iranian financial system, have significantly restricted Iranian access to the international banking system, making transactions incredibly difficult. This directly impacts Iran's ability to export its petrochemicals.

- Limitations imposed by sanctions on trade with Iran: Sanctions prohibit most US companies and those using US dollar transactions from dealing directly with Iranian entities, creating a complex web of compliance challenges.

- Challenges faced by Chinese companies in importing Iranian petrochemicals: Chinese companies face significant difficulties in making payments to Iranian suppliers, necessitating the use of alternative, often riskier, methods.

- Use of alternative payment methods and the risks involved: The reliance on non-dollar transactions and potentially opaque financial channels increases the risk of sanctions violations and financial instability for Chinese importers.

The Chinese Plastics Industry's Dependence on Iranian Petrochemicals

China's Reliance on Imported Petrochemical Feedstock

China's massive plastics industry relies heavily on imported petrochemical feedstock to meet its enormous demand. A significant portion of this import historically came from Iran, due to its competitive pricing and established trade relationships.

- Types of plastics produced in China that rely on Iranian feedstock: Many of the common plastics found in everyday products, such as packaging films, containers, and fibers, utilize feedstock sourced internationally, with Iran playing a significant role in the past.

- Statistics on China's imports of petrochemicals from Iran in previous years: Data from pre-sanctions years show a considerable volume of petrochemical imports from Iran to China, highlighting the dependence before the trade restrictions.

- Key Chinese plastics manufacturers affected: Numerous large and small Chinese plastics manufacturers were directly impacted, facing disruptions to their supply chains and increased costs.

Sourcing Alternatives and Their Limitations

The sanctions have forced Chinese companies to seek alternative suppliers of petrochemicals, primarily from the Middle East, Southeast Asia, and other regions. However, finding adequate replacements poses several limitations.

- Competing petrochemical suppliers and their capacity: While alternative suppliers exist (such as Saudi Arabia, Qatar, and the United States), their capacity may not fully meet the demand previously filled by Iran, leading to shortages and price fluctuations.

- Price implications of switching suppliers: Switching suppliers often means higher costs due to factors like transportation distances, different pricing models, and increased competition for limited resources.

- Geopolitical implications of shifting reliance away from Iran: The shift in sourcing highlights the intricate interplay of geopolitical factors affecting global supply chains and international relationships.

Economic and Geopolitical Ramifications

Increased Costs for Chinese Plastics Manufacturers

The disruption in the supply chain, coupled with the search for alternative, often more expensive, suppliers, has resulted in increased costs for Chinese plastics manufacturers.

- Price increases for key petrochemical feedstocks: The cost of key feedstocks like ethylene and propylene has increased significantly, affecting the final price of plastic products.

- Effect on profitability and competitiveness of Chinese plastics manufacturers: Higher input costs put pressure on profit margins and competitiveness, particularly for smaller companies struggling to adapt.

Shifting Global Supply Chains and Geopolitical Implications

The sanctions have triggered a significant shift in global supply chains for petrochemicals, impacting international relations and the overall landscape of the global plastics market.

- Potential for consolidation in the global petrochemical industry: The disruption may lead to mergers, acquisitions, and further consolidation among the remaining major petrochemical players.

- Impact on US-China relations: The sanctions and their impact on Chinese industries highlight the complex geopolitical tension between the US and China, with trade at the forefront.

- Role of other countries in supplying petrochemicals to China: Countries like Saudi Arabia and Qatar have seen increased demand and have attempted to fill some of the gap left by Iranian exports.

Conclusion

The US sanctions on Iran have created significant challenges for the Chinese plastics supply chain, leading to increased costs, supply chain disruptions, and geopolitical ramifications. Chinese manufacturers are forced to adapt by diversifying their sources and potentially absorbing higher costs. Understanding the intricate interplay between US sanctions, Iran's role in the global petrochemical market, and China's plastics industry is critical for navigating this complex landscape. Further research and proactive strategies are needed to mitigate the long-term implications of US sanctions on Iran on the Chinese plastics supply chain and the global plastics market. Continued monitoring of the evolving situation regarding US sanctions on Iran and their impact on the Chinese plastics supply chain is crucial for businesses and policymakers alike.

Featured Posts

-

Ovechkins Pre Pittsburgh Trip Lucky Sub Cheetos And Game Day Rituals

May 07, 2025

Ovechkins Pre Pittsburgh Trip Lucky Sub Cheetos And Game Day Rituals

May 07, 2025 -

Trdd Rhlat Alkhtwt Almlkyt Almghrbyt Byn Saw Bawlw Waldar Albydae Syrtfe

May 07, 2025

Trdd Rhlat Alkhtwt Almlkyt Almghrbyt Byn Saw Bawlw Waldar Albydae Syrtfe

May 07, 2025 -

Ralph Macchio 38 Years Of Marriage Hollywoods Not The Secret

May 07, 2025

Ralph Macchio 38 Years Of Marriage Hollywoods Not The Secret

May 07, 2025 -

Understanding The Allure Of The Glossy Mirage

May 07, 2025

Understanding The Allure Of The Glossy Mirage

May 07, 2025 -

Ib Ri S Dla Onetu Kto Zyskal A Kto Stracil Zaufanie Polakow

May 07, 2025

Ib Ri S Dla Onetu Kto Zyskal A Kto Stracil Zaufanie Polakow

May 07, 2025

Latest Posts

-

Inter Milans First Leg Triumph Over Bayern Munich In The Champions League

May 08, 2025

Inter Milans First Leg Triumph Over Bayern Munich In The Champions League

May 08, 2025 -

Arsenal News The Arteta Collymore Debate Heats Up

May 08, 2025

Arsenal News The Arteta Collymore Debate Heats Up

May 08, 2025 -

Arteta Faces Scrutiny Following Collymores Comments Arsenal News

May 08, 2025

Arteta Faces Scrutiny Following Collymores Comments Arsenal News

May 08, 2025 -

Champions League Inter Milans Impressive Defeat Of Bayern Munich

May 08, 2025

Champions League Inter Milans Impressive Defeat Of Bayern Munich

May 08, 2025 -

Arsenal News Collymores Strong Criticism Of Artetas Performance

May 08, 2025

Arsenal News Collymores Strong Criticism Of Artetas Performance

May 08, 2025