US Regulatory Developments Drive Bitcoin To Record High

Table of Contents

Increased Institutional Investment Fueled by Regulatory Clarity

Clearer regulatory frameworks in the US are significantly encouraging institutional investors – hedge funds, pension funds, and other large financial players – to enter the Bitcoin market. This increased institutional participation is a major driver behind Bitcoin's recent price appreciation. The reduced regulatory uncertainty fosters greater confidence among these traditionally risk-averse entities.

-

Grayscale Bitcoin Trust (GBTC) and other investment vehicles gaining popularity: The rise of regulated investment vehicles like GBTC provides a relatively accessible and less complicated entry point for institutional investors into the Bitcoin market. This lowers the barrier to entry for institutions seeking Bitcoin exposure without directly managing private keys.

-

Reduced regulatory uncertainty leading to increased confidence among institutional players: As regulatory clarity improves, institutions are less hesitant to allocate a portion of their portfolios to Bitcoin, viewing it as a less volatile, more predictable asset compared to its past. This increased confidence translates directly into higher demand and subsequently, price increases.

-

Examples of specific regulatory actions or pronouncements that have positively impacted institutional interest: While specific pronouncements are constantly evolving, the lack of outright bans and the increasing discussion around a regulated framework for cryptocurrencies has emboldened institutional involvement. Statements from regulatory bodies acknowledging Bitcoin as an asset class, though without explicit endorsement, have also had a positive psychological impact.

-

Mention the role of custody solutions in facilitating institutional adoption of Bitcoin: The emergence of secure and regulated custody solutions for Bitcoin is vital. Institutions need assurance that their Bitcoin holdings are safe and compliant with existing regulations. These custodial services mitigate the risks associated with self-custody, making Bitcoin a more palatable investment.

The Impact of Proposed Stablecoin Legislation on Bitcoin

Proposed regulations on stablecoins, such as USD Coin and Tether, indirectly yet significantly affect Bitcoin's price and market position. Increased scrutiny on stablecoins, which are often used as on-ramps to the crypto market, can inadvertently push investors towards Bitcoin as a more decentralized and inherently less regulated alternative.

-

Explain the potential for increased scrutiny of stablecoins to drive investors towards Bitcoin as a more decentralized alternative: If regulations restrict the operations or perceived stability of stablecoins, investors seeking exposure to the crypto market may turn to Bitcoin as a more established and less regulated option. This shift in preference increases Bitcoin's demand.

-

Discuss the implications of tighter regulations on stablecoin reserves and their impact on Bitcoin's price: Regulations demanding increased transparency and reserve backing for stablecoins might increase their operational costs and reduce their attractiveness. This could indirectly increase the demand for Bitcoin.

-

Analyze the potential for regulatory arbitrage and how this might influence Bitcoin's market share: Stricter regulations in one jurisdiction could drive activity to less regulated areas, potentially increasing Bitcoin's dominance in those regions. This regulatory arbitrage can increase Bitcoin's global market share.

-

Mention potential benefits and drawbacks of stablecoin regulation for Bitcoin: While tighter regulation on stablecoins could benefit Bitcoin in the short term by diverting investment, the overall health of the crypto ecosystem depends on a stable and regulated financial infrastructure. Excessive regulation on stablecoins could stifle innovation and negatively impact the broader market in the long run.

SEC's Stance on Bitcoin ETFs and Their Potential Influence

The SEC's ongoing review of Bitcoin Exchange-Traded Funds (ETFs) is a critical factor influencing Bitcoin's market dynamics. The potential approval of a Bitcoin ETF would dramatically increase market liquidity and price discovery, fundamentally altering the landscape for Bitcoin investment.

-

Explain the potential increase in Bitcoin adoption if a Bitcoin ETF is approved: An ETF would make Bitcoin significantly more accessible to a wider range of investors, including retail investors who may be intimidated by the complexity of directly purchasing and storing Bitcoin.

-

Discuss the implications of increased accessibility for retail investors through ETFs: This increased accessibility could dramatically increase the demand for Bitcoin, driving up the price. It would also increase price transparency and market depth.

-

Analyze the historical impact of ETF approvals on other asset classes: The approval of ETFs for other asset classes has historically resulted in significantly increased trading volume and price appreciation. The same effect is expected for Bitcoin.

-

Mention the arguments for and against the approval of a Bitcoin ETF by the SEC: Arguments for approval focus on increased market transparency and investor protection. Arguments against it typically cite concerns about market manipulation and price volatility.

Navigating the Regulatory Maze: The Future of Bitcoin in the US

The US regulatory landscape for Bitcoin is constantly evolving. Navigating this maze successfully requires a keen understanding of current regulations and anticipated changes. The future trajectory of Bitcoin within the US depends heavily on how these regulatory developments unfold.

-

Discuss potential future regulatory challenges and opportunities for Bitcoin in the US: Future challenges include addressing taxation issues, ensuring consumer protection, and combatting illicit activities related to Bitcoin. Opportunities lie in fostering innovation, promoting responsible adoption, and establishing a clear, consistent regulatory framework.

-

Mention ongoing debates surrounding Bitcoin taxation and its potential implications: The ongoing debate about how Bitcoin transactions should be taxed is a significant concern for investors and businesses. Clarity in this area is crucial for wider adoption.

-

Highlight the importance of compliance for Bitcoin businesses and investors: Compliance with existing and future regulations is paramount for businesses operating in the Bitcoin market and for individual investors. This involves adhering to anti-money laundering (AML) and know-your-customer (KYC) regulations, among others.

-

Discuss the potential for further regulatory clarity and its positive impact on the Bitcoin market: Increased regulatory clarity will undoubtedly boost investor confidence and attract further institutional investment, driving Bitcoin's price higher and further solidifying its position in the financial market.

Conclusion

US regulatory developments are playing a pivotal role in Bitcoin's record-breaking price surge. Increased institutional investment, the indirect impact of stablecoin legislation, and the anticipated approval of Bitcoin ETFs are all contributing factors. While navigating the complexities of the regulatory landscape remains crucial, the overall trend points toward growing acceptance and adoption of Bitcoin in the United States.

Call to Action: Stay informed about the latest US regulatory developments affecting Bitcoin. Understanding these changes is crucial for investors and businesses operating in this dynamic market. Learn more about how these regulatory shifts impact your Bitcoin investment strategy and stay ahead of the curve.

Featured Posts

-

Australias Billie Jean King Cup Hopes Dashed By Kazakhstan

May 23, 2025

Australias Billie Jean King Cup Hopes Dashed By Kazakhstan

May 23, 2025 -

Joe Jonas Addresses Couples Public Dispute About Him

May 23, 2025

Joe Jonas Addresses Couples Public Dispute About Him

May 23, 2025 -

Trucking News Big Rig Rock Report 3 12 From 99 7 The Fox

May 23, 2025

Trucking News Big Rig Rock Report 3 12 From 99 7 The Fox

May 23, 2025 -

Novedades En La Lista De Convocados De Instituto Como Jugara Ante Lanus

May 23, 2025

Novedades En La Lista De Convocados De Instituto Como Jugara Ante Lanus

May 23, 2025 -

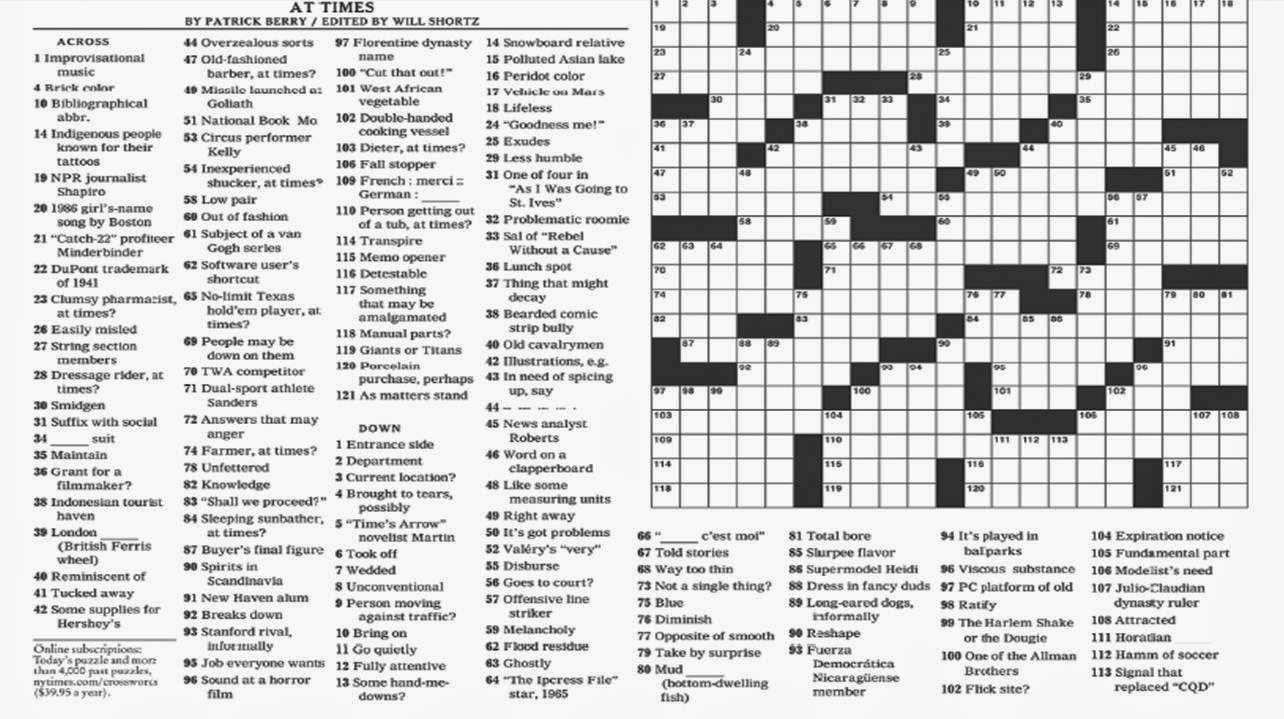

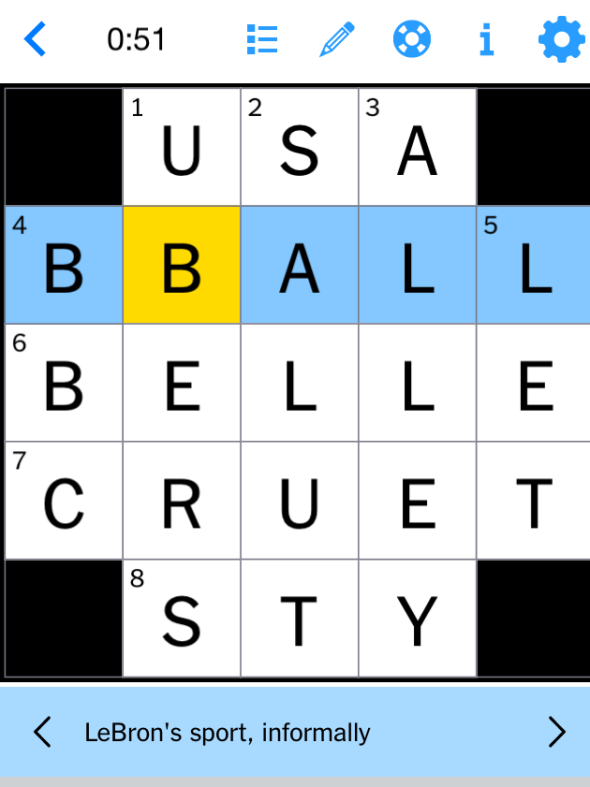

Nyt Mini Sunday Crossword Puzzle April 6 2025 Solutions And Clues

May 23, 2025

Nyt Mini Sunday Crossword Puzzle April 6 2025 Solutions And Clues

May 23, 2025

Latest Posts

-

April 18 2025 Nyt Mini Crossword Answers And Hints

May 23, 2025

April 18 2025 Nyt Mini Crossword Answers And Hints

May 23, 2025 -

Uni Duisburg Essen 900 Euro Fuer Bessere Noten Ein Skandal

May 23, 2025

Uni Duisburg Essen 900 Euro Fuer Bessere Noten Ein Skandal

May 23, 2025 -

March 26 2025 Nyt Mini Crossword Find The Answers Here

May 23, 2025

March 26 2025 Nyt Mini Crossword Find The Answers Here

May 23, 2025 -

Essen Diese Eissorte Erobert Nrw Ein Ueberraschender Favorit

May 23, 2025

Essen Diese Eissorte Erobert Nrw Ein Ueberraschender Favorit

May 23, 2025 -

Nyt Mini Crossword Answers For March 16 2025

May 23, 2025

Nyt Mini Crossword Answers For March 16 2025

May 23, 2025