US Money Managers Warned: $65 Billion Dutch Investment Firm's Notice

Table of Contents

The Nature of the Warning

The warning from this significant Dutch investment firm highlights serious concerns about potential regulatory non-compliance and risky investment strategies among some US money managers. The specific nature of the warning remains partially undisclosed to protect the involved parties and ongoing investigations, but it centers around several key areas of concern impacting investment risk and financial regulations within the US market. The firm’s $65 billion asset base underscores the gravity of the situation and the potential impact on global finance.

-

Regulatory Scrutiny: The warning emphasizes the growing regulatory scrutiny of investment practices, particularly concerning compliance with US financial regulations like the Investment Advisers Act of 1940 and other relevant legislation. The Dutch firm suggests that some US money managers may be falling short of these requirements.

-

Risky Investment Strategies: Certain investment strategies employed by some US firms are flagged as excessively risky and potentially exposing them to significant financial losses. This includes potential overexposure to specific emerging markets experiencing instability, speculative investments in high-risk assets, and a lack of proper due diligence in the investment selection process.

-

Potential Legal Ramifications: The warning alludes to the potential for legal repercussions, including sanctions and investigations by regulatory bodies, for US money managers found to be non-compliant or engaged in risky practices. This could lead to significant financial penalties and reputational damage.

-

Bullet Points:

- The warning specifically mentions concerns about inadequate reporting of investment performance and potential conflicts of interest.

- Examples of risky investments include highly leveraged positions in volatile cryptocurrencies and unproven start-ups.

- Potential penalties include hefty fines, temporary or permanent suspension of operations, and even criminal charges in severe cases.

Impact on US Money Managers

The warning from the Dutch investment firm has significant implications for US money managers, demanding immediate action to avoid potential financial losses and reputational damage. This situation necessitates a thorough review of current investment strategies, risk management protocols, and regulatory compliance procedures.

-

Portfolio Adjustments: US money managers must immediately assess their portfolios for potential vulnerabilities highlighted by the warning. This involves identifying any high-risk investments, overexposure to specific sectors or geographies, and areas of potential regulatory non-compliance. Rebalancing portfolios to mitigate these risks is crucial.

-

Revised Risk Management: Existing risk management strategies must be rigorously reviewed and updated to reflect the evolving regulatory landscape and the specific concerns raised in the warning. This includes strengthening internal controls, enhancing due diligence processes, and implementing more robust risk assessment models.

-

Increased Due Diligence: The warning underscores the critical importance of thorough due diligence in all investment decisions. Money managers need to strengthen their processes to ensure compliance with all relevant regulations and to avoid engaging in high-risk strategies.

-

Bullet Points:

- Portfolio adjustments may involve divesting from high-risk assets, increasing diversification, and bolstering cash reserves.

- Risk mitigation strategies could include employing stress testing models, diversifying investment strategies, and enhancing internal audits.

- Improved due diligence processes involve rigorous background checks, enhanced compliance training for staff, and regularly updated compliance manuals.

Response and Next Steps for US Money Managers

The warning issued by the $65 billion Dutch investment firm requires immediate and decisive action from US money managers. A proactive approach focusing on regulatory compliance and robust risk management is crucial for mitigating potential negative consequences.

-

Seeking Legal Advice: US money managers should immediately seek legal counsel to assess their current compliance posture and understand the implications of the warning in the context of their specific investment strategies and operational practices.

-

Conducting Thorough Risk Assessments: A comprehensive risk assessment is essential to identify potential vulnerabilities within the organization’s investment portfolio and operational procedures. This assessment should incorporate stress testing and scenario planning to anticipate potential impacts.

-

Developing a Comprehensive Action Plan: A detailed action plan outlining specific steps to address the concerns raised in the warning is paramount. This plan should incorporate timelines, responsibilities, and measurable outcomes to ensure its successful execution.

-

Bullet Points:

- Strengthening regulatory compliance involves conducting thorough internal audits, implementing updated compliance programs, and ensuring employee training in relevant regulations.

- Key questions for legal counsel include assessing current compliance status, identifying potential areas of non-compliance, and developing strategies for remediation.

- A robust action plan includes clearly defined goals, specific tasks, responsible individuals, deadlines, and measurable success criteria.

Conclusion

The warning from the Dutch investment firm, managing assets exceeding $65 billion, serves as a critical reminder of the importance of regulatory compliance and robust risk management for US money managers. Ignoring this warning could lead to significant financial losses, legal repercussions, and reputational damage. Immediate action is necessary to mitigate potential risks and ensure continued compliance with all relevant US financial regulations. The need for thorough due diligence, proactive compliance efforts, and the implementation of robust risk management strategies cannot be overstated. Don't ignore this crucial US Money Managers warning. Take decisive action today to safeguard your investments and protect your firm's future.

Featured Posts

-

French Open Draw Sinner In Favorable Top Half

May 28, 2025

French Open Draw Sinner In Favorable Top Half

May 28, 2025 -

The Latest News And Pictures Of Nicolas Anelka

May 28, 2025

The Latest News And Pictures Of Nicolas Anelka

May 28, 2025 -

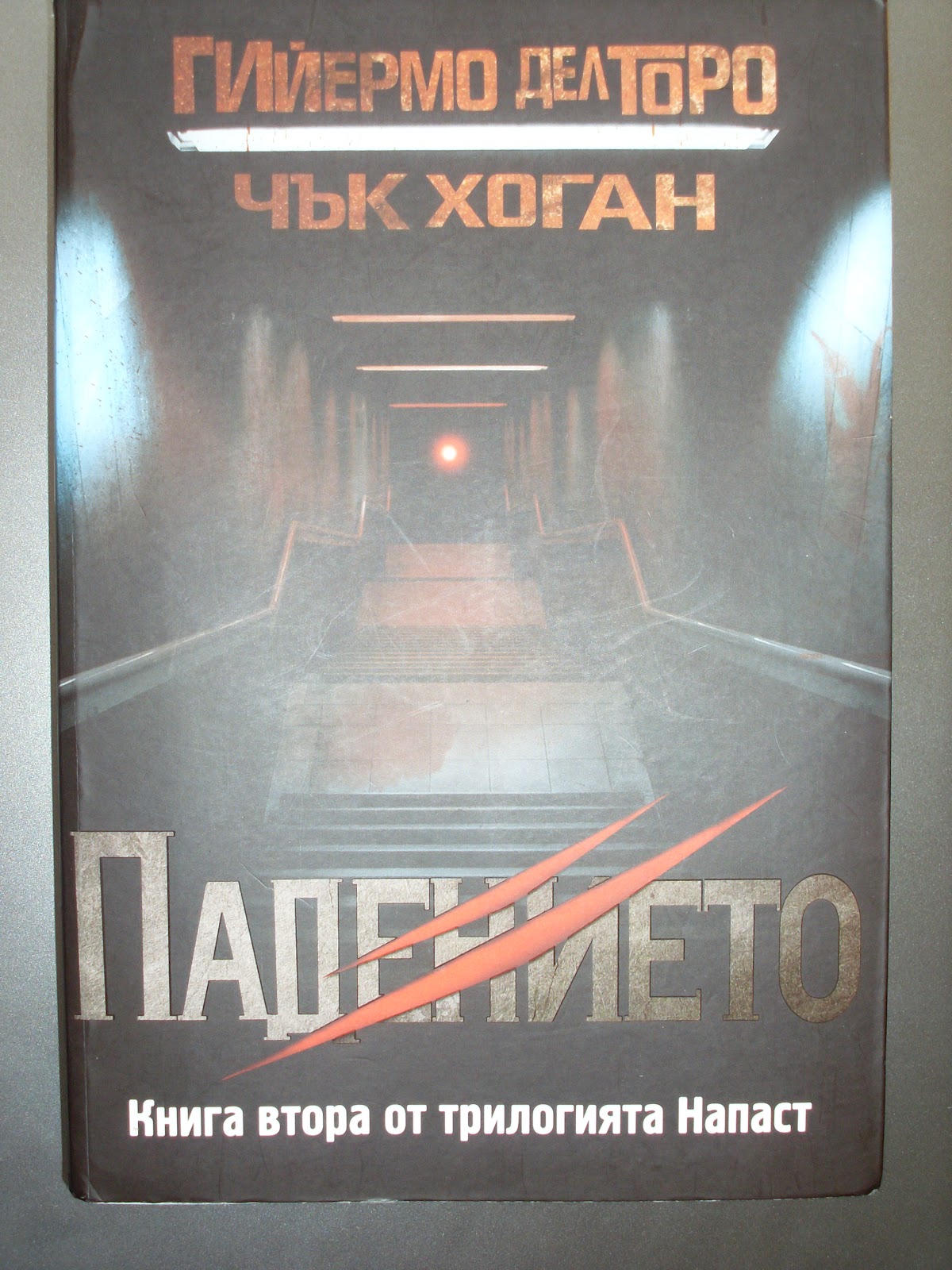

Benisio Del Toro I Ues Andersn Prvi Pogled Km Noviya Im Film

May 28, 2025

Benisio Del Toro I Ues Andersn Prvi Pogled Km Noviya Im Film

May 28, 2025 -

Oleh Oleh Kuliner Bali Temukan 8 Pilihan Unik Selain Pie Susu

May 28, 2025

Oleh Oleh Kuliner Bali Temukan 8 Pilihan Unik Selain Pie Susu

May 28, 2025 -

Padres Vs Braves 2025 Wild Card Rematch

May 28, 2025

Padres Vs Braves 2025 Wild Card Rematch

May 28, 2025