US IPO Filing: Chime's Rise In Digital Banking Revenue

Table of Contents

Chime's IPO Filing: Key Financial Highlights

The Chime IPO filing is a significant event, providing investors with valuable insights into the company's financial health and future prospects. It offers a detailed look at Chime's performance, allowing potential investors to assess its growth potential and long-term viability within the competitive digital banking market. The filing's transparency is crucial for understanding Chime's financial strategy and its ability to generate sustainable digital banking revenue.

Here are some key financial metrics revealed in the filing:

- Total Revenue Figures: [Insert hypothetical figures here, for example: Chime reported a total revenue of $1.5 billion in 2022, representing a year-over-year growth of 60%. This demonstrates a significant acceleration compared to previous years.] These impressive figures highlight the company's strong growth trajectory. Illustrative charts can be included here.

- Revenue Breakdown: Chime's revenue streams are diversified. [Insert hypothetical breakdown, for example: Interchange fees account for approximately 70% of total revenue, with subscription fees and other services contributing the remaining 30%.]. This balanced approach mitigates risk and provides a solid foundation for future growth. A pie chart visually representing this breakdown would be beneficial.

- Profitability Analysis: [Insert hypothetical analysis, for example: While Chime is not yet profitable, the IPO filing shows a narrowing of its net losses. This suggests a clear path to profitability within the next few years, fueled by continued customer acquisition and operational efficiencies. ] A line graph showing net loss over time would further illustrate this point.

Growth Drivers: Factors Contributing to Chime's Revenue Success

Chime's rapid revenue growth can be attributed to several key factors:

- Innovative Features and Services: Chime's success hinges on its innovative features. Early access to paychecks, robust budgeting tools, and fee-free services are just some of the features that appeal to a broad customer base. These features directly contribute to customer loyalty and high digital banking revenue.

- Target Market Strategy: Chime effectively targets underserved customer segments, offering a user-friendly banking experience to those traditionally overlooked by traditional banks. This strategic focus has been instrumental in driving significant customer acquisition.

- Effective Marketing and Customer Acquisition: Chime's marketing campaigns are highly effective, leveraging digital channels to reach its target audience. Their focus on customer experience enhances customer acquisition and retention, directly impacting revenue growth.

- Technological Advantages: Chime’s technological infrastructure plays a crucial role in streamlining operations and delivering a seamless customer experience. Its investment in technology gives it a competitive edge, allowing it to manage costs effectively while scaling its operations.

Competitive Landscape and Future Outlook: Chime's Position in the Digital Banking Market

Chime operates in a fiercely competitive market, facing established players like [mention key competitors like PayPal, Robinhood, etc.] However, its strong brand recognition, innovative features, and effective marketing position it well for continued growth.

Potential challenges include increasing competition, regulatory changes in the fintech sector, and maintaining customer trust in a rapidly evolving landscape.

Looking ahead, Chime's future growth prospects are promising. The IPO filing suggests several avenues for expansion:

- Expansion into new financial products and services: Offering loans, investment products, and other financial services can significantly increase revenue streams.

- International expansion: Expanding into new geographic markets will broaden Chime’s customer base and drive significant growth.

- Strategic partnerships and acquisitions: Collaborations and acquisitions can accelerate growth and enhance market positioning.

Impact of the US IPO Filing on the Digital Banking Sector

Chime's US IPO filing has significant implications for the wider digital banking sector. It signals a growing investor confidence in the neobanking model and validates Chime's innovative approach. This could lead to increased competition, further investment in the sector, and a surge of innovation. The success of Chime’s IPO could serve as a catalyst for other fintech companies considering a public offering, shaping the future of the digital banking revenue landscape.

Conclusion: US IPO Filing Signals Bright Future for Chime's Digital Banking Revenue

Chime’s US IPO filing reveals a company with strong financial performance, a clear path to profitability, and significant growth potential. Its innovative approach to digital banking, coupled with a strategic focus on underserved markets, has enabled it to capture a substantial market share and generate impressive digital banking revenue. The success of Chime’s IPO signifies a pivotal moment for the fintech industry and highlights the future potential of neobanks. Stay informed about the future of digital banking revenue by following Chime's progress post-IPO and analyzing its ongoing impact on the financial technology sector.

Featured Posts

-

Yuval Raphael Israels Eurovision 2025 Hopeful

May 14, 2025

Yuval Raphael Israels Eurovision 2025 Hopeful

May 14, 2025 -

000 Baeume Wiederaufforstung Im Nationalpark Saechsische Schweiz

May 14, 2025

000 Baeume Wiederaufforstung Im Nationalpark Saechsische Schweiz

May 14, 2025 -

Novinari Deniku N A Seznam Zprav Nedostali Pristup Na Brifink Ct

May 14, 2025

Novinari Deniku N A Seznam Zprav Nedostali Pristup Na Brifink Ct

May 14, 2025 -

The Bonds Ohtani Debate Is The Criticism Justified

May 14, 2025

The Bonds Ohtani Debate Is The Criticism Justified

May 14, 2025 -

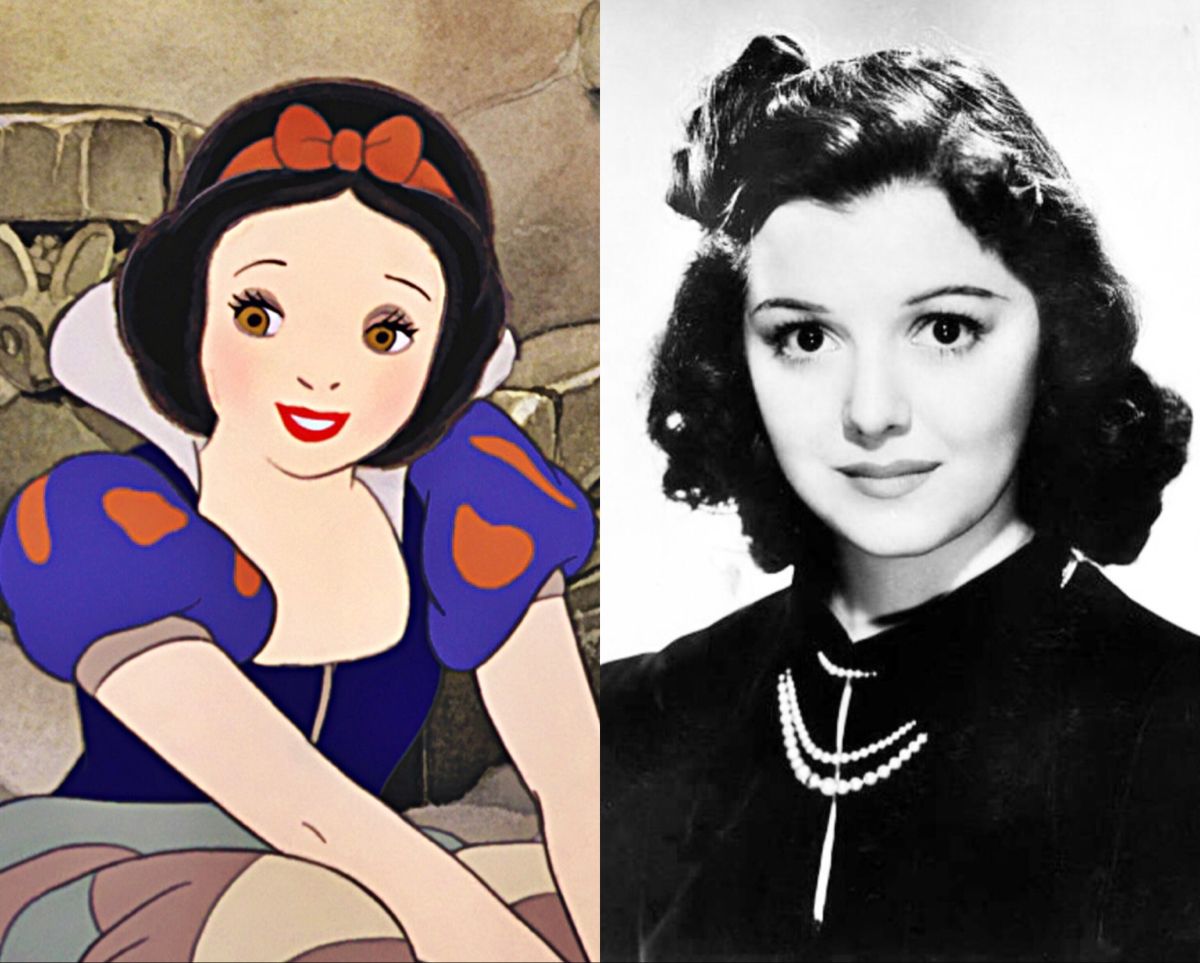

Revisiting Snow White A Look At The 1987 Film And Disneys New Adaptation

May 14, 2025

Revisiting Snow White A Look At The 1987 Film And Disneys New Adaptation

May 14, 2025

Latest Posts

-

Forest And Fulham Nigerian Duos Fa Cup Quarter Final Bid

May 14, 2025

Forest And Fulham Nigerian Duos Fa Cup Quarter Final Bid

May 14, 2025 -

Fa Cup Quarter Finals Fulhams Nigerian Duo Ready To Shine

May 14, 2025

Fa Cup Quarter Finals Fulhams Nigerian Duo Ready To Shine

May 14, 2025 -

Fulhams Nigerian Duo Back In Fa Cup Quarter Final Action

May 14, 2025

Fulhams Nigerian Duo Back In Fa Cup Quarter Final Action

May 14, 2025 -

Nottingham Forests Awoniyi An Fa Cup Start

May 14, 2025

Nottingham Forests Awoniyi An Fa Cup Start

May 14, 2025 -

Fa Cup Awoniyi Earns Starting Spot

May 14, 2025

Fa Cup Awoniyi Earns Starting Spot

May 14, 2025