US Debt Limit: Potential August Expiration Raises Concerns

Table of Contents

Understanding the US Debt Limit

The US debt ceiling, also known as the debt limit, is the total amount of money the US government is legally allowed to borrow to meet its existing obligations. It's not a limit on spending; rather, it's a limit on the government's ability to finance the spending that Congress has already authorized. The debt ceiling is distinct from the federal budget, which outlines the government's planned spending and revenue for a fiscal year. The budget deficit, the difference between spending and revenue, contributes to the national debt, which is the total accumulation of past deficits.

Currently, the US national debt is at an unprecedented level, and exceeding the debt limit would prevent the government from paying its bills, including salaries for federal employees, Social Security benefits, and interest payments on the national debt. Failure to raise the debt ceiling would have severe consequences.

- Definition of the debt ceiling: A legally mandated limit on the total amount of money the US government can borrow.

- Historical context of debt ceiling increases: The debt ceiling has been raised numerous times throughout US history, reflecting the nation's growing debt. However, recent years have seen increased political polarization surrounding these increases.

- Current debt level and projected increase: The current debt level is exceptionally high, and without an increase in the debt ceiling, the US faces an imminent default.

- The role of Congress in raising the debt limit: Congress is responsible for raising or suspending the debt ceiling through legislation. This process often involves intense political negotiations.

Potential Economic Consequences of a Default

A US default on its debt obligations would have catastrophic consequences, both domestically and internationally. The impact would reverberate throughout the global economy.

- Credit rating downgrade and increased borrowing costs: A default would likely lead to a downgrade of the US credit rating, making it significantly more expensive for the government to borrow money in the future. This would increase interest rates on everything from mortgages to business loans.

- Stock market volatility and potential crashes: The uncertainty surrounding a default would create significant volatility in the stock market, potentially leading to a major market crash and loss of investor confidence.

- Increased unemployment and economic recession: A default could trigger a severe recession, leading to widespread job losses and a sharp decline in economic activity. Government shutdowns would exacerbate the situation.

- Global market instability and ripple effects: A US default would send shockwaves through global financial markets, impacting economies worldwide and potentially causing a global financial crisis. International investors would lose confidence in the US dollar, potentially causing a currency crisis.

Political Implications and Negotiations

The political implications of the debt ceiling debate are significant. The issue has become highly partisan, with differing viewpoints between the Republican and Democratic parties. Negotiations to raise the debt limit often involve contentious compromises and brinkmanship.

- Potential political gridlock and partisan divisions: The deeply divided political climate in the US makes finding a bipartisan solution challenging, increasing the risk of a default.

- Role of the White House and Congress in resolving the issue: Both the executive and legislative branches have crucial roles in resolving the debt ceiling crisis. Negotiations between the White House and Congressional leaders are essential.

- Potential compromise measures and their likelihood: Potential compromise solutions include short-term debt ceiling increases, spending cuts, or a combination of both. The likelihood of any specific compromise depends heavily on the political climate and willingness to negotiate.

- Public opinion and its influence on negotiations: Public opinion can exert pressure on lawmakers to reach a solution and avoid a default. Understanding public sentiment is crucial for navigating these complex political negotiations.

The Role of the Treasury Department

The Treasury Department plays a critical role in managing the situation. Its actions will be crucial in mitigating the potential economic fallout.

- Extraordinary measures to avoid default: The Treasury Department may employ extraordinary measures, such as prioritizing certain payments, to delay the effects of a potential default. However, these measures are temporary and cannot prevent a default indefinitely.

- Prioritization of government payments: In a default scenario, the Treasury would be forced to prioritize payments, potentially delaying or defaulting on certain obligations. This process would be incredibly complex and fraught with difficult decisions.

- Transparency efforts and communications to the public: Open and transparent communication from the Treasury Department is crucial to maintain public confidence and manage expectations during this critical period.

Conclusion

The potential expiration of the US debt limit in August presents a serious threat to the US and global economies. Failure to act could lead to a financial crisis with severe repercussions. Political gridlock and differing viewpoints add to the complexity of the situation, highlighting the urgent need for a resolution. The consequences of inaction extend far beyond the realm of politics and economics, potentially impacting the everyday lives of American citizens.

Call to Action: Stay informed about the ongoing negotiations surrounding the US Debt Limit. Contact your elected officials to express your concerns and urge them to find a solution to prevent a catastrophic default. Understanding the implications of the US debt ceiling and the national debt is crucial for every citizen. Learn more about the potential impact on your financial future and actively participate in the democratic process to ensure responsible fiscal policy.

Featured Posts

-

Analyzing Brian Brobbeys Strength Ahead Of Crucial Europa League Match

May 10, 2025

Analyzing Brian Brobbeys Strength Ahead Of Crucial Europa League Match

May 10, 2025 -

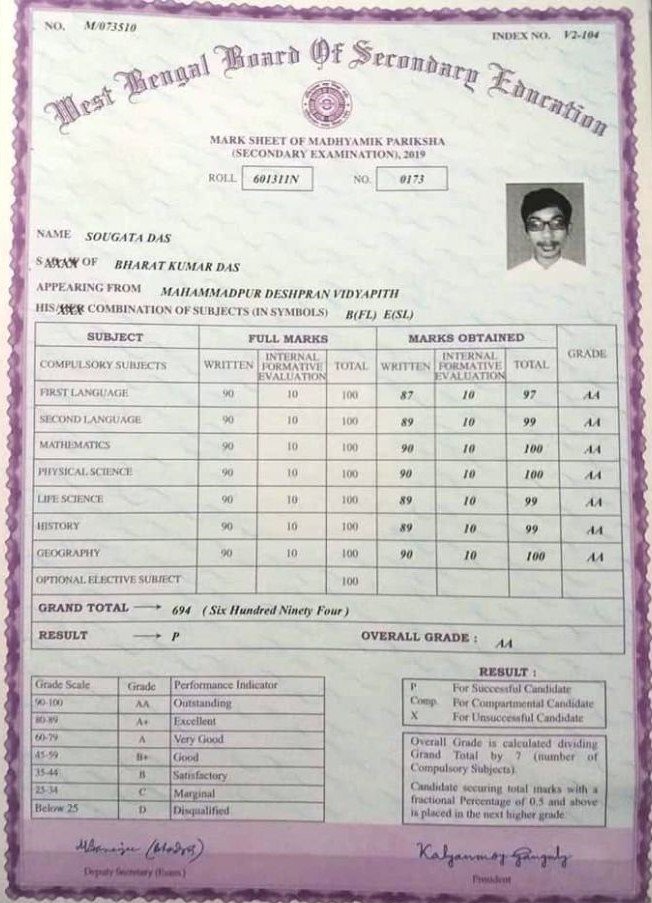

Madhyamik 2025 Merit List Date Time And Official Website

May 10, 2025

Madhyamik 2025 Merit List Date Time And Official Website

May 10, 2025 -

Trade Chaos Cripples Chinese Exports The Case Of Bubble Blasters

May 10, 2025

Trade Chaos Cripples Chinese Exports The Case Of Bubble Blasters

May 10, 2025 -

Detroit Red Wings Playoff Bid Takes Hit Following 6 3 Loss To Vegas

May 10, 2025

Detroit Red Wings Playoff Bid Takes Hit Following 6 3 Loss To Vegas

May 10, 2025 -

Harry Styles Response To A Hilarious But Bad Snl Impression

May 10, 2025

Harry Styles Response To A Hilarious But Bad Snl Impression

May 10, 2025