US Bond ETF Investment Slowdown: Taiwanese Investors Pull Back

Table of Contents

Rising Interest Rates and Their Impact on US Bond ETFs

Higher interest rates are significantly impacting the attractiveness of US Bond ETFs for Taiwanese investors. This section delves into the reasons why.

Reduced Attractiveness of Fixed-Income Investments

Higher interest rates directly impact the appeal of existing bond ETFs.

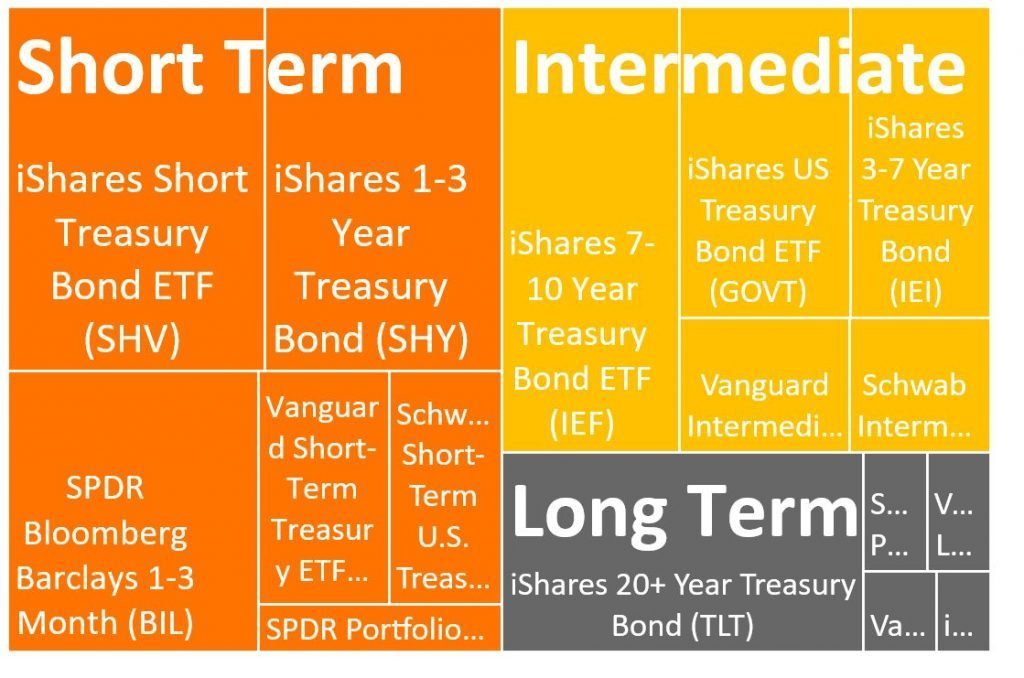

- Inverse Relationship: Bond prices and interest rates share an inverse relationship. When interest rates rise, the value of existing bonds with lower yields decreases, making them less attractive compared to newly issued bonds offering higher returns. This directly impacts the net asset value (NAV) of US Bond ETFs.

- Recent Rate Hikes: The recent series of interest rate hikes by the Federal Reserve have significantly impacted the performance of US Bond ETFs. For example, a 0.75% increase can translate to considerable losses for investors holding these ETFs, especially those with longer durations.

- Capital Appreciation Concerns: Investors seeking capital appreciation are particularly affected. The declining bond prices make it harder to achieve significant gains, prompting a reassessment of investment strategies.

Shifting Investment Strategies

The changing interest rate environment forces investors to reconsider their approach to fixed-income investments.

- Alternative Asset Classes: Many Taiwanese investors are exploring alternative investment options, such as equities, real estate, and other international bond markets offering potentially higher yields.

- Financial Advisor Influence: Financial advisors play a crucial role in guiding investors towards more suitable strategies. They help clients navigate the complexities of the changing market and adjust their portfolios accordingly.

- Increased Risk: It's important to note that shifting to alternative investments often entails increased risk. Equities, for example, are inherently more volatile than bonds, requiring a higher risk tolerance.

Geopolitical Uncertainty and its Influence on Investment Decisions

Geopolitical instability adds another layer of complexity to investment decisions, particularly affecting the appeal of US Bond ETFs.

US-China Relations and Global Economic Concerns

Global uncertainties significantly impact investor sentiment.

- Trade War Fallout: The lingering effects of the US-China trade war continue to create uncertainty in global markets, impacting investor confidence and leading to risk aversion.

- Inflation and Recession Fears: Global inflation and the threat of recession further fuel investor anxieties, pushing them towards safer havens or more geographically diversified investments.

- Bond Market Volatility: Increased volatility in the bond market makes it harder to predict returns, making US Bond ETFs a less appealing option for investors seeking stability.

Diversification Strategies and Reduced Allocation to US Bonds

Taiwanese investors are actively adjusting their portfolio diversification strategies.

- Regional Diversification: To mitigate risks associated with US-centric investments, many are diversifying into other regions like Europe or Asia, seeking to reduce their overall exposure to the US market.

- Currency Fluctuations: Currency fluctuations between the Taiwanese dollar and the US dollar also play a critical role. Unfavorable exchange rates can significantly reduce the overall returns from US Bond ETF investments.

- International Portfolio Diversification: The emphasis on international portfolio diversification highlights a broader shift in investment philosophy, prioritizing risk management over solely focusing on US bond yields.

Domestic Market Opportunities in Taiwan

The attractiveness of domestic investment opportunities within Taiwan is also playing a role in the slowdown.

Attractiveness of Local Investment Options

The growth of the Taiwanese economy is creating compelling investment opportunities.

- Taiwanese Economic Growth: The robust growth of the Taiwanese economy offers promising prospects for local investments, making them a more appealing alternative to international options.

- Domestic Investment Opportunities: Specific sectors like technology and manufacturing within Taiwan present attractive investment opportunities with potentially higher returns and lower perceived risk.

- Risk-Reward Profile: Compared to international investments, domestic investments in Taiwan often offer a more favorable risk-reward profile for some investors, particularly those seeking capital preservation.

Regulatory Changes and Tax Implications

Regulatory and tax changes within Taiwan influence investment decisions.

- International Investment Regulations: New regulations impacting international investments can make the process more complex and costly, reducing the appeal of US Bond ETFs.

- Tax Implications on Withdrawals: Tax implications on withdrawing investments from US Bond ETFs need careful consideration. Changes in tax policies can significantly affect the overall return.

- Cost of Investing in US Bond ETFs: The cumulative effect of these regulations and tax implications increases the overall cost of investing in US Bond ETFs, making domestic options more attractive.

Conclusion

The slowdown in Taiwanese investment in US Bond ETFs is a multifaceted issue stemming from rising interest rates, geopolitical uncertainties, and the growing appeal of domestic investment opportunities. Understanding these interconnected factors is essential for both investors and market analysts. For Taiwanese investors, thorough research, diversification across different asset classes and geographies, and consultation with financial professionals are paramount to navigating this evolving investment landscape. Stay informed on the latest developments impacting US Bond ETFs and global markets to make well-informed decisions about your investment portfolio. Don't hesitate to consult financial advisors to optimize your investment strategy and understand the implications of the shifting dynamics of US Bond ETFs.

Featured Posts

-

Winning Numbers Daily Lotto Friday 18 April 2025

May 08, 2025

Winning Numbers Daily Lotto Friday 18 April 2025

May 08, 2025 -

Vse Matchi Arsenala I Ps Zh V Evrokubkakh Rezultaty I Obzory

May 08, 2025

Vse Matchi Arsenala I Ps Zh V Evrokubkakh Rezultaty I Obzory

May 08, 2025 -

Who Could Replace Taj Gibson On The Charlotte Hornets Finding A Veteran Presence

May 08, 2025

Who Could Replace Taj Gibson On The Charlotte Hornets Finding A Veteran Presence

May 08, 2025 -

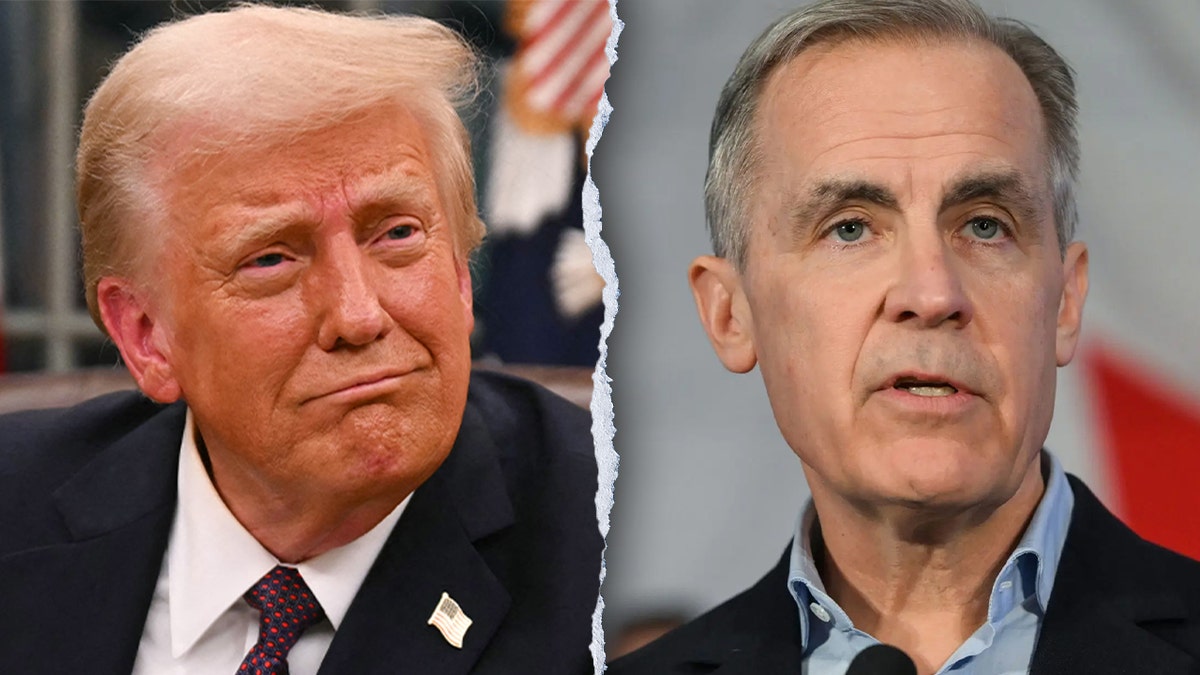

First Meeting Carney Labels Trump A Transformational President

May 08, 2025

First Meeting Carney Labels Trump A Transformational President

May 08, 2025 -

Three Star Wars Andor Episodes Streaming Free On You Tube

May 08, 2025

Three Star Wars Andor Episodes Streaming Free On You Tube

May 08, 2025