Urgent: New HMRC Correspondence Requires Immediate Attention From UK Residents

Table of Contents

Receiving unexpected correspondence from Her Majesty's Revenue and Customs (HMRC) can be alarming. This is especially true if it involves a tax demand or an urgent HMRC communication. This guide provides crucial information on how UK residents should react to urgent HMRC communications and the steps to take to ensure compliance. Ignoring HMRC correspondence can have serious consequences, so immediate action is essential.

Identifying Genuine HMRC Correspondence

It's crucial to verify the authenticity of any communication claiming to be from HMRC before taking any action. Phishing scams are common, designed to steal your personal and financial information.

Recognising Official Communication

Genuine HMRC correspondence will always display specific characteristics:

- Official Letterhead: Look for the official HMRC logo and letterhead.

- Unique Reference Number: Every HMRC communication will include a unique reference number. This is vital for tracking your correspondence.

- Correct Contact Details: The communication should use the correct HMRC contact details, including address and phone number. You can verify these on the official HMRC website.

- Professional Tone and Language: Official HMRC communications use professional language and avoid informal slang or overly aggressive wording.

- Secure Online Portal Links: If the communication directs you to an online portal, ensure the link begins with "https://" and the website address is legitimate. Never click on links from suspicious emails.

To verify the legitimacy of HMRC contact:

- Check the HMRC Website: The official HMRC website provides information on current communication methods and what to expect.

- Call HMRC Directly: Use the phone number listed on the official HMRC website to verify any communication you've received. Never use a phone number provided in a suspicious email or text message.

Types of Urgent HMRC Correspondence

Several reasons might prompt urgent HMRC communication. Understanding these is crucial for an appropriate response. These include:

- Tax Assessments: These inform you of your tax liability for the tax year. Ignoring this could lead to penalties.

- Tax Demands: These demand payment of your outstanding tax liability.

- Investigation Letters: These initiate an HMRC investigation into your tax affairs. Cooperation is vital.

- Penalty Notices: These inform you of penalties for late filing or non-payment of taxes.

- Requests for Information: These requests require you to provide additional information to support your tax return or clarify any discrepancies.

- Changes to Your Tax Code: This communication might inform you about changes affecting your tax deductions at source.

Ignoring any of these communications can result in escalating issues and severe consequences.

Responding to Urgent HMRC Correspondence

Prompt action is critical when dealing with urgent HMRC correspondence. Delaying a response can significantly worsen the situation.

Immediate Actions to Take

Upon receiving urgent HMRC correspondence, immediately:

- Read the Letter Carefully: Understand the content completely, noting all deadlines and reference numbers.

- Note All Deadlines and Reference Numbers: Keep these readily available for future reference and communication.

- Gather Relevant Documents: Collect payslips, tax returns, bank statements, and any other supporting documents mentioned in the communication.

- Contact HMRC if You Need Clarification: Do not hesitate to contact HMRC if you require clarification or have any questions.

Methods of Contacting HMRC

Several options exist for contacting HMRC:

- Telephone: Use the phone numbers provided on the official HMRC website. Expect potential waiting times.

- Online Portal: Access your HMRC online account to manage your tax affairs, submit documents, and communicate with HMRC securely.

- Writing a Letter: Send a formal letter via recorded delivery to the address provided in the communication.

Choose the most suitable method based on the type of communication and your preference. The online portal is generally the most efficient method for managing your tax affairs and replying to HMRC correspondence.

Understanding Potential Consequences of Ignoring HMRC Correspondence

Failing to respond to urgent HMRC communication can lead to severe consequences.

Financial Penalties

Ignoring tax demands or failing to meet deadlines can result in:

- Late Payment Penalties: Penalties increase based on the amount owed and the duration of the delay.

- Interest Charges: Interest is charged on outstanding tax debts.

- Additional Assessments: Further investigations may lead to additional tax assessments, compounding the debt.

Legal Action

In cases of persistent non-compliance, HMRC may take legal action, including:

- Court Summons: You may be summoned to court to explain your failure to comply.

- Debt Collection Agency Involvement: HMRC may pass your debt to a debt collection agency.

- Potential Imprisonment (in extreme cases): In severe cases of tax evasion, imprisonment is a possibility.

Non-compliance can result in significant financial penalties and serious legal repercussions.

Conclusion

Receiving urgent HMRC correspondence requires immediate and careful attention. Failure to respond promptly can lead to significant financial penalties and legal action. Understanding how to identify genuine HMRC communications and respond appropriately is crucial for UK residents.

Don't delay! Act now if you've received urgent HMRC correspondence. Review the information provided and contact HMRC immediately to resolve any outstanding issues. Learn more about navigating HMRC communications and ensuring tax compliance by visiting the official HMRC website. Proactive management of your HMRC correspondence is essential for peace of mind.

Featured Posts

-

Formula 1 Yeni Sezon Tarihler Sueruecueler Ve Beklentiler

May 20, 2025

Formula 1 Yeni Sezon Tarihler Sueruecueler Ve Beklentiler

May 20, 2025 -

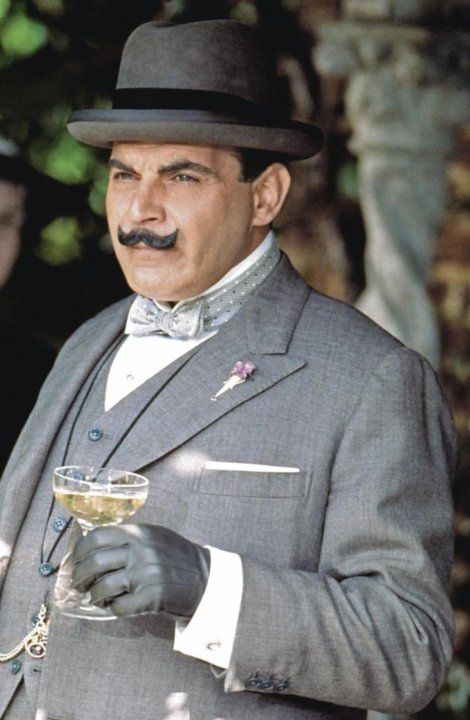

Agatha Christies Poirot Unraveling The Mysteries

May 20, 2025

Agatha Christies Poirot Unraveling The Mysteries

May 20, 2025 -

Solve The Nyt Mini Crossword March 18 Answers

May 20, 2025

Solve The Nyt Mini Crossword March 18 Answers

May 20, 2025 -

Apprendre L Ecriture Avec Agatha Christie Et L Ia

May 20, 2025

Apprendre L Ecriture Avec Agatha Christie Et L Ia

May 20, 2025 -

Uk Households Urgent Action Needed On New Hmrc Letters

May 20, 2025

Uk Households Urgent Action Needed On New Hmrc Letters

May 20, 2025

Latest Posts

-

Rodenje Drugog Djeteta Jennifer Lawrence Zvanicna Potvrda

May 20, 2025

Rodenje Drugog Djeteta Jennifer Lawrence Zvanicna Potvrda

May 20, 2025 -

Jennifer Lawrence Majka Drugi Put Vijesti I Detalji

May 20, 2025

Jennifer Lawrence Majka Drugi Put Vijesti I Detalji

May 20, 2025 -

Novo Dijete Jennifer Lawrence Sve Sto Znamo

May 20, 2025

Novo Dijete Jennifer Lawrence Sve Sto Znamo

May 20, 2025 -

Jennifer Lawrence I Drugo Dijete Objava I Reakcije

May 20, 2025

Jennifer Lawrence I Drugo Dijete Objava I Reakcije

May 20, 2025 -

Drugo Dijete Jennifer Lawrence Kada I Kako

May 20, 2025

Drugo Dijete Jennifer Lawrence Kada I Kako

May 20, 2025