Understanding Your Updated HMRC Tax Code: Implications For Savings Income

Table of Contents

Deciphering Your HMRC Tax Code

Understanding your HMRC tax code is the first step to managing your tax efficiently. Let's break down how to understand and locate this crucial piece of information.

Understanding the Structure of a Tax Code

Your HMRC tax code is a combination of numbers and sometimes a letter. The numbers represent your personal allowance, while letters indicate specific tax situations.

-

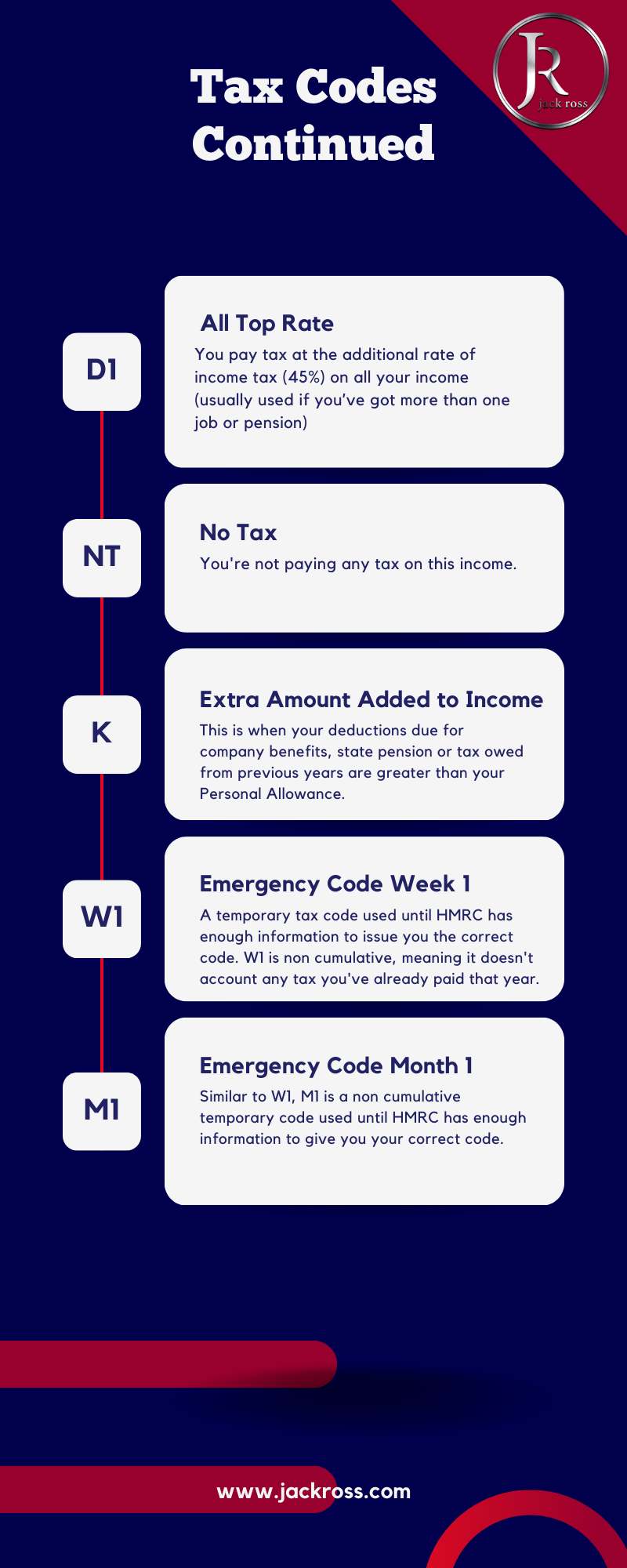

Examples of Tax Codes and their Meanings:

- 1257L: This is a common tax code indicating a standard personal allowance.

- 1100L: This suggests a reduced personal allowance.

- BR: This indicates that your tax code is being reviewed by HMRC.

- K10660: The 'K' indicates that you've already paid tax through another method, such as via your employer. This can be relevant for savings income that is not already deducted via PAYE.

-

The 'K' Code and its Impact on Savings Income: The 'K' code in your tax code means your employer or pension provider has already deducted tax on your income, hence no further tax is usually deducted at source from savings income. However, if your savings income exceeds the Personal Savings Allowance, you may still need to pay tax.

-

Further Information: For a detailed explanation of different tax codes and their meanings, visit the official .

Locating Your Tax Code

Knowing where to find your tax code is essential. You can typically find it on:

-

Your P60: This annual statement summarizes your earnings and tax deductions for the previous tax year.

-

Your Payslips: Your tax code is usually printed on each payslip.

-

Your HMRC Online Account: Accessing your HMRC online account provides a convenient way to view and manage your tax information.

-

Accessing Your Tax Code Online:

- Go to the .

- Log in to your online account.

- Navigate to your tax details section.

-

What to Do If Your Tax Code Is Incorrect: If you believe your tax code is wrong, contact HMRC immediately to rectify the issue. An incorrect tax code can lead to overpayment or underpayment of tax.

-

Regularly Checking Your Tax Code: Make it a habit to check your tax code regularly to ensure its accuracy and avoid potential tax problems.

How Your Tax Code Affects Savings Income

Your tax code significantly impacts how much tax you pay on your savings and investment income.

Tax on Savings Interest

Interest earned on savings accounts is typically taxed under the PAYE (Pay As You Earn) system. This means tax is usually deducted at source by your bank or building society.

-

Different Tax Bands and Rates: The amount of tax you pay depends on your tax code and which tax band your savings income falls into. These tax bands and rates are subject to change and you should check the latest information from the government website.

-

Personal Savings Allowance: The Personal Savings Allowance allows you to earn a certain amount of savings interest tax-free. The amount varies depending on your income tax bracket. Exceeding this allowance means you pay tax on the excess interest.

-

Implications of Exceeding the Personal Savings Allowance: If your savings interest exceeds your Personal Savings Allowance, you will need to pay tax on the excess amount. This will depend on your tax bracket and this is usually added to your overall tax liability calculated by your employer at the end of the tax year.

Tax on Investment Income

Investment income, including dividends and capital gains, is also subject to tax.

-

Tax Rates for Dividends and Capital Gains: Dividend income is taxed at different rates depending on the level of your income. Capital Gains Tax applies to profits made from selling assets like stocks and shares. The allowance is subject to change, so always refer to official government sources for the most up-to-date information.

-

Dividend Allowance: Similar to the Personal Savings Allowance, there's a Dividend Allowance that allows you to receive a certain amount of dividend income tax-free.

-

Capital Gains Tax Allowances: There are also annual Capital Gains Tax allowances, allowing you to make a certain amount of profit from selling assets each tax year without paying tax.

Tax Relief on Savings

Certain savings accounts offer tax relief, helping you reduce your tax bill.

-

Examples of Tax-Efficient Savings Accounts (ISAs): Individual Savings Accounts (ISAs) are a popular tax-efficient way to save. Interest and capital gains earned within an ISA are generally tax-free.

-

Benefits of Investing in Tax-Advantaged Accounts: Tax-advantaged accounts, like ISAs, allow you to build wealth with the benefit of tax relief, growing your investment faster and more effectively.

Changes to Your HMRC Tax Code and Their Impact

Changes to your circumstances can lead to changes in your HMRC tax code.

Understanding Tax Code Changes

Several factors can cause your tax code to change.

-

Common Reasons for Tax Code Updates: Changes in income, tax allowances, or adjustments to previous tax years.

-

Reporting Changes in Circumstances to HMRC: It's crucial to inform HMRC of any changes to your circumstances promptly, such as a change in your employment status or income level.

Impact of Changes on Savings Income

A change in your tax code directly affects the amount of tax deducted from your savings interest.

-

Examples: A higher tax code might mean more tax deducted from your savings interest, while a lower tax code would result in less tax being deducted. Calculations and the impact will depend on your specific tax code, savings amount and your tax bracket.

-

Potential for Underpayment or Overpayment of Tax: An inaccurate tax code can lead to either underpaying or overpaying tax on your savings, potentially resulting in penalties and interest later.

Conclusion

Understanding your HMRC tax code and its implications for your savings income is crucial for effective financial planning. Regularly reviewing your tax code ensures accuracy and helps you optimize your tax position, maximizing your savings and keeping more of your money. Remember the importance of the Personal Savings Allowance and other relevant allowances, and don't hesitate to utilize tax-efficient saving options.

Call to Action: Regularly review your HMRC tax code to ensure accuracy and optimize your tax position. If you have any questions or concerns about your tax code and its implications for your savings income, consult with a qualified financial advisor or visit the official HMRC website for further guidance. Understanding your updated HMRC tax code is crucial for managing your finances effectively.

Featured Posts

-

Napad Na Detsu U Bi Kh Tadi Optuzhu E Shmita Za Podstitsanje Sukoba

May 20, 2025

Napad Na Detsu U Bi Kh Tadi Optuzhu E Shmita Za Podstitsanje Sukoba

May 20, 2025 -

Agatha Christies Poirot A Study Of Character And Crime Solving Techniques

May 20, 2025

Agatha Christies Poirot A Study Of Character And Crime Solving Techniques

May 20, 2025 -

Fonoi Anazitontas Tin Alitheia Piso Apo To Tampoy

May 20, 2025

Fonoi Anazitontas Tin Alitheia Piso Apo To Tampoy

May 20, 2025 -

Fenerbahce De Talisca Tartismasi Ve Tadic Transferi Yoenetim Ne Yapacak

May 20, 2025

Fenerbahce De Talisca Tartismasi Ve Tadic Transferi Yoenetim Ne Yapacak

May 20, 2025 -

Cameroun Macron Referendum Et La Question Du Troisieme Mandat En 2032

May 20, 2025

Cameroun Macron Referendum Et La Question Du Troisieme Mandat En 2032

May 20, 2025

Latest Posts

-

The Leclerc Hamilton Dynamic A Look At The Ferrari Team Orders Dispute

May 20, 2025

The Leclerc Hamilton Dynamic A Look At The Ferrari Team Orders Dispute

May 20, 2025 -

Miami Gp Hamilton And Ferraris Heated Tea Break Exchange

May 20, 2025

Miami Gp Hamilton And Ferraris Heated Tea Break Exchange

May 20, 2025 -

Leclercs Clear Message Analyzing The Ferrari Strategy And Its Impact On Hamilton

May 20, 2025

Leclercs Clear Message Analyzing The Ferrari Strategy And Its Impact On Hamilton

May 20, 2025 -

Hamilton Ferrari Feud Boils Over During Miami Gp Tea Break

May 20, 2025

Hamilton Ferrari Feud Boils Over During Miami Gp Tea Break

May 20, 2025 -

Ferrari Team Orders Controversy Leclercs Reaction To Hamiltons Involvement

May 20, 2025

Ferrari Team Orders Controversy Leclercs Reaction To Hamiltons Involvement

May 20, 2025