Understanding X's Financial Future: Interpreting Data From The Recent Debt Sale

Table of Contents

Analyzing the Debt Sale Details

The details surrounding X's debt sale are crucial for assessing its impact on the company's financial health. Let's break down the key aspects.

Sale Volume and Terms

X successfully sold [Insert Amount] in debt, primarily consisting of [Insert Type of Debt, e.g., high-yield bonds]. The sale was structured with an average interest rate of [Insert Interest Rate] and maturity dates ranging from [Insert Range of Maturity Dates].

- Specific Figures: The total debt sold represents [Percentage]% of X's total debt.

- Comparison to Previous Sales: Compared to X's previous debt sale in [Year], this represents a [Increase/Decrease] in volume. This suggests [Interpretation of the increase/decrease].

- Interest Rate Implications: The [Insert Interest Rate]% interest rate reflects the current market conditions and investor sentiment towards X. This is [Higher/Lower/Similar] to the prevailing market rates for similar debt instruments, indicating [Positive/Negative/Neutral] market perception of X's creditworthiness.

Keywords: X's debt sale, debt volume, interest rate implications, maturity dates, debt restructuring.

Investor Participation and Market Response

The debt sale attracted a diverse range of investors, including [List Key Investors or Investor Types, e.g., institutional investors, hedge funds]. The market's reaction to the announcement was initially [Positive/Negative/Neutral], with X's stock price experiencing a [Percentage]% fluctuation in the immediate aftermath. However, [Mention any long-term changes].

- Key Investors: The participation of prominent investors suggests a degree of confidence in X's long-term prospects.

- Stock Price Fluctuations: The initial [Increase/Decrease] in stock price reflects the market's immediate assessment of the debt sale's impact.

- Analyst Opinions: Analysts at [Mention reputable financial institutions] have issued [Positive/Negative/Mixed] commentary on the debt sale, citing [Reasons for their assessment].

Keywords: investor confidence, market reaction, X's stock performance, investor sentiment, credit rating.

Debt Reduction and Capital Structure

This debt sale significantly reduces X's overall debt load. The reduction of [Amount] in debt will positively impact X's capital structure, lowering the debt-to-equity ratio from [Previous Ratio] to [Projected Ratio]. This improvement could lead to a better credit rating, potentially reducing future borrowing costs.

- Debt-to-Equity Ratio: A lower debt-to-equity ratio indicates improved financial stability and reduced financial risk.

- Credit Rating Impact: A potential upgrade in X's credit rating would significantly enhance their borrowing capacity and reduce interest expense in the future.

- Improved Financial Flexibility: This improved financial position offers X greater flexibility in making future investments and navigating economic uncertainty.

Keywords: debt reduction strategy, capital structure optimization, credit rating impact, financial leverage.

Implications for X's Future Investments and Growth

The successful debt sale has significant implications for X's future investment and growth strategy.

Impact on Future Funding

The debt sale strengthens X's position to secure future funding. Having reduced its debt burden, X now has improved access to capital markets, making it easier to raise further capital for future growth initiatives.

- Access to Capital Markets: A healthier balance sheet makes X a more attractive borrower, potentially leading to more favorable terms in future debt issuances.

- Future Debt Issuance: X is now better positioned to issue new debt at potentially lower interest rates.

- Investment in R&D and Expansion: The freed-up capital can be reinvested in research and development, technology upgrades, or strategic expansion projects.

Keywords: future funding opportunities, investment strategy, growth prospects, capital expenditures.

Effect on Operational Efficiency and Profitability

The reduced debt burden translates directly into lower interest payments. This increased cash flow can then be reinvested into the business to further enhance operational efficiency and boost profitability.

- Lower Interest Payments: Reduced interest expense directly increases X's net income, improving profitability metrics.

- Reinvestment of Savings: The savings from reduced interest payments can be reinvested to upgrade infrastructure, improve technology, or enhance marketing efforts.

- Return on Investment: These investments will hopefully lead to a higher return on investment and further strengthen X's financial position.

Keywords: profitability improvements, operational efficiency, return on investment, cash flow management.

Potential Risks and Uncertainties

Despite the positive aspects of the debt sale, several risks and uncertainties remain.

Unforeseen Market Conditions

The global economic landscape is constantly evolving, and unforeseen events could negatively impact X's financial health.

- Macroeconomic Factors: Changes in interest rates, inflation, or geopolitical events could create challenges for X.

- Interest Rate Volatility: Fluctuations in interest rates could affect the cost of future borrowing.

- Potential for Recession: An economic downturn could negatively impact X's sales and profitability.

Keywords: market volatility, economic uncertainty, risk assessment, macroeconomic environment.

Long-Term Financial Sustainability

While the debt sale addresses immediate financial concerns, the long-term financial sustainability of X remains dependent on several factors.

- Long-Term Debt Management Strategy: X needs a robust long-term strategy for managing its remaining debt.

- Future Debt Refinancing: The terms of future debt refinancing will be crucial to maintaining financial stability.

- Overall Financial Health: Continuous monitoring of key financial indicators is essential for ensuring long-term financial health.

Keywords: long-term financial health, debt management, financial sustainability, debt repayment schedule.

Conclusion

The recent debt sale offers valuable insights into X's financial future. While the sale signifies a reduction in debt and potentially improved financial flexibility, careful consideration must be given to potential market risks and the company's long-term debt management strategy. Understanding the intricacies of X's financial future requires continuous monitoring and analysis of key financial indicators. Stay informed about X's progress and further developments to make informed decisions regarding your investment in X's financial future. Keep an eye on future announcements regarding X's debt and financial performance to better understand the evolution of X's financial future.

Featured Posts

-

Next White Lotus Location A Compelling Case For Location Name

Apr 29, 2025

Next White Lotus Location A Compelling Case For Location Name

Apr 29, 2025 -

Full Pardon For Rose Trumps Decision Explained

Apr 29, 2025

Full Pardon For Rose Trumps Decision Explained

Apr 29, 2025 -

Tragedy Strikes Georgia Deputy Killed Colleague Injured In Traffic Stop

Apr 29, 2025

Tragedy Strikes Georgia Deputy Killed Colleague Injured In Traffic Stop

Apr 29, 2025 -

Is Anthony Edwards Playing Tonight Timberwolves Vs Lakers Injury Report

Apr 29, 2025

Is Anthony Edwards Playing Tonight Timberwolves Vs Lakers Injury Report

Apr 29, 2025 -

Is Made In America Really Worth The Struggle

Apr 29, 2025

Is Made In America Really Worth The Struggle

Apr 29, 2025

Latest Posts

-

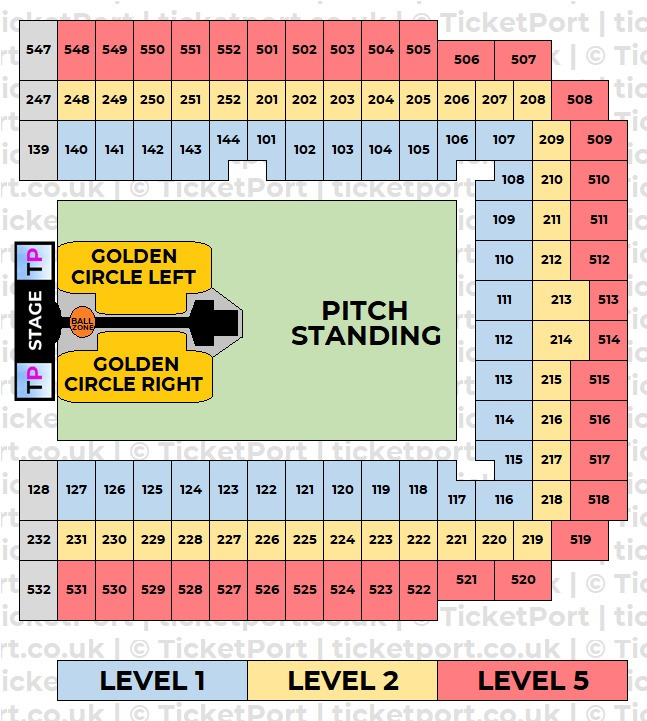

How To Get Capital Summertime Ball 2025 Tickets A Complete Guide

Apr 29, 2025

How To Get Capital Summertime Ball 2025 Tickets A Complete Guide

Apr 29, 2025 -

Capital Summertime Ball 2025 Tickets Everything You Need To Know

Apr 29, 2025

Capital Summertime Ball 2025 Tickets Everything You Need To Know

Apr 29, 2025 -

Your Guide To Buying Capital Summertime Ball 2025 Tickets

Apr 29, 2025

Your Guide To Buying Capital Summertime Ball 2025 Tickets

Apr 29, 2025 -

How To Secure Capital Summertime Ball 2025 Tickets

Apr 29, 2025

How To Secure Capital Summertime Ball 2025 Tickets

Apr 29, 2025 -

Capital Summertime Ball 2025 Your Guide To Ticket Acquisition

Apr 29, 2025

Capital Summertime Ball 2025 Your Guide To Ticket Acquisition

Apr 29, 2025