Understanding The Tuesday Plunge In CoreWeave (CRWV) Stock Price

Table of Contents

Analyzing the Pre-Tuesday Market Conditions for CRWV

Before the dramatic Tuesday drop, understanding the leading indicators is crucial to grasping the full picture of the CRWV stock price plunge. Analyzing CRWV's stock performance in the days and weeks leading up to the event provides valuable context. This pre-plunge analysis allows us to assess whether the fall was a sudden shock or the culmination of underlying trends.

-

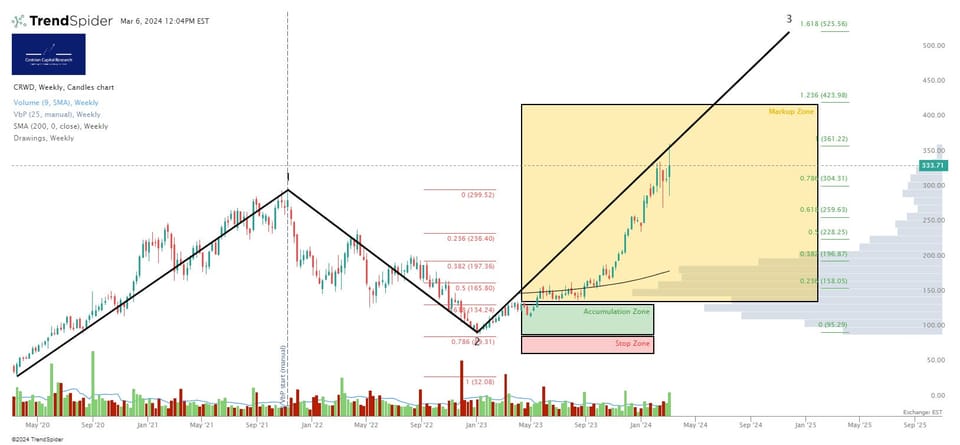

CRWV's Stock Performance Leading Up to the Drop: A review of CRWV's stock chart reveals whether there was a gradual decline in share price or a period of sideways trading before the sharp downturn. This helps determine if the Tuesday plunge was an isolated event or part of a broader pattern.

-

Pre-existing Market Conditions: The overall market climate plays a significant role. A broader tech sector downturn, rising interest rates, or general economic uncertainty could have created a fragile environment, making CRWV more susceptible to a sharp decline. The prevailing market sentiment – optimistic or pessimistic – also heavily influences investor behavior.

-

Technical Analysis Indicators: Examining technical indicators such as trading volume and chart patterns (like head and shoulders or bearish flags) can provide clues about potential warning signs that might have been missed. High trading volume accompanying a price drop, for instance, often indicates significant selling pressure.

-

Analyst Ratings and Price Targets: Pre-plunge analyst ratings and price targets offer another perspective. Were analysts largely bullish on CRWV, suggesting a disconnect between expectations and the actual market reaction? Or did pre-existing concerns already foreshadow potential volatility?

Potential Triggers for the Tuesday CRWV Stock Price Drop

Identifying the specific triggers for the CRWV stock decline is paramount. While pinpointing the single cause is difficult, a combination of factors likely contributed to the significant drop.

-

Significant News Events: Any negative news, whether directly related to CoreWeave or impacting the broader market, could have triggered the sell-off. This could include a disappointing earnings report, regulatory announcements affecting the company’s operations, or major developments from competitors.

-

Market Reaction to News: Analyzing the market's response to any news is critical. The speed and severity of the price drop following specific news events can highlight the market's sensitivity and the impact of investor sentiment.

-

Investor Sentiment and Fear: Fear and uncertainty play a crucial role in stock market volatility. Negative news, regardless of its actual impact, can amplify fear among investors, leading to panic selling and exacerbating the price drop.

-

Broader Market Trends: The performance of the broader tech sector and the overall economic climate significantly impact individual tech stocks like CRWV. A general downturn in the tech sector or economic recessionary fears would likely intensify the sell-off.

Impact of the AI Sector and Market Competition on CRWV

CoreWeave operates in the rapidly evolving AI and cloud computing sector. Understanding the competitive dynamics and market influences is vital.

-

AI Market Impact: The overall performance of the AI market directly affects CRWV's performance. Increased competition from established players or the emergence of disruptive technologies can impact market share and investor confidence.

-

Competitive Landscape: Analyzing CRWV's competitive positioning within the cloud computing and AI space is crucial. Identifying key competitors and evaluating their strengths and weaknesses helps understand CRWV's relative standing and potential vulnerabilities.

-

Future Innovation Implications: The potential for future innovation in AI significantly affects CRWV’s long-term viability. The company’s ability to adapt to technological advancements and maintain its competitive edge will be vital for future success.

Post-Tuesday Market Analysis and Investor Outlook for CRWV

The aftermath of the Tuesday plunge requires close examination to gauge its lasting impact.

-

Market Reaction to the Plunge: Did the CRWV stock price recover quickly after the initial drop, or did the downward trend continue? This indicates the market’s assessment of the event's severity and long-term implications.

-

Investor Confidence and Future Decisions: The plunge likely shook investor confidence. Analyzing investor sentiment post-plunge, including trading volume and any shifts in institutional holdings, provides insights into future investment decisions.

-

CRWV's Long-Term Prospects: Evaluating CRWV’s long-term prospects requires a holistic assessment of its growth potential, financial health, and competitive landscape. A thorough analysis, considering all factors, will inform investors on whether this is a buying opportunity or a sign of long-term weakness.

Conclusion

This article explored the significant Tuesday plunge in CoreWeave (CRWV) stock price, examining pre-existing market conditions, potential triggers, the influence of the AI sector, and the post-plunge market analysis. We analyzed news events, investor sentiment, competitive pressures, and broader market trends to offer a comprehensive understanding of the situation. Understanding the factors behind the Tuesday plunge in CRWV stock price is crucial for informed investment decisions. Stay informed about market trends and continue to monitor CoreWeave's performance for a clearer picture of its future prospects. Further research into CRWV and its competitors in the cloud computing and AI market is recommended for a thorough understanding of the stock's long-term potential. Careful consideration of the CRWV stock price and its volatility is essential for any investor considering adding it to their portfolio.

Featured Posts

-

The Chicago Sun Times And The Ai Hoax A Detailed Examination

May 22, 2025

The Chicago Sun Times And The Ai Hoax A Detailed Examination

May 22, 2025 -

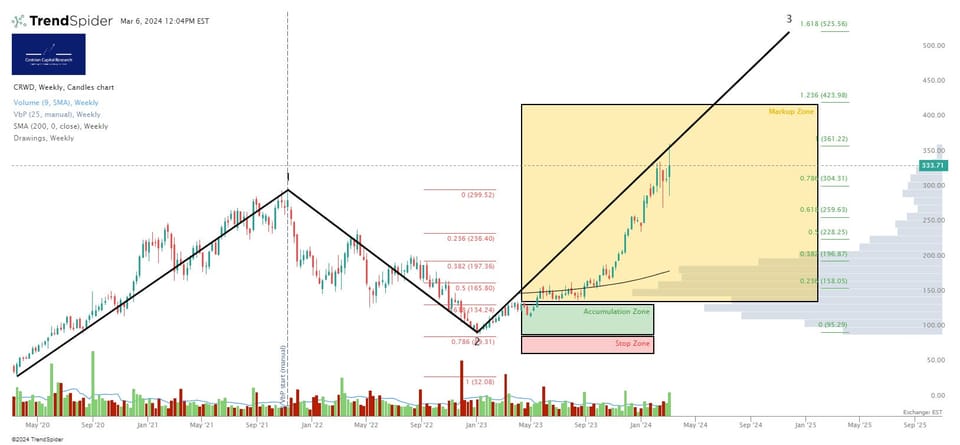

Ex Tory Councillors Wife Awaits Racial Hatred Tweet Appeal Ruling

May 22, 2025

Ex Tory Councillors Wife Awaits Racial Hatred Tweet Appeal Ruling

May 22, 2025 -

Huizenprijzen Nederland Debat Geen Stijl Vs Abn Amro

May 22, 2025

Huizenprijzen Nederland Debat Geen Stijl Vs Abn Amro

May 22, 2025 -

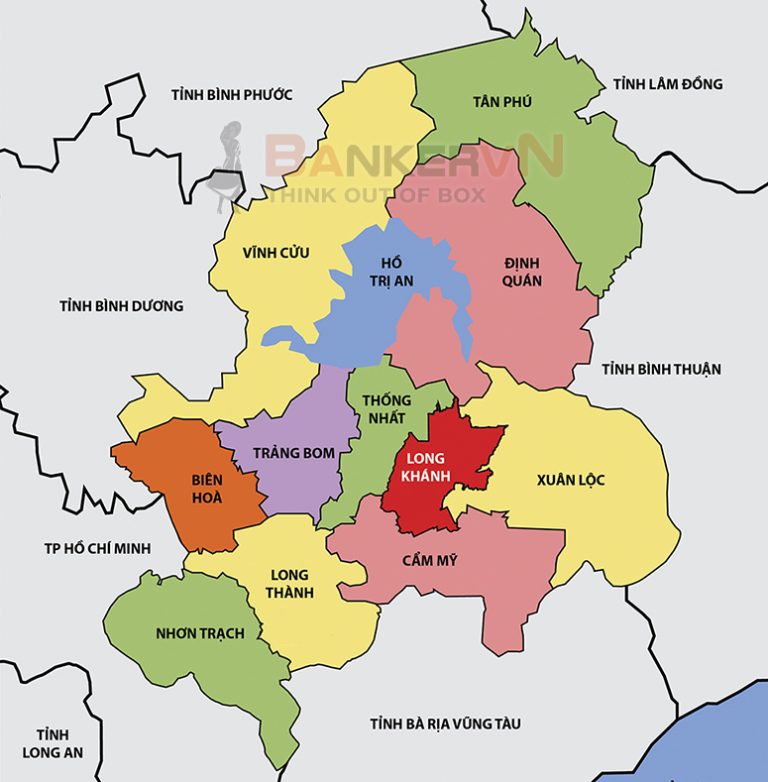

Cau Ma Da Noi Dong Nai Va Binh Phuoc Khoi Cong Thang 6 2024

May 22, 2025

Cau Ma Da Noi Dong Nai Va Binh Phuoc Khoi Cong Thang 6 2024

May 22, 2025 -

Love Monster How To Identify And Address Relationship Red Flags

May 22, 2025

Love Monster How To Identify And Address Relationship Red Flags

May 22, 2025

Latest Posts

-

Wordle Today 1 356 Hints Clues And Answer For Thursday March 6th Game

May 22, 2025

Wordle Today 1 356 Hints Clues And Answer For Thursday March 6th Game

May 22, 2025 -

Wordle Answer And Hints Today April 26 2025 Puzzle 1407

May 22, 2025

Wordle Answer And Hints Today April 26 2025 Puzzle 1407

May 22, 2025 -

Wordle 370 Answer Hints And Clues For Thursday March 20th Game

May 22, 2025

Wordle 370 Answer Hints And Clues For Thursday March 20th Game

May 22, 2025 -

Wordle Game 370 Hints Clues And Answer For Thursday March 20th

May 22, 2025

Wordle Game 370 Hints Clues And Answer For Thursday March 20th

May 22, 2025 -

Wordle 1358 Hints And Solution For March 8th

May 22, 2025

Wordle 1358 Hints And Solution For March 8th

May 22, 2025