Understanding The Stealthy Wealthy: How They Accumulate Wealth Discreetly

Table of Contents

The Mindset of the Stealthy Wealthy

The core of the stealthy wealthy's success lies in their mindset. It's not about deprivation; it's about strategic prioritization and long-term vision.

Prioritizing Financial Literacy and Long-Term Planning

The foundation of discreet wealth is built on financial literacy and a robust long-term plan. This isn't about getting rich quick; it's about consistent, strategic growth.

- Budgeting: Meticulous budgeting is crucial for tracking income and expenses, identifying areas for savings, and establishing clear financial goals.

- Investing: Understanding different investment vehicles, including index funds, bonds, and real estate, is essential for long-term growth.

- Financial Education: Continuously learning about personal finance, investment strategies, and tax laws is paramount for making informed decisions.

- Seeking Expert Advice: Engaging financial advisors, tax planners, and other financial professionals provides invaluable guidance and support.

Developing a strong financial foundation involves understanding your risk tolerance, setting realistic financial goals (both short-term and long-term), and diversifying your investments. Learning about different investment strategies, such as value investing or growth investing, can help you tailor your approach to your personal circumstances and risk tolerance. Seeking professional financial guidance is crucial for navigating complex financial matters and ensuring your wealth is protected.

Avoiding Conspicuous Consumption and Embracing Frugality

Stealthy wealthy individuals avoid conspicuous consumption. They understand the power of delayed gratification and prioritize needs over wants.

- Delayed Gratification: Resisting impulsive purchases and saving for larger, more meaningful investments.

- Mindful Spending: Consciously evaluating purchases and prioritizing value over immediate gratification.

- Needs vs. Wants: Clearly differentiating between essential needs and non-essential wants, focusing spending on necessities.

- Frugal Living: Adopting a lifestyle that values practicality and efficiency over extravagance.

By avoiding impulsive spending, they preserve capital for investments and reduce unnecessary financial burdens. This doesn't mean living in deprivation; it means making conscious choices about spending, aligning purchases with long-term financial goals.

Building Multiple Income Streams

Diversifying income sources is a hallmark of the stealthy wealthy. They don't rely on a single source of income, creating resilience and accelerating wealth accumulation.

- Passive Income: Generating income streams that require minimal ongoing effort, such as rental properties, dividends from stocks, or online businesses.

- Active Income: Maintaining a primary source of income while actively pursuing additional income-generating opportunities.

- Diversification: Spreading income across various sources to mitigate risk and enhance financial stability.

Multiple income streams create financial security and allow for faster wealth accumulation. This reduces reliance on a single job or business, protecting against potential job loss or economic downturns.

Strategies Employed by the Stealthy Wealthy

Beyond mindset, the stealthy wealthy employ specific strategies to build and protect their discreet wealth.

Strategic Investing and Wealth Preservation

Strategic investing is crucial for long-term wealth growth and preservation.

- Diversification: Spreading investments across different asset classes to minimize risk.

- Long-Term Strategies: Focusing on long-term growth rather than short-term gains.

- Tax Optimization: Employing tax-efficient investment strategies to minimize tax liabilities.

- Risk Management: Understanding and mitigating potential risks associated with investments.

The stealthy wealthy often favor low-risk, high-yield investment options, focusing on steady, consistent growth over high-risk, high-reward ventures. They diligently research investment opportunities, considering factors like diversification, risk tolerance, and potential tax implications.

Smart Debt Management and Leverage

Debt can be a powerful tool when used strategically, but irresponsible debt management can hinder wealth building.

- Strategic Debt Utilization: Using debt for income-generating assets, like investment properties, while ensuring manageable repayments.

- Minimizing High-Interest Debt: Prioritizing the repayment of high-interest debt to reduce overall financial burden.

- Understanding Leverage: Knowing how to use debt effectively to amplify returns on investments.

Effective debt management involves understanding the terms of loans and choosing financing options wisely. It's about using debt strategically to enhance investment returns while avoiding excessive debt accumulation that hinders financial progress.

Tax Optimization and Estate Planning

Careful tax planning and estate planning are essential for protecting accumulated wealth and minimizing tax burdens.

- Tax-Advantaged Accounts: Utilizing retirement accounts and other tax-advantaged investment vehicles to reduce tax liabilities.

- Estate Planning: Implementing strategies like trusts and wills to ensure the efficient transfer of wealth to heirs.

- Minimizing Tax Liabilities: Employing various legal and financial strategies to reduce overall tax burden.

These strategies can significantly impact long-term wealth preservation, allowing the stealthy wealthy to pass on their accumulated wealth efficiently to future generations.

Conclusion: Unlocking the Secrets of the Stealthy Wealthy

The stealthy wealthy achieve financial success not through extravagance but through a disciplined approach to finance characterized by financial literacy, long-term planning, and strategic investment. They prioritize building multiple income streams, managing debt wisely, and employing tax optimization strategies. By embracing frugality and avoiding conspicuous consumption, they build their discreet wealth steadily and securely. By adopting similar strategies and cultivating the right mindset, you too can pave the way towards building your own significant and discreet wealth. Consider seeking advice from a financial advisor to create a personalized plan to achieve your own financial goals and become a part of the stealthy wealthy.

Featured Posts

-

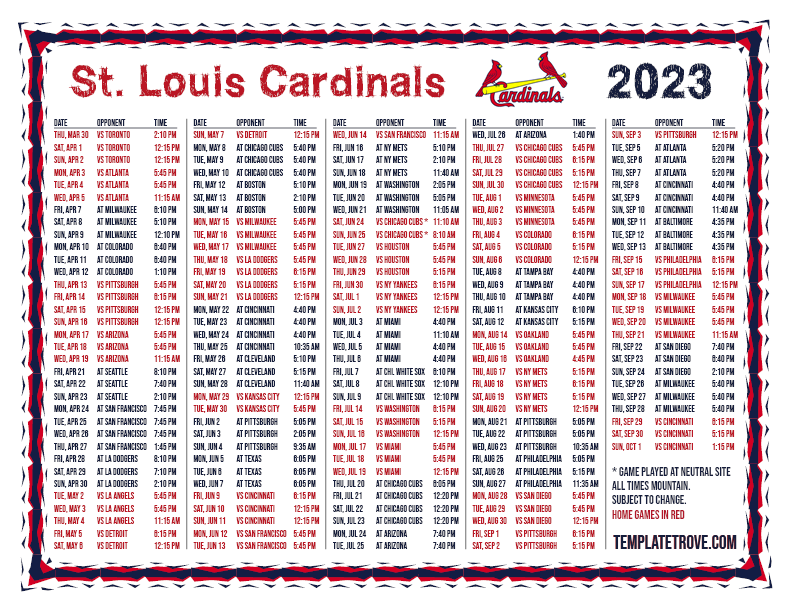

St Louis Cardinals Wednesday Afternoon Report

May 19, 2025

St Louis Cardinals Wednesday Afternoon Report

May 19, 2025 -

5 Uber Shuttle Service Launches For United Center Events

May 19, 2025

5 Uber Shuttle Service Launches For United Center Events

May 19, 2025 -

Eurovision Voting Explained A Complete Guide

May 19, 2025

Eurovision Voting Explained A Complete Guide

May 19, 2025 -

Tonawanda Employee Arrested For Drug Distribution To Coworker

May 19, 2025

Tonawanda Employee Arrested For Drug Distribution To Coworker

May 19, 2025 -

Khtt Eml Qablt Lltnfydh Liemar Ghzt Mn Nqabt Almhndsyn

May 19, 2025

Khtt Eml Qablt Lltnfydh Liemar Ghzt Mn Nqabt Almhndsyn

May 19, 2025