Understanding The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

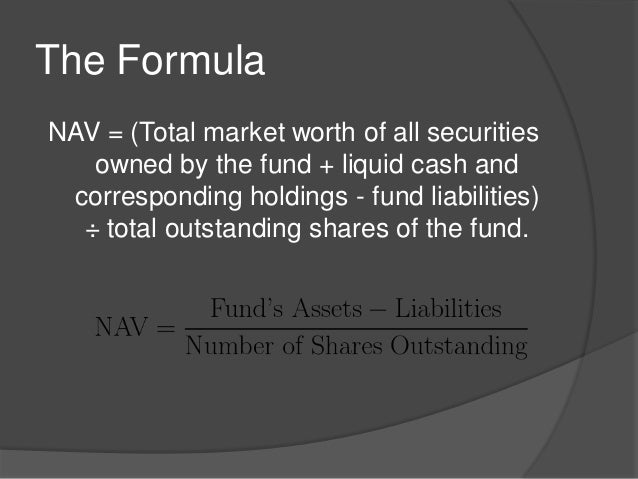

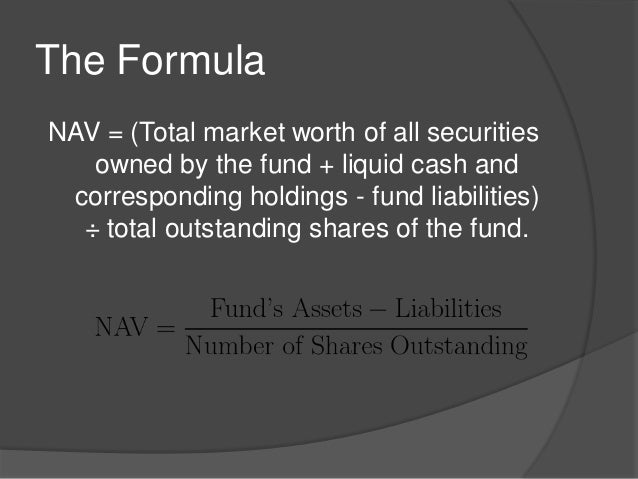

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the net worth of an ETF's underlying assets. It's essentially the value of all the assets the ETF owns (like stocks and bonds) minus its liabilities (expenses, fees, and other obligations). The calculation is straightforward: Assets (market value of holdings) – Liabilities = NAV.

The NAV calculation is influenced significantly by the composition of the ETF's underlying assets. For example, an ETF heavily invested in volatile growth stocks will experience more dramatic NAV fluctuations than one primarily holding government bonds. The market value of each asset within the portfolio is crucial in determining the total asset value.

- Assets: Include the market value of all underlying securities held by the ETF. This is typically calculated daily at market close using the closing prices of each holding.

- Liabilities: Encompass expenses, management fees, accrued interest payable, and any other outstanding obligations of the fund.

- NAV Calculation Frequency: NAV is usually calculated daily at the market close, providing a snapshot of the fund's net asset value at that specific point in time.

Understanding the Amundi Dow Jones Industrial Average UCITS ETF's NAV

The Amundi Dow Jones Industrial Average UCITS ETF tracks the performance of the Dow Jones Industrial Average, a price-weighted index of 30 large, publicly owned companies in the United States. Therefore, the ETF's NAV is directly influenced by the performance of these 30 constituent stocks. If the Dow Jones Industrial Average rises, the ETF's NAV generally rises as well, and vice versa.

The ETF's replication methodology also plays a role. Most likely, this ETF uses a full replication strategy, meaning it holds all 30 stocks in the same proportions as the index. This ensures a close tracking of the index performance, directly impacting the NAV.

- Dow Jones Impact: Fluctuations in the prices of the 30 Dow Jones stocks directly impact the ETF's NAV. A significant price increase in one or more of these stocks will generally lead to an increase in the ETF's NAV.

- Currency Fluctuations: Since the Dow Jones Industrial Average is a US-based index, currency fluctuations between the US dollar and the Euro (if you are investing in the Euro version of the ETF) could slightly affect the NAV.

- Expense Ratio: The ETF's expense ratio, which covers management fees and other operational costs, subtly reduces the NAV over time. This is factored into the daily NAV calculation.

How to Find the Amundi Dow Jones Industrial Average UCITS ETF's NAV

Finding the daily NAV for the Amundi Dow Jones Industrial Average UCITS ETF is relatively easy. Several reliable sources provide this information:

- Amundi's Website: Check the official website of Amundi, the ETF provider. They usually have a dedicated section for fund factsheets, where you will find the daily NAV.

- Financial News Websites: Major financial news websites like Bloomberg, Yahoo Finance, and Google Finance generally list ETF NAVs. Search for the ETF's ticker symbol.

- Brokerage Platforms: If you hold the ETF through a brokerage account, your account statement or platform will display the NAV alongside the current market price.

Understanding the difference between bid and ask price is vital. The bid price is what someone is willing to buy the ETF for, while the ask price is what someone is willing to sell it for. The NAV usually lies between the bid and ask price, and discrepancies can be due to market supply and demand.

- Website Links: [Insert links to relevant websites here – Amundi website, Bloomberg, Yahoo Finance, etc.]

- Discrepancies: Remember that the market price of the ETF can slightly deviate from the NAV due to trading volume and market dynamics.

- Brokerage Platforms: Most major brokerage platforms display the NAV in real-time or with a slight delay.

Using NAV to Make Informed Investment Decisions

Monitoring the Amundi Dow Jones Industrial Average UCITS ETF's NAV over time helps assess its performance. By comparing the NAV to the ETF’s market price, you can potentially identify arbitrage opportunities (although this usually requires sophisticated trading strategies). However, remember that NAV is just one metric.

- Tracking NAV Changes: For example, tracking the monthly NAV changes over a year gives you a clear picture of the ETF's return.

- Premium/Discount: Sometimes, the market price trades at a premium or discount to the NAV. This can indicate market sentiment toward the underlying assets.

- Thorough Research: Always conduct extensive research before investing and consider other investment metrics like expense ratios, historical performance, and volatility.

Conclusion: Mastering the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is fundamental for effective investment management. Knowing how to calculate, find, and interpret the NAV enables you to monitor performance, compare it to the market price, and make more informed decisions. Regular monitoring of the NAV, alongside other key performance indicators, is crucial for optimizing your portfolio. Learn more about maximizing your investment strategies by understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF and other ETFs. [Insert relevant links to further resources here.]

Featured Posts

-

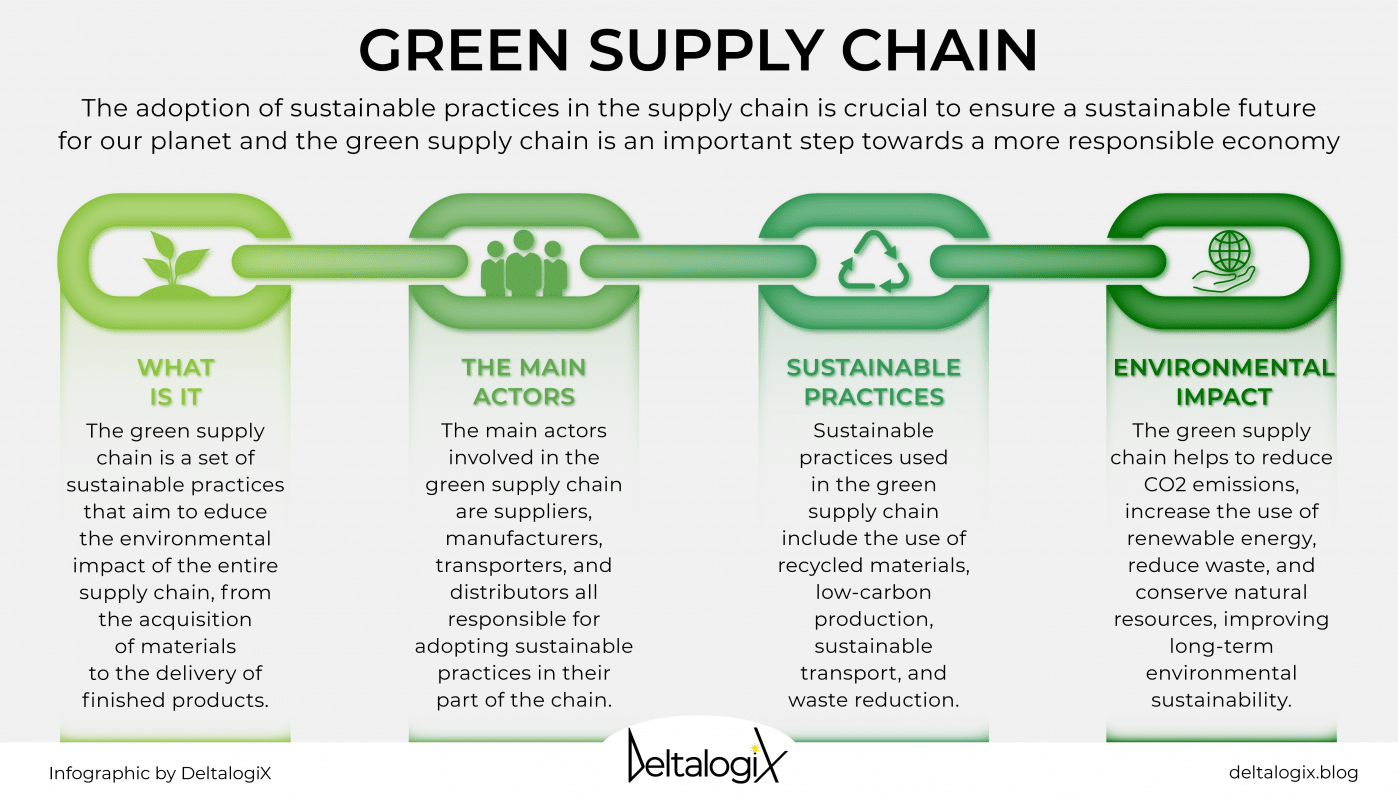

Massimo Vian Exits Gucci Impact On Industrial And Supply Chain Operations

May 24, 2025

Massimo Vian Exits Gucci Impact On Industrial And Supply Chain Operations

May 24, 2025 -

Classifica Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo Musk Zuckerberg E Bezos A Confronto

May 24, 2025

Classifica Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo Musk Zuckerberg E Bezos A Confronto

May 24, 2025 -

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist Explained

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist Explained

May 24, 2025 -

Buying Bbc Radio 1 Big Weekend 2025 Tickets A Step By Step Process

May 24, 2025

Buying Bbc Radio 1 Big Weekend 2025 Tickets A Step By Step Process

May 24, 2025 -

Avrupa Borsalari Buguenkue Kapanis Fiyatlari Ve Analiz

May 24, 2025

Avrupa Borsalari Buguenkue Kapanis Fiyatlari Ve Analiz

May 24, 2025

Latest Posts

-

Piazza Affari Borsa In Attenzione Debolezza Bancaria E Performance Di Italgas

May 24, 2025

Piazza Affari Borsa In Attenzione Debolezza Bancaria E Performance Di Italgas

May 24, 2025 -

Trade War Intensifies Amsterdam Stock Market Suffers 7 Plunge

May 24, 2025

Trade War Intensifies Amsterdam Stock Market Suffers 7 Plunge

May 24, 2025 -

Borsa Europa Cauta Attesa Per La Fed Banche Deboli A Piazza Affari

May 24, 2025

Borsa Europa Cauta Attesa Per La Fed Banche Deboli A Piazza Affari

May 24, 2025 -

Amsterdam Stock Market Opens Down 7 On Trade War Concerns

May 24, 2025

Amsterdam Stock Market Opens Down 7 On Trade War Concerns

May 24, 2025 -

Amsterdam Stock Market Plunge 7 Drop Amidst Rising Trade War Fears

May 24, 2025

Amsterdam Stock Market Plunge 7 Drop Amidst Rising Trade War Fears

May 24, 2025