Understanding The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF Dist

Table of Contents

What is the NAV and how is it calculated for the Amundi MSCI World II UCITS ETF Dist?

The Net Asset Value (NAV) represents the total value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. For the Amundi MSCI World II UCITS ETF Dist, which tracks the MSCI World Index, this calculation involves several steps.

The ETF's assets primarily consist of a diversified portfolio of global equities, mirroring the composition of the MSCI World Index. To calculate the NAV, each stock within the ETF's portfolio is valued at its closing market price. This daily valuation is crucial in determining the ETF's net asset value. Bonds, if any, are also valued accordingly.

Currency exchange rates play a significant role, as the Amundi MSCI World II UCITS ETF Dist holds international assets. The value of foreign holdings is converted into the base currency of the ETF (likely Euros) using the prevailing exchange rates at the end of the trading day. Any discrepancies in these rates directly influence the final NAV calculation.

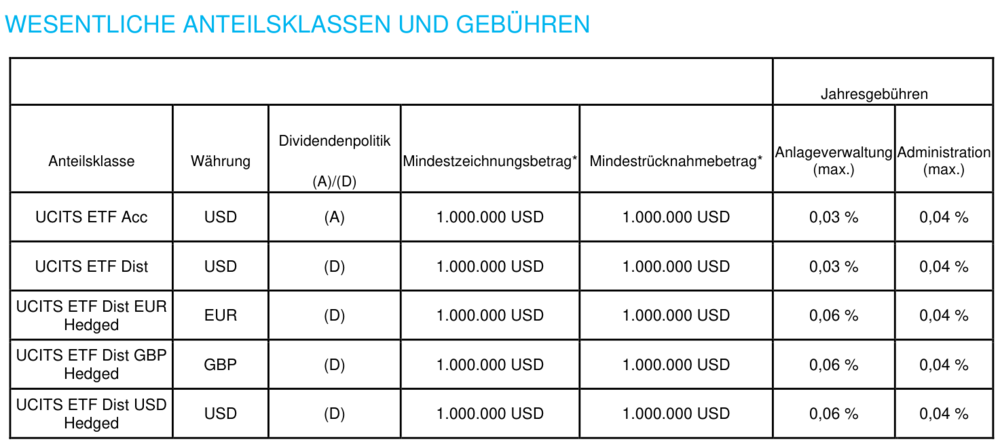

Finally, the ETF's expenses (management fees, administrative costs) and any liabilities are subtracted from the total asset value before the final NAV is computed. This ensures a fair representation of the net worth of each share.

- Asset Valuation Methods Used: Primarily market prices for equities, and standard valuation techniques for other assets if applicable.

- Frequency of NAV Calculation: Daily, typically at the close of the relevant markets.

- Where to Find Official NAV Data: Amundi's official website, major financial news sources like Bloomberg or Reuters, and your brokerage platform.

Factors Affecting the NAV of the Amundi MSCI World II UCITS ETF Dist

Several factors influence the daily fluctuations of the Amundi MSCI World II UCITS ETF Dist NAV. Understanding these factors is crucial for interpreting NAV changes and making informed investment decisions.

Market fluctuations are the most significant influence. Changes in the prices of the underlying stocks within the index directly impact the overall value of the ETF's assets, thereby affecting the NAV. A rising market generally leads to a higher NAV, while a falling market results in a lower NAV.

Currency exchange rate movements affect the NAV, especially for a globally diversified ETF. Fluctuations in exchange rates between the base currency of the ETF and the currencies of the underlying assets can significantly impact the overall value. A strengthening Euro, for example, could reduce the NAV if a significant portion of the underlying assets are in weaker currencies.

Dividend distributions from the underlying stocks also affect the NAV. When a company within the index pays a dividend, the ETF receives its proportional share. This distribution reduces the value of the underlying assets, leading to a temporary decrease in the NAV. However, the dividend income is usually reinvested or distributed to ETF shareholders.

- Market Volatility and its Impact: High volatility can lead to significant daily swings in the NAV.

- Specific Economic Events Influencing the NAV: Major economic news (interest rate changes, geopolitical events) can cause significant shifts in market sentiment and thus NAV.

- Impact of Individual Stock Performance: Strong or weak performance of individual stocks within the index influences the overall NAV proportionally.

Using NAV to Make Informed Investment Decisions with the Amundi MSCI World II UCITS ETF Dist

The Amundi MSCI World II UCITS ETF Dist NAV is a key tool for evaluating performance and making investment choices. By tracking the NAV over time, you can assess the fund's growth or decline. Comparing it to other investments helps determine relative performance within your portfolio.

The NAV plays a crucial role in buy/sell decisions. While the market price of the ETF might fluctuate slightly around the NAV due to supply and demand, significant deviations can indicate arbitrage opportunities. Regularly monitoring the NAV helps understand the potential returns of your investment.

The relationship between NAV and ETF price is vital. While ideally, they should be very close, minor discrepancies can arise due to market forces. Understanding this relationship can help identify potential buying or selling opportunities.

- Comparing NAV to ETF Share Price: Identifying potential arbitrage opportunities when the price deviates significantly from the NAV.

- Using NAV to Assess the Fund's Performance Over Time: Tracking NAV changes over weeks, months, or years allows you to assess long-term performance.

- The Role of NAV in Investment Strategies: Using NAV to implement strategies like dollar-cost averaging for consistent investment.

Where to Find the NAV of the Amundi MSCI World II UCITS ETF Dist

Finding the most up-to-date NAV for the Amundi MSCI World II UCITS ETF Dist is straightforward. The most reliable sources are:

- Amundi's Official Website: Amundi, the fund manager, publishes the daily NAV on their official website within the fund's fact sheet or dedicated page.

- Financial News Websites and Data Providers: Major financial news sites and data providers such as Bloomberg, Yahoo Finance, and Google Finance usually provide real-time or end-of-day NAV data.

- Brokerage Platforms: Your brokerage account will likely display the NAV alongside the current market price of the ETF.

Remember, slight delays might occur in NAV reporting. Always rely on official sources to ensure accuracy.

Conclusion: Mastering the Net Asset Value of Your Amundi MSCI World II UCITS ETF Dist Investment

Understanding the Net Asset Value (NAV) of your Amundi MSCI World II UCITS ETF Dist investment is crucial for informed decision-making. By regularly monitoring your Amundi MSCI World II UCITS ETF Dist NAV and understanding the factors that influence it, you can effectively track your investment's performance and make sound investment choices. Remember to consult official sources for accurate NAV data and utilize this information to understand your ETF NAV and maximize your investment returns. Start monitoring your Amundi MSCI World II UCITS ETF Dist NAV today to improve your investment strategy!

Featured Posts

-

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist Explained

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist Explained

May 24, 2025 -

Leeds Uniteds Pursuit Of Kyle Walker Peters Transfer Update

May 24, 2025

Leeds Uniteds Pursuit Of Kyle Walker Peters Transfer Update

May 24, 2025 -

Amundi Msci All Country World Ucits Etf Usd Acc Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci All Country World Ucits Etf Usd Acc Understanding Net Asset Value Nav

May 24, 2025 -

Explanation Kyle Walker Mystery Women And Annie Kilners Departure

May 24, 2025

Explanation Kyle Walker Mystery Women And Annie Kilners Departure

May 24, 2025 -

Lauryn Goodman Explains Her Move To Italy After Kyle Walkers Ac Milan Transfer

May 24, 2025

Lauryn Goodman Explains Her Move To Italy After Kyle Walkers Ac Milan Transfer

May 24, 2025

Latest Posts

-

Kyle And Teddis Heated Confrontation A Dog Walker Dispute

May 24, 2025

Kyle And Teddis Heated Confrontation A Dog Walker Dispute

May 24, 2025 -

Kyle And Teddis Explosive Dog Walker Argument

May 24, 2025

Kyle And Teddis Explosive Dog Walker Argument

May 24, 2025 -

Explanation Kyle Walker Mystery Women And Annie Kilners Departure

May 24, 2025

Explanation Kyle Walker Mystery Women And Annie Kilners Departure

May 24, 2025 -

Annie Kilners Engagement Ring Following Recent Walker Sighting

May 24, 2025

Annie Kilners Engagement Ring Following Recent Walker Sighting

May 24, 2025 -

Kyle Walker And Mystery Women The Story Behind Annie Kilners Flight Home

May 24, 2025

Kyle Walker And Mystery Women The Story Behind Annie Kilners Flight Home

May 24, 2025